I-43

EXHIBIT A

Description of Land

SALE, PURCHASE AND ESCROW AGREEMENT

BETWEEN

LT Realty Company LLC

and

Liberty Towers Urban Renewal LLC, as Seller

AND

ROSELAND ACQUISITION CORP., as Buyer

AND

Stewart Title Guaranty Company, as Escrow Agent

TABLE OF CONTENTS

|

|

|

|

|

Section |

|

Page |

|

|

|

|

|

|

SALE, PURCHASE AND ESCROW AGREEMENT |

1 |

|

|

|

|

|

|

|

|

|

|

ARTICLE I |

|

|

|

RECITALS |

1 |

|

1.1 |

Real Property |

1 |

|

1.2 |

Leasehold. |

1 |

|

1.3 |

Personal Property |

1 |

|

1.4 |

Purchase and Sale |

2 |

|

|

|

|

|

|

|

|

|

|

ARTICLE II |

|

|

|

PURCHASE PRICE |

2 |

|

2.1 |

Price |

2 |

|

2.2 |

Investments |

2 |

|

2.3 |

Interest on the Deposit |

3 |

|

|

|

|

|

|

|

|

|

|

ARTICLE III |

|

|

|

CONDITIONS TO THE PARTIES’ OBLIGATIONS |

3 |

|

3.1 |

Conditions to Buyer’s Obligation to Purchase |

3 |

|

3.2 |

Conditions to Seller’s Obligation to Sell |

4 |

|

3.3 |

No Financing Contingency |

5 |

|

3.4 |

Failure of Condition |

5 |

|

|

|

|

|

|

|

|

|

|

ARTICLE IV |

|

|

|

BUYER’S DELIVERIES AND SELLER’S DELIVERIES TO ESCROW AGENT AND CLOSING AGENT |

5 |

|

4.1 |

Buyer’s Deliveries to Escrow Agent |

5 |

|

4.2 |

Buyer’s Deliveries to Closing Agent |

6 |

|

4.3 |

Seller’s Deliveries |

7 |

|

4.3 |

Failure to Deliver |

8 |

|

|

|

|

|

|

|

|

|

|

ARTICLE V |

|

|

|

INVESTIGATION OF PROPERTY |

9 |

|

5.1 |

Delivery of Documents |

9 |

|

5.2 |

Physical Inspection of the Real Property |

10 |

|

5.3 |

Investigation Period |

10 |

|

5.4 |

Effect of Termination |

11 |

|

5.5 |

No Obligation to Cure |

11 |

|

5.6 |

Copies of Third Party Reports |

12 |

|

|

|

|

|

|

|

|

|

|

ARTICLE VI |

|

|

|

THE CLOSING |

12 |

|

6.1 |

Date and Manner of Closing |

12 |

|

6.2 |

Delay in Closing; Authority to Close |

12 |

|

|

|

|

|

|

|

|

|

|

ARTICLE VII |

|

|

|

PRORATION, FEES, COSTS AND ADJUSTMENTS |

13 |

|

7.1 |

Prorations |

13 |

|

7.2 |

Seller’s Closing Costs |

16 |

|

7.3 |

Buyer’s Closing Costs |

16 |

|

7.4 |

Reimbursement of Closing Costs |

16 |

|

|

|

|

|

|

|

|

|

|

ARTICLE VIII |

|

|

|

DISTRIBUTION OF FUNDS AND DOCUMENTS |

17 |

|

8.1 |

Delivery of the Purchase Price |

17 |

|

8.2 |

Other Monetary Disbursements |

17 |

|

8.3 |

Recorded Documents |

17 |

|

8.4 |

Documents to Buyer |

17 |

|

8.5 |

Documents to Seller |

17 |

|

8.6 |

All Other Documents |

18 |

|

|

|

|

|

|

|

|

|

|

ARTICLE IX |

|

|

|

RETURN OF DOCUMENTS AND FUNDS UPON TERMINATION |

18 |

|

9.1 |

Return of Seller’s Documents |

18 |

|

9.2 |

Return of Buyer’s Documents |

18 |

|

9.3 |

Deposit |

18 |

|

9.4 |

Disbursement of Deposit |

18 |

|

9.5 |

No Effect on Rights of Parties; Survival |

19 |

|

|

|

|

|

|

|

|

|

|

ARTICLE X |

|

|

|

DEFAULT |

19 |

|

10.1 |

Seller’s Remedies |

19 |

|

10.2 |

Buyer’s Remedies |

19 |

|

|

|

|

3

|

|

ARTICLE XI |

|

|

|

REPRESENTATIONS AND WARRANTIES |

20 |

|

11.1 |

Seller’s Warranties and Representations |

20 |

|

11.2 |

Buyer’s Warranties and Representations |

24 |

|

11.3 |

No Other Warranties and Representations |

26 |

|

|

|

|

|

|

|

|

|

|

ARTICLE XII |

|

|

|

CASUALTY AND CONDEMNATION |

27 |

|

|

|

|

|

|

|

|

|

|

ARTICLE XIII |

|

|

|

CONDUCT PRIOR TO CLOSING |

28 |

|

13.1 |

Conduct |

28 |

|

13.2 |

Actions Prohibited |

28 |

|

13.3 |

Modification of Existing Leases and Contracts |

28 |

|

13.4 |

New Leases and Contracts |

29 |

|

13.5 |

Confidentiality |

30 |

|

13.6 |

Right to Cure |

30 |

|

13.7 |

Rent Ready |

30 |

|

13.8 |

Tenant Estoppels |

30 |

|

13.9 |

Financial Agreement |

31 |

|

|

|

|

|

|

|

|

|

|

ARTICLE XIV |

|

|

|

NOTICES |

31 |

|

|

|

|

|

|

|

|

|

|

ARTICLE XV |

|

|

|

TRANSFER OF TITLE AND POSSESSION |

32 |

|

15.1 |

Transfer of Possession |

32 |

|

15.2 |

Delivery of Documents at Closing |

32 |

|

|

|

|

|

|

|

|

|

|

ARTICLE XVI |

|

|

|

GENERAL PROVISIONS |

33 |

|

16.1 |

Captions |

33 |

|

16.2 |

Exhibits |

33 |

|

16.3 |

Entire Agreement |

33 |

|

16.4 |

Modification |

33 |

|

16.5 |

Attorneys’ Fees |

33 |

|

16.6 |

Governing Law |

33 |

|

16.7 |

Time of Essence |

33 |

|

16.8 |

Survival of Warranties |

33 |

|

16.9 |

Assignment by Buyer |

34 |

4

|

16.10 |

Severability |

34 |

|

16.11 |

Successors and Assigns |

34 |

|

16.12 |

Interpretation |

34 |

|

16.13 |

Counterparts |

35 |

|

16.14 |

Recordation |

35 |

|

16.15 |

Business Days |

35 |

|

16.16 |

Limitation on Liability |

35 |

|

16.17 |

Jury Waiver |

35 |

|

16.18 |

Like Kind (Section 1031) Exchange |

36 |

|

16.19 |

New Jersey Bulk Sales Law |

36 |

|

|

|

|

|

|

ARTICLE XVII |

|

|

|

ESCROW AGENT DUTIES AND DISPUTES |

37 |

|

17.1 |

Other Duties of Escrow Agent |

37 |

|

17.2 |

Disputes |

39 |

EXHIBITS

|

|

|

|

|

EXHIBIT A |

– |

Description of Land |

|

EXHIBIT B |

– |

Form of Assignment and Assumption of Ground Lease |

|

EXHIBIT C |

– |

Form of Assignment and Assumption of Leases, Contracts and Other Property Interests |

|

EXHIBIT D |

– |

Form of Bill of Sale |

|

EXHIBIT E |

– |

Deed |

|

EXHIBIT F |

– |

Form of Notice to Vendors |

|

EXHIBIT G |

– |

Form of Notice to Tenants |

|

EXHIBIT H |

– |

Form of FIRPTA Certificate |

|

EXHIBIT I |

– |

Title Affidavit |

|

EXHIBIT J |

– |

Contracts |

|

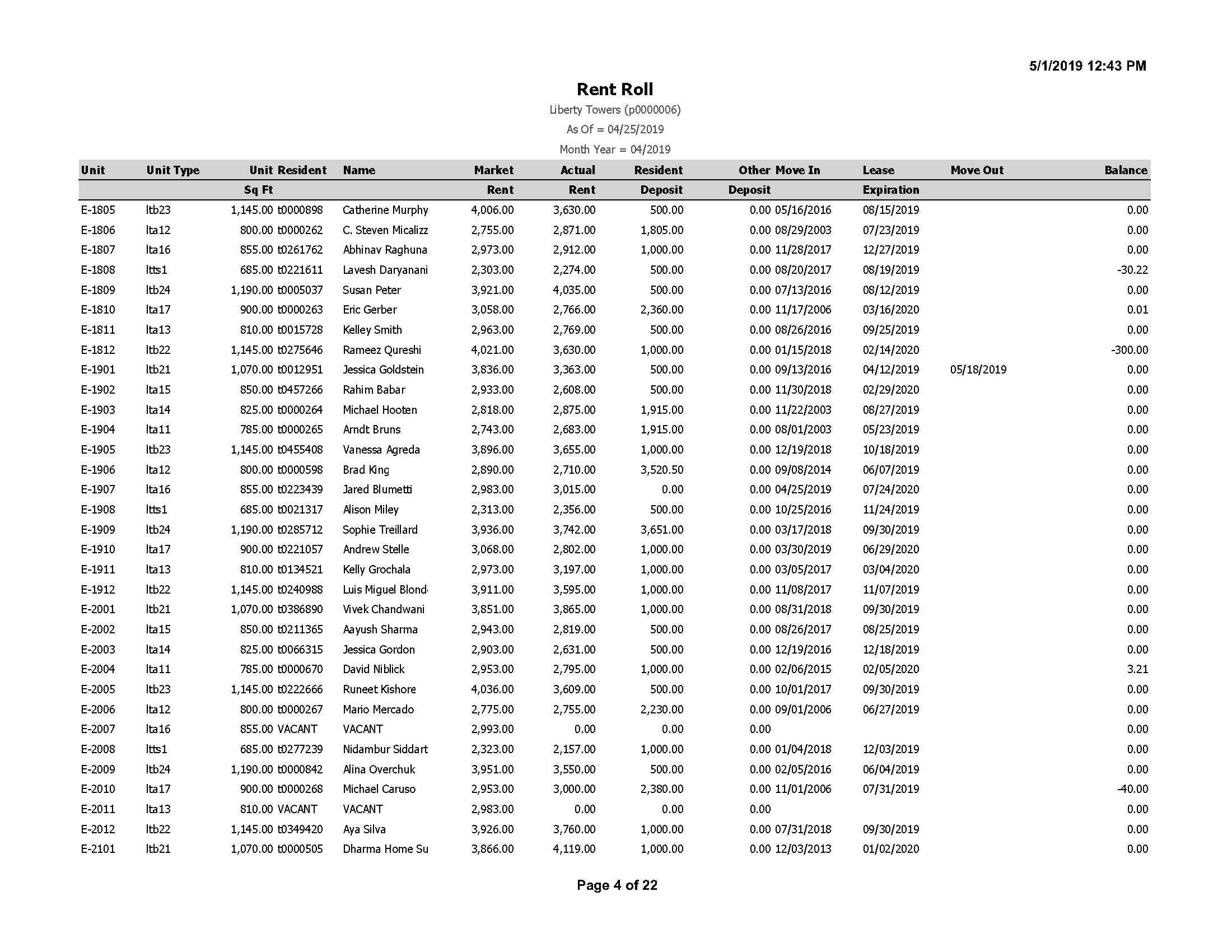

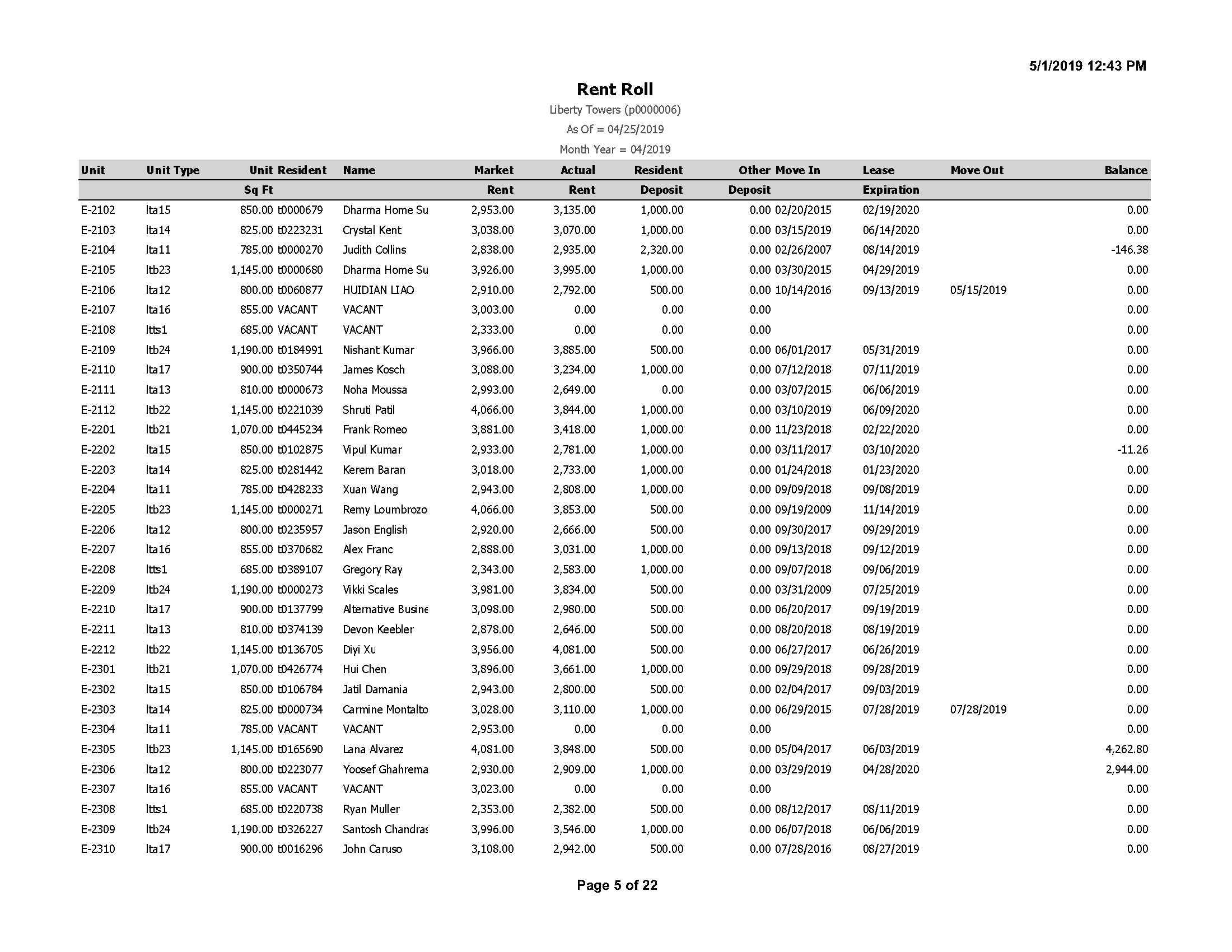

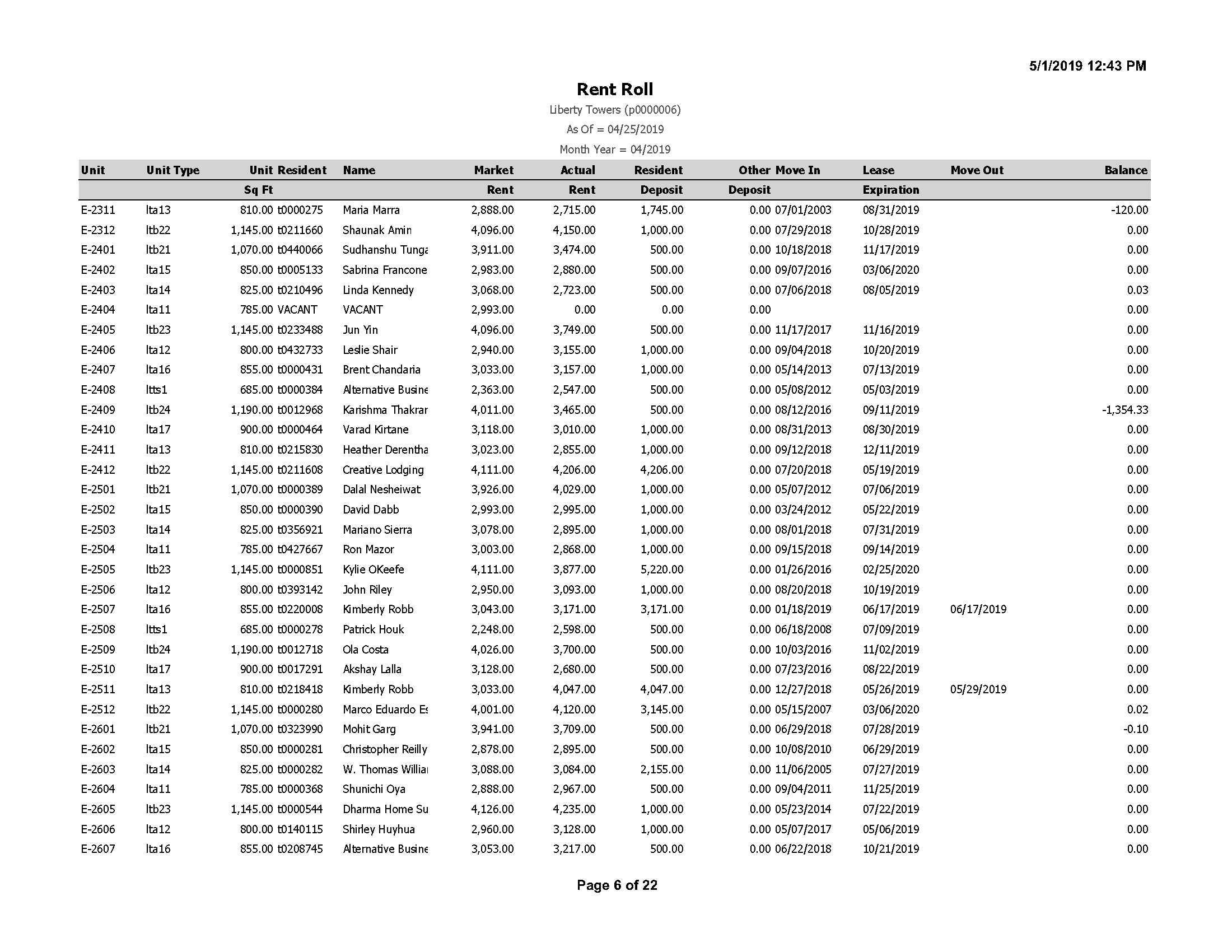

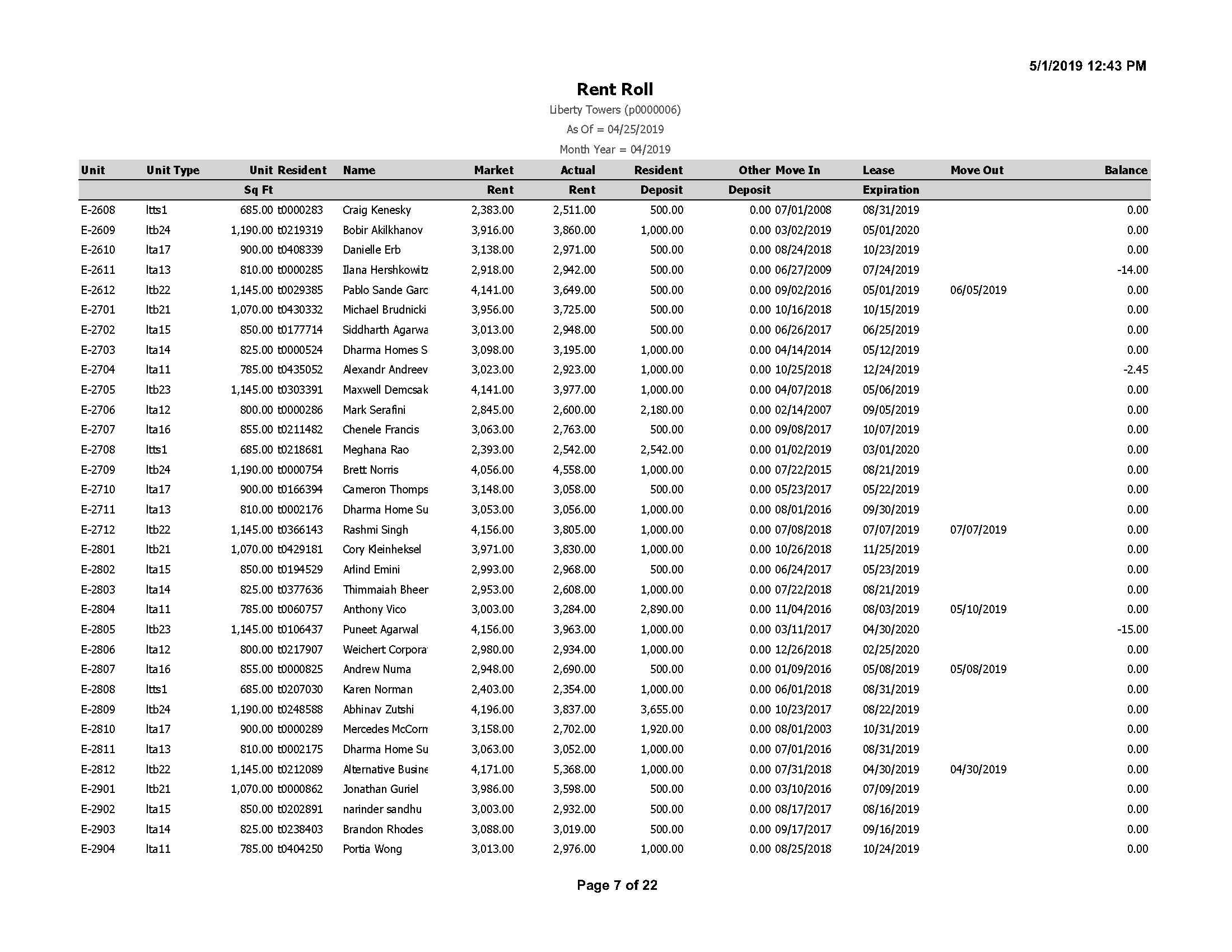

EXHIBIT K |

– |

Preliminary Title Report |

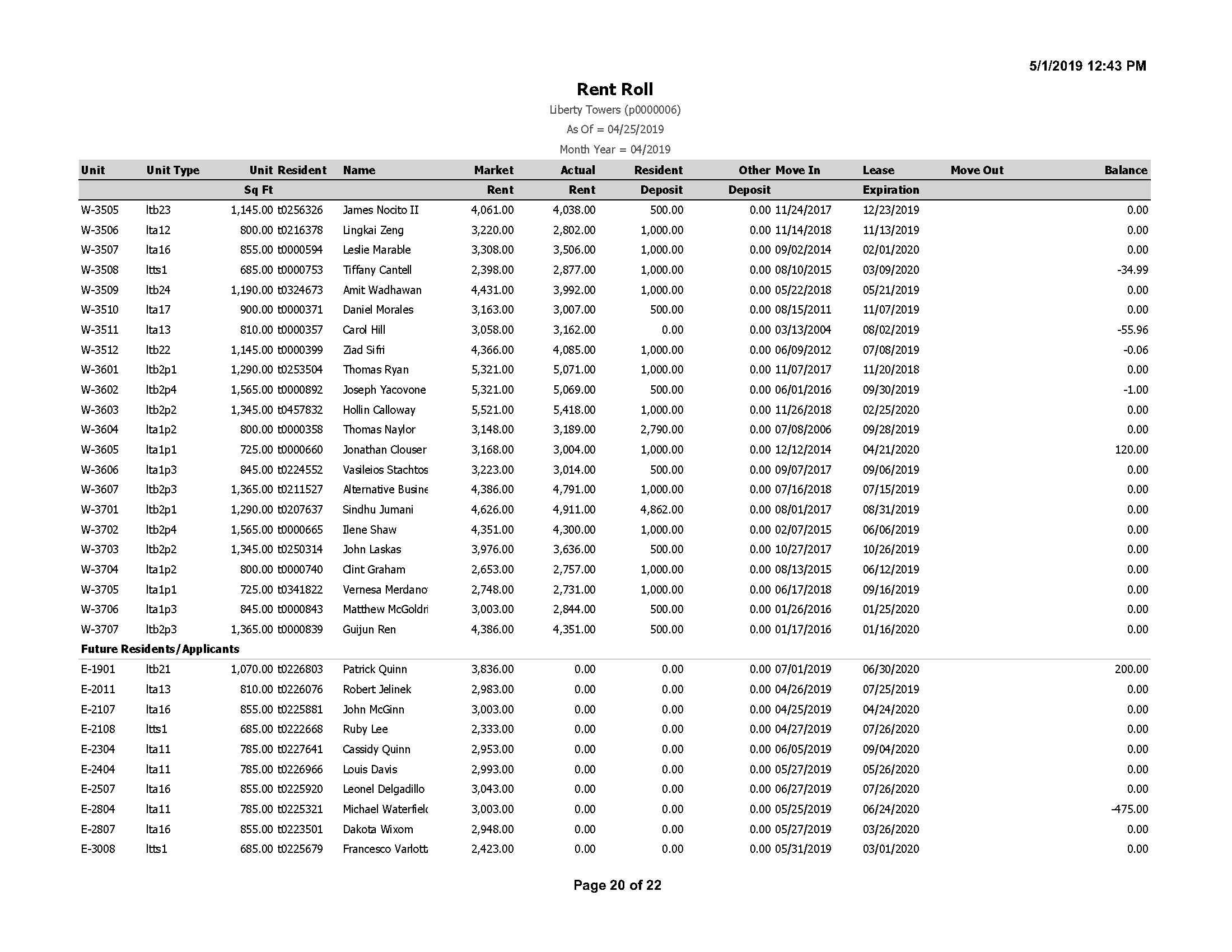

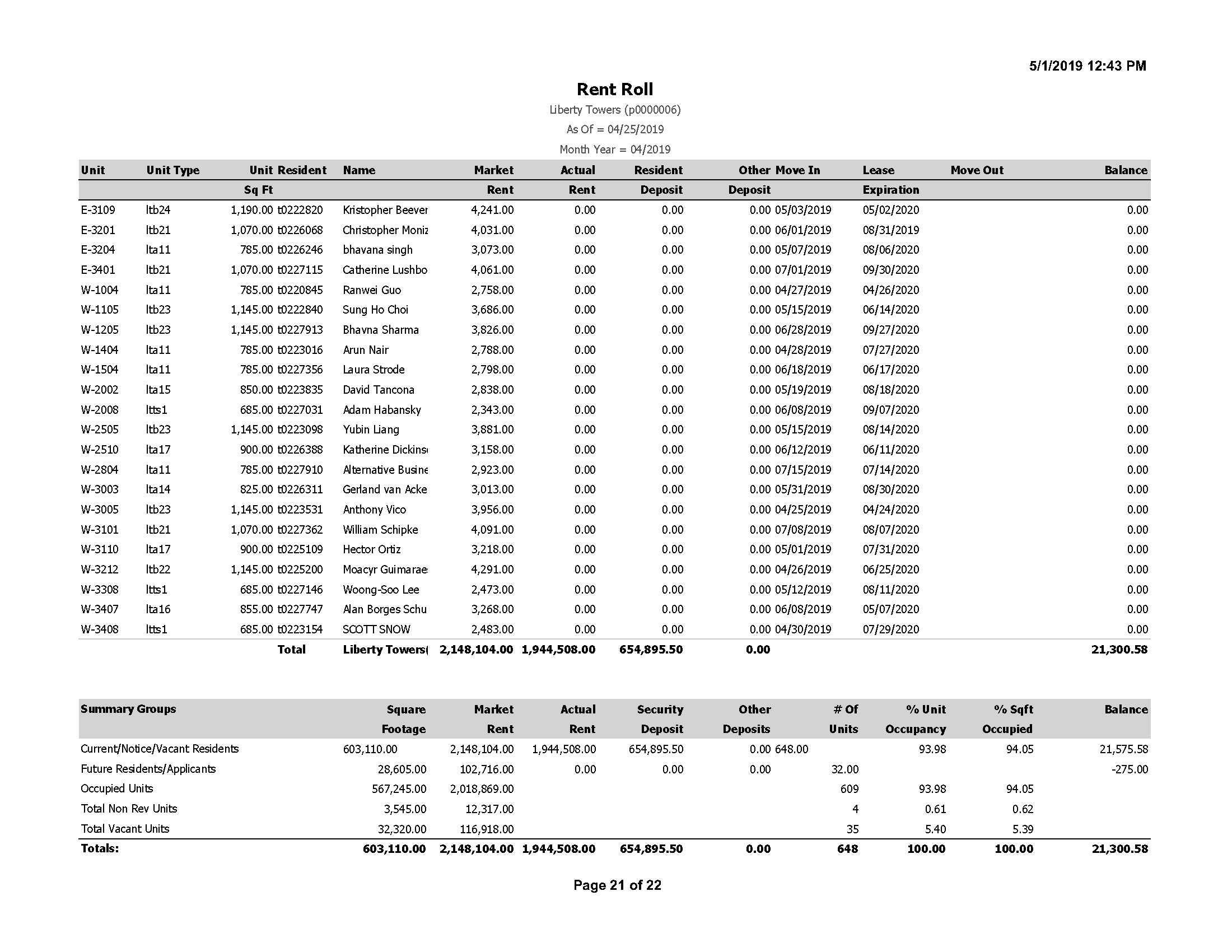

|

EXHIBIT L |

– |

Rent Roll |

|

EXHIBIT M |

– |

Form of Tenant Estoppel Certificate |

|

|

– |

|

|

Schedule 1.3 |

– |

Personal Property |

|

Schedule 4.2.1 |

– |

Permitted Exceptions |

|

Schedule 5.5 |

– |

Must-Cure Items |

|

Schedule 7.1.1 |

– |

Licenses and Permits |

|

Schedule 11.1.9 |

– |

Litigation |

5

SALE, PURCHASE AND ESCROW AGREEMENT

This Sale, Purchase and Escrow Agreement (this “Agreement”), dated as of June 28, 2019, is made by and between LT Realty Company LLC, a Delaware limited liability company (“Owner”) and Liberty Towers Urban Renewal LLC, a New Jersey limited liability company (“Ground Lessee”, and together with Owner, collectively, “Seller”) and ROSELAND ACQUISITION CORP., a Delaware corporation (“Buyer”) and constitutes (i) a contract of sale and purchase between the parties and (ii) an escrow agreement between Seller, Buyer Stewart Title Guaranty Company (“Escrow Agent”), and Lincoln Land Services, LLC (“Closing Agent”) the consent of which appears at the end hereof.

1.1 Real Property. Owner (i) owns and holds fee title to that certain land (the “Land”) described in Exhibit A, together with all improvements (the “Improvements”) located at 33 Hudson Street, Jersey City, New Jersey (collectively, the “Real Property”), and (ii) is the lessor under that certain Ground Lease dated as of April 6, 2001, by and between Essex Waterfront Owners LLC, a New Jersey limited liability company, as landlord, and Essex Waterfront Urban Renewal Entity, L.L.C., a New Jersey limited liability company, as tenant, evidenced by that certain Memorandum of Lease recorded April 18, 2001 in the Hudson County, New Jersey Recorder’s Office (“Recorded”) in Book 5790, page 156, as assigned to Owner, as landlord pursuant to that certain Assignment and Assumption of Ground Lease dated as of January 31, 2011 and Recorded February 9, 2011 in Book 8776, page 486 (collectively, the “Ground Lease”). Ground Lessee is the lessee under the Ground Lease.

1.2 Leasehold. Ground Lessee holds the ground leasehold interest in the Real Property pursuant to the Ground Lease.

1.3 Personal Property. In connection with the Real Property, Seller has (i) obtained certain governmental permits and approvals, (ii) obtained certain contractual rights including Seller’s right, title and interest in and to the Leases (as hereinafter defined), Contracts (as hereinafter defined) and other intangible assets, including, without limitation, Seller’s right, title and interest in and to the right to the use of any names (including the name "Liberty Towers"), marks, trademarks, trade names, websites, domain names and telephone numbers and listings employed in connection with the Land or the Improvements or the operations thereon, (iii) obtained certain warranties and guaranties relating to the Land, the Improvements, the Personal Property, if any, and (iv) acquired certain other items of tangible personal property, including, without limitation, fixtures, building systems, furnishings, appliances, and floor and wall coverings, all as set forth on Schedule 1.3 (the foregoing items (i) through (iv) area collectively, the “Personal Property”). The Real Property, the Ground Lease and the Personal Property are collectively referred to as the “Property.”

1.4 Purchase and Sale. Seller now desires to sell and Buyer now desires to purchase all of Seller’s right, title and interest in and to the Property, upon the terms and covenants and subject to the conditions set forth below.

2.1 Price. In consideration of the covenants herein contained, Seller hereby agrees to sell and Buyer hereby agrees to purchase the Property for a total purchase price of Four Hundred Nine Million Dollars ($409,000,000.00) (the “Purchase Price”), which shall be paid by Buyer as follows:

2.1.1 Deposit. Within three (3) business days following the execution of this Agreement, Buyer shall deliver to Escrow Agent by bank wire of immediately available funds the sum of Two Million Dollars ($2,000,000.00) (together with any interest accrued thereon, the “Deposit”) to insure the full and faithful performance by Buyer of the terms of this Agreement. Within three (3) business days following the expiration of the Investigation Period (as defined in Section 5.3.3), Buyer shall deliver to Escrow Agent, by bank wire transfer of immediately available funds, an additional Ten Million Dollars ($10,000,000.00) (the “Additional Funds”, such money to become part of the Deposit, for an aggregate Deposit of $12,000,000.00), unless Buyer shall have terminated this Agreement in accordance with Section 5.3. Failure to deliver any portion of the Deposit when due shall be a default by Buyer under this Agreement.

2.1.2 Balance of Purchase Price. Buyer shall, at or before the Closing (as defined in Section 6.1), deliver to Escrow Agent, by bank wire transfer of immediately available funds, a sum equal to the balance of the Purchase Price. The balance of the Purchase Price received by Seller at Closing shall be adjusted to reflect any credit of interest to Buyer under Section 2.3 and prorations and other adjustments pursuant to Section 7.1.

2.2 Investments. Following the collection of the Deposit, Escrow Agent shall, at the direction of Buyer, invest the Deposit in:

(i) obligations of the United States government, its agencies or independent departments;

(ii) certificates of deposit issued by a banking institution whose principal office is in New York City; or

2

(iii) an interest-bearing account of a banking institution whose principal office is in New York City.

No investment of the Deposit shall have a maturity date beyond the Closing Date (as defined in Section 6.1).

2.3 Interest on the Deposit. Any interest earned on the Deposit shall be credited and delivered to the party receiving the Deposit, except however, if the transaction closes, at Closing any interest earned on the Deposit prior to its delivery to Seller shall be paid to Seller and be credited against the Purchase Price.

ARTICLE III

CONDITIONS TO THE PARTIES’ OBLIGATIONS

3.1 Conditions to Buyer’s Obligation to Purchase. Buyer’s obligation to purchase is expressly conditioned upon each of the following:

3.1.1 Performance by Seller. Performance in all material respects of the obligations and covenants of, and deliveries required of, Seller hereunder, including, without limitation, making all material deliveries required by Section 4.3.

3.1.2 Delivery of Title and Possession. Delivery at the Closing of (i) the Deed (as defined in Section 4.3.1) by Owner, (ii) Assignment of Ground Lease (as defined in Section 4.1.2) by Owner and Ground Lessee, and (iii) possession as provided in Section 15.1.

3.1.3 Title Insurance. Subject to Buyer’s payment of the premium for the Title Policy (as defined below) and satisfaction of any requirements of the Title Company (as defined below) that are imposed on the proposed insured in the Title Report (as defined in Section 5.1.1), delivery at the Closing of a standard 2006 form of American Land Title Association owner’s policy of title insurance (or a signed marked binder thereof) (the “Title Policy”) with liability in the amount of the Purchase Price issued by Lincoln Land Services, LLC, as policy issuing agent for Stewart Title Guaranty Company (the “Title Company”), insuring that the fee title to the Real Property vests in Buyer subject only to the permitted exceptions set forth in Schedule 4.2.1 (collectively, the “Permitted Exceptions”). At its option, Buyer may direct the Title Company to issue additional title insurance endorsements, if Buyer pays for the extra cost of such additional endorsements, provided that the Title Company’s failure to issue any such additional endorsements shall not affect Buyer’s obligations under this Agreement. Notwithstanding anything to the contrary herein, if the Title Company is not able to issue its portion of the Title Policy at Closing, then Seller and Buyer shall cooperate to obtain the Title Policy

3

from another national title insurance company and, if such title insurance company is willing to provide the Title Policy in the form required hereunder at regular rates, Buyer shall procure such Title Policy, provided either Buyer or Seller may adjourn the Closing for up to fifteen (15) days to procure such Title Policy. Nothing in this Section 3.1.3 shall obligate Seller to deliver any affidavit, indemnity or other instrument except as provided in Sections 4.2 and 5.3.2.

3.1.4 Seller’s Representations. The representations and warranties by Seller set forth in Section 11.1 being true and correct in all material respects as of the Closing, except as modified by (i) notice (in accordance with Section 11.1) to which Buyer does not object in writing by the later of (a) three (3) business days after receipt thereof, or (b) the end of the Investigation Period (as defined in Section 5.3.3), (ii) any acts of Seller permitted to be taken pursuant to the terms of this Agreement and (iii) changed facts or circumstances not resulting from the actions or wrongful omissions of Seller (except as permitted under this Agreement), but in each case only if such event has a material adverse effect on the Property (or with respect to violations, a cost of $5,000 or more in the aggregate), Buyer shall have no obligation to close and shall be entitled to terminate this Agreement and obtain a return of the Deposit, it being agreed that any such changes shall not constitute a default by Seller under this Agreement.

3.1.5 Association Certificate. Seller shall have received an estoppel certificate from the Colgate Center Property Owner Association (the “Association”), confirming that all of Seller’s Association fees are paid and current, it being agreed that Seller’s failure to obtain such estoppel certificate shall not constitute a default by Seller under this Agreement.

3.1.6 Violations. There shall be no uncured violations of law or open permits affecting the Property that would cost, in the aggregate, in excess of Five Thousand Dollars ($5,000) to cure. If Seller is unable to cure any violations Seller is required to cure under this Section 3.1.6 by the then scheduled Closing, Seller may adjourn the Closing for up to fifteen (15) business days to do so. Notwithstanding the foregoing, any uncured violation shall not constitute a default by Seller under this Agreement.

3.2 Conditions to Seller’s Obligation to Sell. Seller’s obligation to sell is expressly conditioned upon each of the following:

3.2.1 Performance by Buyer. Performance in all material respects of the obligations and covenants of, and deliveries required of, Buyer hereunder, including, without limitation, making all material deliveries required by Section 4.1.

4

3.2.2 Buyer’s Representations. The representations and warranties by Buyer set forth in Section 11.2 being true and correct in all material respects as of the date hereof and as of the Closing, except as modified by (i) notice to which Seller does not object in writing within three (3) business days after receipt thereof and (ii) any acts of Buyer permitted to be taken pursuant to the terms of this Agreement.

3.2.3 Receipt of Purchase Price. Delivery of the Purchase Price (subject to any adjustments set forth herein) at the Closing to the Escrow Agent in the manner herein provided.

3.3 No Financing Contingency. Notwithstanding anything to the contrary contained herein, Buyer acknowledges and agrees that, while Buyer may at its own risk attempt to obtain financing with regard to its acquisition of the Property, (i) Buyer’s obtaining, or ability to obtain, financing for its acquisition of the Property is in no way a condition to Buyer’s performance of its obligations under this Agreement and (ii) Buyer’s performance of its obligations under this Agreement is in no way dependent or conditioned upon the availability of any financing whether generally in the marketplace or specifically in favor of Buyer and (iii) in no event shall the Closing be delayed on account of Buyer’s obtaining, or ability to obtain, financing. Notwithstanding the foregoing, Seller acknowledges that Buyer intends to obtain financing and Seller shall cooperate, to the extent commercially reasonable, with all of Buyer’s reasonable requests related to Buyer’s financing, at Buyer’s sole cost and expense, and any information provided in connection therewith shall be without any Seller representation or warranty of any kind, including, without limitation, their accuracy or completeness.

3.4 Failure of Condition. In the event of a failure of any of the foregoing conditions precedent, the party for whose benefit the condition exists may (i) if such failure was caused by the default of the other party in performing any obligation or covenant to be performed hereunder or the breach by such other party of any of its representations or warranties, exercise its remedies under Article X hereof, or (ii) if such failure was not caused by the default of the other party in performing any obligation or covenant to be performed hereunder or the breach by such other party of any of its representations or warranties, elect to terminate this Agreement by written notice to the other party, in which event this Agreement shall terminate except for any obligations which expressly survive the termination of this Agreement and the Deposit shall be returned to Buyer.

BUYER’S DELIVERIES AND SELLER’S DELIVERIES TO ESCROW AGENT AND CLOSING AGENT

4.1 Buyer’s Deliveries to Escrow Agent. Buyer shall, at or before the Closing, deliver (or cause to be delivered) to Escrow Agent each of the following:

5

4.1.1 Purchase Price. The balance of the Purchase Price as set forth in Article II.

4.2 Buyer’s Deliveries to Closing Agent. Buyer shall, at or before the Closing, deliver (or cause to be delivered) to Closing Agent each of the following:

4.2.1 Assignment of Ground Lease. Four (4) executed counterparts of the Assignment and Assumption of Ground Lease (the “Assignment of Ground Lease”) in the form of Exhibit B.

4.2.2 Assignment of Leases and Contracts. Four executed counterparts of the Assignment and Assumption of Leases, Contracts and Other Property Interests (the “Assignment of Leases and Contracts”) in the form of Exhibit C.

4.2.3 Bill of Sale. Four executed counterparts of a bill of sale (the “Bill of Sale”) in the form of Exhibit D.

4.2.4 Transfer Declarations. Executed copies Transfer Declarations (as defined in Section 4.2.7), as applicable.

4.2.5 Closing Statement. An executed settlement statement reflecting the prorations and adjustments required under Section 2.3 and Article VII.

4.2.6 Consents or Resolutions. Consents or Resolutions of Buyer, including copies of Buyer’s organizational documents, in form reasonably acceptable to the Title Company.

4.2.7 Parking Lease. Two executed counterparts of a joint notice of termination (with Seller and Buyer as signatories) of that certain Parking Facilities Lease, dated as of January 31, 2011 (the “Parking Facilities Lease”), stating that the effective date of such termination will be thirty (30) days after the Closing Date (the “Parking Facilities Lease Termination”). Buyer shall be responsible for duplication and distribution of the Parking Facilities Lease Termination to the parking operator upon Closing.

4.2.8 Bring-Down Certificate. Certificate signed by Buyer confirming that the Representations and Warranties of Buyer set forth in Section 11.2 remain true and complete in all material respects as of the Closing Date (“Buyer’s Bring-Down Certificate”), provided, however, that if any of the representations and warranties or schedules have changed since the date hereof, then Buyer shall revise the representations and warranties and schedules, as set forth in Buyer’s Bring-Down Certificate, to conform to the changed circumstances, provided further, however, that no such change

6

shall be deemed to cure or restore any inaccuracy of the substance of any particular representation or warranty when made for the purposes of satisfying Seller’s conditions to Closing, except as provided for in Section 3.2.2 above.

4.3 Seller’s Deliveries. Seller shall, at or before the Closing, deliver (or cause to be delivered) to Closing Agent each of the following:

4.3.1 Deed. A bargain and sale deed with covenants against grantor’s acts (the “Deed”) executed and acknowledged by Owner, pursuant to which Seller shall convey title to the Real Property, in the form attached hereto as Exhibit E subject only to the Permitted Exceptions.

4.3.2 Assignment of Leases and Contracts. Four executed counterparts of the Assignment of Leases and Contracts signed by Seller and Seller’s Manager (as defined in Section 16.16). Schedule A of the Assignment of Leases and Contracts shall include an updated Rent Roll (as defined in Section 11.1.6) as of the Closing Date (which Rent Roll shall set forth the Leases being assigned) and Schedule B shall include all of the “Assigned Contracts” listed in Exhibit J . Prior to Closing, Seller shall terminate all Contracts other than the Assigned Contracts.

4.3.3 Bill of Sale. Four executed counterparts of the Bill of Sale.

4.3.4 Notices to Vendors. A notice signed by Seller (or Seller’s Manager for the Improvements) to vendors under the Assigned Contracts in the form of Exhibit F (the “Notice to Vendors”). Buyer shall be responsible for duplication and distribution of the Notice to Vendors to vendors under the Assigned Contracts upon Closing.

4.3.5 Notices to Tenants. Notices signed by Seller (or Seller’s Manager for the Improvements) to tenants under the then existing Leases in the form of Exhibit G (the “Notice to Tenants”). Buyer shall be responsible for duplication and distribution of the Notice to Tenants to the tenants under the then existing Leases promptly following the Closing.

4.3.6 FIRPTA Certificate. Executed copies of a certificate in the form of Exhibit H, with respect to the Foreign Investment in Real Property Tax Act.

4.3.7 Transfer Declarations. Executed copies of state, county and local transfer declarations, as applicable, including, without limitation, the State of New Jersey Affidavit of Consideration For Use By Seller and State of New Jersey Seller’s Residency Certification/Exemption (collectively, “Transfer Declarations”).

7

4.3.8 Title Affidavit. A title affidavit executed by Seller (to be delivered to the Title Company) in the form of Exhibit I.

4.3.9 Closing Statement. An executed settlement statement reflecting the prorations and adjustments required under Section 2.3 and Article VII.

4.3.10 Assignment of Ground Lease. Four (4) executed counterparts of the Assignment of Ground Lease. The parties agree that such assignment is made without any recourse representations or warranties of any kind, express or implied, except as expressly provided in this Agreement.

4.3.11 Consents or Resolutions. Consents or Resolutions of Seller, including copies of Seller’s organizational documents, in form reasonably acceptable to the Title Company.

4.3.12 Bring-Down Certificate. Certificate signed by Seller confirming that the Representations and Warranties of Seller set forth in Section 11.1 remain true and complete in all material respects as of the Closing Date (“Seller’s Bring-Down Certificate”), provided, however, that if any of the representations and warranties or schedules have changed since the date hereof, then Seller shall revise the representations and warranties and schedules, as set forth in Seller’s Bring-Down Certificate, to conform to the changed circumstances, provided further, however, that no such change shall be deemed to cure or restore any inaccuracy of the substance of any particular representation or warranty when made for the purposes of satisfying Buyer’s conditions to Closing, except as provided for in Section 3.1.4 above.

4.3.13 Parking Lease. Two executed counterparts of the Parking Facilities Lease Termination.

4.3.14 Leases and Contracts. Original counterparts, or, if originals are unavailable, copies certified to be true and complete by Seller, of all Leases and Contracts affecting the Property. For the purpose of satisfying the requirements of this Section 4.3.14, such Leases and Contracts may be left in the management office located at the Property.

4.3.15 Keys. All keys to the Improvements in Seller’s in Seller’s possession, which may be left in the management office located at the Property.

4.4 Failure to Deliver. The failure of Buyer or Seller to make any delivery required above by and in accordance with this Article IV shall constitute a default hereunder by such party.

8

ARTICLE V

INVESTIGATION OF PROPERTY

5.1 Delivery of Documents. Seller shall deliver, cause to be delivered, or make available to Buyer the following:

5.1.1 Preliminary Title Report. A current preliminary title report covering the Real Property issued by Stewart Title Guaranty Company, together with copies of all documents referred to as exceptions therein file number 01258-5305 ( the “Preliminary Title Report” and together with any Continuations, the “Title Report”).

5.1.2 Survey. A copy of that certain survey of Real Property, dated March 20, 2019, prepared by NV5 (the “Survey”).

5.1.3 Ground Lease, Leases and Contracts. Copies of (i) the Ground Lease, (ii) the Leases, (iii) the Parking Facilities Lease, and (iv) the revenue contracts, service contracts, equipment leases, maintenance agreements and other contracts affecting the Real Property entered into by Seller or on Seller’s behalf enumerated in Exhibit J or executed in accordance with this Agreement after the date hereof (collectively, the “Contracts”), which for the avoidance of doubt shall exclude that certain Residential Management and Leasing Agreement, dated as of January 31, 2011, by and between Ground Lessee and Bozzuto Management Company, a Maryland corporation (the “Management Agreement”), which Seller shall terminate as of the Closing Date at no cost to Buyer. “Lease” as used herein shall mean the following pertaining to the Real Property: (i) any and all written leases, rental agreements, occupancy agreements and license agreements (and any and all written renewals. amendments, modifications and supplements thereto) entered into (x) on or prior to the date hereto or after the date hereof and (y) prior to the Closing Date in accordance with this Agreement and (ii) any and all new written renewals, amendments, modifications and supplements to any of the foregoing entered into after date hereof and prior to the Closing Date in accordance with this Agreement. Leases shall not include (x) the Ground Lease, (y) any parking space leases, or (z) any subleases, franchise agreements or similar occupancy agreements entered into by third-party tenants or subtenants which, by their nature, are subject to Leases (collectively, “Other Leases”).

5.1.4 Books and Records. Copies of books and records, monthly operating statements and variance reports, tax bills and utility bills regarding the Property for the 2018 calendar year and 2019 (year-to-date) (the “Books and Records”), it being acknowledged that the foregoing shall not include any financial analyses, budgets, projections, appraisals, or confidential materials.

9

5.1.5 Permits. Copies of all governmental permits, certificates of occupancy and approvals, in each case regarding the Property, which are in Seller’s possession.

5.1.6 Registration. Copy of the certificate of inspection (green card) for the Property from the Department of Community Affairs.

5.1.7 Certificates of Occupancy. A copy of the certificate of occupancy issued by the City of Jersey City with respect to the Property.

If requested by Seller, Buyer shall provide written verification of its receipt of those items listed in this Section 5.1 which are delivered to Buyer. For the avoidance of doubt, Buyer hereby acknowledges that Seller makes no representation or warranty as to the truth, accuracy or completeness of any materials, data or other information made available to Buyer, other than the representations and warranties of Seller that are expressly set forth in this Agreement or the documents delivered to Buyer by Seller in connection with the Closing.

5.2 Physical Inspection of the Real Property. Prior to the expiration of the Investigation Period, Buyer and Buyer’s representatives, agents and designees shall have the right at reasonable times and upon reasonable notice to Seller to enter upon the Real Property in accordance with that certain Access Agreement, dated as of May 15, 2019, by and between Seller and Buyer (the “Access Agreement”).

5.2.1 No Communication with Tenants. Neither Buyer nor Buyer’s representatives, agents and designees shall meet, interview or communicate with any tenant, adjacent landowner or governmental authority except as permitted by the Access Agreement.

5.3 Investigation Period. Buyer shall have the right to make the following investigations.

5.3.1 Preliminary Title Reports and Existing Survey. Buyer acknowledges that Buyer has received and reviewed the Preliminary Title Report and hereby agrees that unless otherwise stated in the marked-up Preliminary Title Report attached hereto as Exhibit K, all exceptions set forth therein shall be Permitted Exceptions. Buyer acknowledges Buyer has received and reviewed the Existing Survey and hereby agrees that the Existing Survey is acceptable to Buyer.

5.3.2 Title and Survey Continuation. If exceptions to first appear on any update or continuation of the Preliminary Title Report or Existing Survey (each a “Continuation”) which are not Permitted Exceptions (each a “Title Objection”), Buyer shall notify Seller thereof by the earlier to occur of (y) the day that is five (5) business days after Buyer receives such Continuation and (z) at least one (1) business day prior to the then scheduled Closing Date. If

10

Buyer does give such notice, Seller shall have five (5) business days after receipt thereof to notify Buyer that Seller (a) will cause or (b) elects not to cause, any or all Title Objections to be removed or, if Buyer approves in its sole discretion exercised in good faith, insured over by the Title Company. Seller’s failure to notify Buyer within such five (5) business day period as to any Title Objection shall be deemed an election by Seller not to remove or have the Title Company insure over such Title Objection. If Seller notifies or is deemed to have notified Buyer that Seller shall not remove nor have the Title Company insure over any or all of the Title Objections, Buyer shall have the right, exercisable within five (5) business days following receipt (or deemed receipt) of such notice, either to (i) terminate this Agreement due to such Title Objections, in which event Escrow Agent shall refund the Deposit to Buyer and neither party shall thereafter have any further rights or obligations under this Agreement, except for those rights or obligations that expressly survive or (ii) waive such Title Objections and proceed to closing without any abatement or reduction in the Purchase Price on account of such Title Objections, in which event such Title Objections shall be deemed Permitted Exceptions for all purposes hereof. If Buyer does not timely give such notice, Buyer shall be deemed to have elected (ii) above.

5.3.3 General Investigation. In addition, Buyer shall have from the date hereof until the date hereof at 5:00 p.m. New York City Time (the “Investigation Period”) to notify Seller that as a result of Buyer's review of the documents set forth in Section 5.1 (other than the Title Report or the Survey which are covered in Sections 5.3.1 and 5.3.2 above) or Buyer’s investigation of the Property pursuant to Section 5.2 it disapproves the purchase of the Property (which disapproval may be for any reason or no reason whatsoever in Buyer's sole discretion) and has elected to terminate this Agreement. If Buyer fails to give such notice of disapproval and termination prior to the expiration of the Investigation Period, such failure shall be conclusively deemed to be a waiver of Buyer’s right to terminate this Agreement under this Section 5.3.3.

5.4 Effect of Termination. If Buyer terminates this Agreement in accordance with Section 5.3, all further rights and obligations of the parties shall cease and terminate without any further liability of either party to the other (except those obligations which are specifically provided to survive such termination as provided in this Agreement).

5.5 No Obligation to Cure. Nothing contained in this Agreement or otherwise shall require Seller to render its title marketable or to remove or correct any exception or matter disapproved by Buyer or to spend any money or incur any expense in order to do so other than the items set forth in Schedule 5.5 (the “Must-Cure Items”), which Must-Cure Items Seller shall be obligated to remove from title as of the then scheduled Closing Date. Notwithstanding anything to the contrary herein, Seller may use the Purchase Price at Closing to cure Must-Cure Items and any other items Seller has agreed to cure.

11

5.6 Copies of Third Party Reports. Upon Seller’s request after termination of this Agreement for any reason other than a default by Seller, Buyer, within three days after such request, shall provide Seller with copies of all third party reports and work product generated with respect to the Property provided that such items shall be delivered without representations or warranties to their accuracy or completeness and with no right of Seller to rely thereon without the consent of the third party.

6.1 Date and Manner of Closing. Closing Agent shall close the escrow (the “Closing”) as soon as all conditions to closing contained in this Agreement have been satisfied which shall in any event be not later than August 22, 2019 (the “Closing Date”) (subject only to adjournment rights under Sections 3.1.3, 3.1.6, 13.6, 13.9 and 16.19, in either of which events the adjourning party will give the other party not less than three (3) business day’s notice of the date of Closing), by recording and delivering all documents and funds as set forth in Article VIII. Buyer shall have the right to extend the Closing Date for an additional period of thirty (30) days, by providing written notice to Seller and Escrow Agent at least three (3) business day before the scheduled Closing Date, provided that Buyer delivers to Escrow Agent, simultaneously with such notice, an additional deposit of Six Million Dollars ($6,000,000.00), which shall be treated as part of the Deposit for all purposes of this Agreement. In addition to any other rights to extend the Closing Date contained in this Agreement, Buyer or Seller may elect to extend the Closing Date by a period of up to five (5) business days by delivering written notice to the other party at least one (1) business day prior to the Closing Date.

6.2 Delay in Closing; Authority to Close. If Escrow Agent or Closing Agent cannot close the escrow on or before the Closing Date, it shall, nevertheless, close the same when all conditions have been satisfied or waived, notwithstanding that one or more of such conditions has not been timely performed, unless after the Closing Date and prior to the close of the escrow, Escrow Agent receives a written notice to terminate the escrow and this Agreement from a party who, at the time such notice is delivered, is not in default hereunder. The foregoing shall not require the Escrow Agent or Closing Agent to close title in a manner which is contrary to the escrow closing instructions delivered by any party, provided such instructions are in accordance with this Agreement. The exercise of such right of termination, any delay in the exercise of such right, and the return of monies and documents, shall not affect the right of the party giving such notice of termination to pursue remedies permitted under Article X for the other party’s breach of this Agreement. In addition, the giving of such notice, the failure to object to termination of the escrow or the return of monies and documents shall not affect the right of the other party to pursue other remedies permitted under Article X for the breach of the party who gives such notice.

12

ARTICLE VII

PRORATION, FEES, COSTS AND ADJUSTMENTS

7.1 Prorations. Prior to the Closing, Seller shall determine the amounts of the prorations in accordance with this Agreement and notify Buyer thereof. Buyer shall review and approve such determination promptly and prior to the Closing, such approval not to be unreasonably withheld, conditioned or delayed. Thereafter, Buyer and Seller shall each inform Escrow Agent and Closing Agent of such amounts.

7.1.1 Certain Items Prorated. In accordance with the notifications, Escrow Agent shall prorate between the parties (and the parties shall deposit funds therefor with Escrow Agent or shall instruct Escrow Agent to debit against sums held by Escrow Agent owing to such party), as of 11:59 p.m. the day prior to the Closing, all income and expenses with respect to the Property and payable to or by the owner of the Property: (i) all real property taxes, assessment (including Special Improvement District Charges), payments in lieu if taxes and other similar charges (but excluding any Miscellaneous Hotel Tax, which are payable by tenants) on the basis of the fiscal period for which assessed (if the Closing shall occur before the tax rate is fixed, the apportionment of taxes shall be based on the tax rate for the preceding period applied to the latest assessed valuation); (ii) Colgate Center Property Owner Association fees on the basis of period for which assessed (if the Closing shall occur before the amount is fixed, the apportionment of taxes shall be based on the amount for the preceding period); (iii) rents, including percentage rents, additional rent or escalation charges or reimbursements for real property taxes, operating expenses or other charges, parking revenues, other tenant payments and tenant reimbursements (collectively, “Tenant Payments”), if any, actually received under the Leases; (iv) Tenant Payments, whether collected or not, for any tenant which has not made such Tenant Payments as of the Closing Date, but who is still within any grace period under its Lease for the month in which the Closing occurs, provided such tenant is not delinquent with respect to any Tenant Payments through the month prior to the month of the Closing, and if such unpaid Tenant Payments are received by Seller, Seller shall remit to Buyer if and when received; (v) payments received under Assigned Contracts which are revenue Contracts; (vi) amounts prepaid and amounts accrued but unpaid on the Assigned Contracts other than revenue contracts and (vii) the periodic fees for licenses, permits or other authorizations with respect to the Property identified on Schedule 7.1.1. In addition to the foregoing, charges for water, sewer, electricity, gas, fuel and other utility charges, all of which shall be read promptly before Closing shall not be prorated, but such accounts shall be closed and paid in full by Seller as of the Closing Date.

13

7.1.2 Leasing Commissions and Tenant Improvements. At the Closing Buyer shall pay to the applicable broker (if then due), reimburse Seller for (if already paid), and assume from Seller the obligation to pay (if due in the future) all leasing commissions, tenant improvement costs and other charges payable to third-party outside brokers and approved (or deemed approved) or disclosed pursuant to Section 13.3 or 13.4 (e.g. excluding any Seller Indemnified Parties) payable by reason of or in connection with (i) any Lease entered into with Buyer’s approval after the date hereof or without Buyer’s approval after the date hereof if in accordance with the terms of this Agreement and (ii) any renewal, expansion (including any expansion options contained in an existing Lease) or extension of an existing Lease after the date hereof. Seller shall pay at Closing all commissions to brokers in connection with all Leases, other than those that are Buyer’s obligations pursuant to this Section. Notwithstanding anything to contrary contained herein, Buyer approves the Lease extension of Riverside Pediatrics Group, Inc. and Buyer shall pay to broker (if then due), reimburse Seller for (if already paid), and assume from Seller the obligation to pay (if due in the future) the brokerage fee, if any.

7.1.3 Taxes. Real property tax, assessment (including Special Improvement District Charges) or payment in lieu of taxes refunds and credits received after the Closing which are attributable to a fiscal tax year prior to the Closing shall belong to Seller. Any such refunds and credits attributable to the fiscal tax year during which the Closing occurs shall be apportioned between Seller and Buyer when received after deducting the reasonable out-of-pocket expenses of collection thereof. If there are any confirmed or unconfirmed one-time special assessments against the Property (other than Special Improvement District assessments), Seller shall pay same if the work giving rise to the assessment was completed prior to the Closing Date, but if the work giving rise to the assessment was not completed prior to the Closing Date, same shall be paid or assumed by Buyer. However, if such assessment is payable in installments, Seller shall be responsible only for those installments that are due and payable prior to the Closing Date.

7.1.4 Security Deposits. At the Closing, Seller shall credit to Buyer an amount equal to all unapplied refundable security deposits (plus interest accrued thereon to the extent required to be paid by the applicable Lease or applicable law) required to be held by Seller under the commercial Leases. If any security deposits shall be held by Seller in the form of letters of credit or surety bonds, Seller shall assign its rights thereunder to Buyer and shall cooperate reasonably with Buyer in respect of the reissuance of any such letters of credit or bonds in the name of Buyer, including, without limitation, by paying any assignment fees. With respect to security deposits under residential Leases, such security deposits shall be

14

held by Seller strictly in accordance with the provisions of N.J.S.A. 46:8-19 et seq. in segregated interest bearing accounts in trust for the tenants. At the Closing, such accounts will be assigned from Seller to Buyer, pursuant to forms acceptable to the banking institution where such security deposits are deposited. If such assignment is not permitted by the banking institution, Seller shall deliver to Buyer all unapplied security deposits (plus interest accrued thereon to the extent required to be paid by the applicable law). In addition, Seller shall provide Buyer with a copy of the bank statement for the security deposit account as of the date hereof, and as of the date of Closing.

7.1.5 Utility Accounts. Seller shall close its own utility accounts prior to Closing and pay all amounts due and payable to any utility company at Closing. Buyer shall cause utility accounts to be placed in Buyer’s name at Closing and post any utility deposits required by such utility providers. Seller shall be credited at the Closing any remaining contract deposits then held by third parties with respect to the Assumed Contracts.

7.1.6 Delinquent Rentals; Other Tenant Payments. Delinquent Tenant Payments other than such amounts prorated pursuant to Sections 7.1.1(iii) and (iv), if any, shall not be prorated and all rights thereto shall be retained by Seller, who reserves the right to collect and retain such delinquent Tenant Payments, and Buyer agrees to cooperate with Seller in Seller’s efforts to collect such Tenant Payments, at no cost to Buyer, other than de minimis costs, including, if necessary, joining in any legal action instituted by Seller. Buyer reserves the right to collect any delinquent Tenant Payments for the month in which Closing occurs and any month thereafter. If at any time after the Closing, Buyer shall receive any delinquent Tenant Payments (all of which Buyer shall use commercially reasonable efforts to obtain) to which Seller is entitled, Buyer shall immediately remit such Tenant Payments to Seller, provided that any monies received by Buyer from a delinquent tenant shall be applied first to current rents then due and payable and then to delinquent rents in the inverse order in which they became due and payable. For amounts due Seller not collected within three (3) months after the Closing, Seller shall have the right to sue to collect the same, provided that Seller shall not be entitled to commence any lease termination or eviction proceeding against the delinquent tenant.

7.1.7 Post-Closing True-Up. Any prorations or adjustments of revenue or expenses which cannot be ascertained with certainty as of the Closing (including without limitation taxes and payments in lieu of taxes relating to the Property, operating expenses and additional rent paid by tenants) shall be prorated on the basis of the parties’ reasonable

15

estimate of such amounts and shall be re-prorated once the final amounts are determined. Until the date that is six (6) months after the Closing, Seller and Buyer agree to cooperate in good faith to determine if and to what extent any prorations proved to be incorrect. If any of the prorations or adjustments made pursuant to this Section 7.1 shall prove incorrect for any reason, the party in whose favor the error was made will promptly pay to the other party the amount necessary to correct such error. Seller and Buyer shall each be deemed to have waived any right to seek such readjustment of the prorations if it has not sent written notice to the other party prior to the date that is six (6) months after the Closing of a dispute that has not been resolved. In addition to the foregoing, with respect to the prorations of percentage rent, additional rent, escalation charges or reimbursement for real property taxes or operating expenses under the Leases, the parties shall cooperate in good faith to adjust amounts collected and paid by Seller prior to Closing, to enable Buyer to prepare its year-end reconciliation with tenants, until the date that is one (1) year after the Closing, and the parties shall each be deemed to have waived any right to readjustment of such prorations if it has not sent written notice to the other party prior to the date that is one (1) year after the Closing of a dispute that has not been resolved.

7.1.8 Survival. The provisions of this Section 7.1 shall survive the Closing.

7.2 Seller’s Closing Costs. Seller shall pay (i) the realty transfer fee to Hudson County, (ii) one‑half of Escrow Agent’s escrow fee or escrow termination charge and (iii) Seller’s own attorneys’ fees.

7.3 Buyer’s Closing Costs. Buyer shall pay (i) the cost of the Title Report, the title premium for the Title Policy and the cost of any title insurance endorsements ordered by Buyer, (ii) the cost of the Existing Survey and any Continuations, including any items requested by Buyer to be added to the Survey, (iii) taxes and any other costs incurred in recording the Deed, the Assignment of Ground Lease and any other instruments (other than the realty transfer fee), (iv) any costs incurred in connection with Buyer’s investigation of the Real Property pursuant to Article V, (v) one‑half of Escrow Agent’s escrow fee or escrow termination charge and (vi) Buyer’s own attorneys’ fees. Any closing costs not specifically allocated in Section 7.2 or 7.3 shall be allocated between each of Seller and Buyer in a manner customary for commercial real estate purchase and sale transactions in the jurisdiction in which the Real Property is located.

7.4 Reimbursement of Closing Costs. Notwithstanding anything to the contrary contained in Section 7.2 or 7.3, if, prior to the Closing, Buyer or Seller has paid (or caused to be paid) any closing costs that are the other’s responsibility in whole or in part, pursuant to Section 7.2 or 7.3, as applicable, then at the Closing, the party by which (or on whose behalf) such payment was made shall receive a credit in an amount equal to the other’s proportionate responsibility for such closing costs.

16

ARTICLE VIII

DISTRIBUTION OF FUNDS AND DOCUMENTS

8.1 Delivery of the Purchase Price. At the Closing, Escrow Agent shall deliver the Purchase Price to Seller, and the transaction shall not be considered closed until such delivery occurs.

8.2 Other Monetary Disbursements. Escrow Agent shall, at the Closing, hold for personal pickup or arrange for wire transfer, (i) to Seller, or order, as instructed by Seller, all sums and any proration or other credits to which Seller is entitled and less any appropriate proration or other charges and (ii) to Buyer, or order, any excess funds theretofore delivered to Escrow Agent by Buyer and all sums and any proration or other credits to which Buyer is entitled and less any appropriate proration or other charges.

8.3 Recorded Documents. Closing Agent shall cause the Deed and any other documents that Seller or Buyer desires to record to be recorded with the appropriate county recorder and, after recording, returned to the grantee, beneficiary or person acquiring rights under said document or for whose benefit said document was acquired.

8.4 Documents to Buyer. Closing Agent shall at the Closing deliver by overnight express delivery to Buyer the following:

(1) one (1) conformed copy of the Deed;

(2) two (2) originals of the Assignment of Ground Lease;

(3) two (2) originals of the Assignment of Leases and Contracts;

(4) two (2) originals of the Bill of Sale;

(5) two (2) originals of the Notice to Tenants;

(6) two (2) originals of the Notice to Vendors;

(7) two (2) originals of the Parking Facilities Lease Termination;

(8) two (2) originals of the FIRPTA Affidavit;

(9) one (1) copy of any Transfer Declarations;

(10) one (1) original of the Closing Statement

(11) two (2) originals of Seller’s Bring-Down Certificate; and

(12) one (1) original of the Title Policy.

8.5 Documents to Seller. Closing Agent shall at the Closing deliver by overnight express delivery to Seller, the following:

(1) one (1) conformed copy of the Deed;

(2) two (2) originals of the Assignment of Ground Lease;

(3) two (2) originals of the Assignment of Leases and Contracts;

(4) two (2) originals of the Bill of Sale;

(5) a copy of the Parking Facilities Lease Termination;

(6) two (2) originals of the FIRPTA Affidavit

(7) one (1) copy of any Transfer Declarations

17

(8) two (2) originals of Buyer’s Bring-Down Certificate; and

(9) one (1) original of the Closing Statement.

8.6 All Other Documents. Closing Agent shall at the Closing deliver by overnight express delivery, each other document received hereunder by Closing Agent to the person acquiring rights under said document or for whose benefit said document was acquired.

ARTICLE IX

RETURN OF DOCUMENTS AND FUNDS UPON TERMINATION

9.1 Return of Seller’s Documents. If escrow or this Agreement is terminated for any reason, Buyer shall, within five (5) days following such termination, deliver to Seller all documents and materials relating to the Property previously delivered to Buyer by or on behalf of Seller and, unless such termination is due to a default by Seller, copies of all reports, inspections, studies, documents and materials obtained by Buyer from third parties in connection with the Property and Buyer’s investigation thereof. Such items shall be delivered without representation or warranty as to accuracy or completeness and with no right of Seller to rely thereon without the consent of the third party. Closing Agent shall deliver all documents and materials deposited by Seller and then in Closing Agent’s possession to Seller. Upon delivery by Closing Agent to Seller of such documents and materials, Closing Agent’s obligations with regard to such documents and materials under this Agreement shall be deemed fulfilled and Closing Agent shall have no further liability with regard to such documents and materials to either Seller or Buyer.

9.2 Return of Buyer’s Documents. If escrow or this Agreement is terminated for any reason, Closing Agent shall deliver all documents and materials deposited by Buyer and then in Closing Agent’s possession to Buyer. Upon delivery by Closing Agent to Buyer of such documents and materials, Closing Agent’s obligations with regard to such documents and materials under this Agreement shall be deemed fulfilled and Closing Agent shall have no further liability with regard to such documents and materials to either Seller or Buyer.

9.3 Deposit. If escrow or this Agreement is terminated pursuant to any provision which entitles Buyer to the return of the Deposit, then Buyer shall be entitled to obtain the return of the Deposit. If the closing of title does not take place and escrow or this Agreement is terminated due to a default by Buyer or any other provision which entitles Seller to the Deposit, then Seller shall be entitled to the Deposit by retaining or causing Escrow Agent to deliver the Deposit to Seller.

9.4 Disbursement of Deposit. If Escrow Agent receives a notice from either party instructing Escrow Agent to deliver the Deposit to such party, Escrow Agent shall deliver a copy of the notice to the other party within three (3) days after receipt of the notice. If the other party does not object to the delivery of the Deposit as set forth in the notice within three (3) business days after receipt of the copy of the notice, Escrow Agent

18

shall, and is hereby authorized to, deliver the Deposit to the party requesting it pursuant to the notice. Any objection hereunder shall be by notice setting forth the nature and grounds for the objection and shall be sent to Escrow Agent and to the party requesting the Deposit.

9.5 No Effect on Rights of Parties; Survival. The return of documents and monies as set forth above shall not affect the right of either party to seek such legal or equitable remedies as such party may have under Article X with respect to the enforcement of this Agreement. The obligations under this Article IX shall survive termination of this Agreement.

10.1 Seller’s Remedies. If the sale is not completed as herein provided solely by reason of any material default of Buyer, and such material default has not been remedied by Buyer within ten (10) business days after receipt by Buyer of written notice from Seller specifying the same, Seller shall be entitled to terminate this Agreement by delivering written notice to Buyer, in which event this Agreement shall terminate except for those obligations that expressly survive termination and the parties shall be released from any further obligations hereunder. Insofar as it would be extremely impracticable and difficult to estimate the damage and harm which Seller would suffer due to such failure, and insofar as a reasonable estimate of the total net detriment that Seller would suffer from such failure is the amount of the Deposit, Seller shall retain or cause Escrow Agent to deliver the Deposit to Seller as liquidated damages, which amount is not intended to be and is not a penalty, and which shall be Seller’s sole remedy for damages arising from Buyer’s failure to complete the acquisition. If Seller is released pursuant to this Section 10.1, Buyer shall deliver an instrument confirming such release promptly upon demand of Seller.

10.2 Buyer’s Remedies. If the sale is not completed as herein provided solely by reason of any material default of Seller, and such material default has not been remedied by Seller within ten (10) business days after receipt by Seller of written notice from Buyer specifying the same, Buyer shall be entitled to (i) terminate this Agreement (by delivering written notice to Seller which includes a waiver of any right, title or interest of Buyer in the Property), in which event this Agreement shall terminate except for those obligations that expressly survive termination and the parties shall be released from any further obligations hereunder, and obtain the return of the Deposit, together with, reimbursement by Seller to Buyer of all out-of-pocket costs and expenses actually incurred by Buyer in connection with this Agreement, up to $250,000, or (ii) treat this Agreement as being in full force and effect and pursue only the specific performance of this Agreement. Buyer waives any right to pursue any other remedy at law or equity for such default of Seller, including, without limitation, any right to seek, claim or obtain damages, punitive damages or consequential damages. Notwithstanding the foregoing, Buyer shall be deemed to have elected to terminate this Agreement and obtain the return

19

of the Deposit if Buyer fails to file suit for specific performance against Seller in a court of competent jurisdiction within sixty (60) days following the earlier of (a) the date of Buyer’s default notice to Seller and (b) the then scheduled Closing Date.

ARTICLE XI

REPRESENTATIONS AND WARRANTIES

11.1 Seller’s Warranties and Representations. The matters set forth in this Section 11.1 constitute representations and warranties by Seller which are now true and correct in all material respects, and, shall (subject to Section 3.1.4) be true and correct at the Closing in all material respects. If Seller learns of, or has a reason to believe that any of the following representations and warranties may cease to be true, then Seller shall give prompt notice to Buyer (which notice shall include copies of the instrument, correspondence, or document, if any, upon which Seller’s notice is based). As used in this Section 11.1, the phrase “to the extent of Seller’s actual knowledge” shall mean the actual knowledge of Kinsey M. Sale, the asset manager responsible for the Property (“Seller’s Knowledge Person”). There shall be no duty imposed or implied to investigate, inspect, or audit any such matters, and there shall be no personal liability on the part of Seller’s Knowledge Person. To the extent Buyer has or acquires actual knowledge or is deemed to know prior to the expiration of the Investigation Period that any representation and warranty is inaccurate, untrue or incorrect in any way, such representations and warranties shall be deemed modified to reflect Buyer’s knowledge or deemed knowledge. Buyer shall be deemed to know a representation or warranty is untrue, inaccurate or incorrect if this Agreement or any files, documents, materials, analyses, studies, tests, or reports disclosed or made available to Buyer, or otherwise obtained by Buyer, prior to the expiration of the Investigation Period contains information which is inconsistent with such representation or warranty.

11.1.1 No Broker. Seller has not engaged or dealt with any broker or finder in connection with the sale contemplated by this Agreement, except Holliday Fenoglio Fowler, L.P. (the “Broker”). Seller shall pay all brokerage commissions to the Broker, as the Broker may be entitled thereto pursuant to the terms of a separate written agreement. Seller shall indemnify and hold harmless Buyer and its agents, employees and affiliates from any claims, costs, damages or liabilities (including attorneys’ fees) arising from any breach of the representation contained in this Section 11.1.1 or if the same shall be based on any statement, representation or agreement by Seller with respect to the payment of any brokerage commissions or finders fees. The foregoing indemnity shall survive Closing.

11.1.2 Power and Authority. Seller has the legal power, right and authority to enter into this Agreement and to consummate the transactions contemplated hereby.

20

11.1.3 Proceedings. Seller has received no written notice of any pending or threatened condemnation or similar proceeding affecting any part of the Real Property.

11.1.4 Contravention. Seller is not prohibited from consummating the transactions contemplated by this Agreement by any law, regulation, agreement, instrument, restriction, order, or judgment.

11.1.5 Ground Lease. Seller has not assigned its interest as lessor or lessee under the Ground Lease. The copy of the Ground Lease (including all amendments and modifications thereto) delivered or made available to Buyer is true, correct and complete in all material respects. The Ground Lease is in full force and effect, and Seller is not in default of any material provision of the Ground Lease.

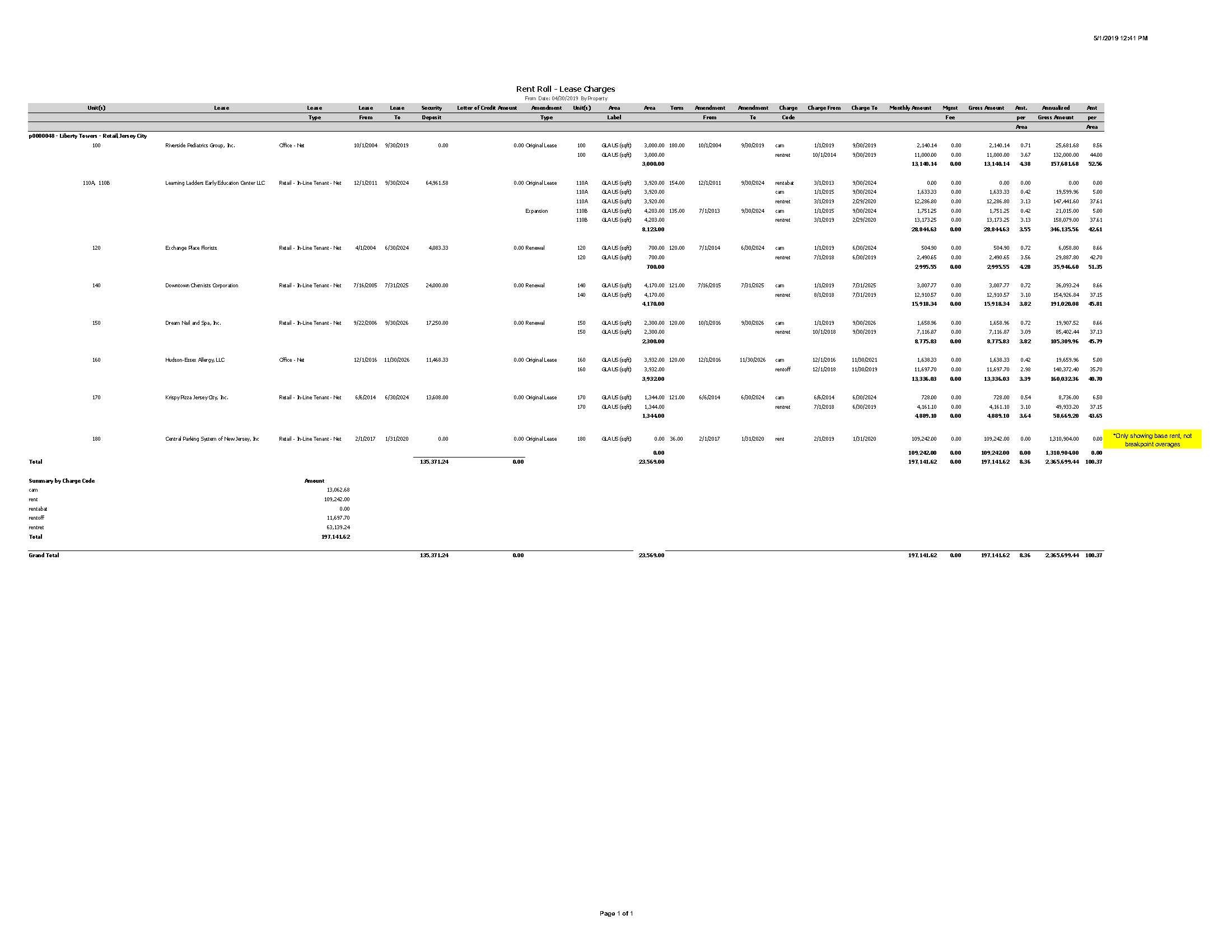

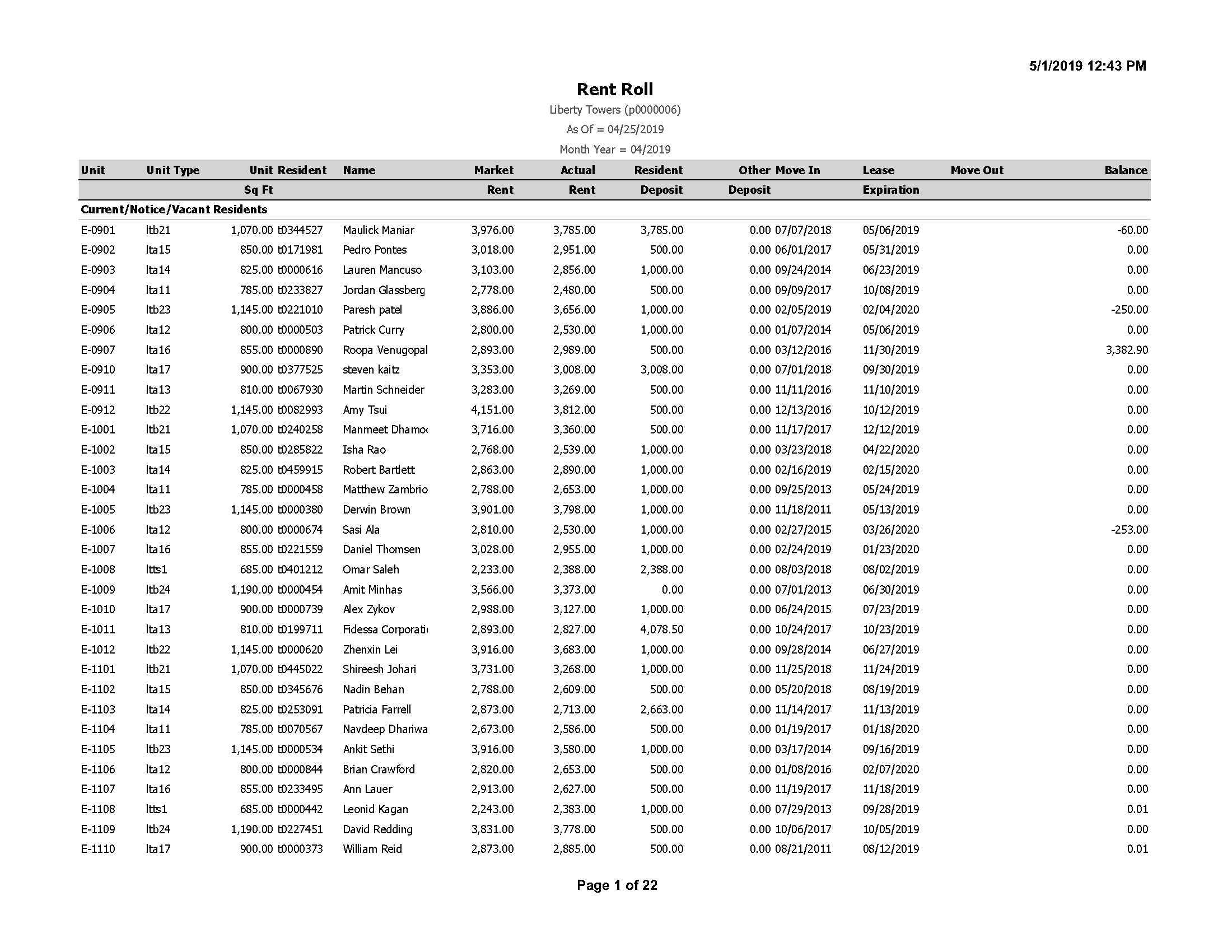

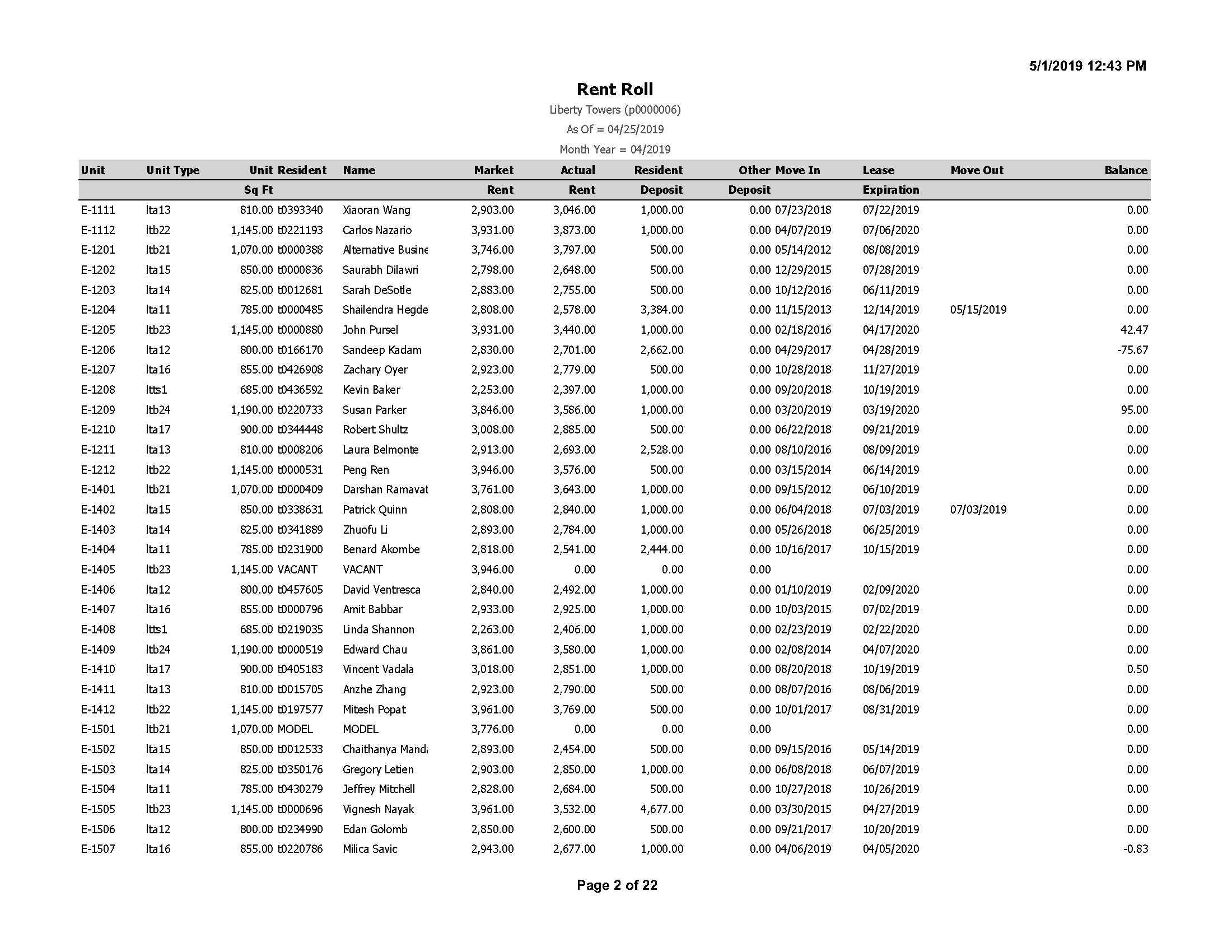

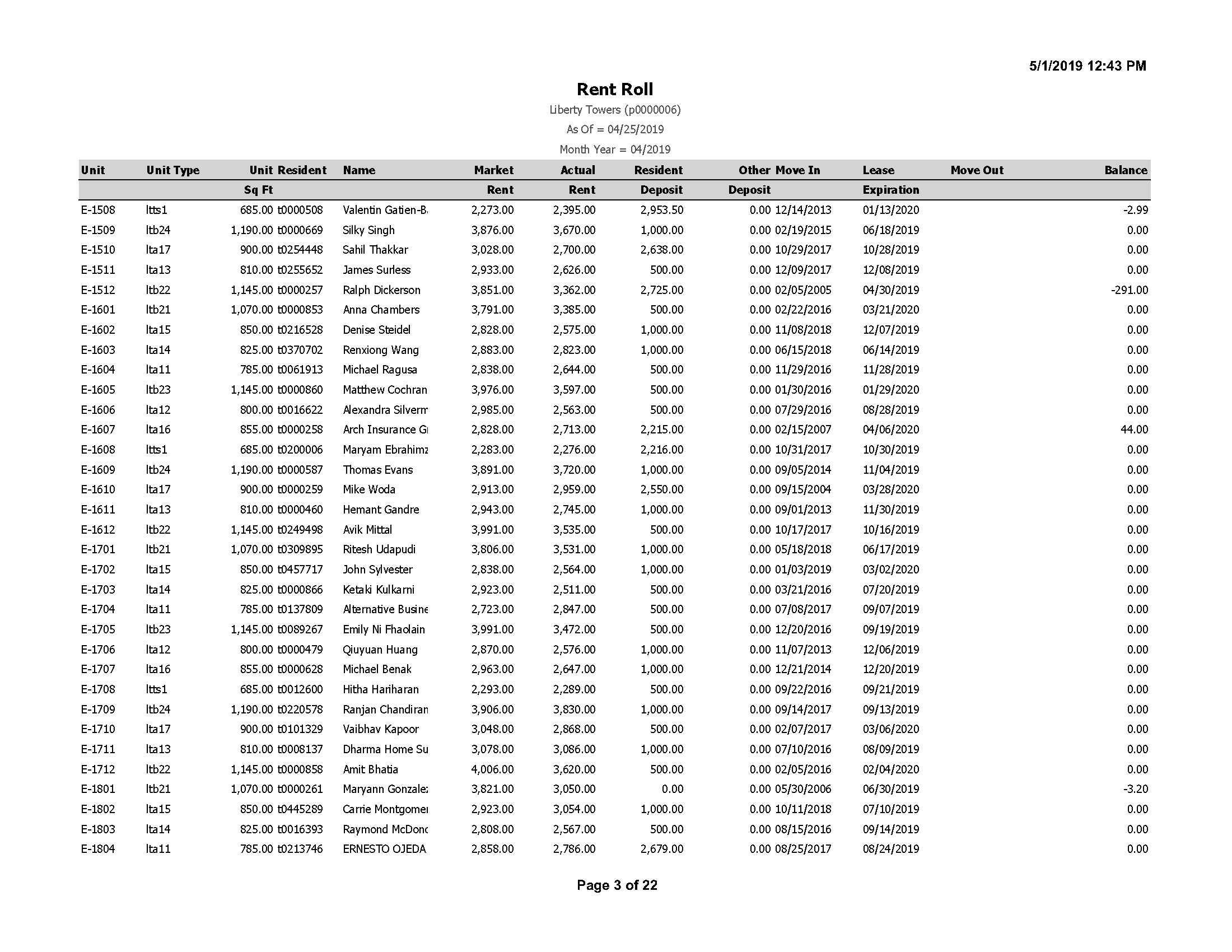

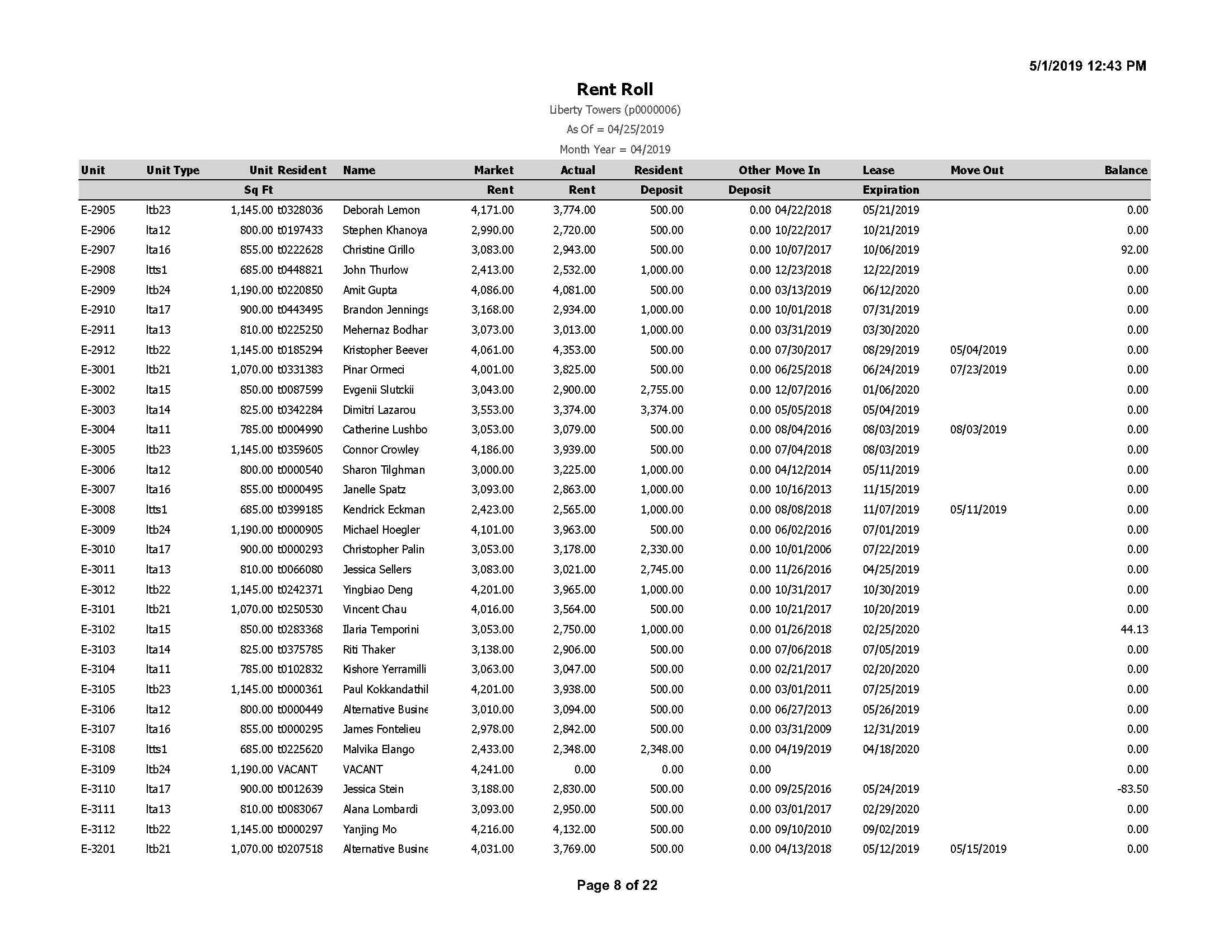

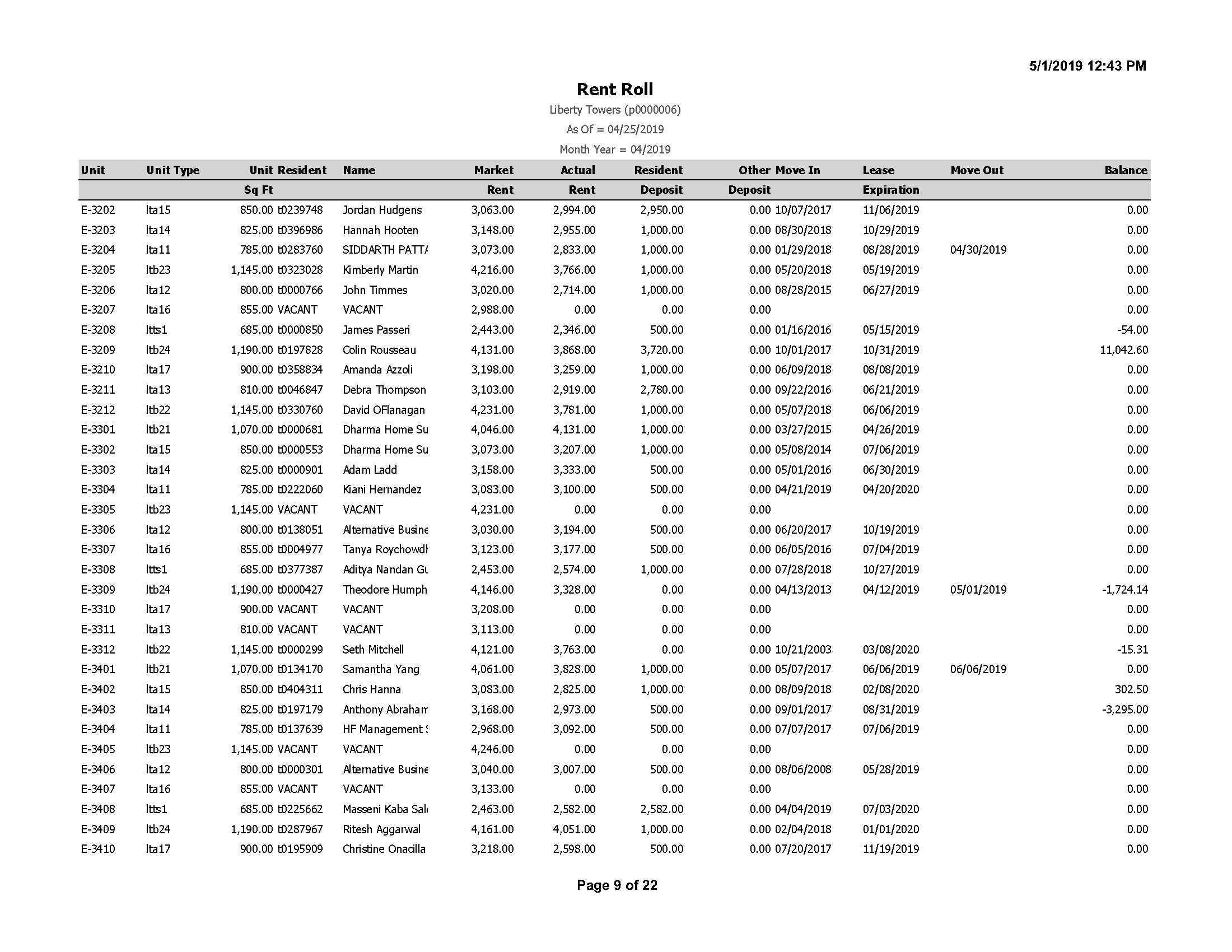

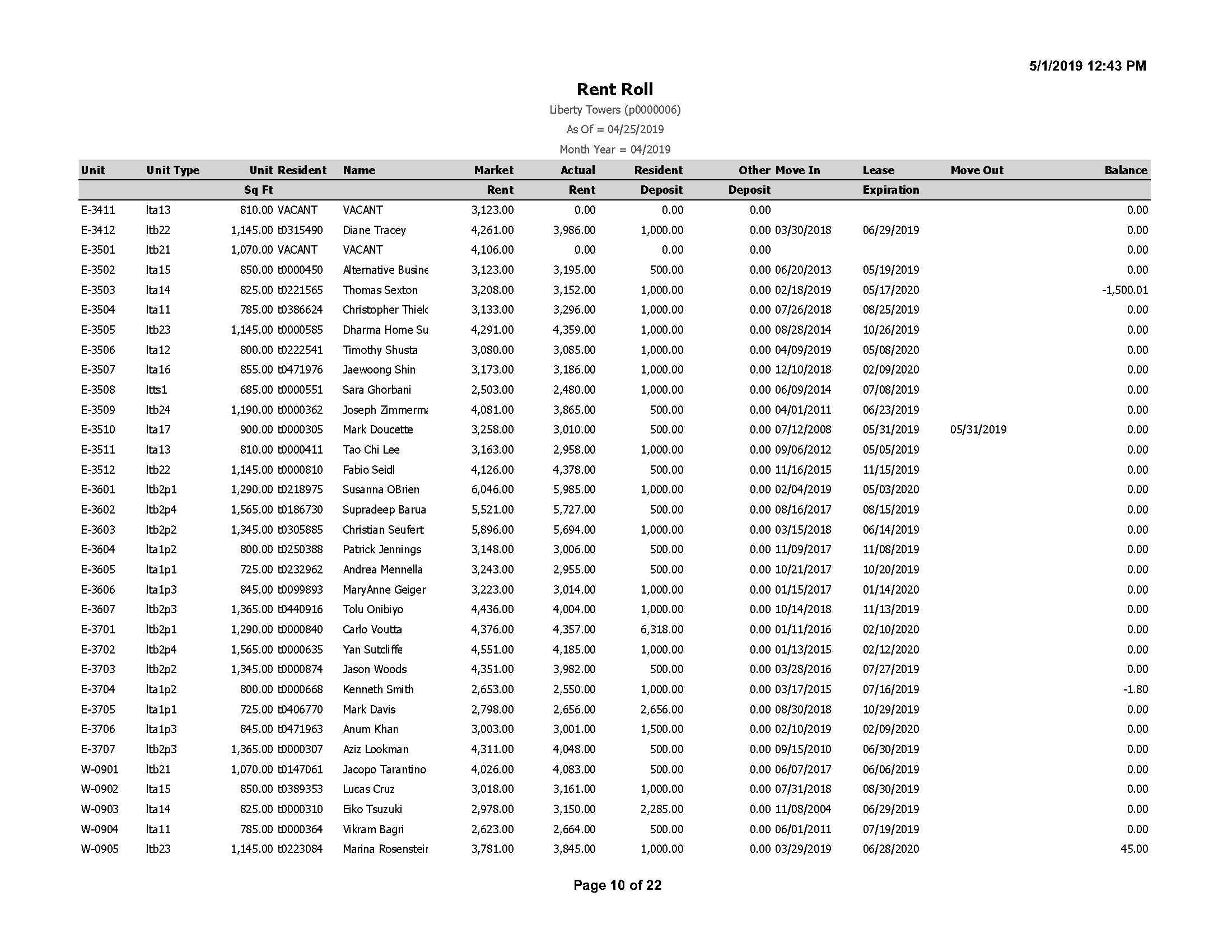

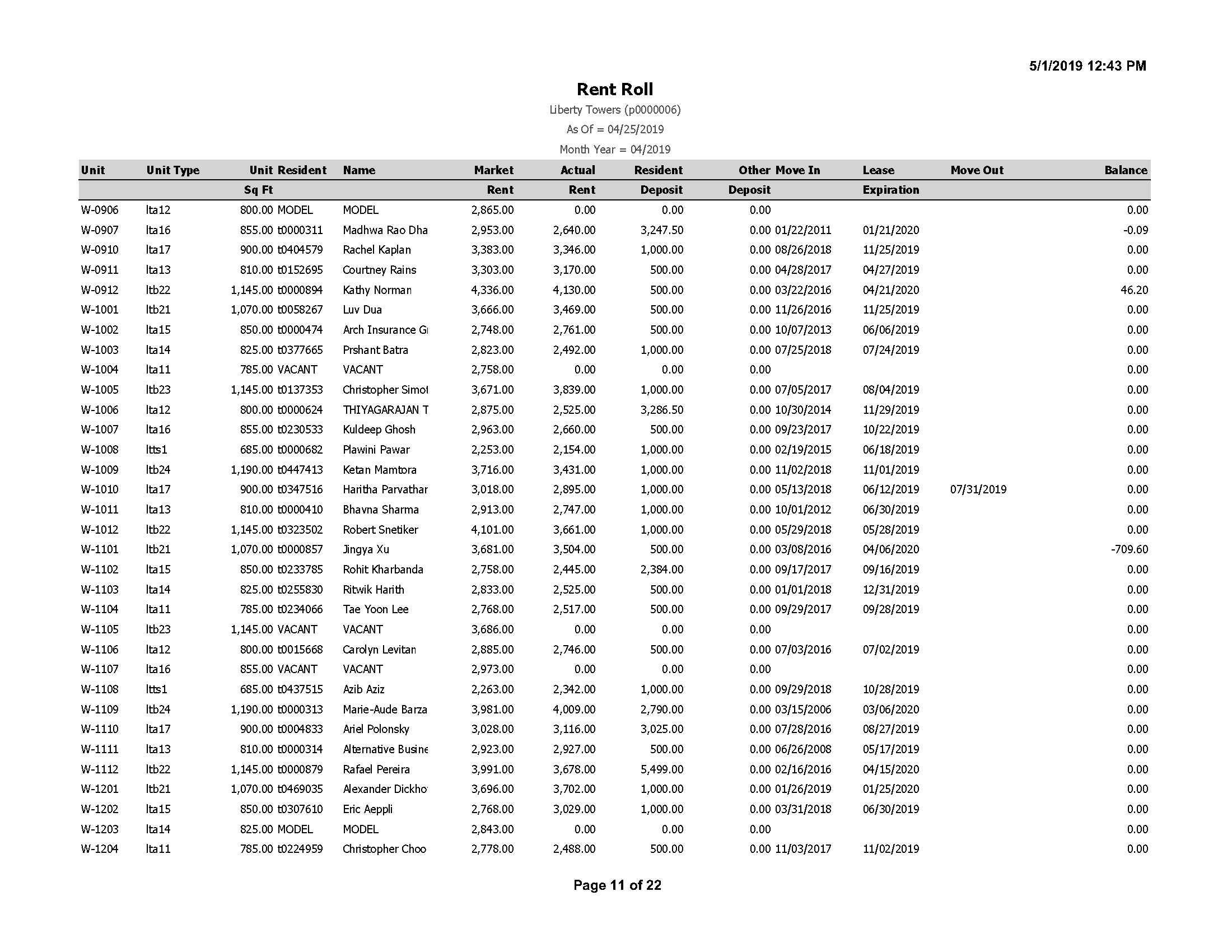

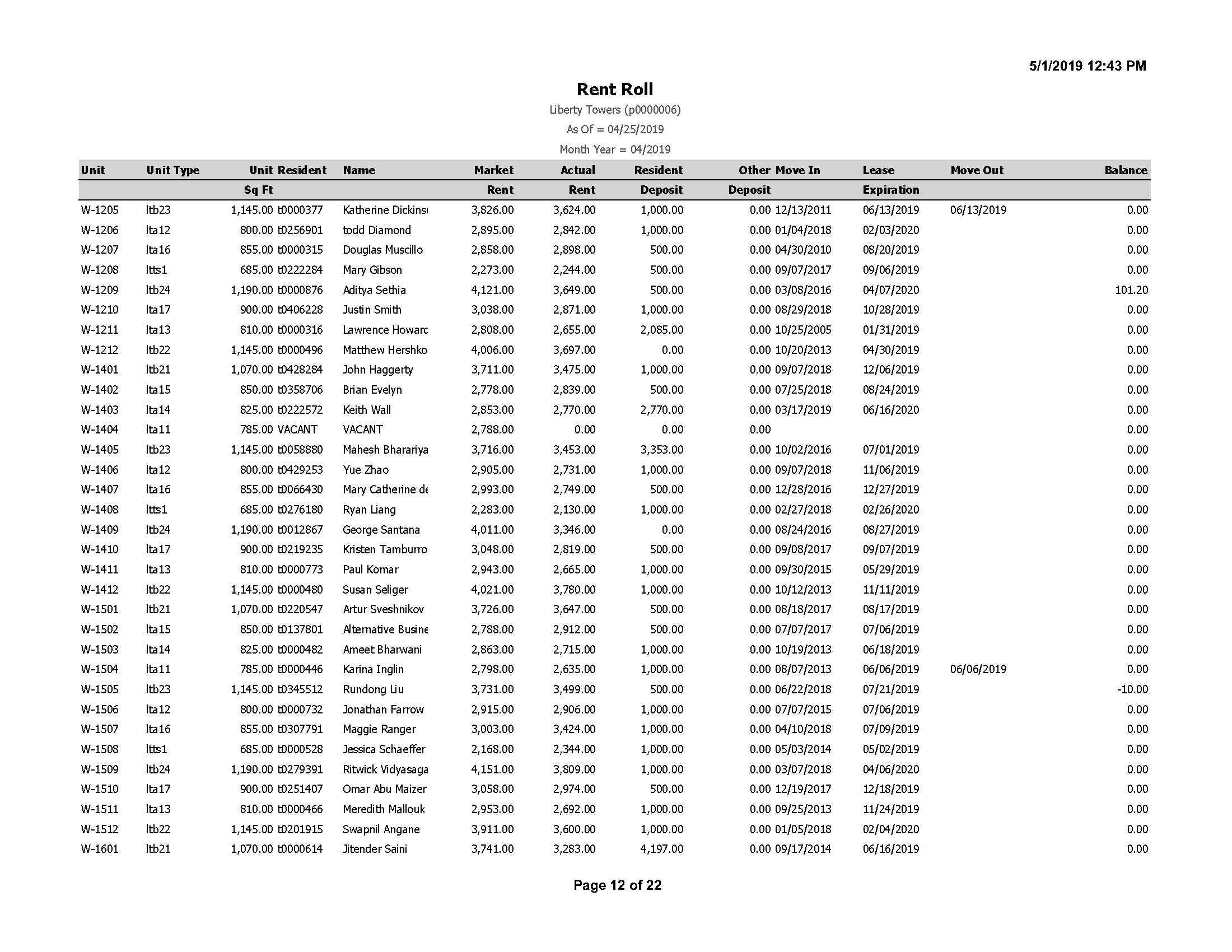

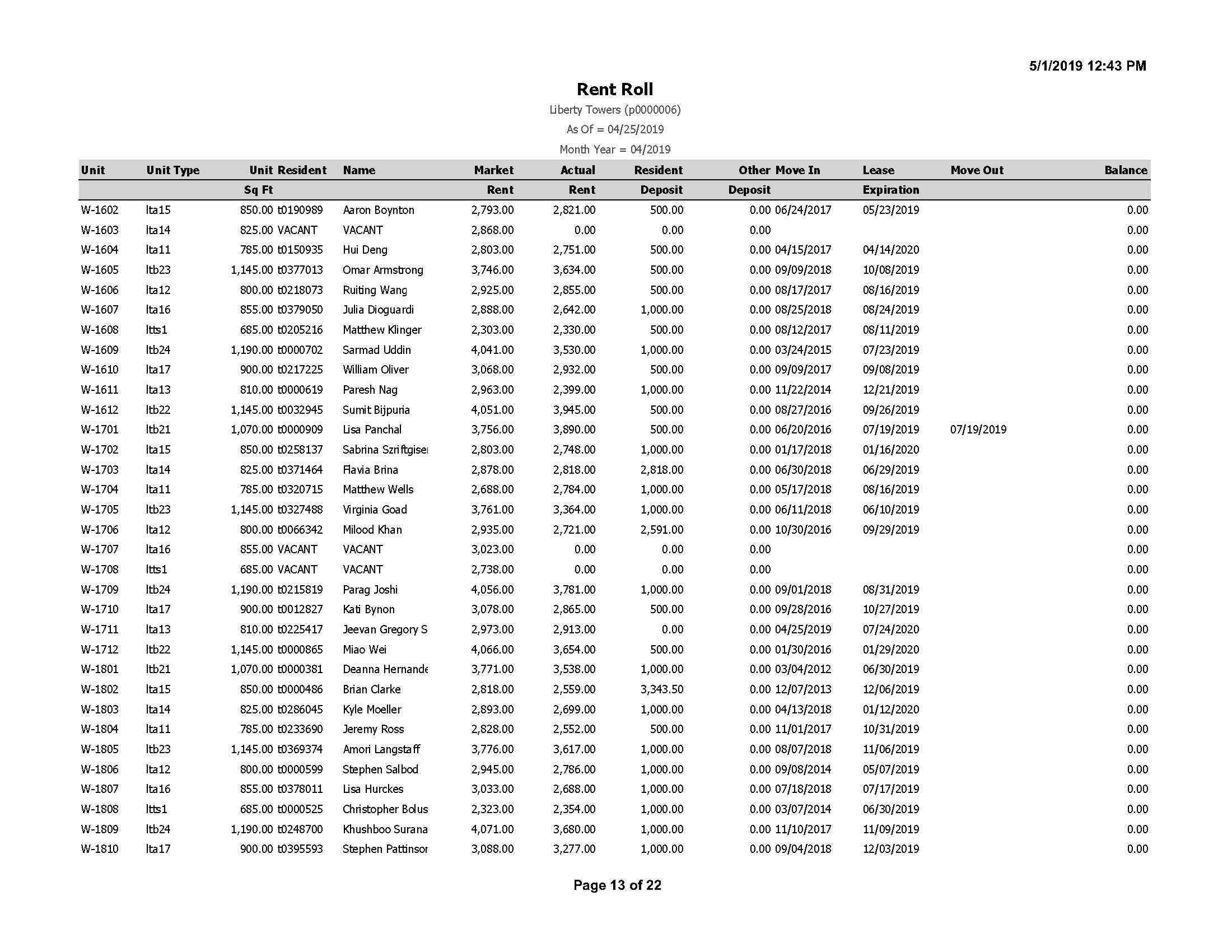

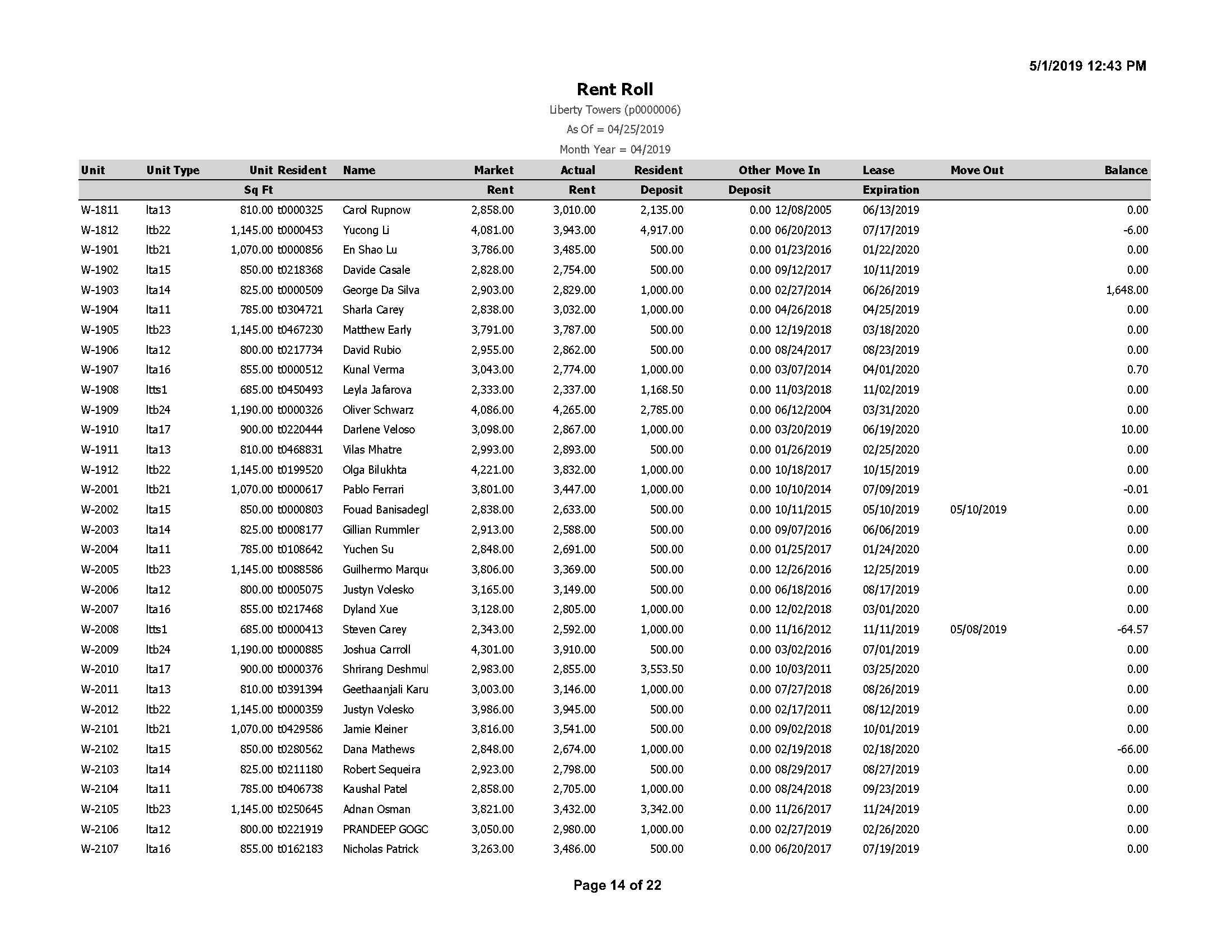

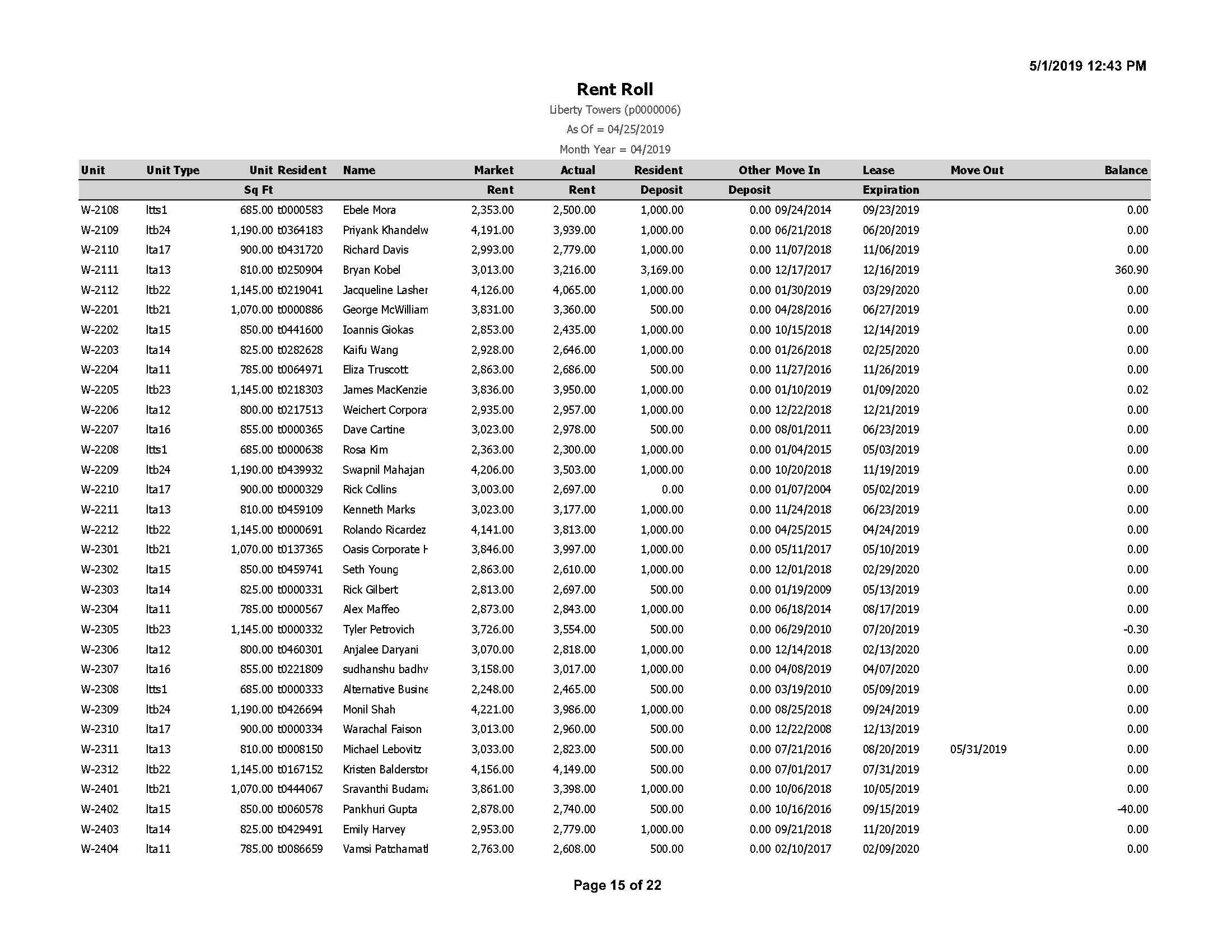

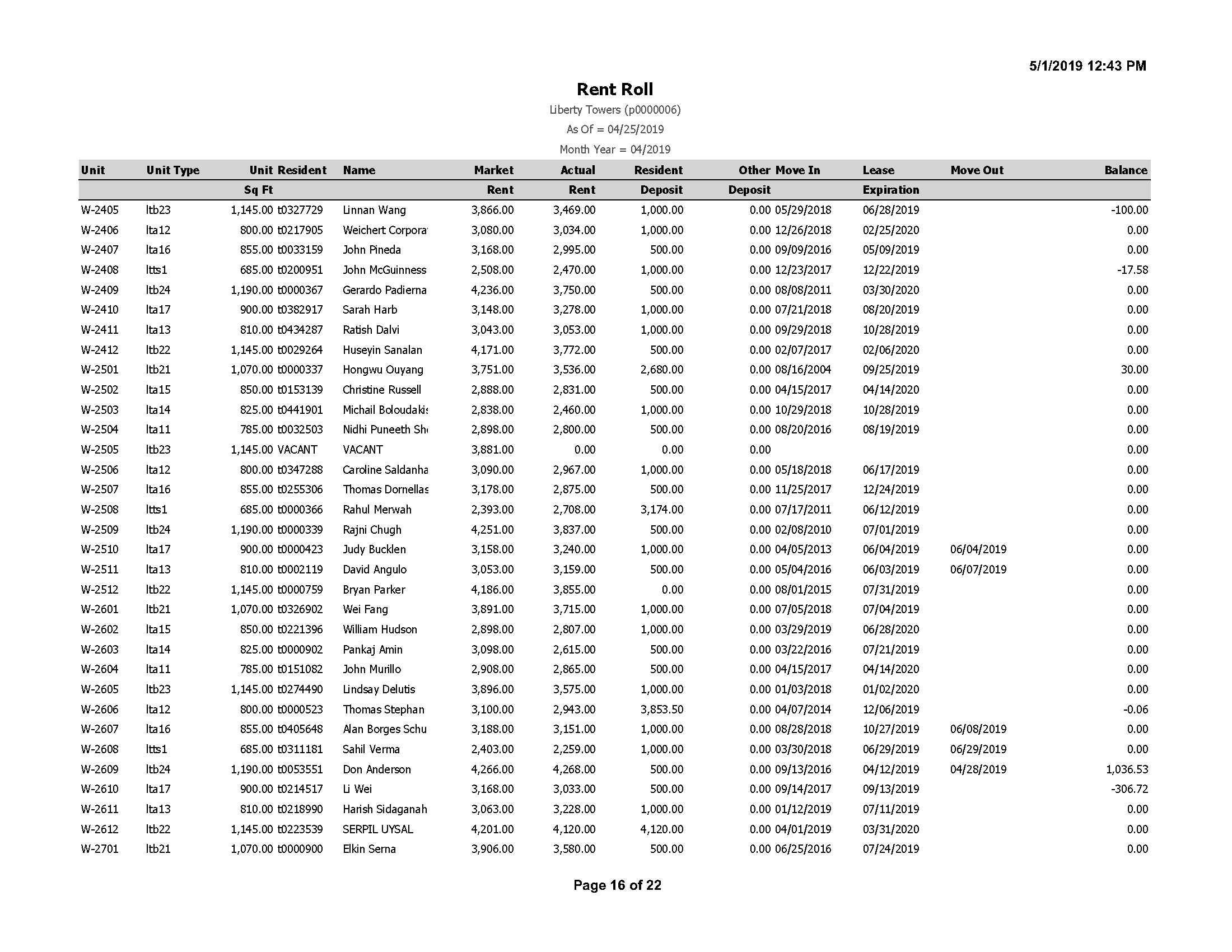

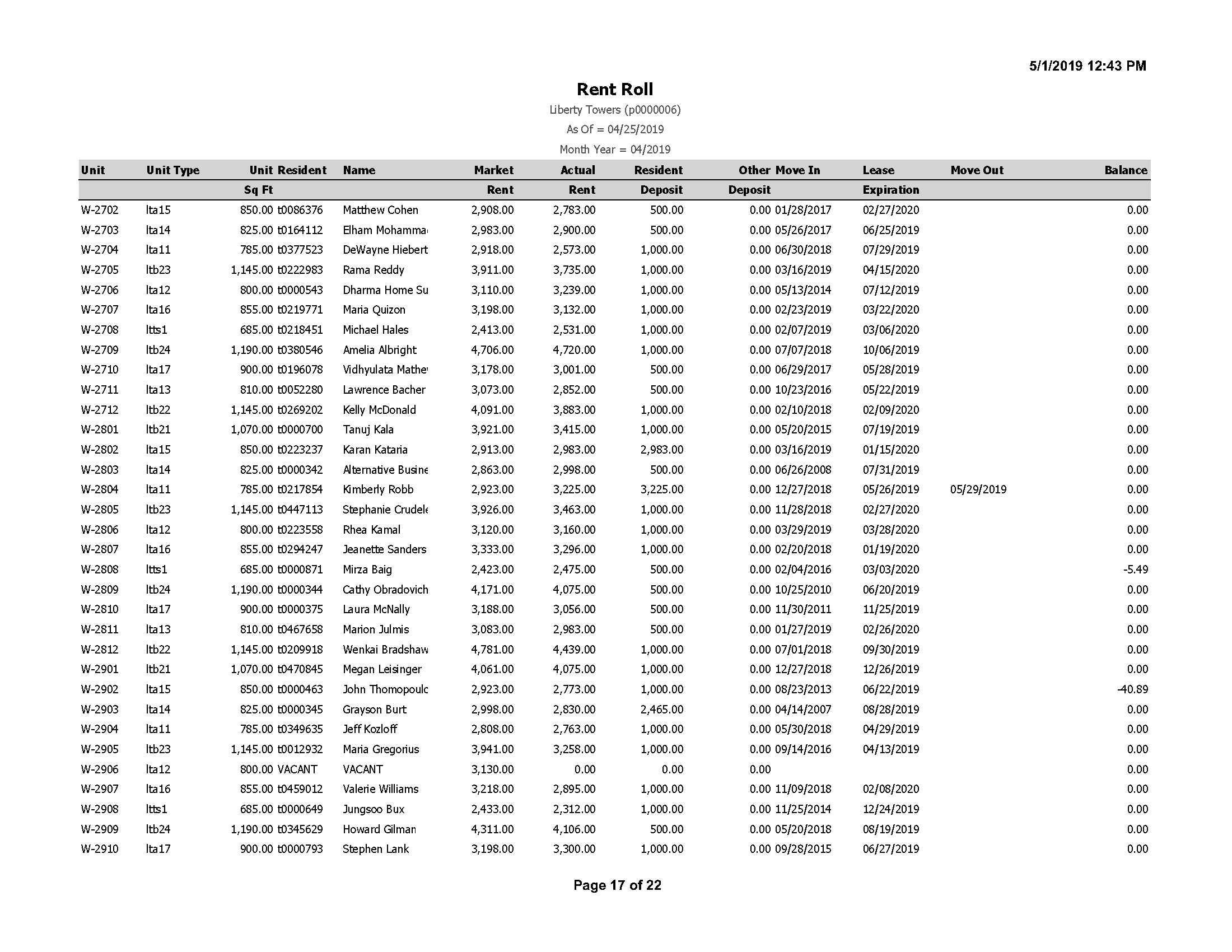

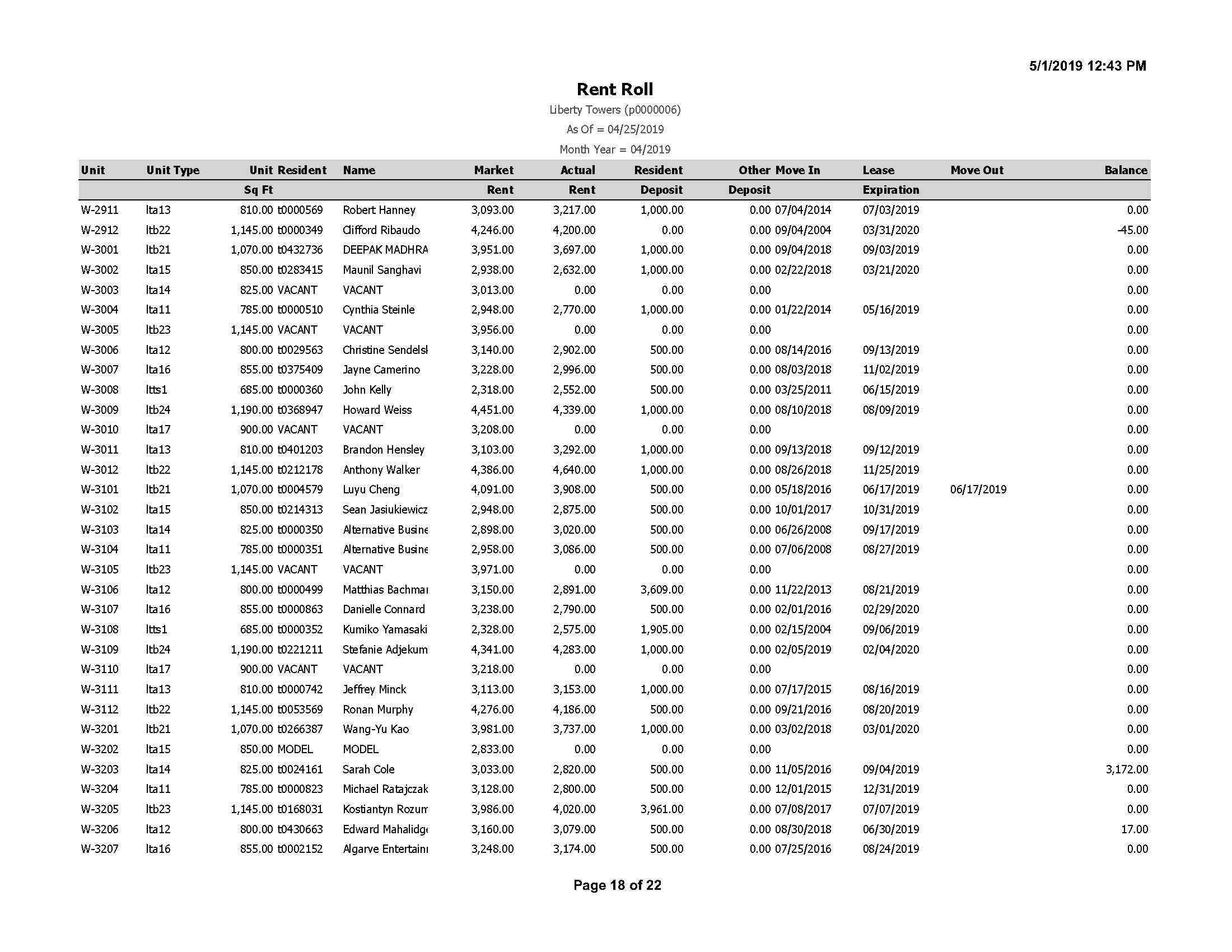

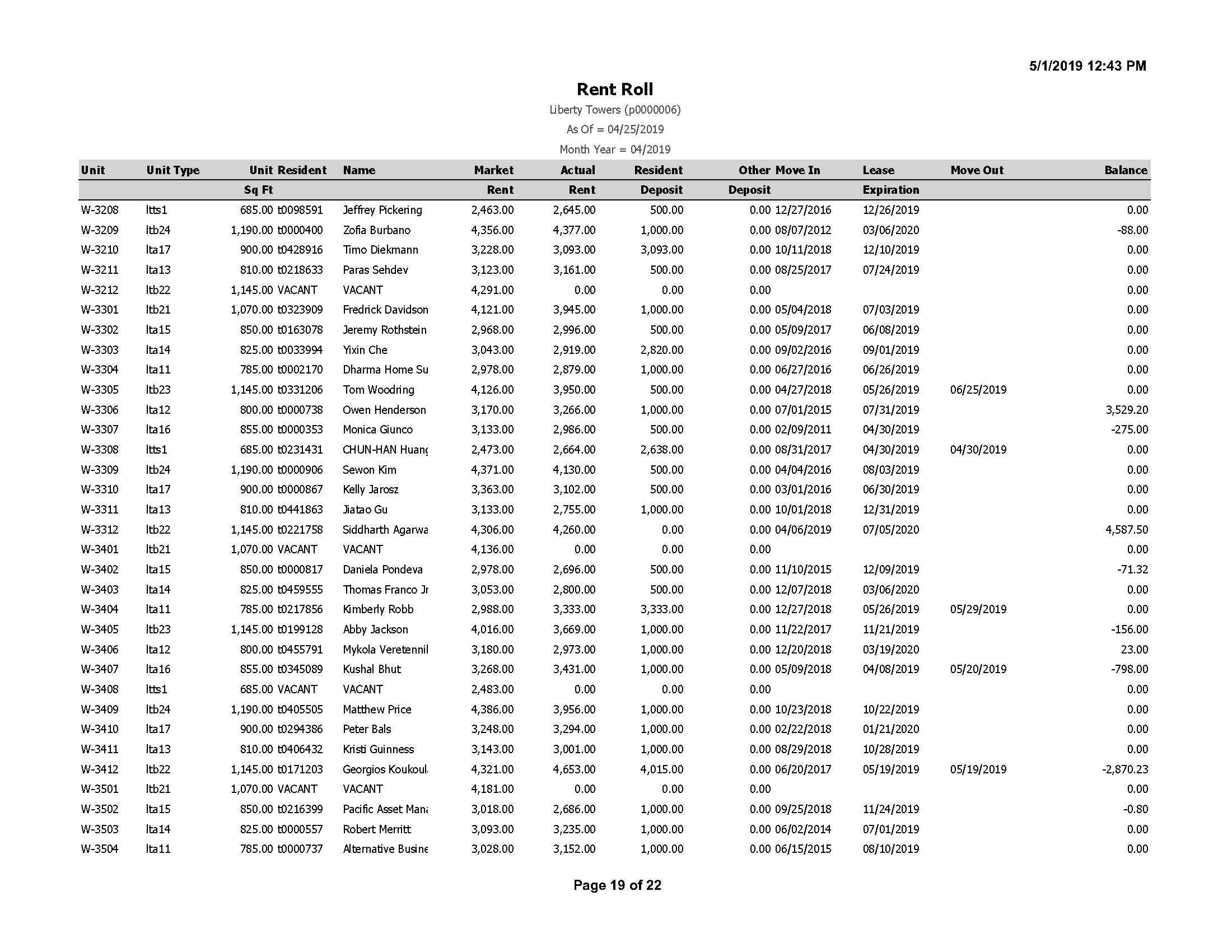

11.1.6 Leases and Contracts. To the extent of Seller’s actual knowledge, the Leases set forth on the rent roll attached hereto as Exhibit L (the “Rent Roll”) and the Contracts comprise all of the leases and material contracts that affect the Property and in effect as of the date hereof, other than the Other Leases and the contracts listed on the Preliminary Title Report. To the extent of Seller’s actual knowledge, the copies of the Leases and Contracts delivered or made available to Buyer are true, complete and correct and set forth all agreements in effect, as of the date hereof, with the tenants and the service providers at the Property, and constitute those documents that Seller’s Manager has provided to Seller as true and complete copies of such Leases and Contracts. To the extent of Seller’s actual knowledge, there are no unwritten Leases affecting the Property. To the extent of Seller’s actual knowledge, all of the Leases and Contracts are in full force and effect. Except as provided to Buyer, Seller has not delivered or received any notice of any default under any of the Contracts and Leases which has not been cured. Buyer acknowledges that, for convenience, Seller has made available to Buyer certain summaries and/or abstracts for certain documents (including, without limitation, the Leases) and/or third party reports, and Seller makes no representations or warranties of any kind with respect to any such summaries, abstracts and/or third party reports, including, without limitation, their accuracy or completeness. Other than in connection with the Riverside Pediatrics Group, Inc. lease renewal, there are no leasing commissions, tenant allowances or other tenant concessions due and payable with respect to the Leases or any renewals or extensions thereof or any commission agreement, except to the extent that the amounts or the method of calculation thereof have been disclosed (i) in writing to Buyer by Seller prior to the end of the Investigation Period or (ii) in the Leases or the Contracts delivered by Seller to Buyer. Other than in connection with the Riverside Pediatrics Group, Inc. lease renewal, any commissions due and payable in connection with the Leases (excluding any commissions to be

21

earned upon the exercise by a tenant after the date of this Agreement of any option term), have been paid in full.

(i) Other than as set forth in the Preliminary Title Report and the Zoning Report, dated April 16, 2019, issued by Zoning-info, Inc. as file #62604 Seller has not received written notice from any governmental authority of any violations of applicable laws or that the Property is not in material compliance with all applicable laws, except for such violations and failures to comply, if any, which have been remedied.

(ii) Seller has not received written notice, complaints or orders that the Property is in violation or non‑compliance with any applicable laws, including Environmental Laws, and to Seller’s actual knowledge there are no violations of or non-compliance with any such laws, including Environmental Laws, relating to the Property. “Environmental Laws” means any applicable federal, state, county or local statutes, laws, regulations, rules, ordinances, or codes relating to the protection of the environment, including by the way of illustration and not be way of limitation, the Clean Air Act, the Federal Water Pollution Control Act of 1972, the Resource, Conservation and Recovery Act of 1976, the Comprehensive Environmental, Response, Compensation and Liability Act of 1980, the Superfund Amendment and Reauthorization Act of 1986, the Federal Hazardous Materials Transportation Act and the Toxic Substance Control Act.

11.1.8 Employees. Seller has no employees providing services to the Property whose employment Buyer will be obligated to assume after the Closing, and all such services are performed by Seller’s Manager (as defined in Section 16.16) who shall be terminated as of the Closing and accordingly as of the Closing Date, there shall be no employees of Seller or Seller’s Manager employed at the Property. There are no collective bargaining agreements relating to Seller’s or Seller’s Manager’s employees that Buyer will be obligated to assume..

11.1.9 Litigation. Except as set forth on Schedule 11.1.9, Seller has not received notice of any pending material litigation affecting the Property, nor has any material litigation been threatened in a writing delivered to Seller. Schedule 11.1.9 identifies whether any such litigation is covered by Seller’s insurance.

11.1.10 Rent Roll. The Rent Roll is the actual rent roll used by Seller in the ordinary course of business, other than with respect to the

22

Parking Facilities Lease, which is incorporated into the Rent Roll for purposes of this Agreement (and shall not be included in the updated Rent Roll to be delivered in connection with the Seller’s Bring-down Certificate). Seller makes no representation or warranties as to the accuracy or completeness of the Rent Roll.

11.1.11 Right to Acquire. Seller has not granted any person, firm, corporation, or other entity any right or option to acquire fee title to the Real Property or any portion thereof, other than to Buyer pursuant to this Agreement.

11.1.12 No Liens on Certain Personal Property. The items of tangible personal property described in Schedule 1.3 are all tangible personal property owned by Seller located at the Property and are free and clear of all liens as of the date of this Agreement.

11.1.13 Tax Matters. Seller is not a party to any tax appeal or similar proceedings relating to the Property, and Seller has not received notice of any special assessments relating to the property, other than Special Improvement District assessments.

11.1.14 Seller’s Books and Records. The Books and Records provided to Buyer in accordance with Section 5.1.4 are the actual books and records used by Seller in the ordinary course of business.

11.1.15 Colgate Center Property Association. Seller has not received written notice of any default of its obligations under the documents governing the Colgate Center Property Owner Association (the “Association”).

11.1.16 ERISA. Either (x) Seller is not, and does not hold the assets of, (i) an “employee benefit plan” (within the meaning of Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”)) that is subject to Title I of ERISA or Section 4975 of the Code or (ii) an employee benefit plan subject to laws or regulations that are similar to the fiduciary responsibility or prohibited transaction provisions contained in Title I of ERISA or Section 4975 of the Code ("Other Plan Law") or (y) based on and assuming the accuracy of Buyer's representation in Section 11.2.5, the entry into this Agreement and the consummation of the transactions contemplated hereby do not and will not constitute a non-exempt prohibited transaction under Section 406 of ERISA or Section 4975 of the Code, or a similar violation of any Other Plan Law.

11.1.17 Patriot Act.

(i) Seller is in compliance with the requirements of Executive Order No. 13224, 66 Fed. Reg. 49079 (Sept. 25, 2001) (the “Order”) and other similar requirements contained in the rules and regulations of the Office of Foreign Assets Control, Department of the Treasury (“OFAC”) and in any

23

enabling legislation or other Executive Orders or regulations in respect thereof (the Order and such other rules, regulations, legislation, or orders are collectively called the “Orders”).

(ii) Neither Seller nor, to the extent of Seller’s actual knowledge, any beneficial owner of Seller:

(1) is listed on the Specially Designated Nationals and Blocked Persons List maintained by OFAC pursuant to the Order and/or on any other list of terrorists or terrorist organizations maintained pursuant to any of the rules and regulations of OFAC or pursuant to any other applicable Orders (such lists are collectively referred to as the “Lists”);

(2) is a person or entity who has been determined by competent authority to be subject to the prohibitions contained in the Orders; or

(3) is owned or controlled by, or acts for or on behalf of, any person or entity on the Lists or any other person or entity who has been determined by competent authority to be subject to the prohibitions contained in the Orders.

11.2 Buyer’s Warranties and Representations. The matters set forth in this Section 11.2 constitute representations and warranties by Buyer which are now true and correct and shall, at the Closing, be true and correct in all material respects.

11.2.1 No Broker. Except for the Broker, Buyer has not engaged or dealt with any broker or finder in connection with the sale contemplated by this Agreement. Buyer shall indemnify and hold Seller Indemnitees (as defined in Section 16.16) harmless from any claims, costs, damages or liabilities (including attorneys’ fees) arising from any breach of the representation contained in this Section 11.2.1 or if the same shall be based on any statement, representation or agreement by Buyer with respect to the payment of any brokerage commissions or finders fees.

11.2.2 Power and Authority. Buyer has the legal power, right and authority to enter into this Agreement and to consummate the transactions contemplated hereby.

11.2.3 Independent Investigation. The consummation of this transaction shall constitute Buyer’s acknowledgment that it has independently inspected and investigated the Property and has made and entered into this Agreement based upon such inspection and investigation and its own examination of the condition of the Property, except for the representations and warranties of Seller set forth in Section 11.1.

24

11.2.4 Buyer Reliance. Buyer is experienced in and knowledgeable about the ownership and management of commercial and residential real estate properties, and it has relied and will rely exclusively on its own consultants, advisors, counsel, employees, agents, principals and/or studies, investigations and/or inspections with respect to the Property, its condition, value and potential. Buyer agrees that, notwithstanding the fact that it has received certain information from Seller or its agents or consultants, Buyer has relied solely upon and will continue to rely solely upon its own analysis and will not rely on any information provided by Seller or its agents or consultants, except as expressly set forth in Section 11.1.

11.2.5 ERISA. Buyer is not, and does not hold assets of, (x) an “employee benefit plan” (within the meaning of Section 3(3) of ERISA) that is subject to Title I of ERISA or Section 4975 of the Code or (y) an employee benefit plan subject to Other Plan law.

11.2.6 Patriot Act.

(i) Buyer is in compliance with the requirements of the Orders. Further, Buyer covenants and agrees to make its policies, procedures and practices regarding compliance with the Orders, if any, available to Seller for its review and inspection during normal business hours and upon reasonable prior notice.

(ii) Neither Buyer nor any beneficial owner of Buyer:

(1) is listed on the Lists;

(2) is a person or entity who has been determined by competent authority to be subject to the prohibitions contained in the Orders; or

(3) is owned or controlled by, or acts for or on behalf of, any person or entity on the Lists or any other person or entity who has been determined by competent authority to be subject to the prohibitions contained in the Orders.

(iii) Buyer hereby covenants and agrees that if Buyer obtains knowledge that Buyer or any of its beneficial owners becomes listed on the Lists or is indicted, arraigned, or custodially detained on charges involving money laundering or predicate crimes to money laundering, Buyer shall immediately notify Seller in writing, and in such event, Seller shall have the right to terminate this Agreement without penalty or liability to Buyer immediately upon delivery of written notice thereof to Buyer.

25

11.3 No Other Warranties and Representations. Except as specifically set forth in this Article XI, neither Seller nor Buyer have made, make or have authorized anyone to make, any warranty or representation as to the Ground Lease, the Leases, the Contracts or any other written materials delivered to Buyer, the persons preparing such materials, the present or future physical condition, development potential, zoning, building or land use law or compliance therewith (including, without limitation, the Americans with Disabilities Act), operation, income generated by, or any other matter or thing affecting or relating to the Property or any matter or thing pertaining to this Agreement. Buyer expressly acknowledges that no such warranty or representation has been made and that Buyer is not relying on any warranty or representation whatsoever other than as is expressly set forth in this Article XI. Buyer shall accept the Property “as is” and in its condition on the Closing Date subject only to the express provisions of this Agreement.