2020 ANNUAL MEETING OF STOCKHOLDERS

OF

MACK-CALI REALTY CORPORATION

PROXY STATEMENT

OF

BOW STREET LLC

PLEASE VOTE BY INTERNET OR PHONE USING THE ENCLOSED GOLD PROXY CARD TODAY

May 6, 2020

Dear Fellow Mack-Cali Stockholder:

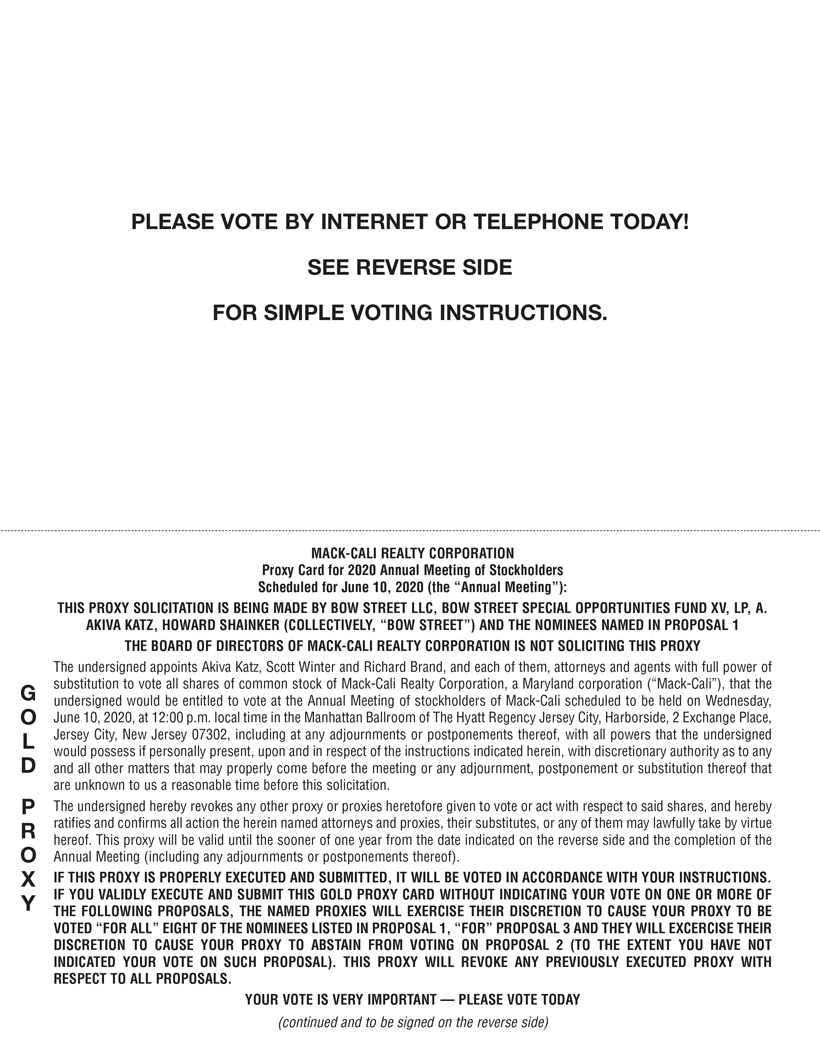

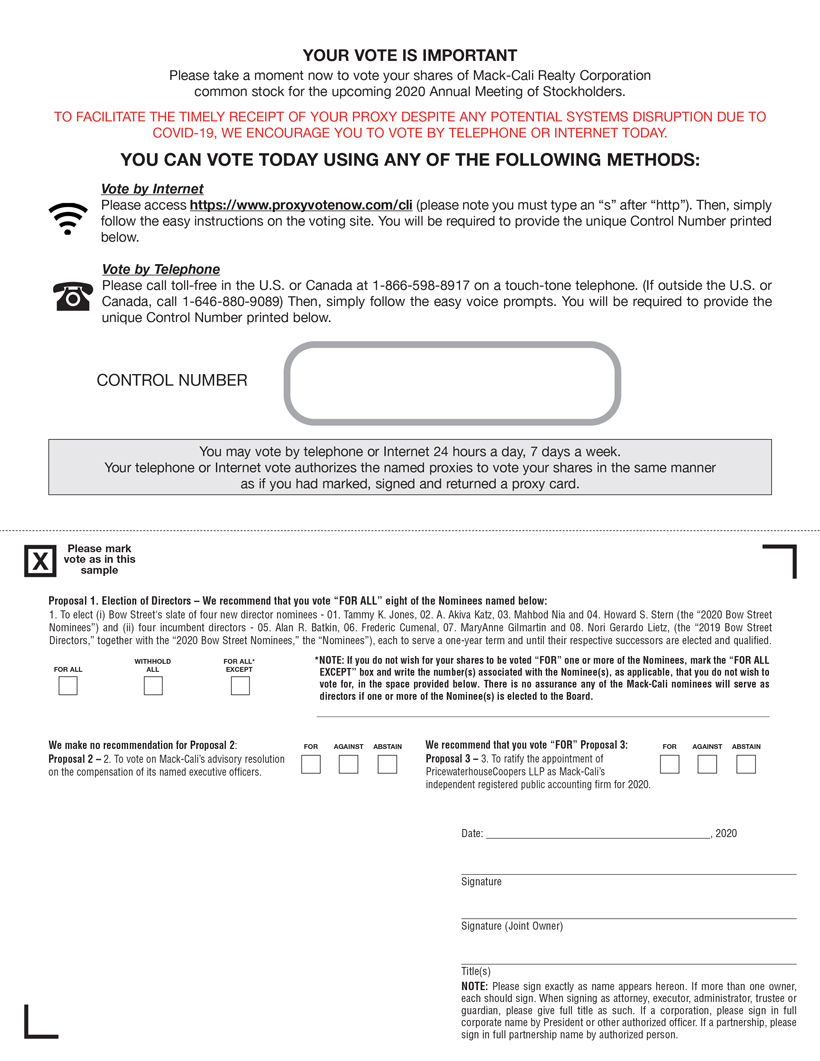

This Proxy Statement and the enclosed GOLD proxy card are being furnished to the stockholders of Mack-Cali Realty Corporation (“Mack-Cali” or the “Company”), a Maryland corporation, by Bow Street LLC (“Bow Street,” “we” or “us”), Bow Street Special Opportunities Fund XV, LP (“Bow Street Special Opportunities”), A. Akiva Katz (“Mr. Katz”), Howard Shainker (“Mr. Shainker”), together with Bow Street, Bow Street Special Opportunities and Mr. Katz (the “Bow Street Parties”) and the director nominees named in Proposal 1 (the “Nominees”) and, with the Bow Street Parties (the “Participants”), in connection with the solicitation of proxies (the “Proxy Solicitation”) from the holders of shares of common stock, $0.01 par value, of the Company (“Common Stock”) for the 2020 Annual Meeting of Stockholders of the Company (including any and all adjournments, postponements, continuations or rescheduling thereof, or any other meeting of stockholders held in lieu thereof, the “2020 Annual Meeting”).

As a significant, long-term stockholder of Mack-Cali, Bow Street is committed to maximizing the value of the Company for all stockholders. To this end, in 2019 Bow Street nominated a minority slate of four independent director candidates to the Mack-Cali Board of Directors (the “Board”). At Mack-Cali’s 2019 Annual Meeting, stockholders overwhelmingly elected Bow Street’s entire slate: Alan R. Batkin, Frederic Cumenal, MaryAnne Gilmartin and Nori Gerardo Lietz (the “2019 Newly-Elected Directors”). In response to this devastating rebuke of the status quo, Mack-Cali made a series of public commitments to stockholders, including the promise of a robust strategic alternatives process overseen by an independent special committee of the Board (the “Shareholder Value Committee”), which was comprised of four directors, namely Alan S. Bernikow, Frederic Cumenal, Irvin D. Reid and MaryAnne Gilmartin. Now, almost a year later, it is clear that Mack-Cali has failed to honor these commitments. In fact, in direct contradiction to the promises Mack-Cali made to investors, the Shareholder Value Committee was neutered by a narrow mandate that prohibited contact with prospective bidders (a role Chief Executive Officer Michael DeMarco reserved for himself), making it a special committee in name only. Despite stockholders’ clear vote for change, the Company’s Board and management team have continued to execute on the very same strategy that has driven continued erosion of stockholder value over the last several years.

It has become clear to Bow Street that more comprehensive action — including additional change at both the Board and management levels — is required to protect Mack-Cali stockholders from the legacy issues that plague the Company. Accordingly, we are nominating four additional, highly-qualified director candidates to the Board and re-nominating the 2019 Newly-Elected Directors. We believe that together these individuals will be fierce advocates for stockholders and facilitate a renewed focus on value creation. Additionally, we are calling