|

| 2 Statements made in this presentation may be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “potential,” “projected,” “should,” “expect,” “anticipate,” “estimate,” “target,” “continue” or comparable terminology. Forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate, and involve factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Disclosure Regarding Forward-Looking Statements” and “Risk Factors” in our annual reports on Form 10-K, as may be supplemented or amended by our quarterly reports on Form 10-Q, which are incorporated herein by reference. We assume no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise. |

| 3 a. Completed $547 million of asset sales YTD and retired $575 million of bonds b. Pricing realized in-line with pre- Covid expectations c. 1.1 million sq ft of remaining suburban sales in process a. Leveraging Harborside as a complete campus offering b. Generating traffic with proactive leasing program and a market leading team c. Activating Waterfront with lifestyle programming a. Operating properties 90% occupied as of May 31,2021 b. Recent development deliveries leasing rapidly c. Residential now contributes 51% to the total NOI (excluding suburban assets) a. Portfolio simplification driving workforce efficiencies b. Aligned ESG efforts with globally recognized frameworks resulting in substantially improved ESG Quality Score |

| 4 Metropark |

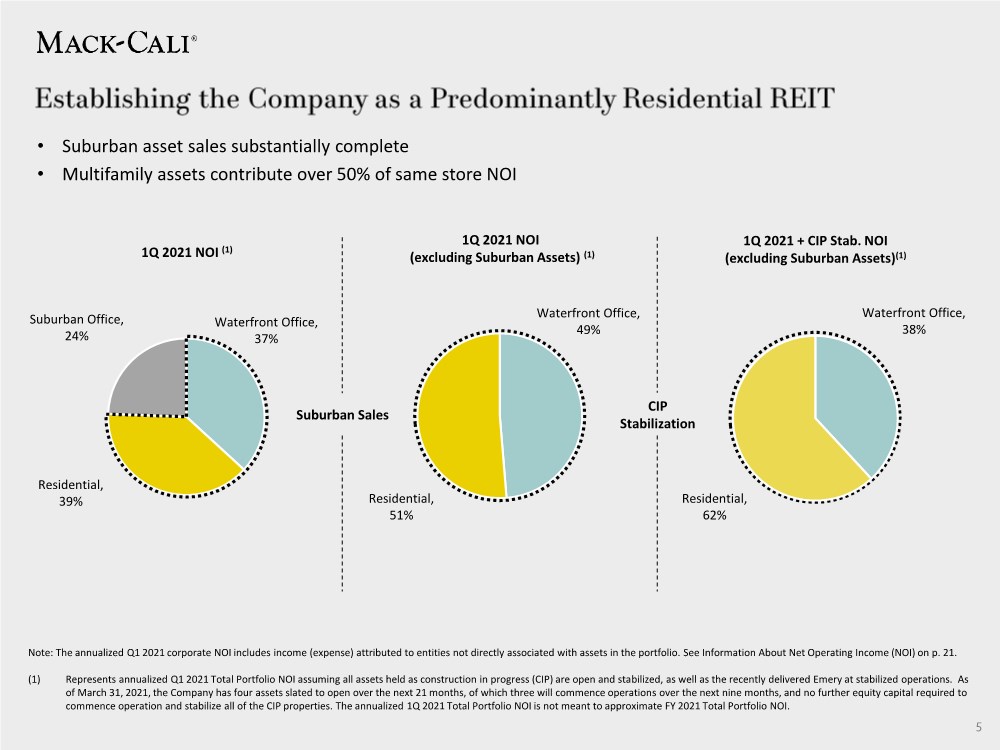

| 5 Note: The annualized Q1 2021 corporate NOI includes income (expense) attributed to entities not directly associated with assets in the portfolio. See Information About Net Operating Income (NOI) on p. 21. (1) Represents annualized Q1 2021 Total Portfolio NOI assuming all assets held as construction in progress (CIP) are open and stabilized, as well as the recently delivered Emery at stabilized operations. As of March 31, 2021, the Company has four assets slated to open over the next 21 months, of which three will commence operations over the next nine months, and no further equity capital required to commence operation and stabilize all of the CIP properties. The annualized 1Q 2021 Total Portfolio NOI is not meant to approximate FY 2021 Total Portfolio NOI. 1Q 2021 NOI (1) 1Q 2021 NOI (excluding Suburban Assets) (1) 1Q 2021 + CIP Stab. NOI (excluding Suburban Assets)(1) Suburban Sales CIP Stabilization Waterfront Office, 37% Waterfront Office, 49% Waterfront Office, 38% Suburban Office, 24% Residential, 39% Residential, 51% Residential, 62% • Suburban asset sales substantially complete • Multifamily assets contribute over 50% of same store NOI |

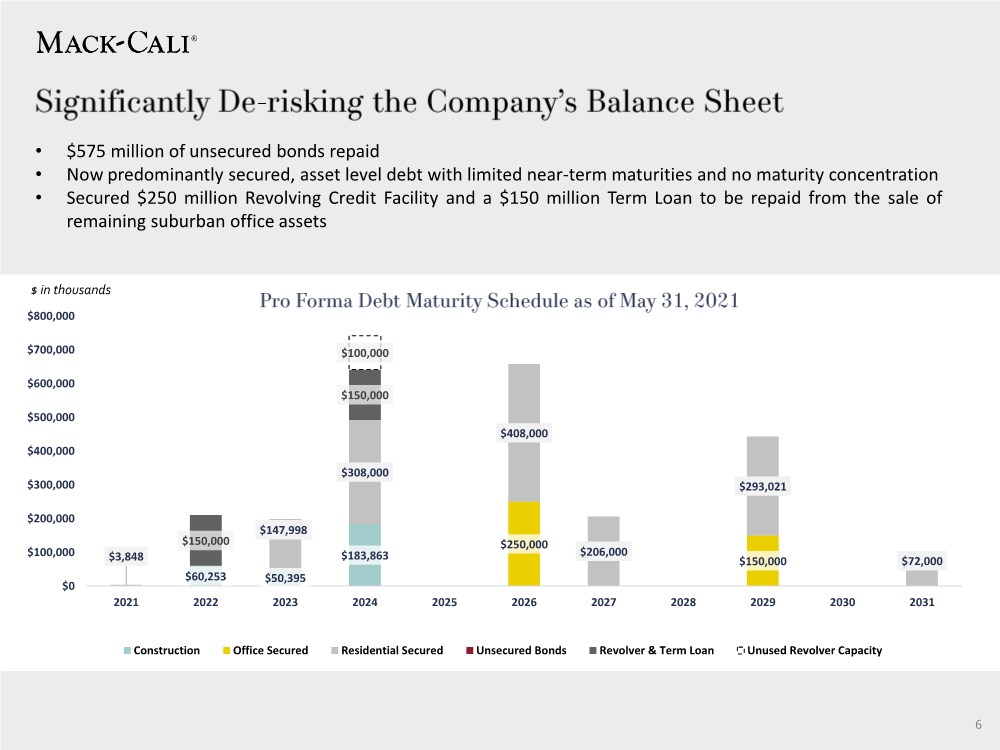

| 6 $60,253 $50,395 $183,863 $250,000 $150,000 $3,848 $147,998 $308,000 $408,000 $206,000 $293,021 $72,000 $150,000 $150,000 $100,000 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Construction Office Secured Residential Secured Unsecured Bonds Revolver & Term Loan Unused Revolver Capacity $ in thousands • $575 million of unsecured bonds repaid • Now predominantly secured, asset level debt with limited near-term maturities and no maturity concentration • Secured $250 million Revolving Credit Facility and a $150 million Term Loan to be repaid from the sale of remaining suburban office assets |

| 7 |

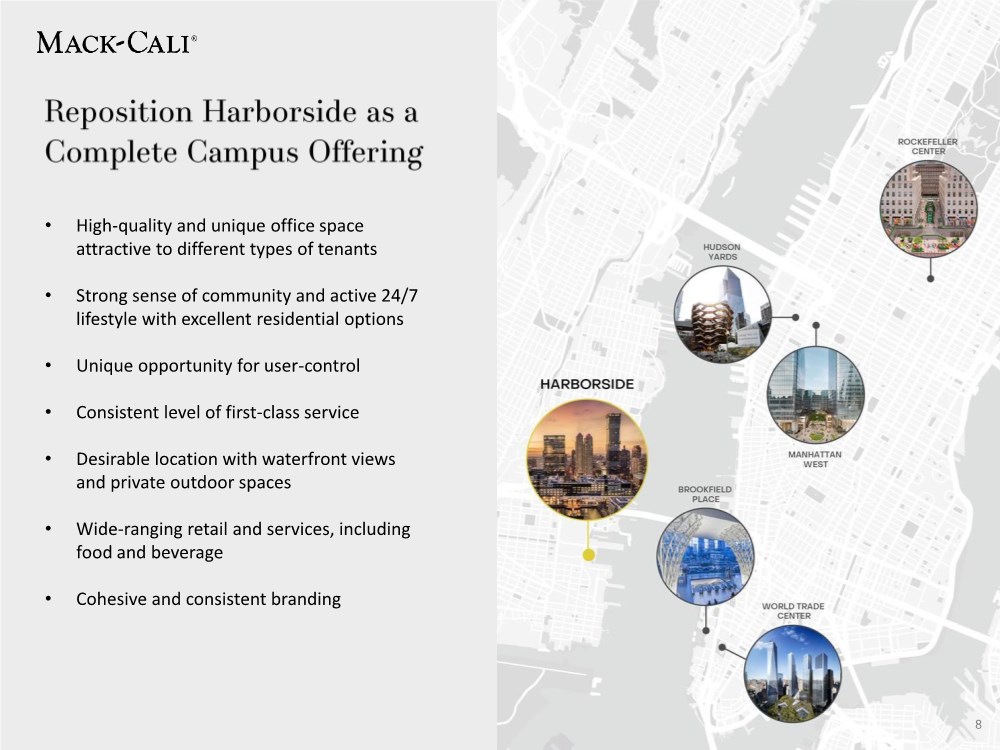

| 8 • High-quality and unique office space attractive to different types of tenants • Strong sense of community and active 24/7 lifestyle with excellent residential options • Unique opportunity for user-control • Consistent level of first-class service • Desirable location with waterfront views and private outdoor spaces • Wide-ranging retail and services, including food and beverage • Cohesive and consistent branding 8 |

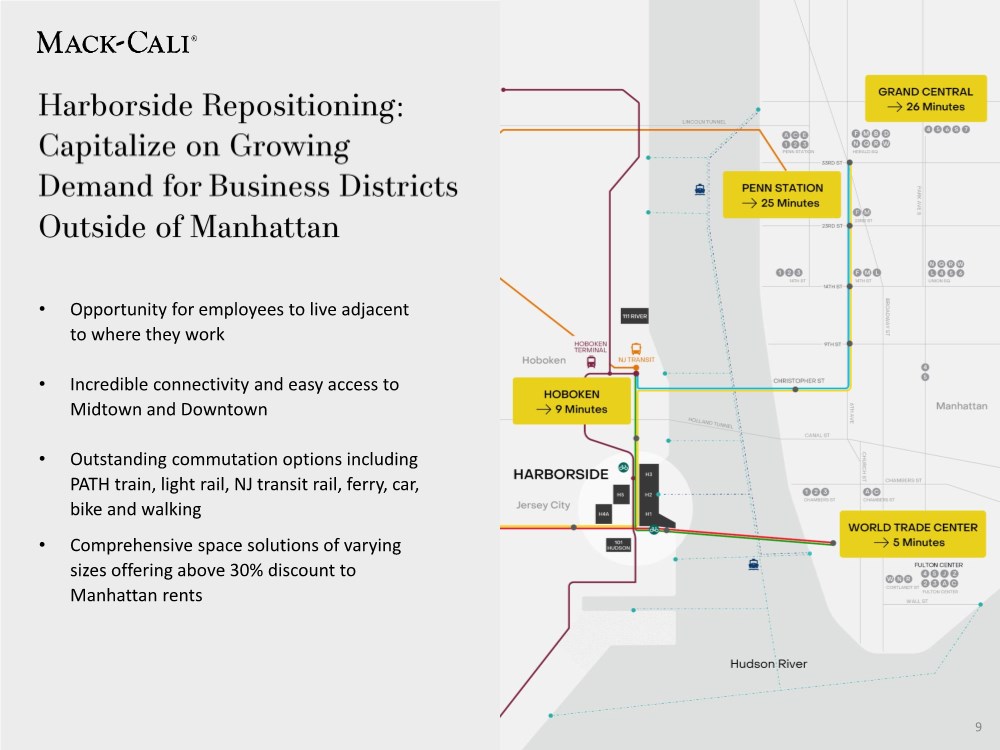

| 9 : Revitalize Waterfront Leasing • Opportunity for employees to live adjacent to where they work • Incredible connectivity and easy access to Midtown and Downtown • Outstanding commutation options including PATH train, light rail, NJ transit rail, ferry, car, bike and walking • Comprehensive space solutions of varying sizes offering above 30% discount to Manhattan rents 9 |

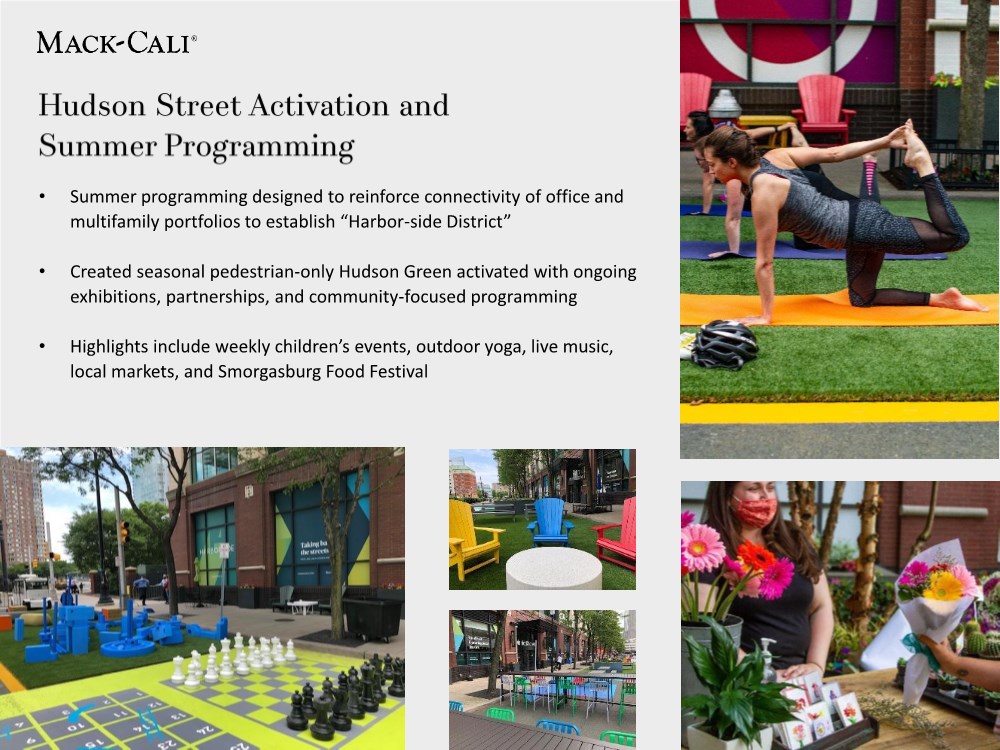

| 10 • Summer programming designed to reinforce connectivity of office and multifamily portfolios to establish “Harbor-side District” • Created seasonal pedestrian-only Hudson Green activated with ongoing exhibitions, partnerships, and community-focused programming • Highlights include weekly children’s events, outdoor yoga, live music, local markets, and Smorgasburg Food Festival |

| 11 The Capstone |

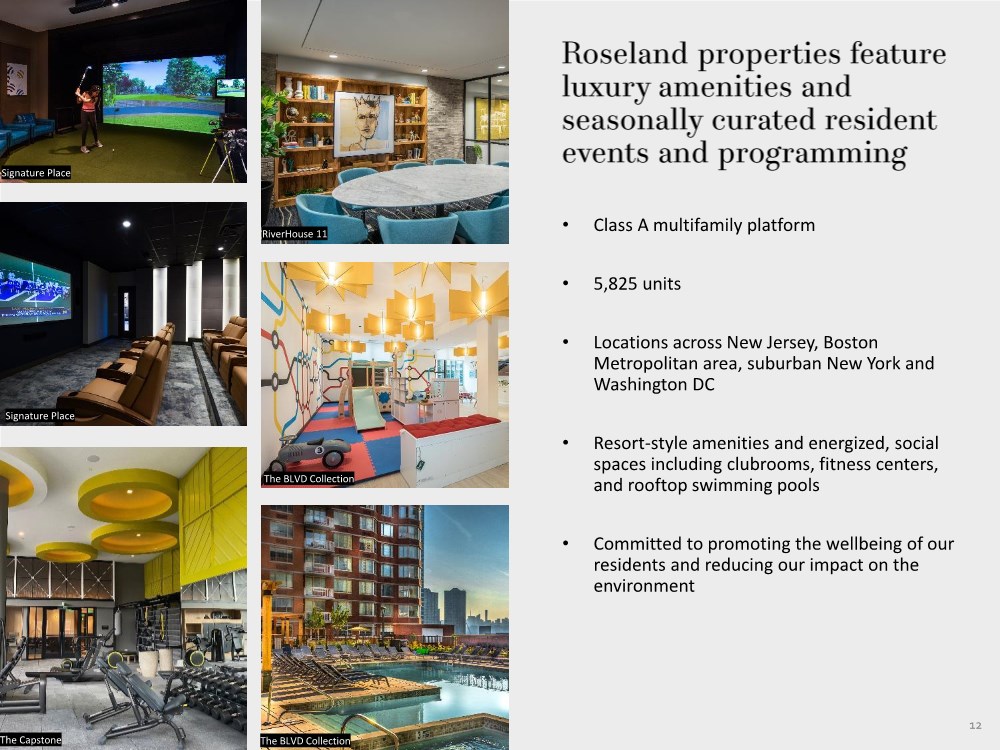

| 12 • Class A multifamily platform • 5,825 units • Locations across New Jersey, Boston Metropolitan area, suburban New York and Washington DC • Resort-style amenities and energized, social spaces including clubrooms, fitness centers, and rooftop swimming pools • Committed to promoting the wellbeing of our residents and reducing our impact on the environment Signature Place Signature Place The Capstone RiverHouse 11 The BLVD Collection The BLVD Collection |

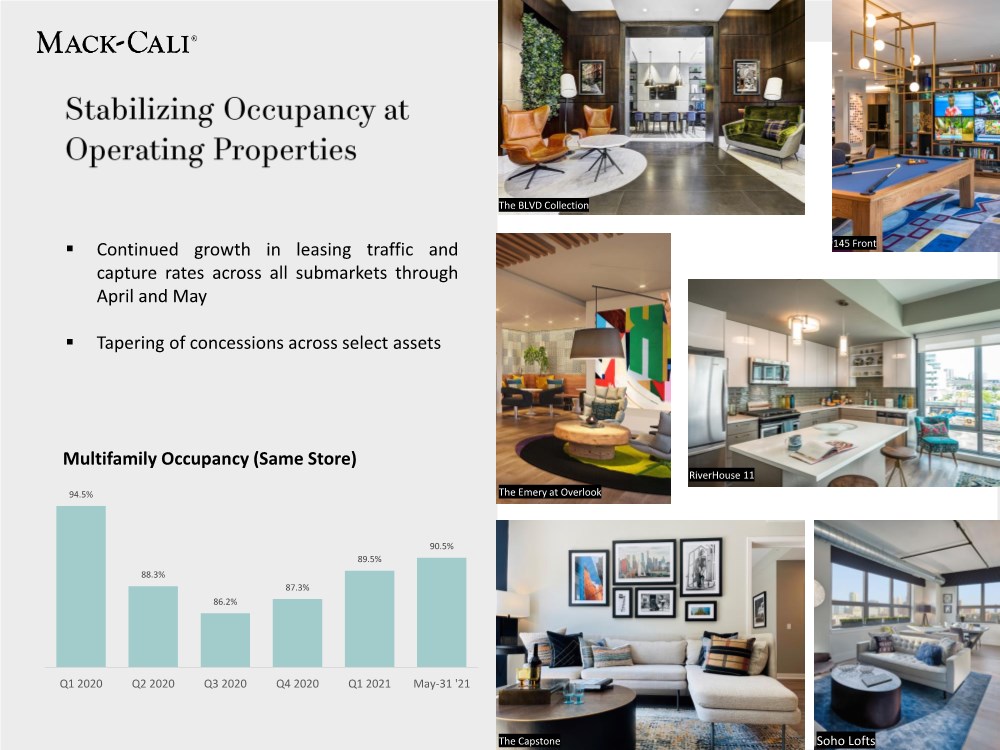

| 13 Multifamily Occupancy (Same Store) 94.5% 88.3% 86.2% 87.3% 89.5% 90.5% Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 May-31 '21 ▪ Continued growth in leasing traffic and capture rates across all submarkets through April and May ▪ Tapering of concessions across select assets The BLVD Collection 145 Front The Emery at Overlook The Capstone RiverHouse 11 Soho Lofts |

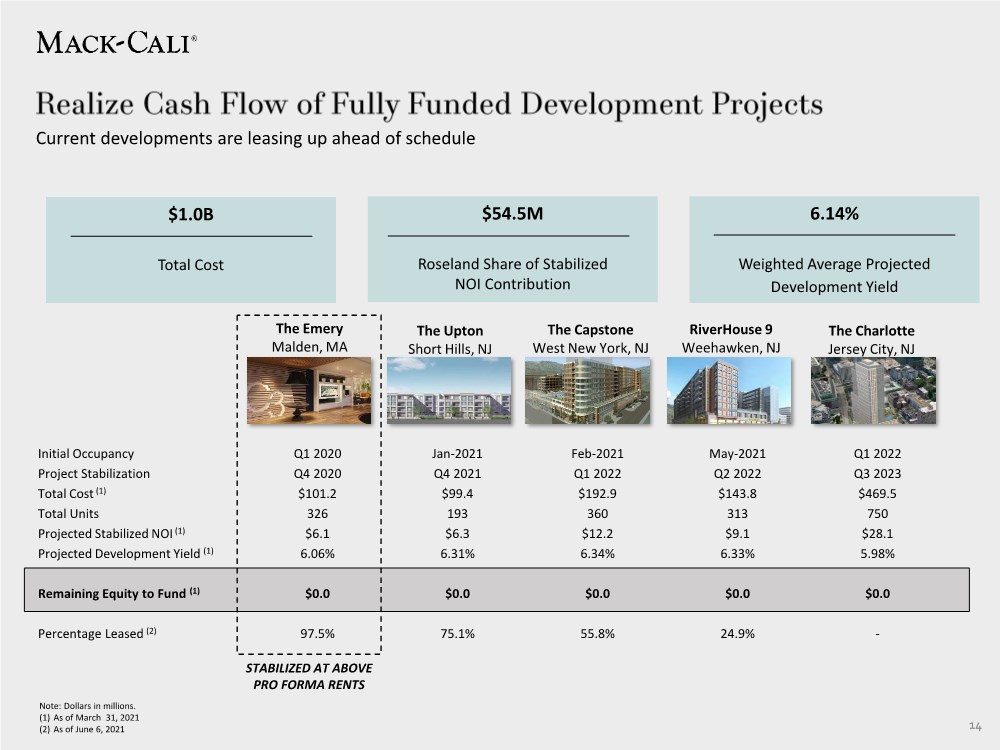

| 14 Current developments are leasing up ahead of schedule The Capstone West New York, NJ Note: Dollars in millions. (1) As of March 31, 2021 (2) As of June 6, 2021 Initial Occupancy Q1 2020 Jan-2021 Feb-2021 May-2021 Q1 2022 Project Stabilization Q4 2020 Q4 2021 Q1 2022 Q2 2022 Q3 2023 Total Cost (1) $101.2 $99.4 $192.9 $143.8 $469.5 Total Units 326 193 360 313 750 Projected Stabilized NOI (1) $6.1 $6.3 $12.2 $9.1 $28.1 Projected Development Yield (1) 6.06% 6.31% 6.34% 6.33% 5.98% Remaining Equity to Fund (1) $0.0 $0.0 $0.0 $0.0 $0.0 Percentage Leased (2) 97.5% 75.1% 55.8% 24.9% - The Charlotte Jersey City, NJ RiverHouse 9 Weehawken, NJ The Upton Short Hills, NJ The Emery Malden, MA $1.0B Total Cost $54.5M Roseland Share of Stabilized NOI Contribution 6.14% Weighted Average Projected Development Yield STABILIZED AT ABOVE PRO FORMA RENTS |

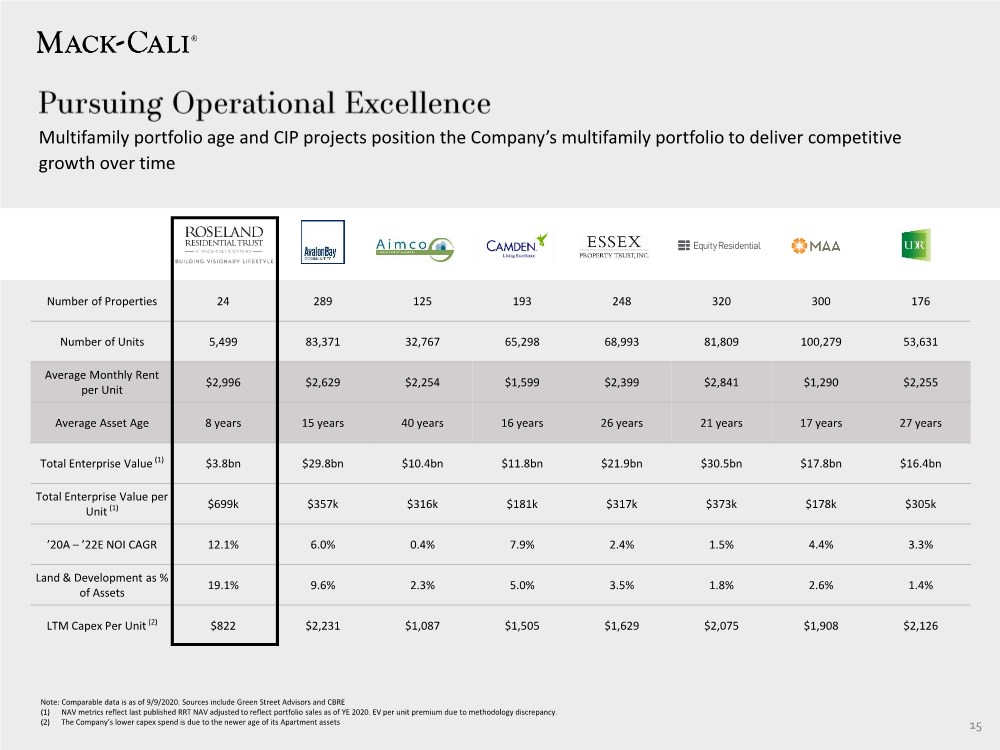

| 15 Note: Comparable data is as of 9/9/2020. Sources include Green Street Advisors and CBRE (1) NAV metrics reflect last published RRT NAV adjusted to reflect portfolio sales as of YE 2020. EV per unit premium due to methodology discrepancy. (2) The Company’s lower capex spend is due to the newer age of its Apartment assets Number of Properties 24 289 125 193 248 320 300 176 Number of Units 5,499 83,371 32,767 65,298 68,993 81,809 100,279 53,631 Average Monthly Rent per Unit $2,996 $2,629 $2,254 $1,599 $2,399 $2,841 $1,290 $2,255 Average Asset Age 8 years 15 years 40 years 16 years 26 years 21 years 17 years 27 years Total Enterprise Value (1) $3.8bn $29.8bn $10.4bn $11.8bn $21.9bn $30.5bn $17.8bn $16.4bn Total Enterprise Value per Unit (1) $699k $357k $316k $181k $317k $373k $178k $305k ’20A –’22E NOI CAGR 12.1% 6.0% 0.4% 7.9% 2.4% 1.5% 4.4% 3.3% Land & Development as % of Assets 19.1% 9.6% 2.3% 5.0% 3.5% 1.8% 2.6% 1.4% LTM Capex Per Unit (2) $822 $2,231 $1,087 $1,505 $1,629 $2,075 $1,908 $2,126 Multifamily portfolio age and CIP projects position the Company’s multifamily portfolio to deliver competitive growth over time |

| 16 |

| 17 Mack-Cali strives to create sustainable communities, placing focus on health & well-being of its employees, tenants and residents while improving the environment. One of Mack-Cali’s most critical objectives is to become a more inclusive and diverse company that reflects the backgrounds of the customers and communities in which it serves. Dedicated to maintaining a high standard for corporate governance predicated on integrity, ethics, diversity, and transparency. E S G Notes: 1. Since 2020, Mack-Cali has been committed to the UN Global Compact corporate responsibility initiative and its principles in the areas of human rights, labor, the environment and anti-corruption. 2. ISS Quality Score as of June 2, 2021. ISS Governance QualityScore is derived from publicly disclosed data and reporting on company governance disclosure, risk and performance. ISS Environmental and Social QualityScore is based on company disclosure and transparency practices. Scores indicate decile rank among relative index, region (Governance QualityScore), or industry group (Environmental and Social QualityScore). Scores are calculated at each pillar by summing the factor scores in that pillar. Not all factors and not all subcategories have equal weight. |

| 18 The Upton |

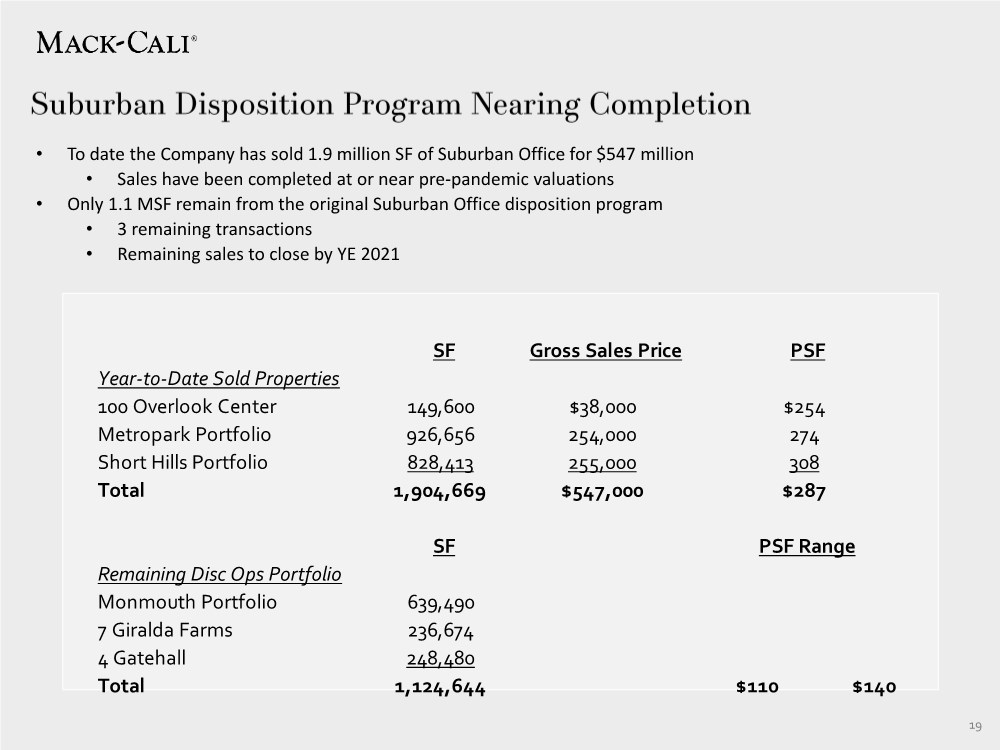

| 19 • To date the Company has sold 1.9 million SF of Suburban Office for $547 million • Sales have been completed at or near pre-pandemic valuations • Only 1.1 MSF remain from the original Suburban Office disposition program • 3 remaining transactions • Remaining sales to close by YE 2021 SF Gross Sales Price Year-to-Date Sold Properties 100 Overlook Center 149,600 $38,000 Metropark Portfolio 926,656 254,000 Short Hills Portfolio 828,413 255,000 Total 1,904,669 $547,000 SF Remaining Disc Ops Portfolio Monmouth Portfolio 639,490 7 Giralda Farms 236,674 4 Gatehall 248,480 Total 1,124,644 $110 $140 PSF Range PSF $254 274 308 $287 |

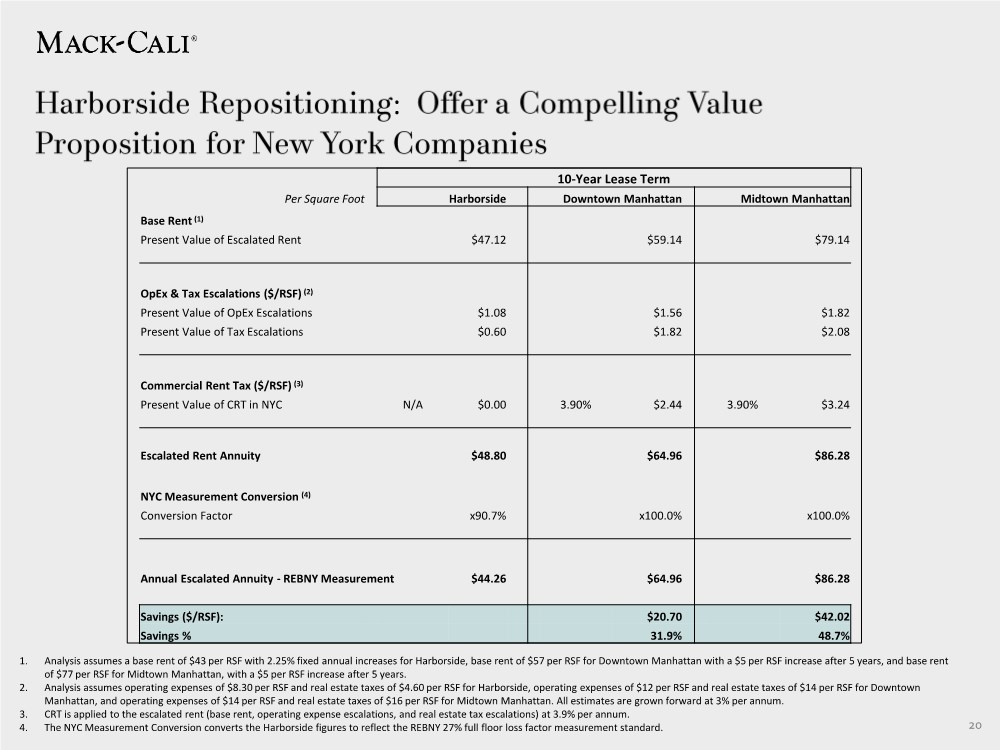

| 20 : 1. Analysis assumes a base rent of $43 per RSF with 2.25% fixed annual increases for Harborside, base rent of $57 per RSF for Downtown Manhattan with a $5 per RSF increase after 5 years, and base rent of $77 per RSF for Midtown Manhattan, with a $5 per RSF increase after 5 years. 2. Analysis assumes operating expenses of $8.30 per RSF and real estate taxes of $4.60 per RSF for Harborside, operating expenses of $12 per RSF and real estate taxes of $14 per RSF for Downtown Manhattan, and operating expenses of $14 per RSF and real estate taxes of $16 per RSF for Midtown Manhattan. All estimates are grown forward at 3% per annum. 3. CRT is applied to the escalated rent (base rent, operating expense escalations, and real estate tax escalations) at 3.9% per annum. 4. The NYC Measurement Conversion converts the Harborside figures to reflect the REBNY 27% full floor loss factor measurement standard. 10-Year Lease Term Per Square Foot Harborside Downtown Manhattan Midtown Manhattan Base Rent (1) Present Value of Escalated Rent $47.12 $59.14 $79.14 OpEx & Tax Escalations ($/RSF) (2) Present Value of OpEx Escalations $1.08 $1.56 $1.82 Present Value of Tax Escalations $0.60 $1.82 $2.08 Commercial Rent Tax ($/RSF) (3) Present Value of CRT in NYC N/A $0.00 3.90% $2.44 3.90% $3.24 Escalated Rent Annuity $48.80 $64.96 $86.28 NYC Measurement Conversion (4) Conversion Factor x90.7% x100.0% x100.0% Annual Escalated Annuity - REBNY Measurement $44.26 $64.96 $86.28 Savings ($/RSF): $20.70 $42.02 Savings % 31.9% 48.7% |

| 21 Average Revenue Per Home: Calculated as total apartment revenue for the quarter divided by the average percent occupied for the quarter, divided by the number of apartments and divided by three. Projected Stabilized Yield: Represents Projected Stabilized Residential NOI divided by Total Costs. See following page for “Projected Stabilized Residential NOI” definition. Consolidated Operating Communities: Wholly owned communities and communities whereby the Company has a controlling interest. Same Store Properties: Specific properties, which represent all in-service properties owned by the Company during the reported period, excluding properties sold, disposed of, held for sale, removed from service, or for any reason considered not stabilized, or being redeveloped or repositioned from January 1, 2020 through March 31, 2021. Future Development: Represents land inventory currently owned or controlled by the Company. Subordinated Joint Ventures: Joint Venture communities where the Company's ownership distributions are subordinate to payment of priority capital preferred returns. In-Construction Communities: Communities that are under construction and have not yet commenced initial leasing activities. Suburban: Office holdings not located on the NJ Hudson River waterfront. Lease-Up Communities: Communities that have commenced initial operations but have not yet achieved Project Stabilization. Third Party Capital: Capital invested by third parties and not Mack-Cali. MCRC Capital: Represents cash equity that the Company has contributed or has a future obligation to contribute to a project. Total Costs: Represents full project budget, including land and developer fees, and interest expense through Project Completion. Operating Communities: Communities that have achieved Project Stabilization. Waterfront: Office assets located on NJ Hudson River waterfront. Project Completion: As evidenced by a certificate of completion by a certified architect or issuance of a final or temporary certificate of occupancy. Project Stabilization: Lease-Up communities that have achieved over 95 percentage leased for six consecutive weeks. |

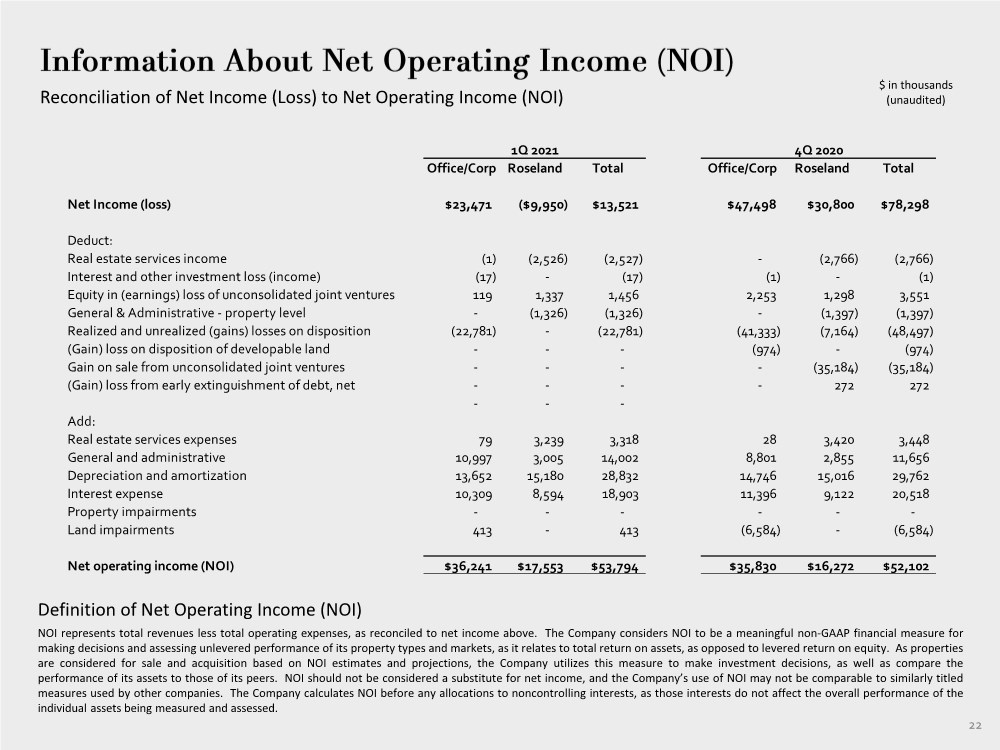

| NOI represents total revenues less total operating expenses, as reconciled to net income above. The Company considers NOI to be a meaningful non-GAAP financial measure for making decisions and assessing unlevered performance of its property types and markets, as it relates to total return on assets, as opposed to levered return on equity. As properties are considered for sale and acquisition based on NOI estimates and projections, the Company utilizes this measure to make investment decisions, as well as compare the performance of its assets to those of its peers. NOI should not be considered a substitute for net income, and the Company’s use of NOI may not be comparable to similarly titled measures used by other companies. The Company calculates NOI before any allocations to noncontrolling interests, as those interests do not affect the overall performance of the individual assets being measured and assessed. Definition of Net Operating Income (NOI) Reconciliation of Net Income (Loss) to Net Operating Income (NOI) $ in thousands (unaudited) 22 Office/Corp Roseland Total Office/Corp Roseland Total Net Income (loss) $23,471 ($9,950) $13,521 $47,498 $30,800 $78,298 Deduct: Real estate services income (1) (2,526) (2,527) - (2,766) (2,766) Interest and other investment loss (income) (17) - (17) (1) - (1) Equity in (earnings) loss of unconsolidated joint ventures 119 1,337 1,456 2,253 1,298 3,551 General & Administrative - property level - (1,326) (1,326) - (1,397) (1,397) Realized and unrealized (gains) losses on disposition (22,781) - (22,781) (41,333) (7,164) (48,497) (Gain) loss on disposition of developable land - - - (974) - (974) Gain on sale from unconsolidated joint ventures - - - - (35,184) (35,184) (Gain) loss from early extinguishment of debt, net - - - - 272 272 - - - Add: Real estate services expenses 79 3,239 3,318 28 3,420 3,448 General and administrative 10,997 3,005 14,002 8,801 2,855 11,656 Depreciation and amortization 13,652 15,180 28,832 14,746 15,016 29,762 Interest expense 10,309 8,594 18,903 11,396 9,122 20,518 Property impairments - - - - - - Land impairments 413 - 413 (6,584) - (6,584) Net operating income (NOI) $36,241 $17,553 $53,794 $35,830 $16,272 $52,102 1Q 2021 4Q 2020 |