Exhibit 99.1

|

1 Supplemental Operating and Financial Data 1Q2021 May 6, 2021 |

|

Table of Contents Company HighlightsPage The Upton – Short Hills, NJ (Commenced Lease-Up) RiverHouse 9 - Weehawken, NJ (In-Construction) This Supplemental Operating and Financial Data should be read in connection with the Company’s first quarter 2021 earnings press release (included as Exhibit 99.2 of the Company’s Current Report on Form 8-K, filed on May 6, 2021) and quarterly report on Form 10-Q for the quarter ended March 31, 2021, as certain disclosures, definitions and reconciliations in such announcement have not been included in this Supplemental Operating and Financial Data. 1Q 2021 The Capstone – West New York, NJ (Commenced Lease-Up)2 |

|

3 1Q 20213 |

|

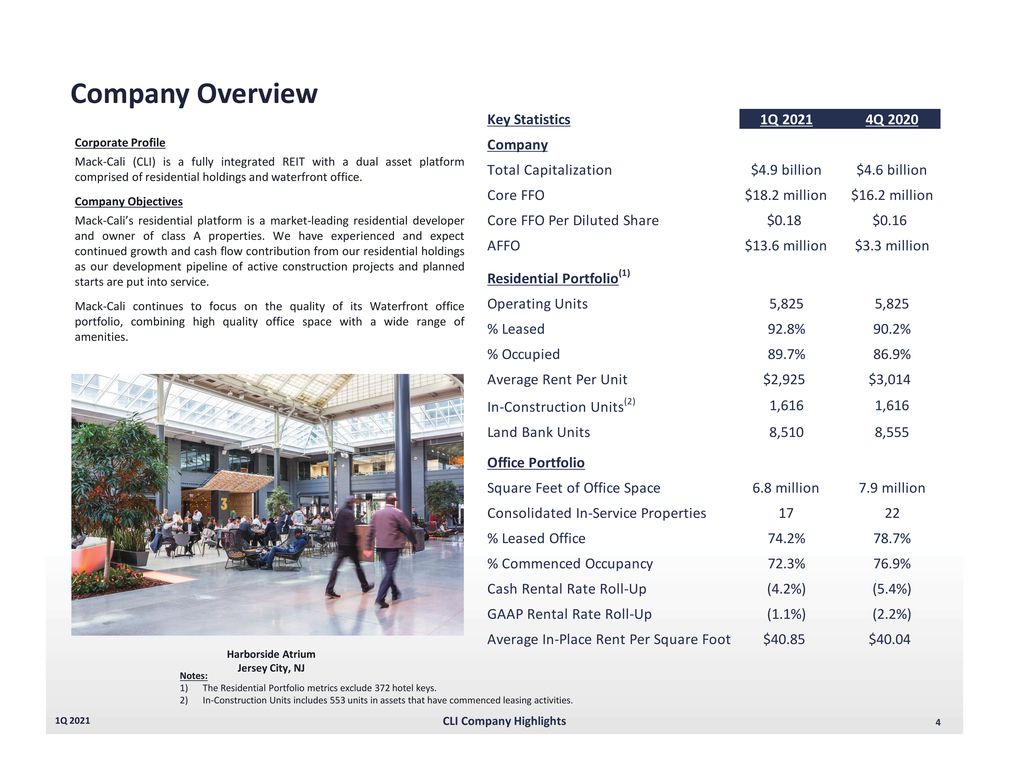

Company Overview Corporate Profile Mack-Cali (CLI) is a fully integrated REIT with a dual asset platform comprised of residential holdings and waterfront office. Company Objectives Mack-Cali’s residential platform is a market-leading residential developer and owner of class A properties. We have experienced and expect continued growth and cash flow contribution from our residential holdings as our development pipeline of active construction projects and planned starts are put into service. Mack-Cali continues to focus on the quality of its Waterfront office portfolio, combining high quality office space with a wide range of amenities. Harborside Atrium Jersey City, NJ Key Statistics1Q 20214Q 2020 Company Total Capitalization$4.9 billion$4.6 billion Core FFO$18.2 million$16.2 million Core FFO Per Diluted Share$0.18$0.16 AFFO$13.6 million$3.3 million Residential Portfolio(1) Operating Units5,8255,825 % Leased92.8%90.2% % Occupied89.7%86.9% Average Rent Per Unit$2,925$3,014 In-Construction Units(2)1,6161,616 Land Bank Units8,5108,555 Office Portfolio Square Feet of Office Space6.8 million7.9 million Consolidated In-Service Properties1722 % Leased Office74.2%78.7% % Commenced Occupancy72.3%76.9% Cash Rental Rate Roll-Up(4.2%)(5.4%) GAAP Rental Rate Roll-Up(1.1%)(2.2%) Average In-Place Rent Per Square Foot$40.85$40.04 1Q 2021 Notes: The Residential Portfolio metrics exclude 372 hotel keys. In-Construction Units includes 553 units in assets that have commenced leasing activities. CLI Company Highlights4 |

|

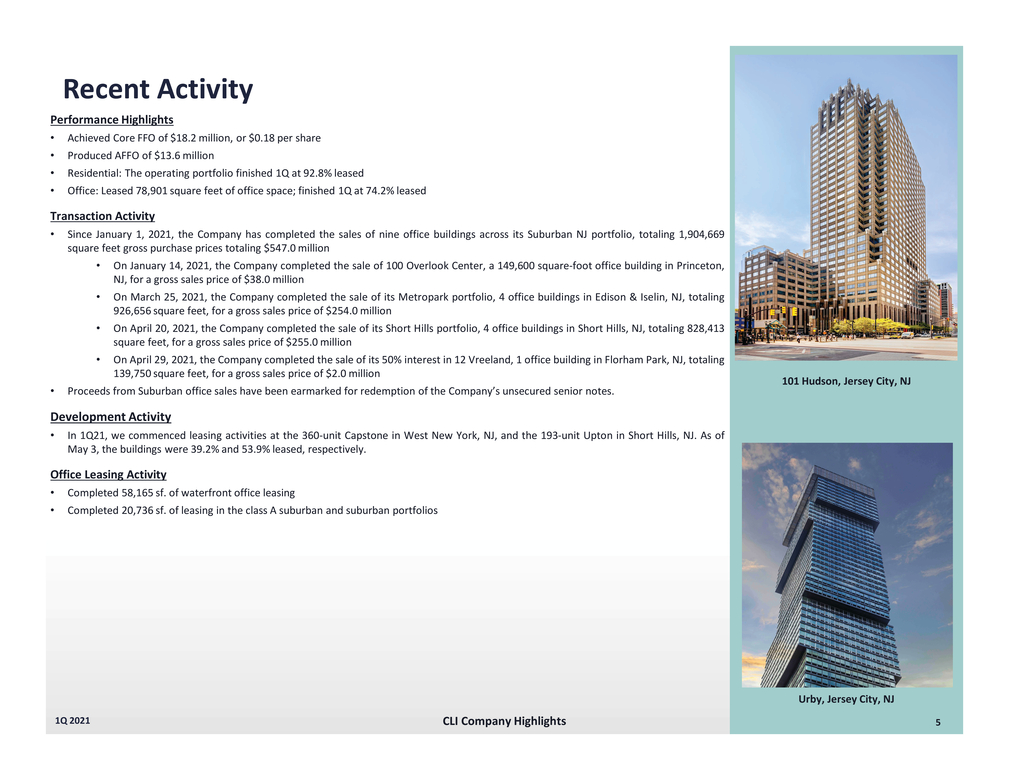

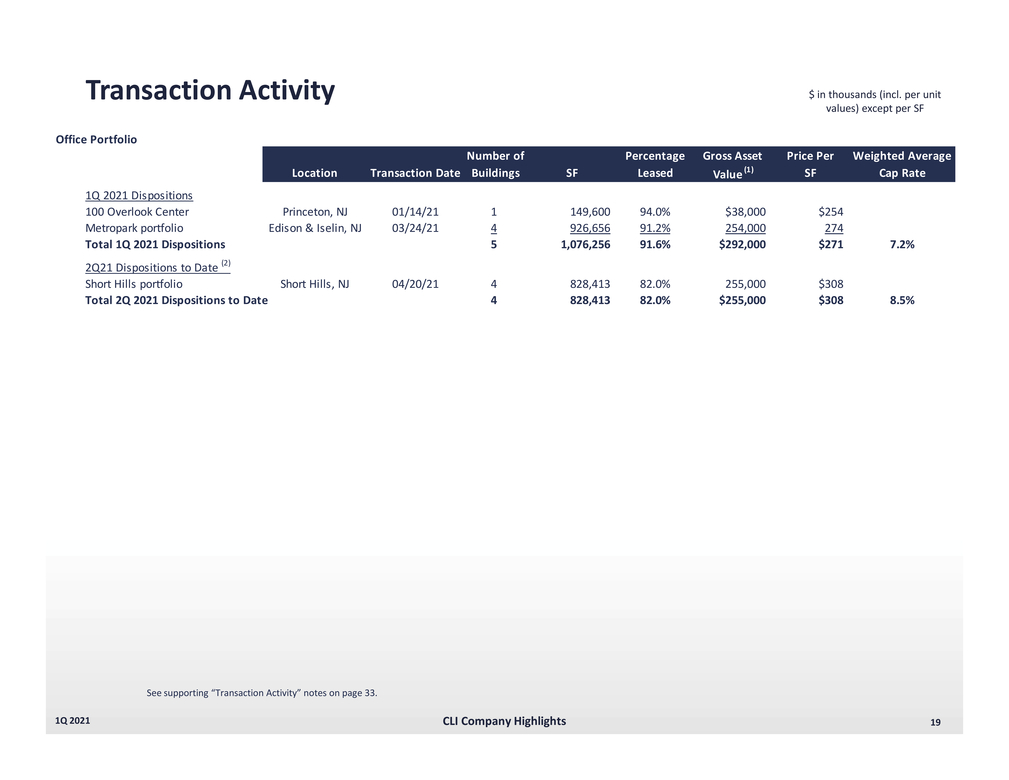

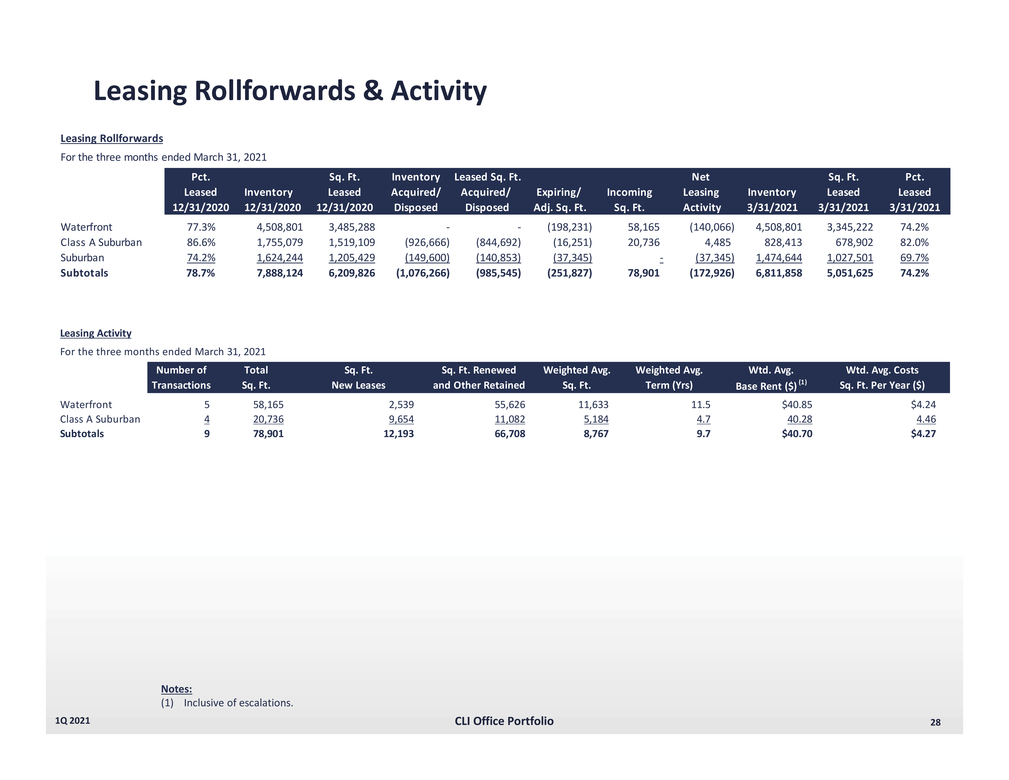

Recent Activity Performance Highlights Achieved Core FFO of $18.2 million, or $0.18 per share Produced AFFO of $13.6 million Residential: The operating portfolio finished 1Q at 92.8% leased Office: Leased 78,901 square feet of office space; finished 1Q at 74.2% leased Transaction Activity Since January 1, 2021, the Company has completed the sales of nine office buildings across its Suburban NJ portfolio, totaling 1,904,669 square feet gross purchase prices totaling $547.0 million On January 14, 2021, the Company completed the sale of 100 Overlook Center, a 149,600 square-foot office building in Princeton, NJ, for a gross sales price of $38.0 million On March 25, 2021, the Company completed the sale of its Metropark portfolio, 4 office buildings in Edison & Iselin, NJ, totaling 926,656 square feet, for a gross sales price of $254.0 million On April 20, 2021, the Company completed the sale of its Short Hills portfolio, 4 office buildings in Short Hills, NJ, totaling 828,413 square feet, for a gross sales price of $255.0 million On April 29, 2021, the Company completed the sale of its 50% interest in 12 Vreeland, 1 office building in Florham Park, NJ, totaling 139,750 square feet, for a gross sales price of $2.0 million Proceeds from Suburban office sales have been earmarked for redemption of the Company’s unsecured senior notes. Development Activity In 1Q21, we commenced leasing activities at the 360-unit Capstone in West New York, NJ, and the 193-unit Upton in Short Hills, NJ. As of May 3, the buildings were 39.2% and 53.9% leased, respectively. Office Leasing Activity Completed 58,165 sf. of waterfront office leasing Completed 20,736 sf. of leasing in the class A suburban and suburban portfolios 101 Hudson, Jersey City, NJ 1Q 2021 CLI Company Highlights Urby, Jersey City, NJ 5 |

|

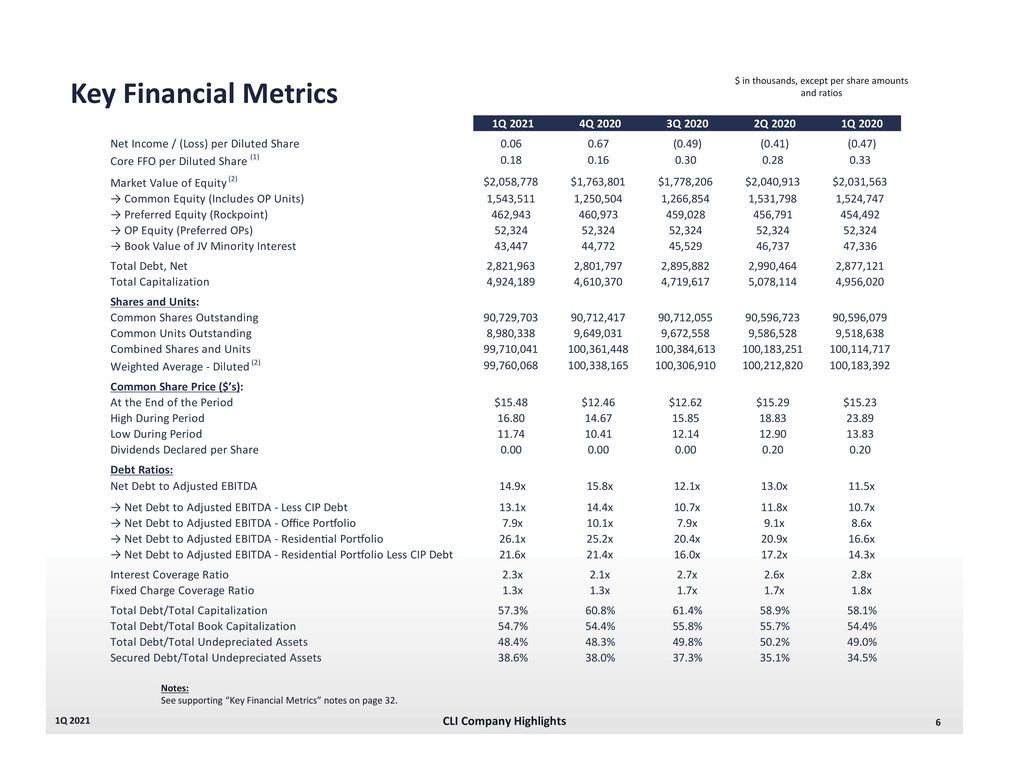

Key Financial Metrics $ in thousands, except per share amounts and ratios 1Q 2021 Notes: See supporting “Key Financial Metrics” notes on page 32. CLI Company Highlights6 |

|

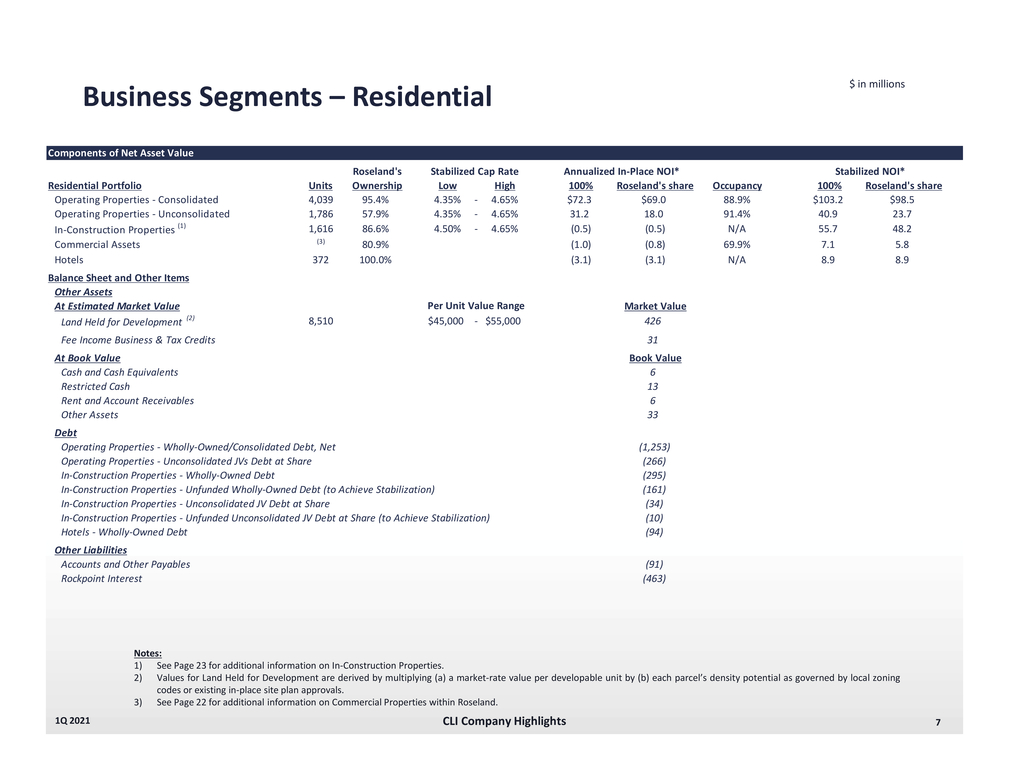

Business Segments – Residential $ in millions Components of Net Asset Value Roseland's Stabilized Cap Rate Annualized In-Place NOI* Stabilized NOI* Residential Portfolio Units Ownership LowHigh 100%Roseland's share Occupancy 100%Roseland's share Operating Properties - Consolidated 4,039 95.4% 4.35%-4.65% $72.3$69.0 88.9% $103.2$98.5 Operating Properties - Unconsolidated 1,786 57.9% 4.35%-4.65% 31.218.0 91.4% 40.923.7 In-Construction Properties (1) 1,616 86.6% 4.50%-4.65% (0.5)(0.5) N/A 55.748.2 Commercial Assets (3) 80.9% (1.0)(0.8) 69.9% 7.15.8 Hotels 372 100.0% (3.1)(3.1) N/A 8.98.9 Other Assets At Estimated Market Value Per Unit Value Range Market Value Land Held for Development (2)8,510$45,000 - $55,000426 Fee Income Business & Tax Credits31 At Book ValueBook Value Cash and Cash Equivalents6 Restricted Cash13 Rent and Account Receivables6 Other Assets33 Debt Operating Properties - Wholly-Owned/Consolidated Debt, Net(1,253) Operating Properties - Unconsolidated JVs Debt at Share(266) In-Construction Properties - Wholly-Owned Debt(295) In-Construction Properties - Unfunded Wholly-Owned Debt (to Achieve Stabilization)(161) In-Construction Properties - Unconsolidated JV Debt at Share(34) In-Construction Properties - Unfunded Unconsolidated JV Debt at Share (to Achieve Stabilization)(10) Hotels - Wholly-Owned Debt(94) Other Liabilities Accounts and Other Payables(91) Rockpoint Interest(463) Notes: See Page 23 for additional information on In-Construction Properties. Values for Land Held for Development are derived by multiplying (a) a market-rate value per developable unit by (b) each parcel’s density potential as governed by local zoning codes or existing in-place site plan approvals. See Page 22 for additional information on Commercial Properties within Roseland. |

|

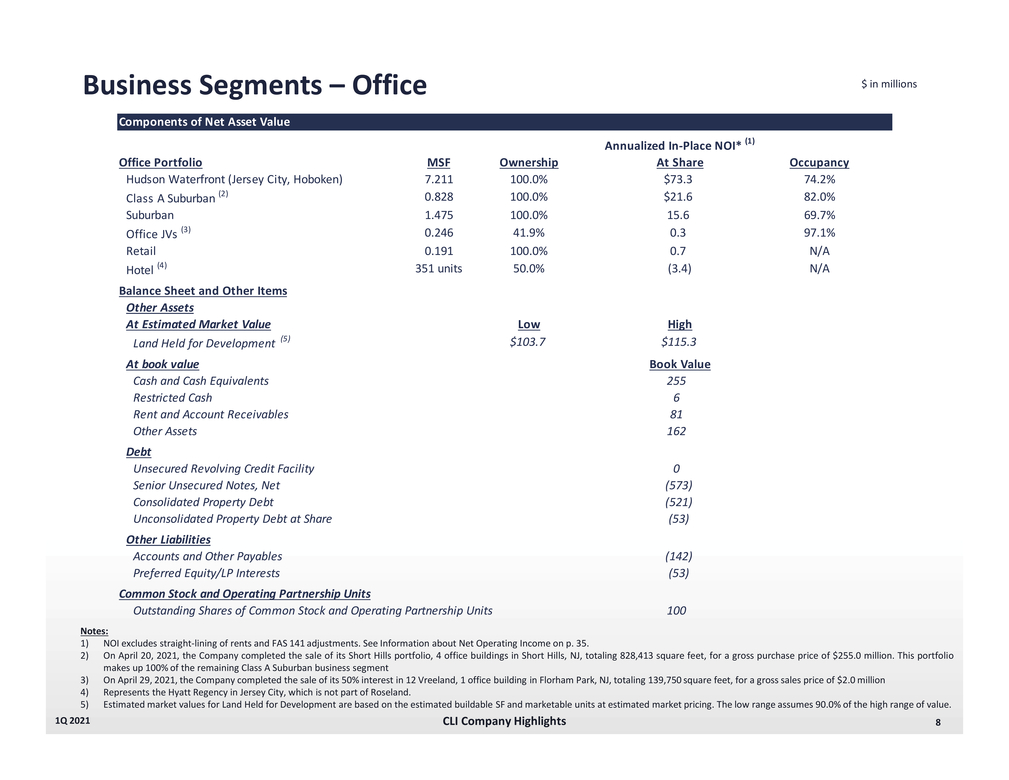

Business Segments – Office $ in millions Balance Sheet and Other Items Notes: Other Liabilities Accounts and Other Payables(142) Preferred Equity/LP Interests(53) Common Stock and Operating Partnership Units Outstanding Shares of Common Stock and Operating Partnership Units100 NOI excludes straight-lining of rents and FAS 141 adjustments. See Information about Net Operating Income on p. 35. On April 20, 2021, the Company completed the sale of its Short Hills portfolio, 4 office buildings in Short Hills, NJ, totaling 828,413 square feet, for a gross purchase price of $255.0 million. This portfolio makes up 100% of the remaining Class A Suburban business segment On April 29, 2021, the Company completed the sale of its 50% interest in 12 Vreeland, 1 office building in Florham Park, NJ, totaling 139,750 square feet, for a gross sales price of $2.0 million Represents the Hyatt Regency in Jersey City, which is not part of Roseland. Estimated market values for Land Held for Development are based on the estimated buildable SF and marketable units at estimated market pricing. The low range assumes 90.0% of the high range of value. |

|

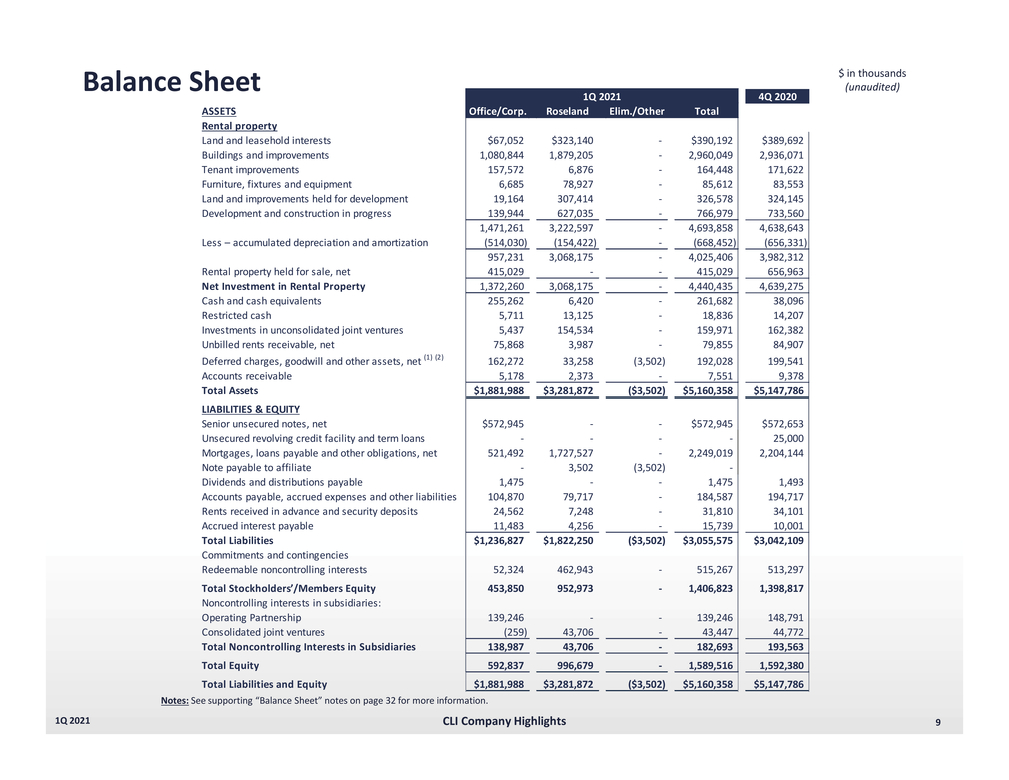

1Q 2021 Office/Corp. Roseland Elim./OtherTotal $67,052 1,080,844 157,572 6,685 19,164 139,944 $323,140-1,879,205-6,876-78,927-307,414-627,035-3,222,597-(154,422)-3,068,175--- 3,068,175-6,420-13,125-154,534-3,987-33,258(3,502) 2,373-$3,281,872($3,502) ---- 1,727,527-3,502(3,502) --79,717-7,248-4,256-$1,822,250($3,502) 462,943-952,973--- 43,706-43,706-996,679-$3,281,872($3,502) $390,192 2,960,049 164,448 85,612 326,578 766,979 1,471,261 (514,030) 4,693,858 (668,452) 957,231 415,029 4,025,406 415,029 1,372,260 4,440,435 255,262 5,711 5,437 75,868 162,272 5,178 261,682 18,836 159,971 79,855 192,028 7,551 $1,881,988 $5,160,358 $572,945 - 521,492 - 1,475 104,870 24,562 11,483 $572,945 - 2,249,019 - 1,475 184,587 31,810 15,739 $1,236,827 52,324 453,850 139,246 (259) $3,055,575 515,267 1,406,823 139,246 43,447 138,987 182,693 592,837 1,589,516 $1,881,988 $5,160,358 (unaudited) 4Q 2020 Notes: See supporting “Balance Sheet” notes on page 32 for more information. |

|

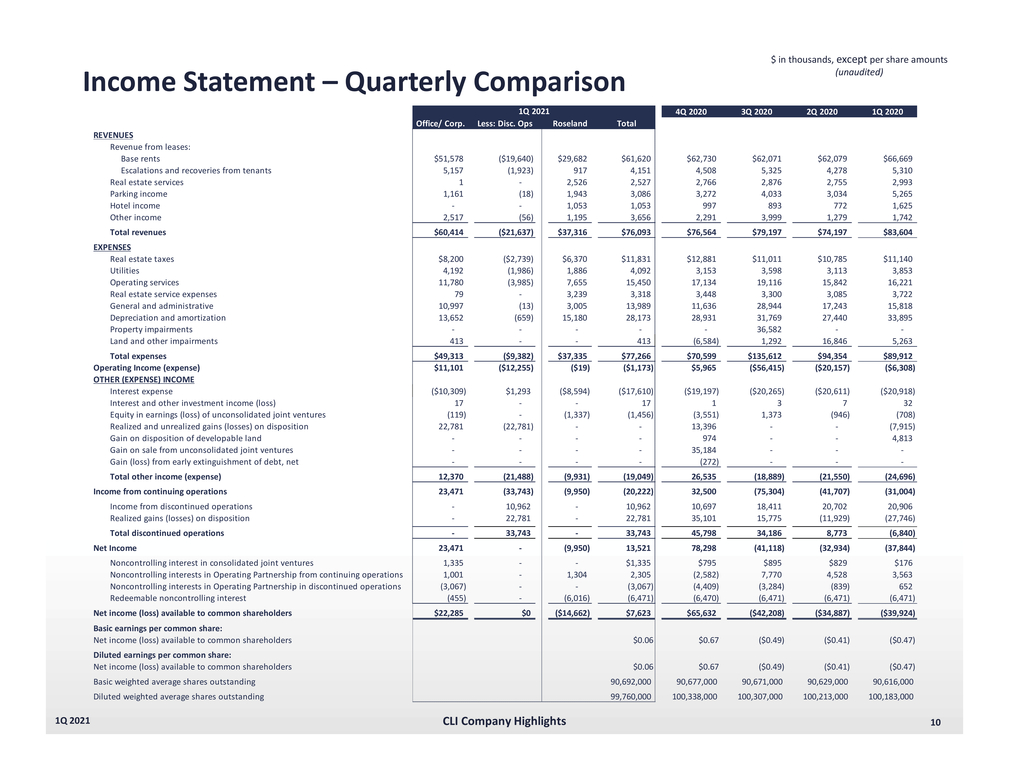

Income Statement – Quarterly Comparison $ in thousands, except per share amounts (unaudited) Office/ Corp. 1Q 2021 Less: Disc. OpsRoseland Total $51,578 ($19,640) $29,682 $61,620 5,157 (1,923) 917 4,151 1 - 2,526 2,527 1,161 (18) 1,943 3,086 - - 1,053 1,053 2,517 (56) 1,195 3,656 $60,414 ($21,637) $37,316 $76,093 $8,200 ($2,739) $6,370 $11,831 4,192 (1,986) 1,886 4,092 11,780 (3,985) 7,655 15,450 79 - 3,239 3,318 10,997 (13) 3,005 13,989 13,652 (659) 15,180 28,173 - - - - 413 - - 413 $49,313 ($9,382) $37,335 $77,266 $11,101 ($12,255) ($19) ($1,173) ($10,309) $1,293 ($8,594) ($17,610) 17 - - 17 (119) - (1,337) (1,456) 22,781 (22,781) - - - - - - - - - - - - - - 12,370 (21,488) (9,931) (19,049) 23,471 (33,743) (9,950) (20,222) - 10,962 - 10,962 - 22,781 - 22,781 - 33,743 - 33,743 23,471 - (9,950) 13,521 1,335 - - $1,335 1,001 - 1,304 2,305 (3,067) - - (3,067) (455) - (6,016) (6,471) $22,285 $0 ($14,662) $7,623 $0.06 $0.06 90,692,000 99,760,000 REVENUES Base rents $62,730 $62,071 $62,079 $66,669 Escalations and recoveries from tenants 4,508 5,325 4,278 5,310 Real estate services 2,766 2,876 2,755 2,993 Parking income 3,272 4,033 3,034 5,265 Hotel income 997 893 772 1,625 Other income Real estate taxes $12,881 $11,011 $10,785 $11,140 Utilities 3,153 3,598 3,113 3,853 Operating services 17,134 19,116 15,842 16,221 Real estate service expenses 3,448 3,300 3,085 3,722 General and administrative 11,636 28,944 17,243 15,818 Depreciation and amortization 28,931 31,769 27,440 33,895 Property impairments - 36,582 - - Land and other impairments (6,584) 1,29216,8465,263 Total expenses $70,599 $135,612$94,354$89,912 Operating Income (expense) OTHER (EXPENSE) INCOME Interest expense $5,965 ($19,197) ($56,415)($20,157)($6,308) ($20,265)($20,611)($20,918) Interest and other investment income (loss) 1 3732 Equity in earnings (loss) of unconsolidated joint ventures (3,551) 1,373(946)(708) Realized and unrealized gains (losses) on disposition 13,396 --(7,915) Gain on disposition of developable land 974 --4,813 Gain on sale from unconsolidated joint ventures 35,184 ---Gain (loss) from early extinguishment of debt, net (272) ---Total other income (expense) 26,535 (18,889)(21,550)(24,696) Income from continuing operations 32,500 (75,304)(41,707)(31,004) Income from discontinued operations 10,697 18,41120,70220,906 Realized gains (losses) on disposition 35,101 15,775(11,929)(27,746) Total discontinued operations 45,798 34,1868,773(6,840) Net Income 78,298 (41,118)(32,934)(37,844) Noncontrolling interest in consolidated joint ventures $795 $895$829$176 Noncontrolling interests in Operating Partnership from continuing operations (2,582) 7,7704,5283,563 Noncontrolling interests in Operating Partnership in discontinued operations (4,409) (3,284)(839)652 Redeemable noncontrolling interest (6,470) (6,471)(6,471)(6,471) Net income (loss) available to common shareholders $65,632 ($42,208)($34,887)($39,924) Basic earnings per common share: Net income (loss) available to common shareholders $0.67 ($0.49)($0.41)($0.47) Diluted earnings per common share: Net income (loss) available to common shareholders $0.67 ($0.49)($0.41)($0.47) Basic weighted average shares outstanding 90,677,000 90,671,00090,629,00090,616,000 Diluted weighted average shares outstanding 100,338,000 100,307,000100,213,000100,183,000 2,291 3,999 1,279 1,742 $76,564$79,197$74,197$83,604 |

|

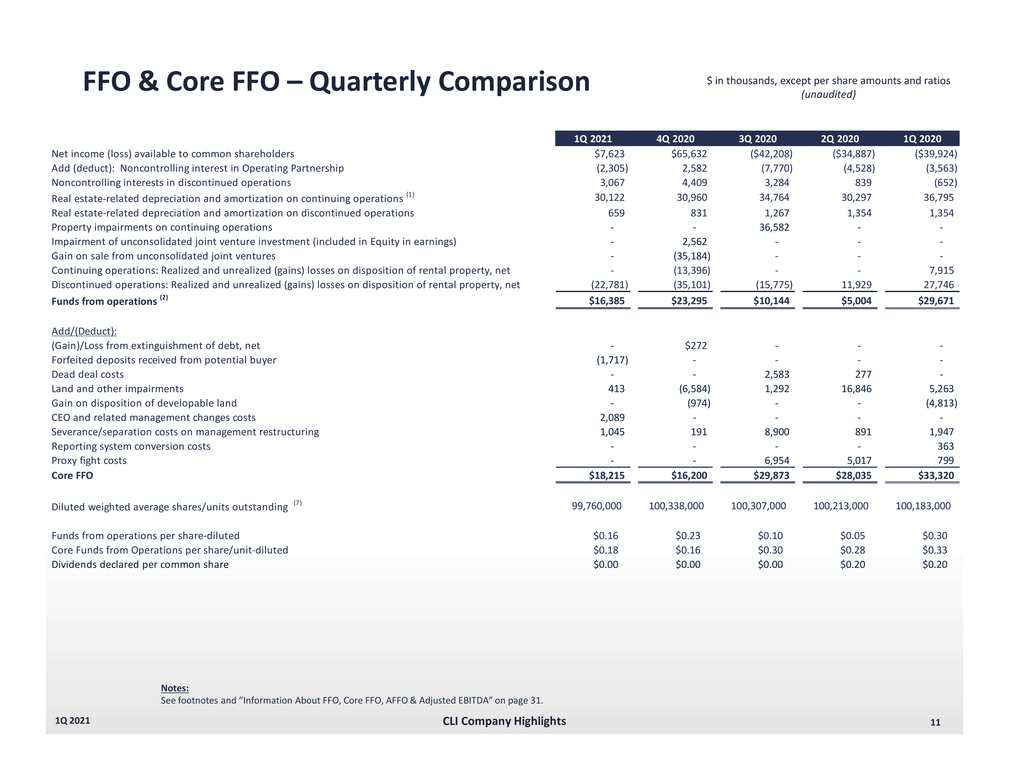

FFO & Core FFO – Quarterly Comparison $ in thousands, except per share amounts and ratios 1Q 2021 4Q 2020 3Q 2020 2Q 2020 1Q 2020 Diluted weighted average shares/units outstanding (7)99,760,000100,338,000100,307,000100,213,000100,183,000 |

|

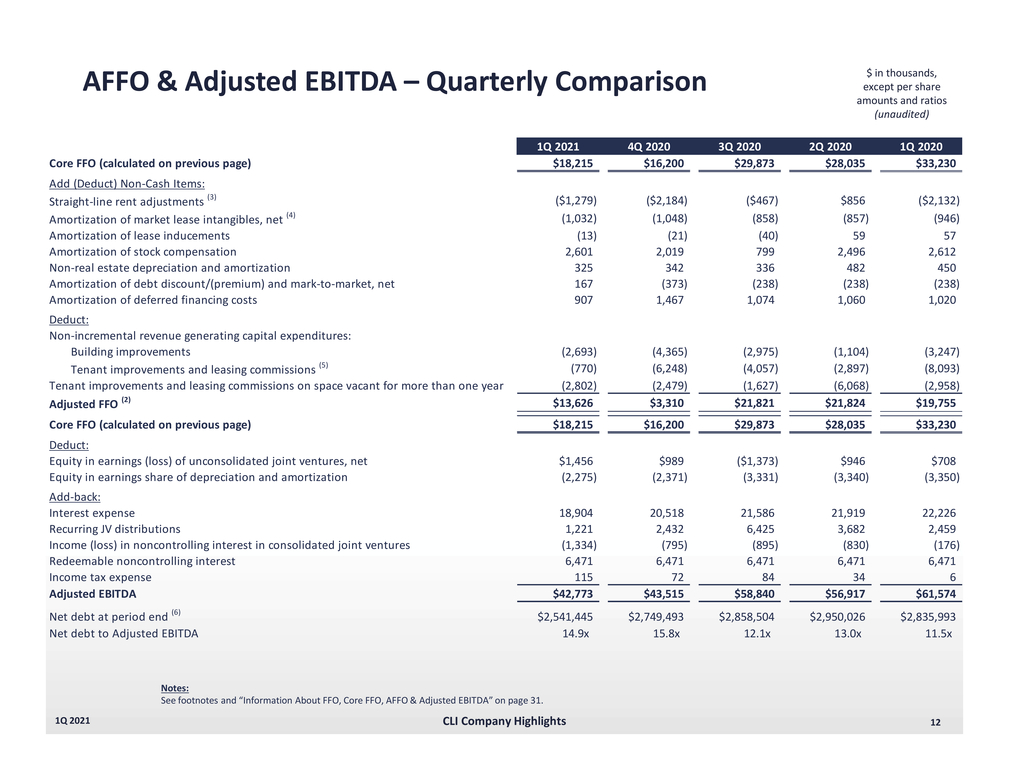

AFFO & Adjusted EBITDA – Quarterly Comparison $ in thousands, except per share amounts and ratios (unaudited) 1Q 2021 4Q 2020 3Q 2020 2Q 2020 1Q 2020 |

|

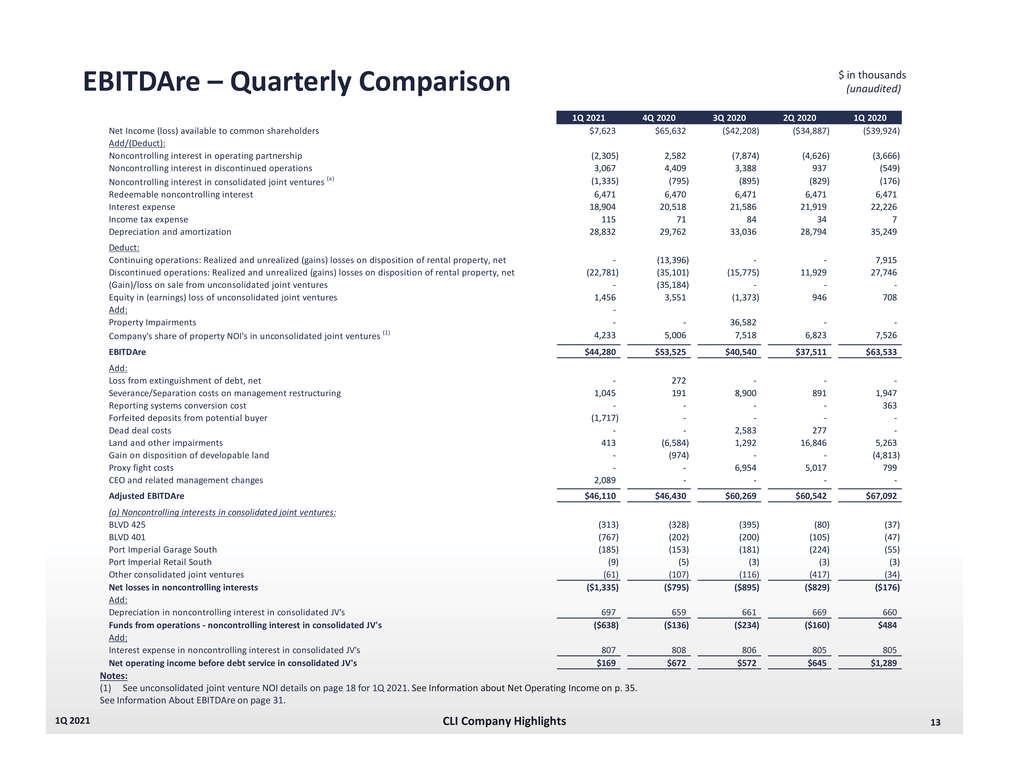

1Q 2021 4Q 2020 3Q 2020 2Q 2020 1Q 2020 $ in thousands (unaudited) Notes: See unconsolidated joint venture NOI details on page 18 for 1Q 2021. See Information about Net Operating Income on p. 35. See Information About EBITDAre on page 31. |

|

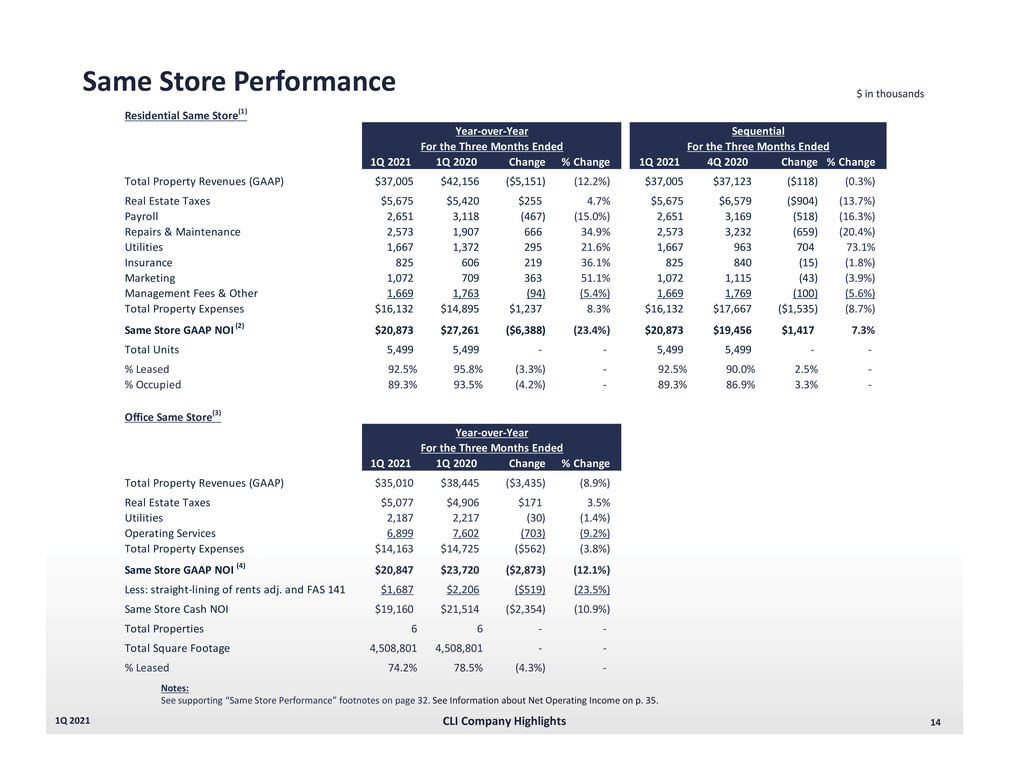

Same Store Performance Residential Same Store(1) Year-over-YearSequential For the Three Months EndedFor the Three Months Ended $ in thousands Office Same Store(3) Year-over-Year For the Three Months Ended 1Q 20211Q 2020Change% Change Total Property Revenues (GAAP)$35,010$38,445($3,435)(8.9%) Real Estate Taxes$5,077$4,906$1713.5% Utilities2,1872,217(30)(1.4%) Operating Services6,8997,602(703)(9.2%) Total Property Expenses$14,163$14,725($562)(3.8%) Same Store GAAP NOI (4)$20,847$23,720($2,873)(12.1%) Less: straight-lining of rents adj. and FAS 141$1,687$2,206($519)(23.5%) Same Store Cash NOI$19,160$21,514($2,354)(10.9%) Total Properties66--Total Square Footage4,508,8014,508,801--% Leased74.2%78.5%(4.3%)-Notes: See supporting “Same Store Performance” footnotes on page 32. See Information about Net Operating Income on p. 35. |

|

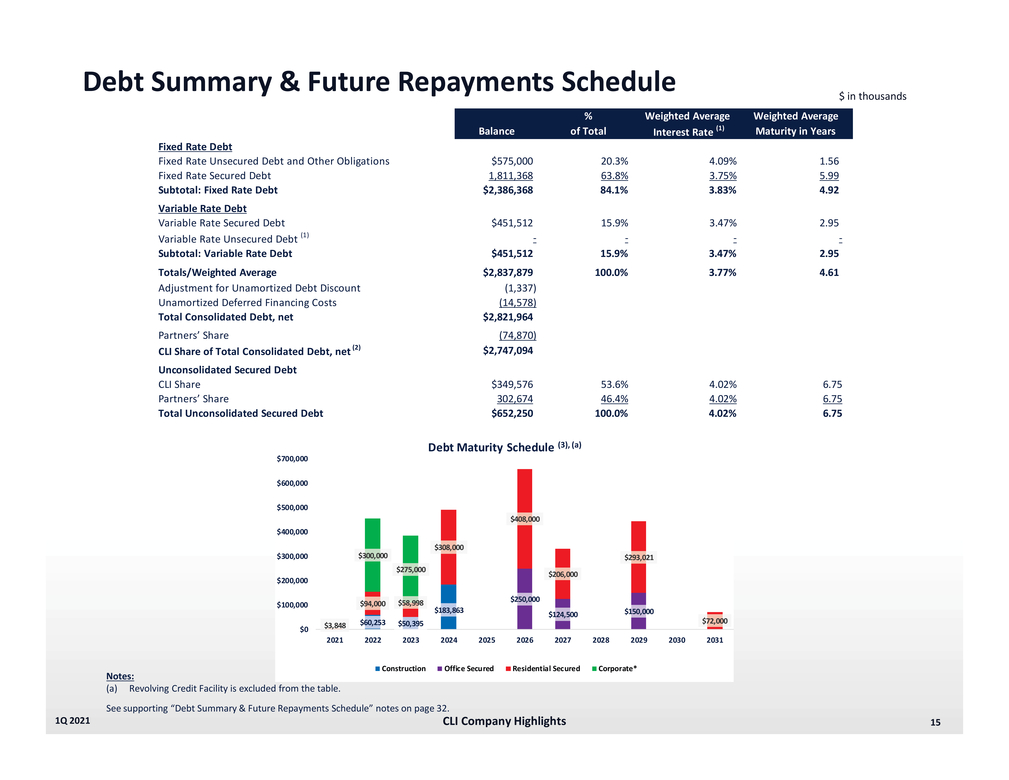

Debt Summary & Future Repayments Schedule $ in thousands $700,000 Debt Maturity Schedule (3), (a) $600,000 $500,000 $400,000 $300,000 $200,000 $300,000 $275,000 $308,000 $408,000 $206,000 $293,021 $100,000 $0 $3,848 $94,000 $58,998 $60,253 $50,395 $183,863 $250,000 $124,500$150,000 $72,000 20212022202320242025202620272028202920302031 Notes: Revolving Credit Facility is excluded from the table. ConstructionOffice SecuredResidential SecuredCorporate* 1Q 2021 See supporting “Debt Summary & Future Repayments Schedule” notes on page 32. CLI Company Highlights 15 |

|

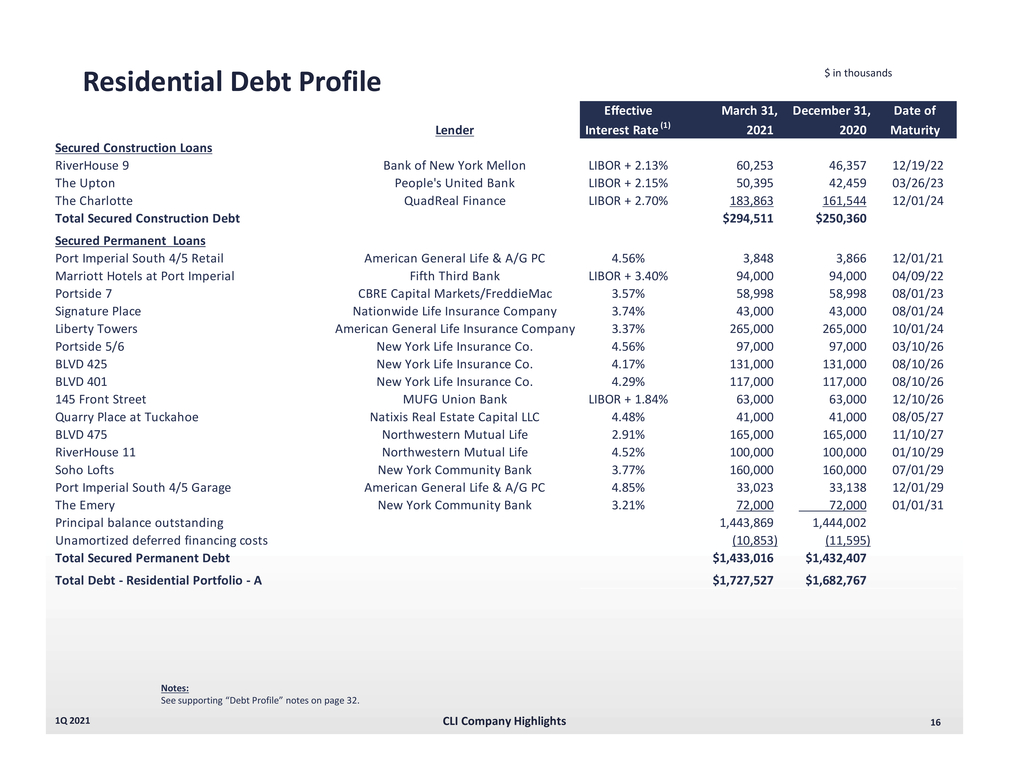

Residential Debt Profile $ in thousands Total Debt - Residential Portfolio - A$1,727,527$1,682,767 1Q 2021 Notes: See supporting “Debt Profile” notes on page 32. CLI Company Highlights16 |

|

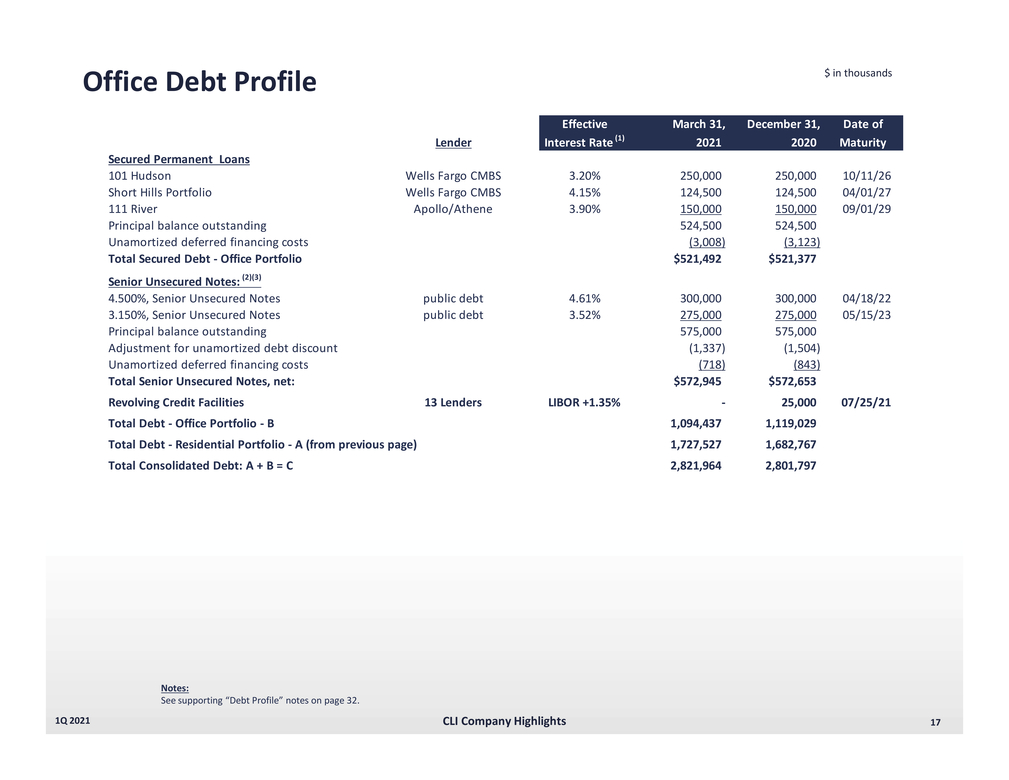

Lender Effective Interest Rate (1) March 31, 2021 December 31, 2020 Date of Maturity Secured Permanent Loans 101 HudsonWells Fargo CMBS 3.20% 250,000 250,000 10/11/26 Short Hills PortfolioWells Fargo CMBS 4.15% 124,500 124,500 04/01/27 111 RiverApollo/Athene 3.90% 150,000 150,000 09/01/29 Principal balance outstanding 524,500 524,500 Unamortized deferred financing costs (3,008) (3,123) Total Secured Debt - Office Portfolio $521,492 $521,377 Senior Unsecured Notes: (2)(3) 4.500%, Senior Unsecured Notespublic debt 4.61% 300,000 300,000 04/18/22 3.150%, Senior Unsecured Notespublic debt 3.52% 275,000 275,000 05/15/23 Principal balance outstanding 575,000 575,000 Adjustment for unamortized debt discount (1,337) (1,504) Unamortized deferred financing costs (718) (843) Total Senior Unsecured Notes, net: $572,945 $572,653 Revolving Credit Facilities13 Lenders LIBOR +1.35% - 25,000 07/25/21 Total Debt - Office Portfolio - B 1,094,437 1,119,029 Total Debt - Residential Portfolio - A (from previous page) 1,727,527 1,682,767 Total Consolidated Debt: A + B = C 2,821,964 2,801,797 $ in thousands 1Q 2021 Notes: See supporting “Debt Profile” notes on page 32. CLI Company Highlights17 |

|

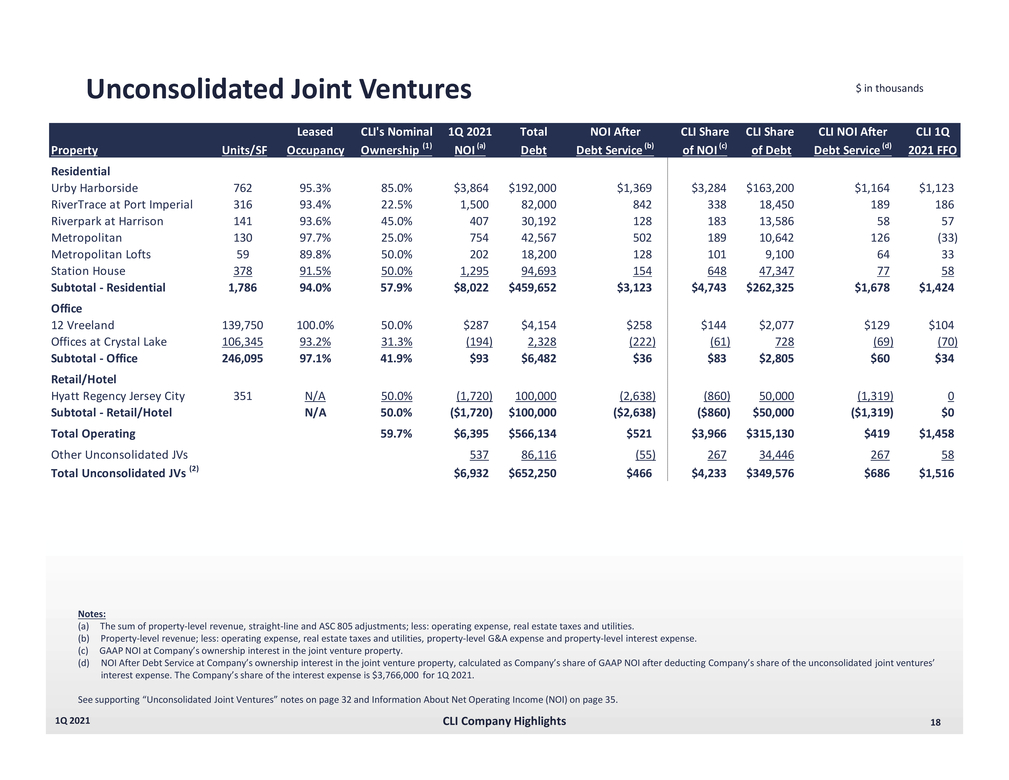

Unconsolidated Joint Ventures $ in thousands LeasedCLI's Nominal1Q 2021TotalNOI AfterCLI ShareCLI ShareCLI NOI AfterCLI 1Q Notes: The sum of property-level revenue, straight-line and ASC 805 adjustments; less: operating expense, real estate taxes and utilities. Property-level revenue; less: operating expense, real estate taxes and utilities, property-level G&A expense and property-level interest expense. GAAP NOI at Company’s ownership interest in the joint venture property. NOI After Debt Service at Company’s ownership interest in the joint venture property, calculated as Company’s share of GAAP NOI after deducting Company’s share of the unconsolidated joint ventures’ interest expense. The Company’s share of the interest expense is $3,766,000 for 1Q 2021. See supporting “Unconsolidated Joint Ventures” notes on page 32 and Information About Net Operating Income (NOI) on page 35. 1Q 2021 CLI Company Highlights18 |

|

Transaction Activity $ in thousands (incl. per unit values) except per SF Office Portfolio 1Q 2021 Dis pos itions Number ofPercentageGross AssetPrice PerWeighted Average LocationTransaction Date BuildingsSFLeasedValue (1)SFCap Rate 100 Overlook CenterPrinceton, NJ01/14/211149,60094.0%$38,000$254 Metropark portfolioEdison & Iselin, NJ03/24/214926,65691.2%254,000274 Total 1Q 2021 Dispositions51,076,25691.6%$292,000$2717.2% 2Q21 Dispositions to Date (2) Short Hills portfolioShort Hills, NJ04/20/214828,41382.0%255,000$308 Total 2Q 2021 Dispositions to Date4828,41382.0%$255,000$3088.5% See supporting “Transaction Activity” notes on page 33. 1Q 2021 CLI Company Highlights19 |

|

20 Multifamily Portfolio |

|

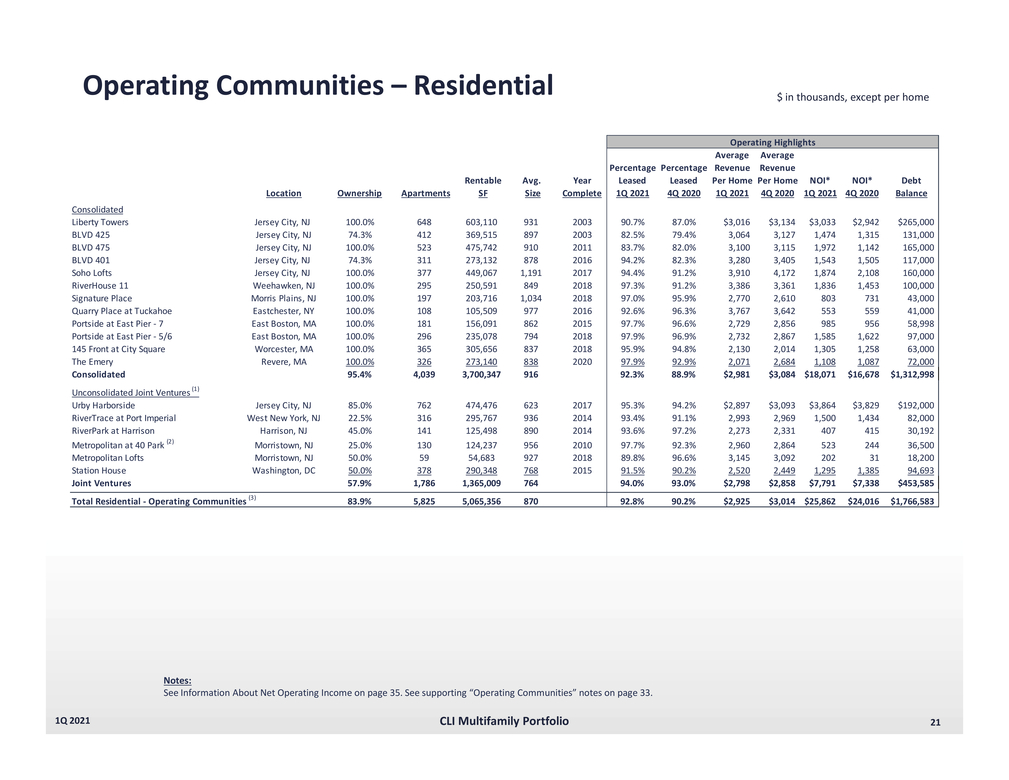

Operating Communities – Residential $ in thousands, except per home Notes: See Information About Net Operating Income on page 35. See supporting “Operating Communities” notes on page 33. |

|

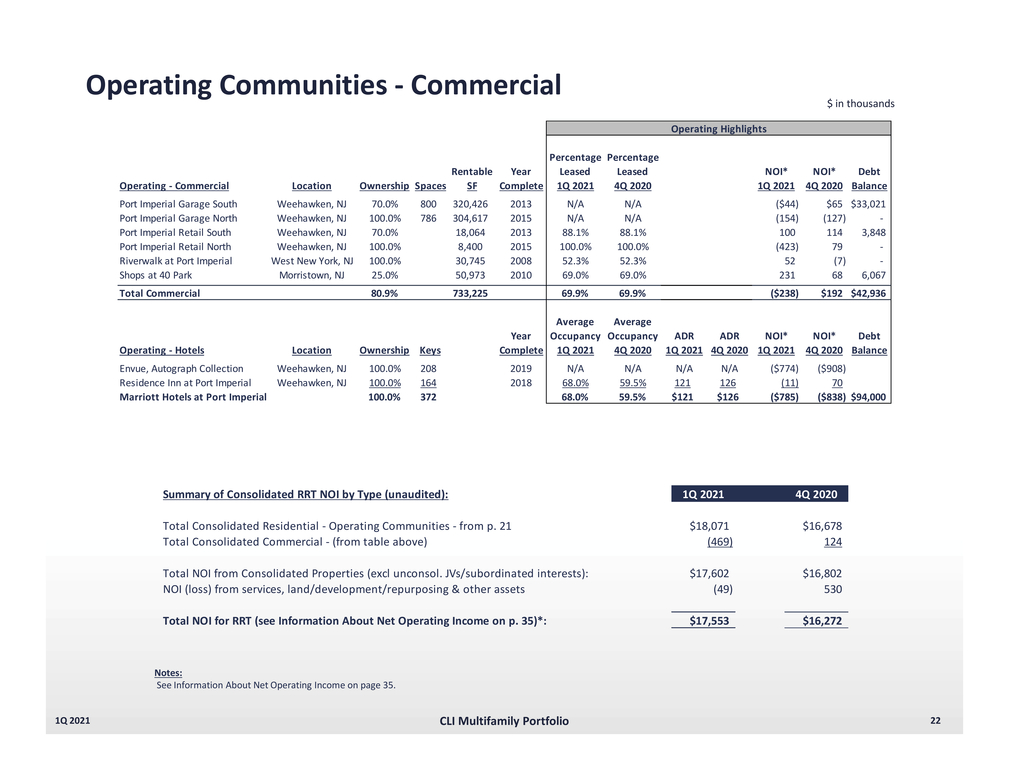

Operating Communities - Commercial $ in thousands Notes: See Information About Net Operating Income on page 35. |

|

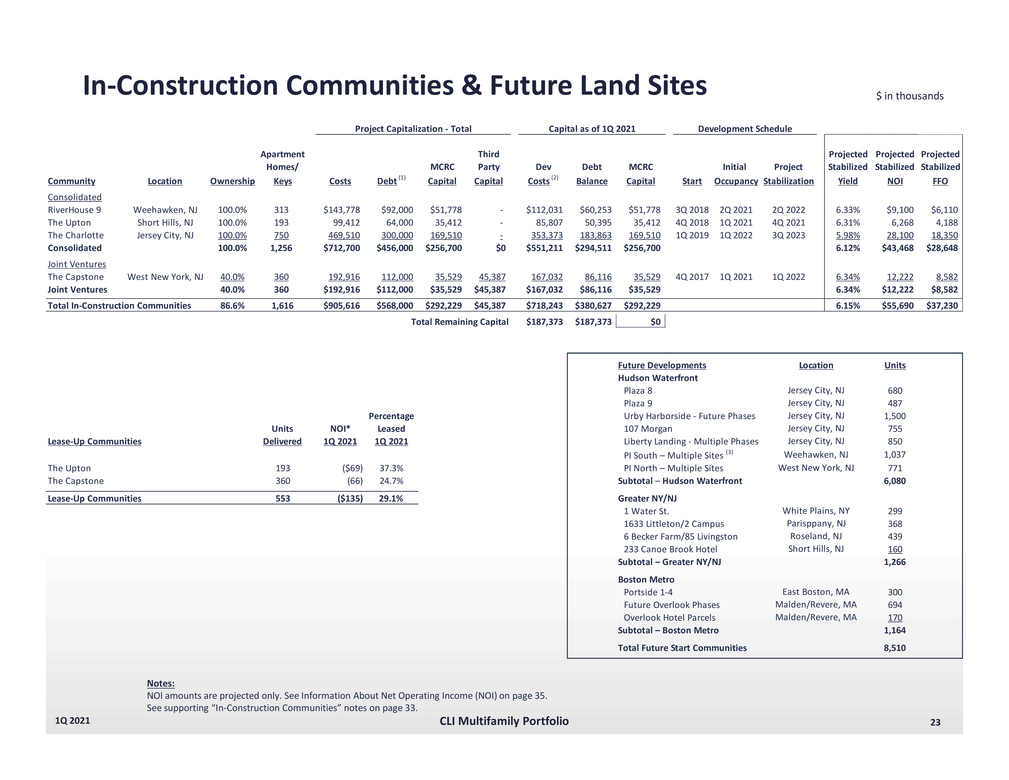

In-Construction Communities & Future Land Sites $ in thousands Project Capitalization - TotalCapital as of 1Q 2021Development Schedule Total Remaining Capital$187,373 $187,373$0 Notes: NOI amounts are projected only. See Information About Net Operating Income (NOI) on page 35. See supporting “In-Construction Communities” notes on page 33. |

|

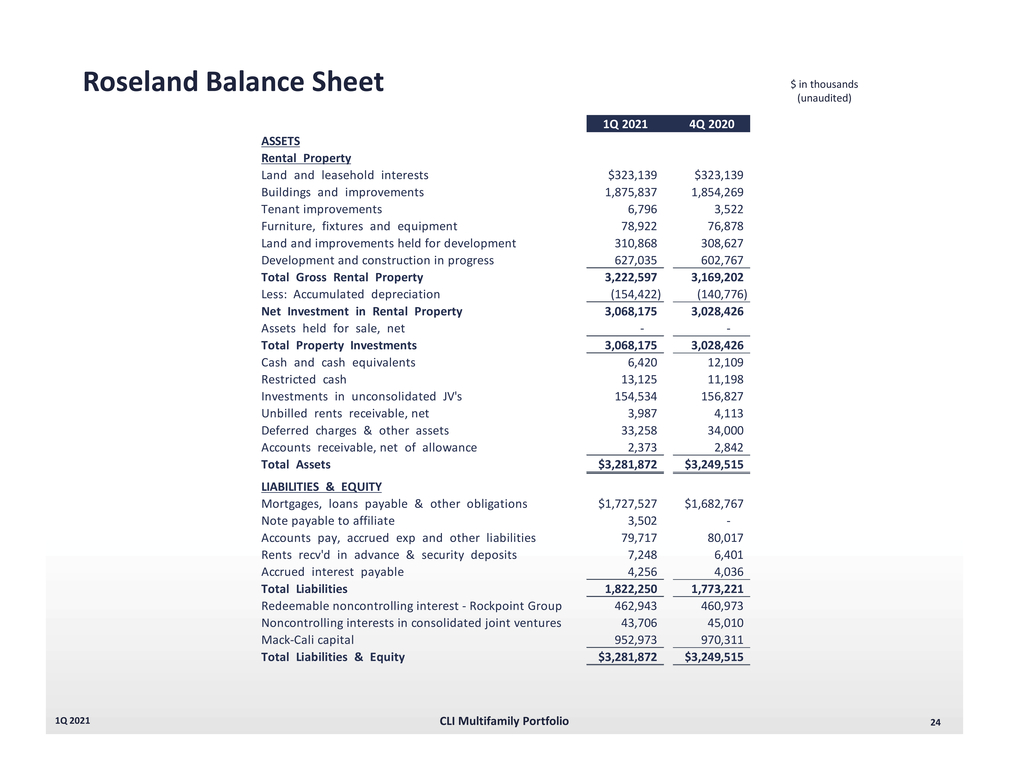

ance Sheet $ in thousands (unaudited) 1Q 2021 4Q 2020 ASSETS Rental Property Land and leasehold interests $323,139 $323,139 Buildings and improvements 1,875,837 1,854,269 Tenant improvements 6,796 3,522 Furniture, fixtures and equipment 78,922 76,878 Land and improvements held for development 310,868 308,627 Development and construction in progress 627,035 602,767 Total Gross Rental Property 3,222,597 3,169,202 Less: Accumulated depreciation (154,422) (140,776) Net Investment in Rental Property 3,068,175 3,028,426 Assets held for sale, net - - Total Property Investments 3,068,175 3,028,426 Cash and cash equivalents 6,420 12,109 Restricted cash 13,125 11,198 Investments in unconsolidated JV's 154,534 156,827 Unbilled rents receivable, net 3,987 4,113 Deferred charges & other assets 33,258 34,000 Accounts receivable, net of allowance 2,373 2,842 Total Assets $3,281,872 $3,249,515 LIABILITIES & EQUITY Mortgages, loans payable & other obligations $1,727,527 $1,682,767 Note payable to affiliate 3,502 - Accounts pay, accrued exp and other liabilities 79,717 80,017 Rents recv'd in advance & security deposits 7,248 6,401 Accrued interest payable 4,256 4,036 Total Liabilities 1,822,250 1,773,221 Redeemable noncontrolling interest - Rockpoint Group 462,943 460,973 Noncontrolling interests in consolidated joint ventures 43,706 45,010 Mack-Cali capital 952,973 970,311 Total Liabilities & Equity $3,281,872 $3,249,515 |

|

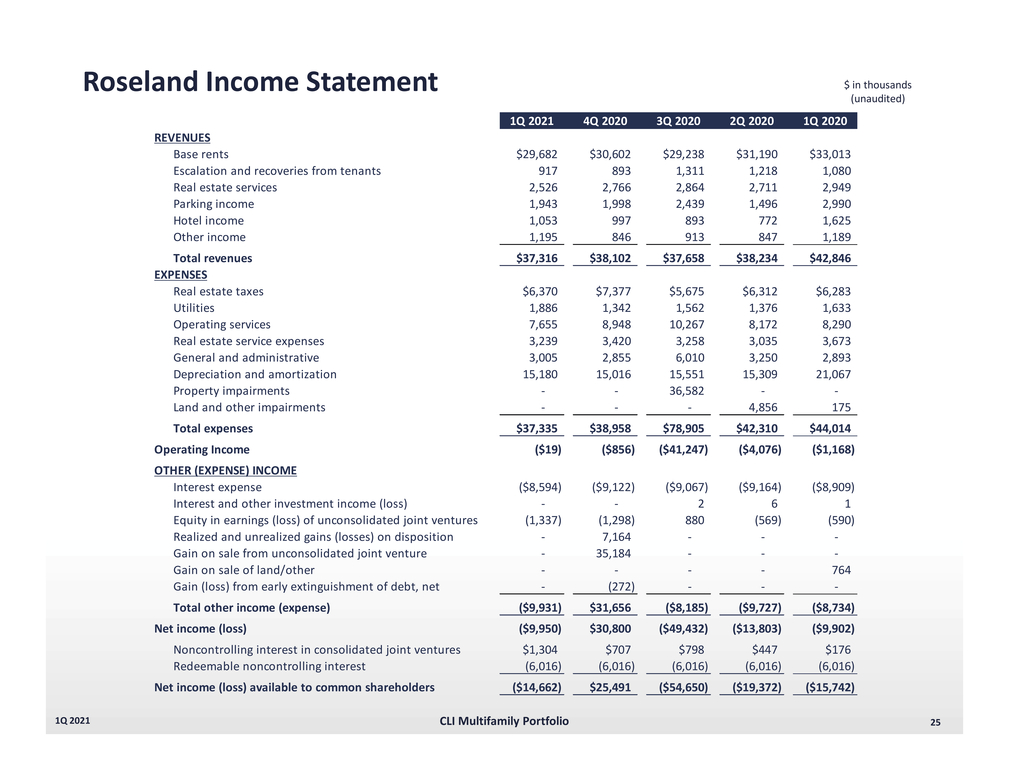

EXPENSES Roseland Income Statement $ in thousands (unaudited) 1Q 2021 4Q 2020 3Q 2020 2Q 2020 1Q 2020 REVENUES Base rents $29,682 $30,602 $29,238 $31,190 $33,013 Escalation and recoveries from tenants 917 893 1,311 1,218 1,080 Real estate services 2,526 2,766 2,864 2,711 2,949 Parking income 1,943 1,998 2,439 1,496 2,990 Hotel income 1,053 997 893 772 1,625 Other income 1,195 846 913 847 1,189 Total revenues $37,316 $38,102 $37,658 $38,234 $42,846 Real estate taxes $6,370 $7,377 $5,675 $6,312 $6,283 Utilities 1,886 1,342 1,562 1,376 1,633 Operating services 7,655 8,948 10,267 8,172 8,290 Real estate service expenses 3,239 3,420 3,258 3,035 3,673 General and administrative 3,005 2,855 6,010 3,250 2,893 Depreciation and amortization 15,180 15,016 15,551 15,309 21,067 Property impairments - - 36,582 - - Land and other impairments - - - 4,856 175 Total expenses $37,335 $38,958 $78,905 $42,310 $44,014 Operating Income ($19) ($856) ($41,247) ($4,076) ($1,168) OTHER (EXPENSE) INCOME Interest expense ($8,594) ($9,122) ($9,067) ($9,164) ($8,909) Interest and other investment income (loss) - - 2 6 1 Equity in earnings (loss) of unconsolidated joint ventures (1,337) (1,298) 880 (569) (590) Realized and unrealized gains (losses) on disposition -7,164 ---Gain on sale from unconsolidated joint venture Gain on sale of land/other Gain (loss) from early extinguishment of debt, net -35,184 ---(272) -----764 ---Total other income (expense) ($9,931)$31,656 ($8,185)($9,727)($8,734) Net income (loss) ($9,950)$30,800 ($49,432)($13,803)($9,902) Noncontrolling interest in consolidated joint ventures $1,304$707 $798$447$176 Redeemable noncontrolling interest (6,016)(6,016) (6,016)(6,016)(6,016) Net income (loss) available to common shareholders ($14,662)$25,491 ($54,650) ($19,372) ($15,742) CLI Multifamily Portfolio 25 |

|

26 Office Portfolio 1Q 2021 26 |

|

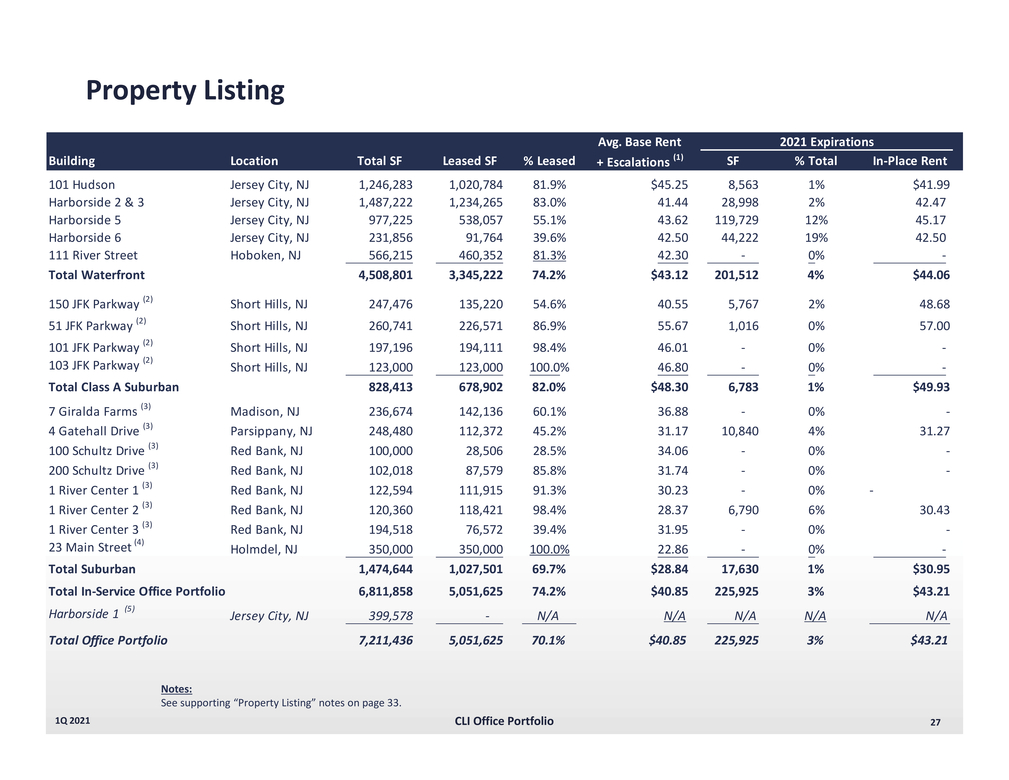

Property Listing Avg. Base Rent 2021 Expirations Notes: See supporting “Property Listing” notes on page 33. 1Q 2021CLI Office Portfolio27 |

|

Leasing Rollforwards & Activity Leasing Rollforwards For the three months ended March 31, 2021 Leasing Activity For the three months ended March 31, 2021 Notes: Inclusive of escalations. 1Q 2021CLI Office Portfolio28 |

|

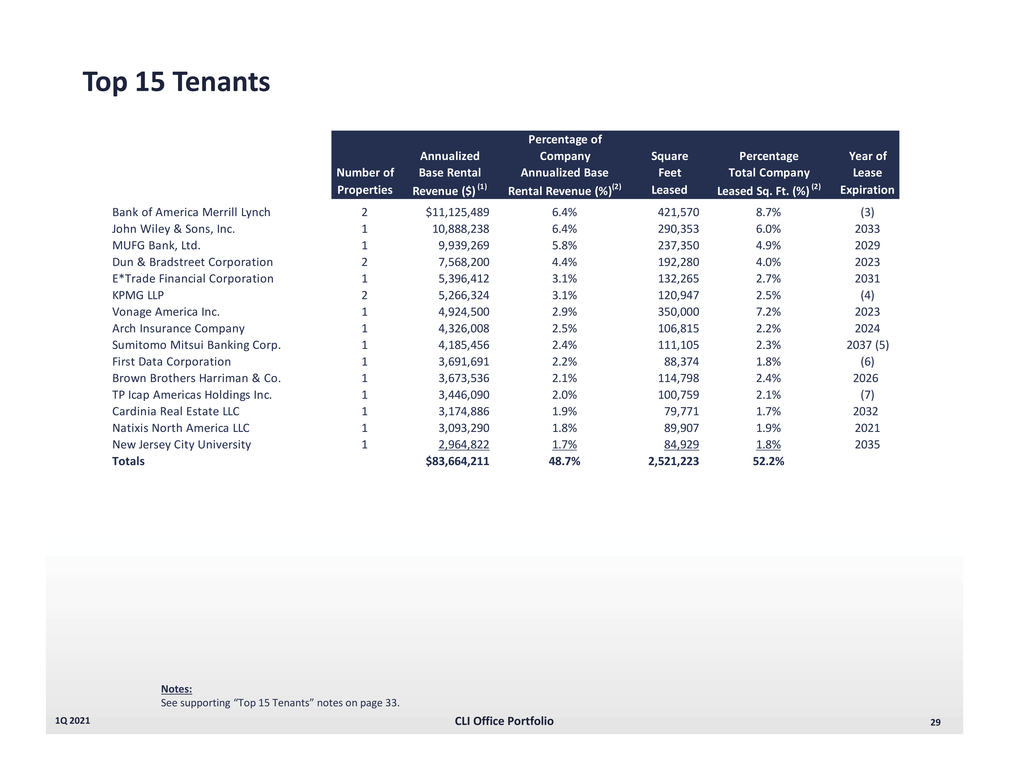

Number of Annualized Base Rental Percentage of Company Annualized Base Square Feet Percentage Total Company Year of Lease Properties Revenue ($) (1) Rental Revenue (%)(2) Leased Leased Sq. Ft. (%) (2) Expiration Bank of America Merrill Lynch 2 $11,125,489 6.4% 421,570 8.7% (3) John Wiley & Sons, Inc. 1 10,888,238 6.4% 290,353 6.0% 2033 MUFG Bank, Ltd. 1 9,939,269 5.8% 237,350 4.9% 2029 Dun & Bradstreet Corporation 2 7,568,200 4.4% 192,280 4.0% 2023 E*Trade Financial Corporation 1 5,396,412 3.1% 132,265 2.7% 2031 KPMG LLP 2 5,266,324 3.1% 120,947 2.5% (4) Vonage America Inc. 1 4,924,500 2.9% 350,000 7.2% 2023 Arch Insurance Company 1 4,326,008 2.5% 106,815 2.2% 2024 Sumitomo Mitsui Banking Corp. 1 4,185,456 2.4% 111,105 2.3% 2037 (5) First Data Corporation 1 3,691,691 2.2% 88,374 1.8% (6) Brown Brothers Harriman & Co. 1 3,673,536 2.1% 114,798 2.4% 2026 TP Icap Americas Holdings Inc. 1 3,446,090 2.0% 100,759 2.1% (7) Cardinia Real Estate LLC 1 3,174,886 1.9% 79,771 1.7% 2032 Natixis North America LLC 1 3,093,290 1.8% 89,907 1.9% 2021 New Jersey City University 1 2,964,822 1.7% 84,929 1.8% 2035 Totals $83,664,211 48.7% 2,521,223 52.2% 1Q 2021 Notes: See supporting “Top 15 Tenants” notes on page 33. CLI Office Portfolio29 |

|

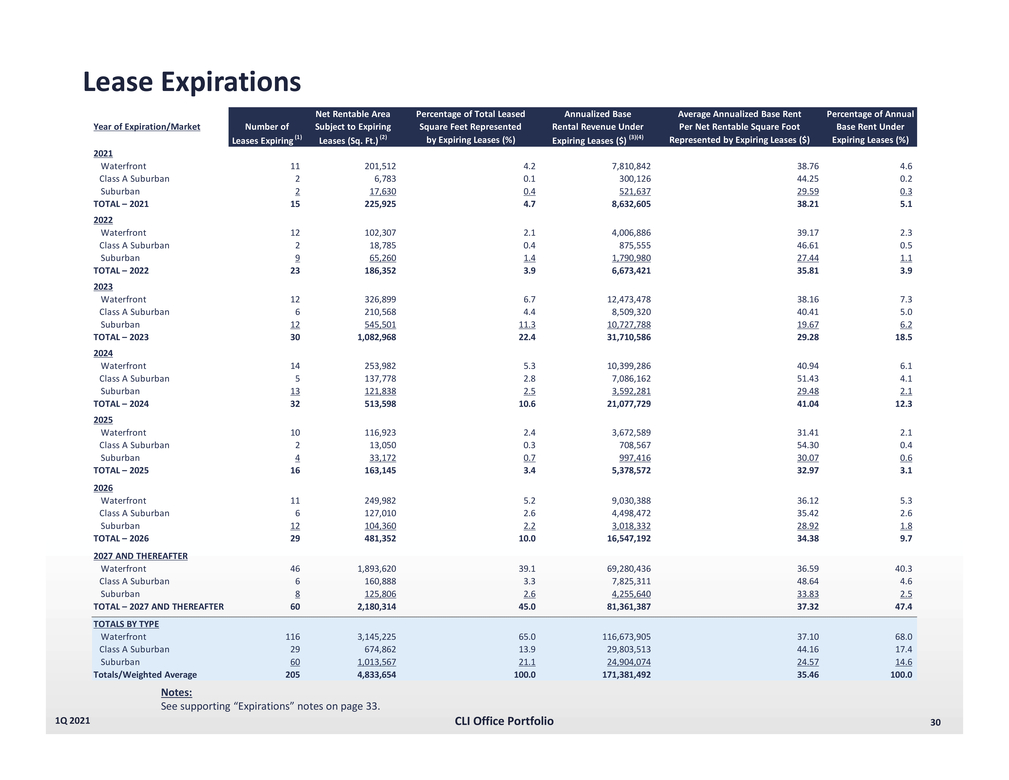

Lease Expirations 1Q 2021 Notes: See supporting “Expirations” notes on page 33. CLI Office Portfolio 30 |

|

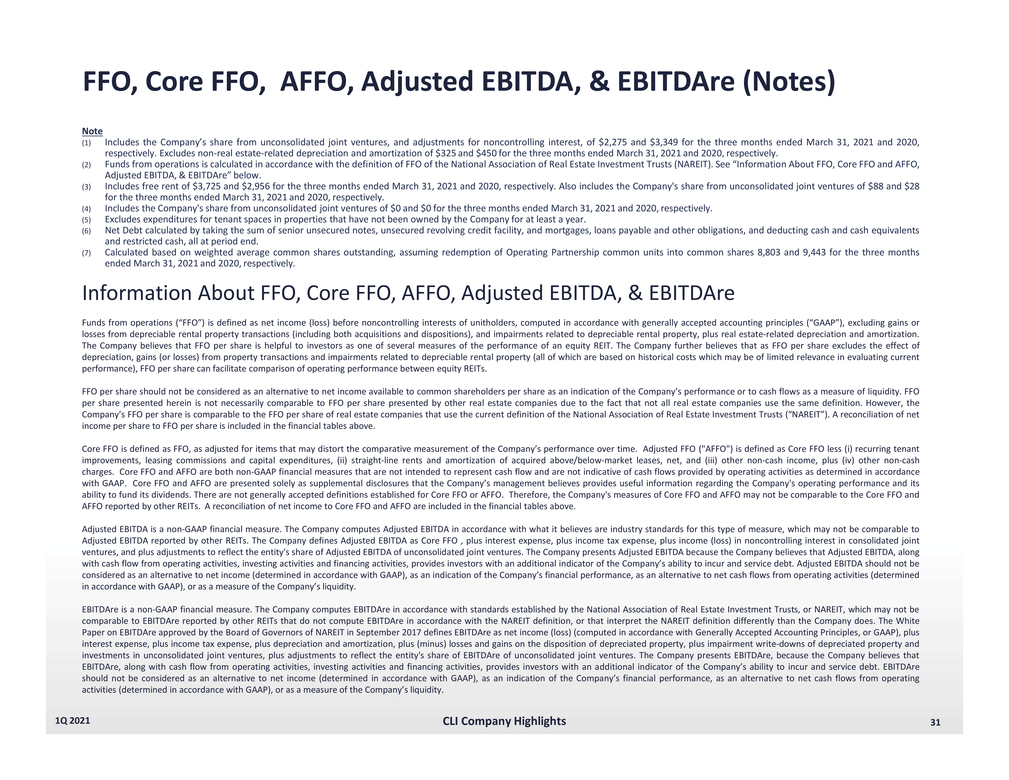

FFO, Core FFO,AFFO, Adjusted EBITDA, & EBITDAre (Notes) Note Includes the Company’s share from unconsolidated joint ventures, and adjustments for noncontrolling interest, of $2,275 and $3,349 for the three months ended March 31, 2021 and 2020, respectively. Excludes non-real estate-related depreciation and amortization of $325 and $450 for the three months ended March 31, 2021 and 2020, respectively. Funds from operations is calculated in accordance with the definition of FFO of the National Association of Real Estate Investment Trusts (NAREIT). See “Information About FFO, Core FFO and AFFO, Adjusted EBITDA, & EBITDAre” below. Includes free rent of $3,725 and $2,956 for the three months ended March 31, 2021 and 2020, respectively. Also includes the Company's share from unconsolidated joint ventures of $88 and $28 for the three months ended March 31, 2021 and 2020, respectively. Includes the Company's share from unconsolidated joint ventures of $0 and $0 for the three months ended March 31, 2021 and 2020, respectively. Excludes expenditures for tenant spaces in properties that have not been owned by the Company for at least a year. Net Debt calculated by taking the sum of senior unsecured notes, unsecured revolving credit facility, and mortgages, loans payable and other obligations, and deducting cash and cash equivalents and restricted cash, all at period end. Calculated based on weighted average common shares outstanding, assuming redemption of Operating Partnership common units into common shares 8,803 and 9,443 for the three months ended March 31, 2021 and 2020, respectively. Information About FFO, Core FFO, AFFO, Adjusted EBITDA, & EBITDAre Funds from operations (“FFO”) is defined as net income (loss) before noncontrolling interests of unitholders, computed in accordance with generally accepted accounting principles (“GAAP”), excluding gains or losses from depreciable rental property transactions (including both acquisitions and dispositions), and impairments related to depreciable rental property, plus real estate-related depreciation and amortization. The Company believes that FFO per share is helpful to investors as one of several measures of the performance of an equity REIT. The Company further believes that as FFO per share excludes the effect of depreciation, gains (or losses) from property transactions and impairments related to depreciable rental property (all of which are based on historical costs which may be of limited relevance in evaluating current performance), FFO per share can facilitate comparison of operating performance between equity REITs. FFO per share should not be considered as an alternative to net income available to common shareholders per share as an indication of the Company’s performance or to cash flows as a measure of liquidity. FFO per share presented herein is not necessarily comparable to FFO per share presented by other real estate companies due to the fact that not all real estate companies use the same definition. However, the Company’s FFO per share is comparable to the FFO per share of real estate companies that use the current definition of the National Association of Real Estate Investment Trusts (“NAREIT”). A reconciliation of net income per share to FFO per share is included in the financial tables above. Core FFO is defined as FFO, as adjusted for items that may distort the comparative measurement of the Company’s performance over time. Adjusted FFO ("AFFO") is defined as Core FFO less (i) recurring tenant improvements, leasing commissions and capital expenditures, (ii) straight-line rents and amortization of acquired above/below-market leases, net, and (iii) other non-cash income, plus (iv) other non-cash charges. Core FFO and AFFO are both non-GAAP financial measures that are not intended to represent cash flow and are not indicative of cash flows provided by operating activities as determined in accordance with GAAP. Core FFO and AFFO are presented solely as supplemental disclosures that the Company’s management believes provides useful information regarding the Company's operating performance and its ability to fund its dividends. There are not generally accepted definitions established for Core FFO or AFFO. Therefore, the Company's measures of Core FFO and AFFO may not be comparable to the Core FFO and AFFO reported by other REITs. A reconciliation of net income to Core FFO and AFFO are included in the financial tables above. Adjusted EBITDA is a non-GAAP financial measure. The Company computes Adjusted EBITDA in accordance with what it believes are industry standards for this type of measure, which may not be comparable to Adjusted EBITDA reported by other REITs. The Company defines Adjusted EBITDA as Core FFO , plus interest expense, plus income tax expense, plus income (loss) in noncontrolling interest in consolidated joint ventures, and plus adjustments to reflect the entity's share of Adjusted EBITDA of unconsolidated joint ventures. The Company presents Adjusted EBITDA because the Company believes that Adjusted EBITDA, along with cash flow from operating activities, investing activities and financing activities, provides investors with an additional indicator of the Company’s ability to incur and service debt. Adjusted EBITDA should not be considered as an alternative to net income (determined in accordance with GAAP), as an indication of the Company’s financial performance, as an alternative to net cash flows from operating activities (determined in accordance with GAAP), or as a measure of the Company’s liquidity. EBITDAre is a non-GAAP financial measure. The Company computes EBITDAre in accordance with standards established by the National Association of Real Estate Investment Trusts, or NAREIT, which may not be comparable to EBITDAre reported by other REITs that do not compute EBITDAre in accordance with the NAREIT definition, or that interpret the NAREIT definition differently than the Company does. The White Paper on EBITDAre approved by the Board of Governors of NAREIT in September 2017 defines EBITDAre as net income (loss) (computed in accordance with Generally Accepted Accounting Principles, or GAAP), plus interest expense, plus income tax expense, plus depreciation and amortization, plus (minus) losses and gains on the disposition of depreciated property, plus impairment write-downs of depreciated property and investments in unconsolidated joint ventures, plus adjustments to reflect the entity's share of EBITDAre of unconsolidated joint ventures. The Company presents EBITDAre, because the Company believes that EBITDAre, along with cash flow from operating activities, investing activities and financing activities, provides investors with an additional indicator of the Company’s ability to incur and service debt. EBITDAre should not be considered as an alternative to net income (determined in accordance with GAAP), as an indication of the Company’s financial performance, as an alternative to net cash flows from operating activities (determined in accordance with GAAP), or as a measure of the Company’s liquidity. 1Q 2021 CLI Company Highlights 31 |

|

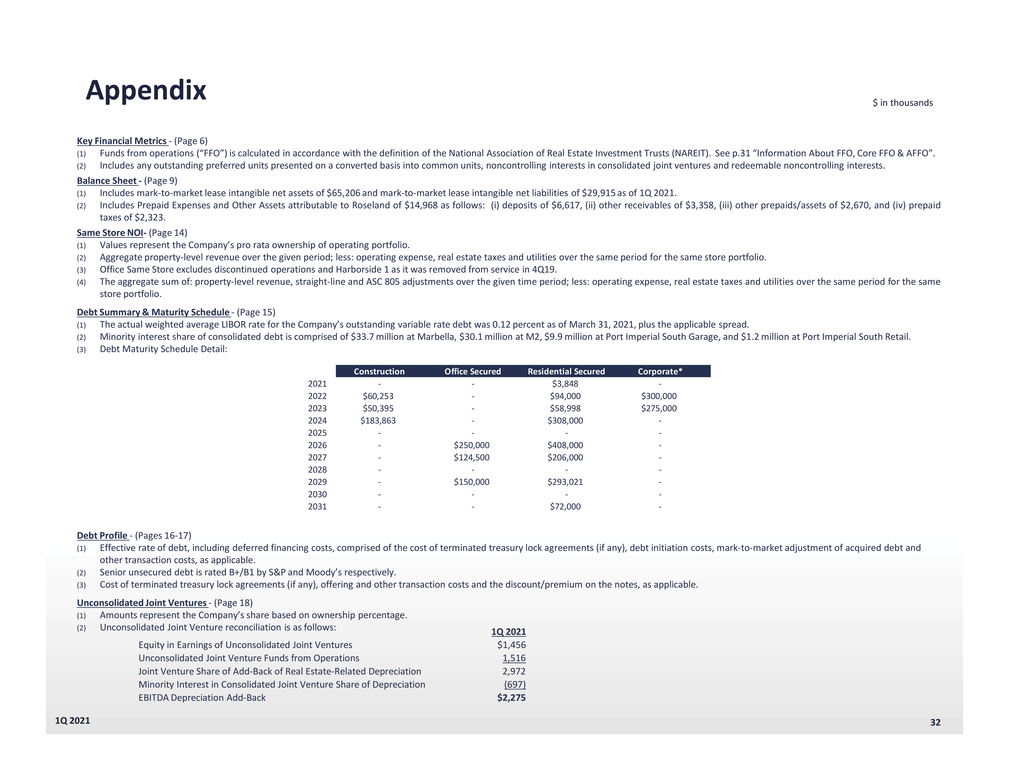

Appendix $ in thousands Key Financial Metrics - (Page 6) Funds from operations (“FFO”) is calculated in accordance with the definition of the National Association of Real Estate Investment Trusts (NAREIT). See p.31 “Information About FFO, Core FFO & AFFO”. Includes any outstanding preferred units presented on a converted basis into common units, noncontrolling interests in consolidated joint ventures and redeemable noncontrolling interests. Balance Sheet - (Page 9) Includes mark-to-market lease intangible net assets of $65,206 and mark-to-market lease intangible net liabilities of $29,915 as of 1Q 2021. Includes Prepaid Expenses and Other Assets attributable to Roseland of $14,968 as follows: (i) deposits of $6,617, (ii) other receivables of $3,358, (iii) other prepaids/assets of $2,670, and (iv) prepaid taxes of $2,323. Same Store NOI-(Page 14) Values represent the Company’s pro rata ownership of operating portfolio. Aggregate property-level revenue over the given period; less: operating expense, real estate taxes and utilities over the same period for the same store portfolio. Office Same Store excludes discontinued operations and Harborside 1 as it was removed from service in 4Q19. The aggregate sum of: property-level revenue, straight-line and ASC 805 adjustments over the given time period; less: operating expense, real estate taxes and utilities over the same period for the same store portfolio. Debt Summary & Maturity Schedule - (Page 15) The actual weighted average LIBOR rate for the Company’s outstanding variable rate debt was 0.12 percent as of March 31, 2021, plus the applicable spread. Minority interest share of consolidated debt is comprised of $33.7 million at Marbella, $30.1 million at M2, $9.9 million at Port Imperial South Garage, and $1.2 million at Port Imperial South Retail. Debt Maturity Schedule Detail: Debt Profile - (Pages 16-17) Effective rate of debt, including deferred financing costs, comprised of the cost of terminated treasury lock agreements (if any), debt initiation costs, mark-to-market adjustment of acquired debt and other transaction costs, as applicable. Senior unsecured debt is rated B+/B1 by S&P and Moody’s respectively. Cost of terminated treasury lock agreements (if any), offering and other transaction costs and the discount/premium on the notes, as applicable. Unconsolidated Joint Ventures - (Page 18) Amounts represent the Company’s share based on ownership percentage. Unconsolidated Joint Venture reconciliation is as follows: 1Q 2021 Equity in Earnings of Unconsolidated Joint Ventures$1,456 Unconsolidated Joint Venture Funds from Operations1,516 Joint Venture Share of Add-Back of Real Estate-Related Depreciation2,972 Minority Interest in Consolidated Joint Venture Share of Depreciation(697) EBITDA Depreciation Add-Back$2,275 1Q 2021 32 |

|

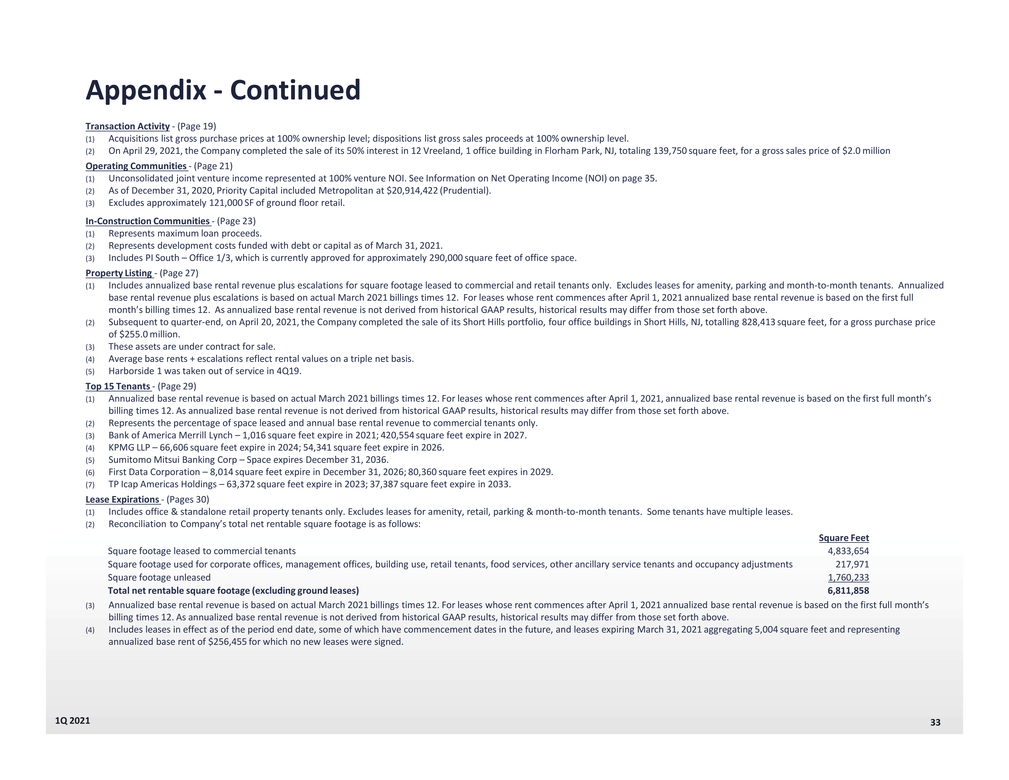

Appendix - Continued Transaction Activity - (Page 19) Acquisitions list gross purchase prices at 100% ownership level; dispositions list gross sales proceeds at 100% ownership level. On April 29, 2021, the Company completed the sale of its 50% interest in 12 Vreeland, 1 office building in Florham Park, NJ, totaling 139,750 square feet, for a gross sales price of $2.0 million Operating Communities - (Page 21) Unconsolidated joint venture income represented at 100% venture NOI. See Information on Net Operating Income (NOI) on page 35. As of December 31, 2020, Priority Capital included Metropolitan at $20,914,422 (Prudential). Excludes approximately 121,000 SF of ground floor retail. In-Construction Communities - (Page 23) Represents maximum loan proceeds. Represents development costs funded with debt or capital as of March 31, 2021. Includes PI South – Office 1/3, which is currently approved for approximately 290,000 square feet of office space. Property Listing - (Page 27) Includes annualized base rental revenue plus escalations for square footage leased to commercial and retail tenants only. Excludes leases for amenity, parking and month-to-month tenants. Annualized base rental revenue plus escalations is based on actual March 2021 billings times 12. For leases whose rent commences after April 1, 2021 annualized base rental revenue is based on the first full month’s billing times 12. As annualized base rental revenue is not derived from historical GAAP results, historical results may differ from those set forth above. Subsequent to quarter-end, on April 20, 2021, the Company completed the sale of its Short Hills portfolio, four office buildings in Short Hills, NJ, totalling 828,413 square feet, for a gross purchase price of $255.0 million. These assets are under contract for sale. Average base rents + escalations reflect rental values on a triple net basis. Harborside 1 was taken out of service in 4Q19. Top 15 Tenants - (Page 29) Annualized base rental revenue is based on actual March 2021 billings times 12. For leases whose rent commences after April 1, 2021, annualized base rental revenue is based on the first full month’s billing times 12. As annualized base rental revenue is not derived from historical GAAP results, historical results may differ from those set forth above. Represents the percentage of space leased and annual base rental revenue to commercial tenants only. Bank of America Merrill Lynch – 1,016 square feet expire in 2021; 420,554 square feet expire in 2027. KPMG LLP – 66,606 square feet expire in 2024; 54,341 square feet expire in 2026. Sumitomo Mitsui Banking Corp – Space expires December 31, 2036. First Data Corporation – 8,014 square feet expire in December 31, 2026; 80,360 square feet expires in 2029. TP Icap Americas Holdings – 63,372 square feet expire in 2023; 37,387 square feet expire in 2033. (1) Includes office & standalone retail property tenants only. Excludes leases for amenity, retail, parking & month-to-month tenants. Some tenants have multiple leases. (2) Reconciliation to Company’s total net rentable square footage is as follows: Square footage leased to commercial tenants Square Feet 4,833,654 Square footage used for corporate offices, management offices, building use, retail tenants, food services, other ancillary service tenants and occupancy adjustments 217,971 Square footage unleased 1,760,233 Total net rentable square footage (excluding ground leases) 6,811,858 Annualized base rental revenue is based on actual March 2021 billings times 12. For leases whose rent commences after April 1, 2021 annualized base rental revenue is based on the first full month’s billing times 12. As annualized base rental revenue is not derived from historical GAAP results, historical results may differ from those set forth above. Includes leases in effect as of the period end date, some of which have commencement dates in the future, and leases expiring March 31, 2021 aggregating 5,004 square feet and representing annualized base rent of $256,455 for which no new leases were signed. 1Q 2021 33 |

|

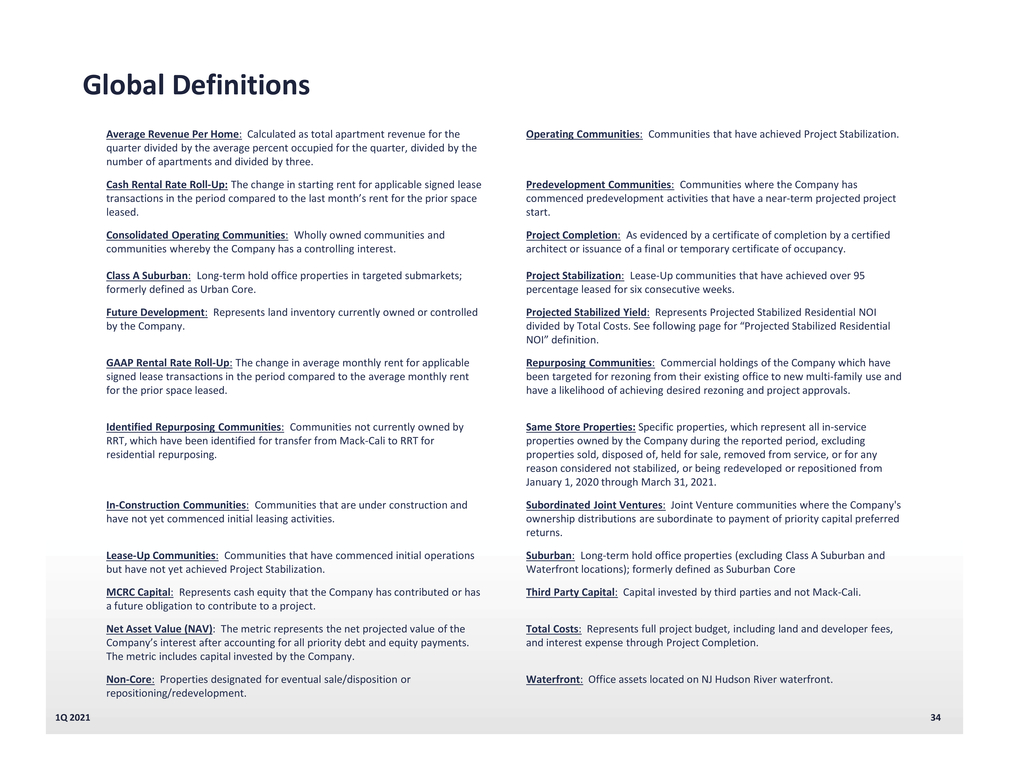

Global Definitions Average Revenue Per Home: Calculated as total apartment revenue for the quarter divided by the average percent occupied for the quarter, divided by the number of apartments and divided by three. Cash Rental Rate Roll-Up: The change in starting rent for applicable signed lease transactions in the period compared to the last month’s rent for the prior space leased. Operating Communities: Communities that have achieved Project Stabilization. Predevelopment Communities: Communities where the Company has commenced predevelopment activities that have a near-term projected project start. Consolidated Operating Communities: Wholly owned communities and communities whereby the Company has a controlling interest. Project Completion: As evidenced by a certificate of completion by a certified architect or issuance of a final or temporary certificate of occupancy. Class A Suburban: Long-term hold office properties in targeted submarkets; formerly defined as Urban Core. Project Stabilization: Lease-Up communities that have achieved over 95 percentage leased for six consecutive weeks. Future Development: Represents land inventory currently owned or controlled by the Company. GAAP Rental Rate Roll-Up: The change in average monthly rent for applicable signed lease transactions in the period compared to the average monthly rent for the prior space leased. Projected Stabilized Yield: Represents Projected Stabilized Residential NOI divided by Total Costs. See following page for “Projected Stabilized Residential NOI” definition. Repurposing Communities: Commercial holdings of the Company which have been targeted for rezoning from their existing office to new multi-family use and have a likelihood of achieving desired rezoning and project approvals. Identified Repurposing Communities: Communities not currently owned by RRT, which have been identified for transfer from Mack-Cali to RRT for residential repurposing. Same Store Properties: Specific properties, which represent all in-service properties owned by the Company during the reported period, excluding properties sold, disposed of, held for sale, removed from service, or for any reason considered not stabilized, or being redeveloped or repositioned from January 1, 2020 through March 31, 2021. In-Construction Communities: Communities that are under construction and have not yet commenced initial leasing activities. Subordinated Joint Ventures: Joint Venture communities where the Company's ownership distributions are subordinate to payment of priority capital preferred returns. Lease-Up Communities: Communities that have commenced initial operations but have not yet achieved Project Stabilization. MCRC Capital: Represents cash equity that the Company has contributed or has a future obligation to contribute to a project. Suburban: Long-term hold office properties (excluding Class A Suburban and Waterfront locations); formerly defined as Suburban Core Third Party Capital: Capital invested by third parties and not Mack-Cali. Net Asset Value (NAV): The metric represents the net projected value of the Company’s interest after accounting for all priority debt and equity payments. The metric includes capital invested by the Company. Non-Core: Properties designated for eventual sale/disposition or repositioning/redevelopment. Total Costs: Represents full project budget, including land and developer fees, and interest expense through Project Completion. Waterfront: Office assets located on NJ Hudson River waterfront. 1Q 2021 34 |

|

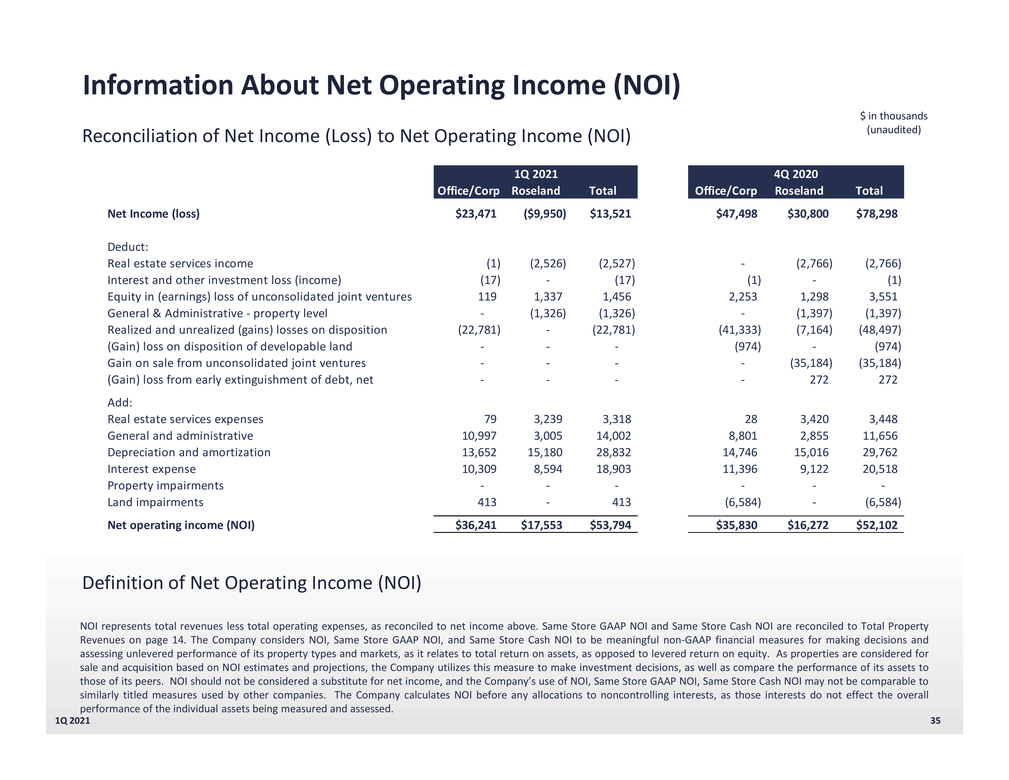

Information About Net Operating Income (NOI) Reconciliation of Net Income (Loss) to Net Operating Income (NOI) $ in thousands (unaudited) Definition of Net Operating Income (NOI) NOI represents total revenues less total operating expenses, as reconciled to net income above. Same Store GAAP NOI and Same Store Cash NOI are reconciled to Total Property Revenues on page 14. The Company considers NOI, Same Store GAAP NOI, and Same Store Cash NOI to be meaningful non-GAAP financial measures for making decisions and assessing unlevered performance of its property types and markets, as it relates to total return on assets, as opposed to levered return on equity. As properties are considered for sale and acquisition based on NOI estimates and projections, the Company utilizes this measure to make investment decisions, as well as compare the performance of its assets to those of its peers. NOI should not be considered a substitute for net income, and the Company’s use of NOI, Same Store GAAP NOI, Same Store Cash NOI may not be comparable to similarly titled measures used by other companies. The Company calculates NOI before any allocations to noncontrolling interests, as those interests do not effect the overall performance of the individual assets being measured and assessed. 1Q 2021 35 |

|

Company Information, Executive Officers, & Analysts Any opinions, estimates, forecasts or predictions regarding Mack-Cali Realty Corporation's performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Mack-Cali Realty Corporation or its management. Mack-Cali does not by its reference above or distribution imply its endorsement of or concurrence with such opinions, estimates, forecasts or predictions. 1Q 2021 36 |

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS The Company considers portions of this information, including the documents incorporated by reference, to be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of such act. Such forward-looking statements relate to, without limitation, our future economic performance, plans and objectives for future operations and projections of revenue and other financial items. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “potential,” “projected,” “should,” “expect,” “anticipate,” “estimate,” “target”, “continue” or comparable terminology. Forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions at the time made, the Company can give no assurance that such expectations will be achieved. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements. Among the factors about which the Company has made assumptions are: -risks and uncertainties affecting the general economic climate and conditions, which in turn may have a negative effect on the fundamentals of the Company’s business and the financial condition of the Company’s tenants and residents; -the value of the Company’s real estate assets, which may limit the Company’s ability to dispose of assets at attractive prices or obtain or maintain debt financing secured by our properties or on an unsecured basis; -the extent of any tenant bankruptcies or of any early lease terminations; -The Company’s ability to lease or re-lease space at current or anticipated rents; -changes in the supply of and demand for the Company’s properties; -changes in interest rate levels and volatility in the securities markets; -The Company’s ability to complete construction and development activities on time and within budget, including without limitation obtaining regulatory permits and the availability and cost of materials, labor and equipment; -forward-looking financial and operational information, including information relating to future development projects, potential acquisitions or dispositions, leasing activities, capitalization rates and projected revenue and income; -changes in operating costs; -The Company’s ability to obtain adequate insurance, including coverage for terrorist acts; -The Company’s credit worthiness and the availability of financing on attractive terms or at all, which may adversely impact our ability to pursue acquisition and development opportunities and refinance existing debt and the Company’s future interest expense; -changes in governmental regulation, tax rates and similar matters; and -other risks associated with the development and acquisition of properties, including risks that the development may not be completed on schedule, that the tenants or residents will not take occupancy or pay rent, or that development or operating costs may be greater than anticipated. In addition, the extent to which the ongoing COVID-19 pandemic impacts us and our tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. For further information on factors which could impact us and the statements contained herein, see Item 1A: Risk Factors in MCRC’s Annual Report on Form 10-K for the year ended December 31, 2020. We assume no obligation to update and supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise. This Supplemental Operating and Financial Data is not an offer to sell or solicitation to buy any securities of the Mack-Cali Reality Corporation (“MCRC”). Any offers to sell or solicitations of the MCRC shall be made by means of a prospectus. The information in this Supplemental Package must be read in conjunction with, and is modified in its entirety by, the Quarterly Report on Form 10-Q (the “10-Q”) filed by the MCRC for the same period with the Securities and Exchange Commission (the “SEC”) and all of the MCRC’s other public filings with the SEC (the “Public Filings”). In particular, the financial information contained herein is subject to and qualified by reference to the financial statements contained in the 10-Q, the footnotes thereto and the limitations set forth therein. Investors may not rely on the Supplemental Package without reference to the 10-Q and the Public Filings. Any investors’ receipt of, or access to, the information contained herein is subject to this qualification. 1Q 2021 37 |