Exhibit 99.1

Citi 2020 Global Property CEO Conference March 2020

This Operating and Financial Data should be read in connection with our Annual Report on Form 10-K for the year ended December 31, 2019. Statements made in this presentation may be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “potential,” “projected,” “should,” “expect,” “anticipate,” “estimate,” “target,” “continue” or comparable terminology. Forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate, and involve factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Disclosure Regarding Forward-Looking Statements” and “Risk Factors” in our annual reports on Form 10-K, as may be supplemented or amended by our quarterly reports on Form 10-Q, which are incorporated herein by reference. We assume no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise. 2

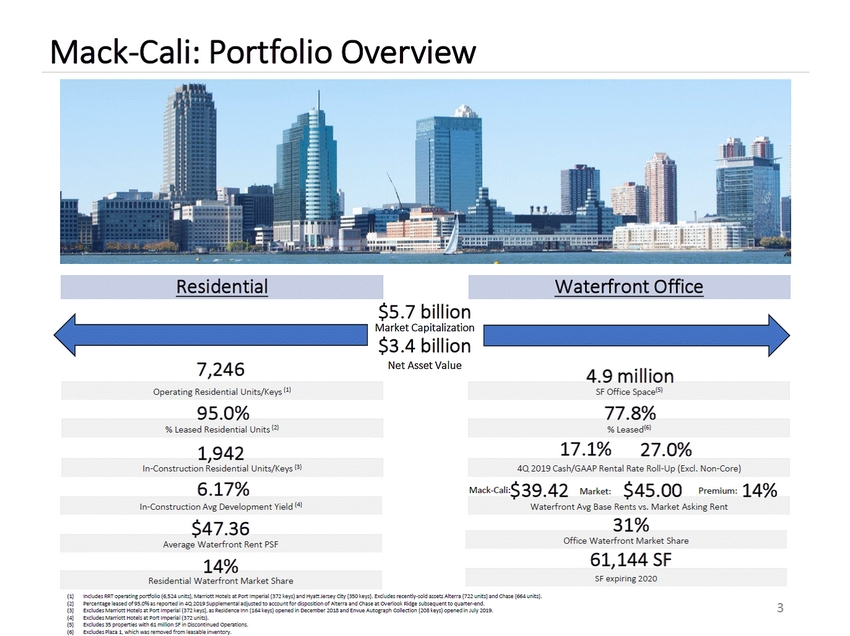

Mack-Cali: Portfolio Overview $5.7 billion Market Capitalization $3.4 billion Net Asset Value 7,246 4.9 million 95.0% 77.8% 17.1%27.0% 1,942 6.17% Mack-Cali:$39.42 $45.00 Premium: 14% Market: 31% $47.36 61,144 SF 14% (1) (2) (3) (4) (5) (6) Includes RRT operating portfolio (6,524 units), Marriott Hotels at Port Imperial (372 keys) and Hyatt Jersey City (350 keys). Excludes recently-sold assets Alterra (722 units) and Chase (664 units). Percentage leased of 95.0% as reported in 4Q 2019 Supplemental adjusted to account for disposition of Alterra and Chase at Ov erlook Ridge subsequent to quarter-end. Excludes Marriott Hotels at Port Imperial (372 keys), as Residence Inn (164 keys) opened in December 2018 and Envue Autograph Collection (208 keys) opened in July 2019. Excludes Marriott Hotels at Port Imperial (372 units). Excludes 35 properties with 61 million SF in Discontinued Operations. Excludes Plaza 1, which was removed from leasable inventory. 3 Residential Waterfront Market Share SF expiring 2020 Average Waterfront Rent PSF Office Waterfront Market Share In-Construction Avg Development Yield (4) Waterfront Avg Base Rents vs. Market Asking Rent In-Construction Residential Units/Keys (3) 4Q 2019 Cash/GAAP Rental Rate Roll-Up (Excl. Non-Core) % Leased Residential Units (2) % Leased(6) Operating Residential Units/Keys (1) SF Office Space(5) Waterfront Office Residential

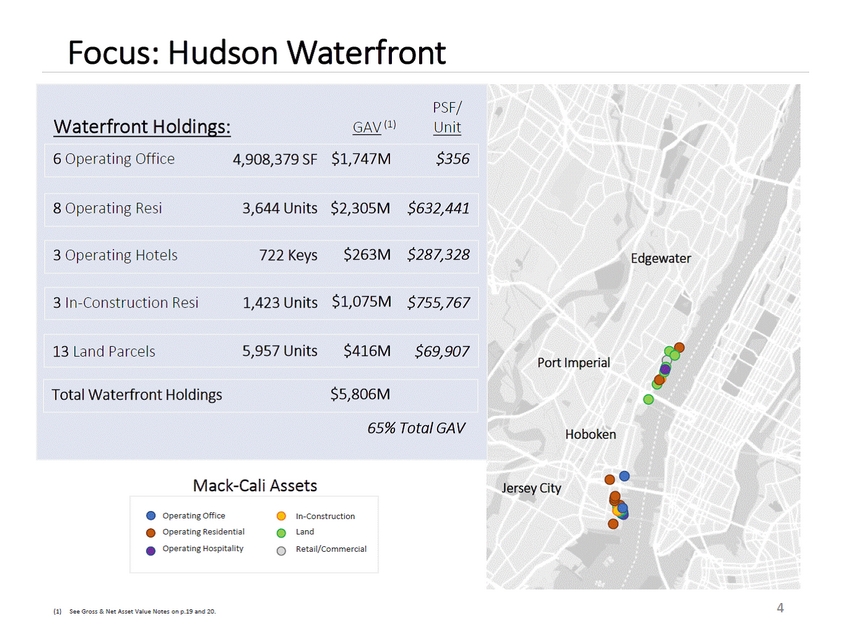

Focus: Hudson Waterfront Edgewater Port Imperial Hoboken Mack-Cali Assets Jersey City 4 (1) See Gross & Net Asset Value Notes on p.19 and 20. Operating OfficeIn-Construction Operating ResidentialLand Operating HospitalityRetail/Commercial PSF/ Waterfront Holdings: GAV (1) Unit 65% Total GAV Total Waterfront Holdings$5,806M 13 Land Parcels5,957 Units$416M$69,907 3 In-Construction Resi1,423 Units$1,075M$755,767 3 Operating Hotels722 Keys$263M$287,328 8 Operating Resi3,644 Units$2,305M$632,441 6 Operating Office4,908,379 SF$1,747M$356

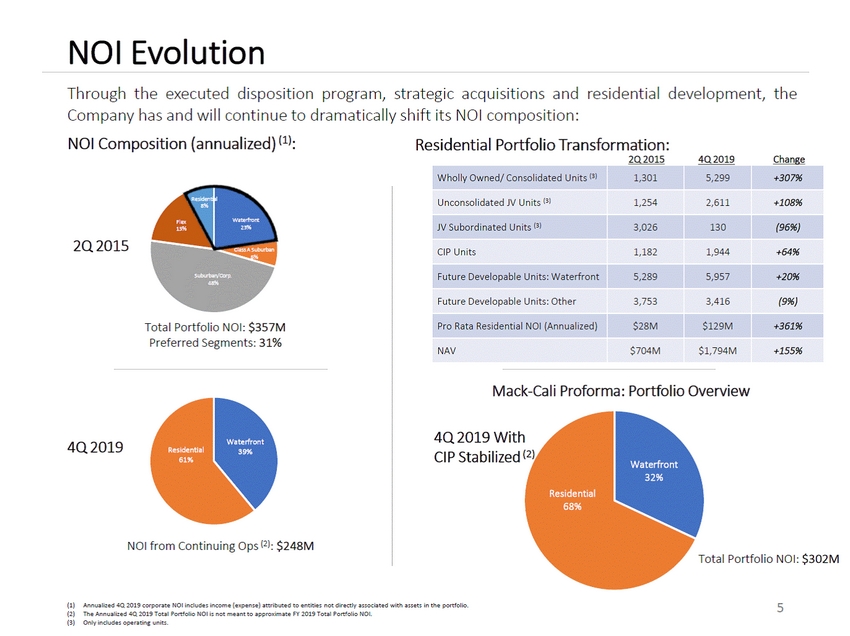

NOI Evolution Through the executed disposition program, strategic acquisitions and residential development, Company has and will continue to dramatically shift its NOI composition: the NOI Composition (annualized) (1): Residential Portfolio Transformation: 2Q 2015 4Q 2019 Change Residenti l 8% Waterfront 23% Flex 15 2Q 2015 Class A Suburban 6% Suburban/Corp. 48% Total Portfolio NOI: $357M Preferred Segments: 31% Mack-Cali Proforma: Portfolio Overview 4Q 2019 With CIP Stabilized (2) Waterf nt 39% 4Q 2019 Residential 61% Waterfront 32% Residential 68% NOI from Continuing Ops (2): $248M Total Portfolio NOI: $302M (1) (2) (3) Annualized 4Q 2019 corporate NOI includes income (expense) attributed to entities not directly associated with assets in the portfolio. The Annualized 4Q 2019 Total Portfolio NOI is not meant to approximate FY 2019 Total Portfolio NOI. Only includes operating units. 5 Wholly Owned/ Consolidated Units (3) 1,301 5,299 +307% Unconsolidated JV Units (3) 1,254 2,611 +108% JV Subordinated Units (3) 3,026 130 (96%) CIP Units 1,182 1,944 +64% Future Developable Units: Waterfront 5,289 5,957 +20% Future Developable Units: Other 3,753 3,416 (9%) Pro Rata Residential NOI (Annualized) $28M $129M +361% NAV $704M $1,794M +155%

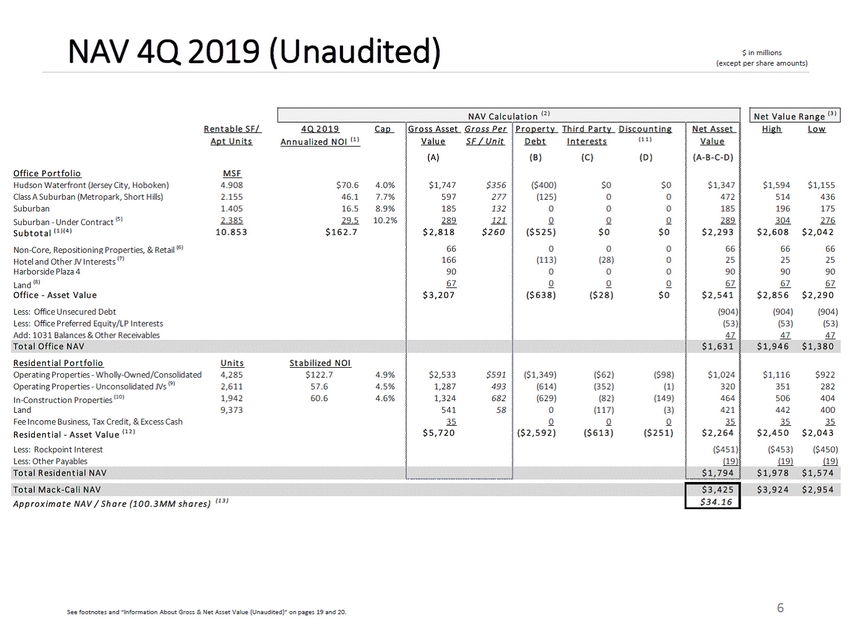

NAV 4Q 2019 (Unaudited) $ in millions (except per share amounts) 6 See footnotes and “Information About Gross & Net Asset Value (Unaudited)” on pages 19 and 20. N A V C a lc u la t io n ( 2 ) H i g h L o w $1,594 $1,155 514 436 196 175 304 276 $ 2 , 6 0 8 $ 2 , 0 4 2 66 66 25 25 90 90 67 67 $ 2 , 8 5 6 $ 2 , 2 9 0 (904) (904) (53) (53) 47 47 R e n t a b l e S F / 4 Q 2 0 1 9 C a p A p t U n i t s A n n u a l i z e d N O I ( 1 ) O f f i c e P o r t f o l i o M S F Hudson Waterfront (Jersey City, Hoboken) 4.908 $70.6 4.0% Class A Suburban (Metropark, Short Hills) 2.155 46.1 7.7% Suburban 1.405 16.5 8.9% Suburban - Under Contract (5 ) 2.385 29.5 10.2% S u b t o t a l ( 1 ) ( 4 ) 1 0 . 8 5 3 $ 1 6 2 . 7 Non-Core, Repositioning Properties, & Retail (6 ) Hotel and Other JV Interests (7 ) Harborside Plaza 4 Land (8 ) O f f ic e - A s s et V a lu e Less: Office Unsecured Debt Less: Office Preferred Equity/LP Interests Add: 1031 Balances & Other Receivables G r o s s A s s e t G r o s s P e r V a l u e S F / U n i t ( A ) $1,747 $356 597 277 185 132 289 121 $ 2 , 8 1 8$260 66 166 90 67 $ 3 , 2 0 7 P r o p e r t y T h i r d P a r t y D i s c o u n t i n g D e b t I n t er es t s ( 1 1 ) ( B ) ( C ) ( D ) ($400) $0 $0 (125) 0 0 0 0 0 0 0 0 ( $ 5 2 5 )$0$0 0 0 0 (113) (28) 0 0 0 0 0 0 0 ( $ 6 3 8 )( $ 2 8 )$0 N e t A s s e t V a l u e ( A - B - C - D ) $1,347 472 185 289 $ 2 , 2 9 3 66 25 90 67 $ 2 , 5 4 1 (904) (53) 47 T o t a l O f f ic e N A V $ 1 , 6 3 1 $ 1 , 9 4 6 $ 1 , 3 8 0 R e s i d e n t i a l P o r t f o l i o U n i t s S t a b i l i z e d N O I Operating Properties - Wholly-Owned/Consolidated 4,285 $122.7 4.9% Operating Properties - Unconsolidated JVs (9 ) 2,611 57.6 4.5% In-Construction Properties (1 0 ) 1,942 60.6 4.6% Land 9,373 Fee Income Business, Tax Credit, & Excess Cash R es id en t ia l - A s s et V a lu e ( 1 2 ) Less: Rockpoint Interest Less: Other Payables $2,533 $591 1,287 493 1,324 682 541 58 35 $ 5 , 7 2 0 ($1,349) ($62) ($98) (614) (352) (1) (629) (82) (149) 0 (117) (3) 0 0 0 ( $ 2 , 5 9 2 ) ( $ 6 1 3 ) ( $ 2 5 1 ) $1,024 320 464 421 35 $ 2 , 2 6 4 ($451) (19) $1,116 $922 351 282 506 404 442 400 35 35 $ 2 , 4 5 0 $ 2 , 0 4 3 ($453) ($450) (19) (19) T o t a l R es id en t ia l N A V $ 1 , 7 9 4 $ 1 , 9 7 8 $ 1 , 5 7 4 T o t a l M a c k - C a li N A V $ 3 , 4 2 5 $ 3 , 9 2 4 $ 2 , 9 5 4 A p p r o x im a t e N A V / S h a r e ( 1 0 0 . 3 M M s h a r e s ) ( 1 3 ) $ 3 4 . 1 6 N et V a lu e R a n g e ( 3 )

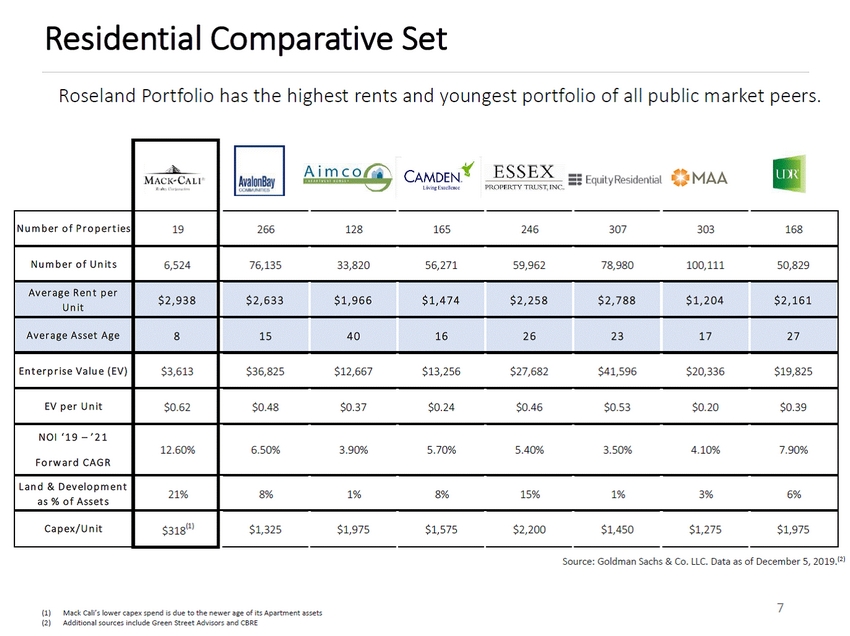

Residential Comparative Set Roseland Portfolio has the highest rents and youngest portfolio of all public market peers. Source: Goldman Sachs & Co. LLC. Data as of December 5, 2019.(2) 7 (1)Mack Cali’s lower capex spend is due to the newer age of its Apartment assets (2)Additional sources include Green Street Advisors and CBRE N u m b er o f P r o p er t ies 19 266 128 165 246 307 303 168 N u m b er o f U n it s 6,524 76,13533,82056,27159,96278,980100,11150,829 A v er a g e R en t p er U n it $ 2 , 9 3 8 $ 2 , 6 3 3 $ 1 , 9 6 6 $ 1 , 4 7 4 $ 2 , 2 5 8 $ 2 , 7 8 8 $ 1 , 2 0 4 $ 2 , 1 6 1 A v er a g e A s s et A g e 8 15 40 16 26 23 17 27 En t er p r is e V a lu e ( EV ) $3,613 $36,825 $12,667 $13,256 $27,682 $41,596 $20,336 $19,825 EV p er U n it $0.62 $0.48 $0.37 $0.24 $0.46 $0.53 $0.20 $0.39 N O I ‘ 1 9 – ’ 2 1 F o r w a r d C A G R 12.60% 6.50% 3.90% 5.70% 5.40% 3.50% 4.10% 7.90% L a n d & D ev elo p m en t a s % o f A s s et s 21% 8% 1% 8% 15% 1% 3% 6% C a p ex / U n it $318(1) $1,325 $1,975 $1,575 $2,200 $1,450 $1,275 $1,975

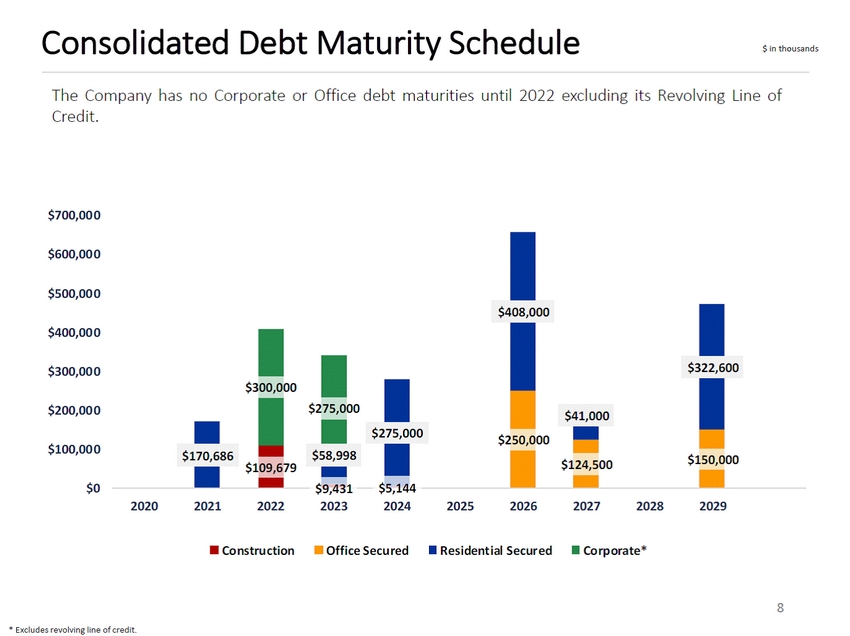

Consolidated Debt Maturity Schedule $ in thousands The Company Credit. has no Corporate or Office debt maturities until 2022 excluding its Revolving Line of $700,00 0 $600,00 0 $500,00 0 $400,00 0 $300,00 0 $300,000 $275,000 $200,00 0 $250,000 $100,00 0 $109,679 $0 $9,431 2023 $5,144 2024 2020 2021 2022 2025 2026 2027 2028 2029 Construction Office Secured Resident ial Secur ed Corporate* 8 * Excludes revolving line of credit. $124,500 $150,000 $170,686 $58,998 $41,000 $275,000 $322,600 $408,000

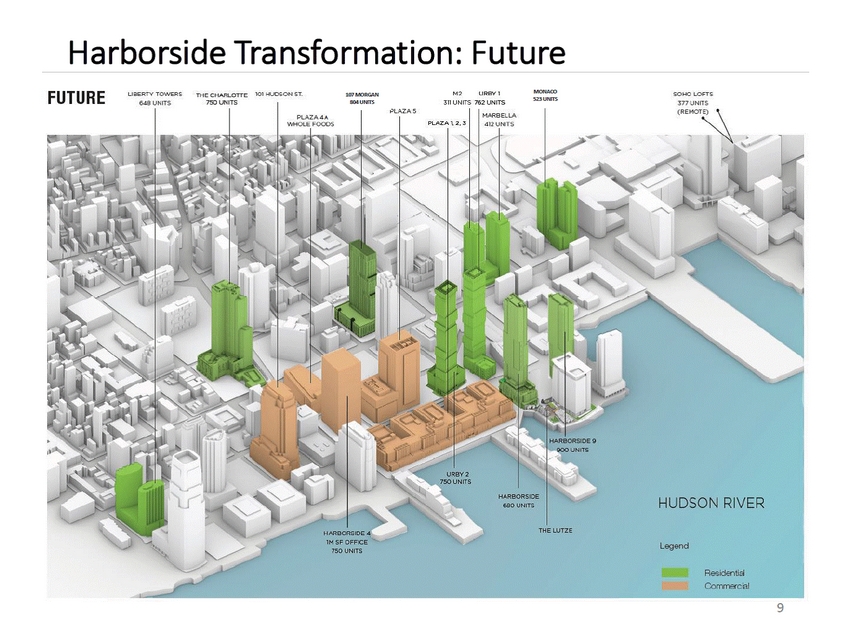

Harborside Transformation: Future MlNJI£0 S23UNlS FUTURE M2 URBY I SOHO LOFTS 377UNITS UBERTY TOWERS 648 UNITS THE CHARLOTTE 150UNITS 101 HUDSON ST. 107MlA3AN 8llUNlS lP UNITS 7152 UNITS MARSELLA 412UNITS (REMm'\ PLAZA4A WHOLE FOOOS PI.AZA \2.3 HARBORSI[); e80UNITS HUDSON RIVER THEWTZE 1M SF OFFICE 750UNITS Legend Residential Commercial 9

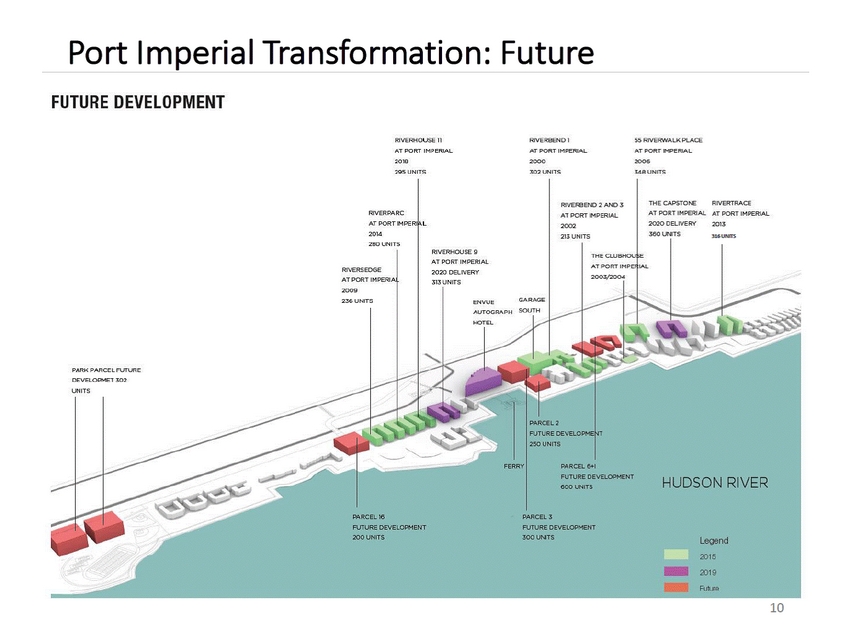

Port Imperial FUTURE DEVELOPMENT Transformation: Future RIVERHOUISE 11 AT PORT IMPERIAL 2018 295UNITS RIVERBENOl AT PORT IMPERIAL 2000 302UNITS 55 RIVERWALK PLACE AT PORT IMPERIAL 2006 348UNITS THE CAPSTONE RIVERTRACE RIVERSEND 2 AND 3 AT PORT IMPERIAL 2002 2l3UNITS RIVERPARC AT PORT IMPERIAL AT PORT IMPERIAL AT PORT IMPERI L 2020 DELIVERY 360UNITS 201-3 :U6UNITS 2014 280UNITS RIVERHOUSE 9 AT PORT IMPERIAL 2020 DELIVERY 313 UNITS THE CLUBHOU E AT PORT IMPE IAL RIVERSEDGE AT PORT IMPERIA 2009 236 UNITS 2003/2004 GARAGE ENVUE AUTOGRAPH HOTEL PARK PARCELFUTURE OEVELOPMET 302 UNITS HUDSON RIVER 600UNITS 10 2SOUNITS FERRY PARCEL 6+1 FUTURE DEVELOPMENT RO.RCEL 16 PARCEl l FUTUR E DEVELOPMENT FUTURE DEVELOPMENT 200UNITS 300UNTI S Legend 2015 2019 Future

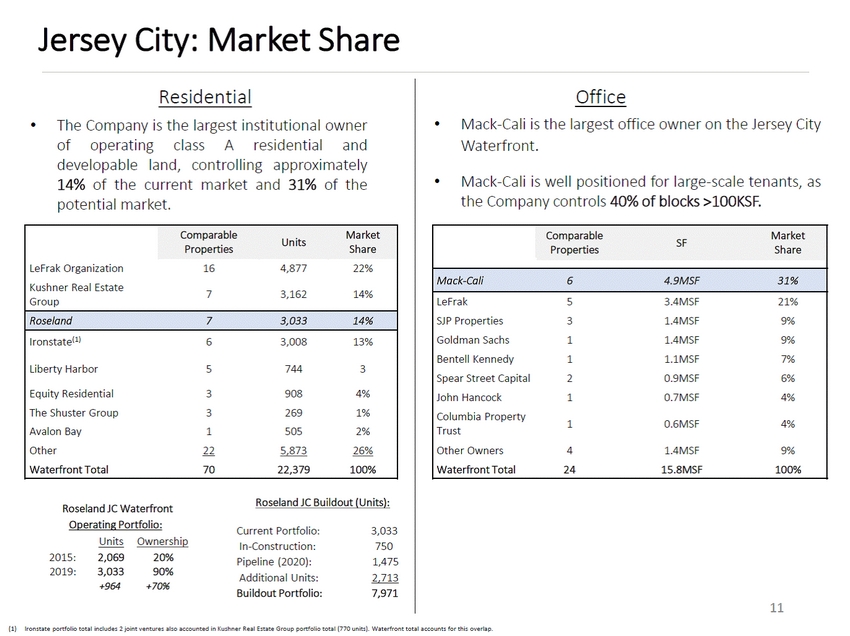

Jersey City: Market Share Residential The Company is the largest institutional owner Office Mack-Cali is the largest office owner on the Jersey City Waterfront. Mack-Cali is well positioned for large-scale tenants, as the Company controls 40% of blocks >100KSF. • • of operating class A residential and developable land, controlling approximately • 14% of the current potential market. market and 31% of the Share 7 3,162 14% Group Avalon Bay 1 505 2% Roseland JC Buildout (Units): Roseland JC Waterfront Operating Portfolio: Current Portfolio: In-Construction: Pipeline (2020): Additional Units: Buildout Portfolio: 3,033 750 1,475 2,713 7,971 Units 2,069 3,033 +964 Ownership 20% 90% +70% 2015: 2019: 11 (1) Ironstate portfolio total includes 2 joint ventures also accounted in Kushner Real Estate Group portfolio total (770 units). Waterfront total accounts for this overlap. Comparable Properties Units Market LeFrak Organization164,87722% Kushner Real Estate Roseland73,03314% Ironstate(1)63,00813% Liberty Harbor5 7443 Equity Residential39084% The Shuster Group32691% Other22 5,873 26% Waterfront Total7022,379100% Comparable Properties SF Market Share Mack-Cali64.9MSF31% LeFrak 5 3.4MSF 21% SJP Properties 3 1.4MSF 9% Goldman Sachs 1 1.4MSF 9% Bentell Kennedy 1 1.1MSF 7% Spear Street Capital 2 0.9MSF 6% John Hancock 1 0.7MSF 4% Columbia Property Trust 1 0.6MSF 4% Other Owners 4 1.4MSF 9% Waterfront Total 24 15.8MSF 100%

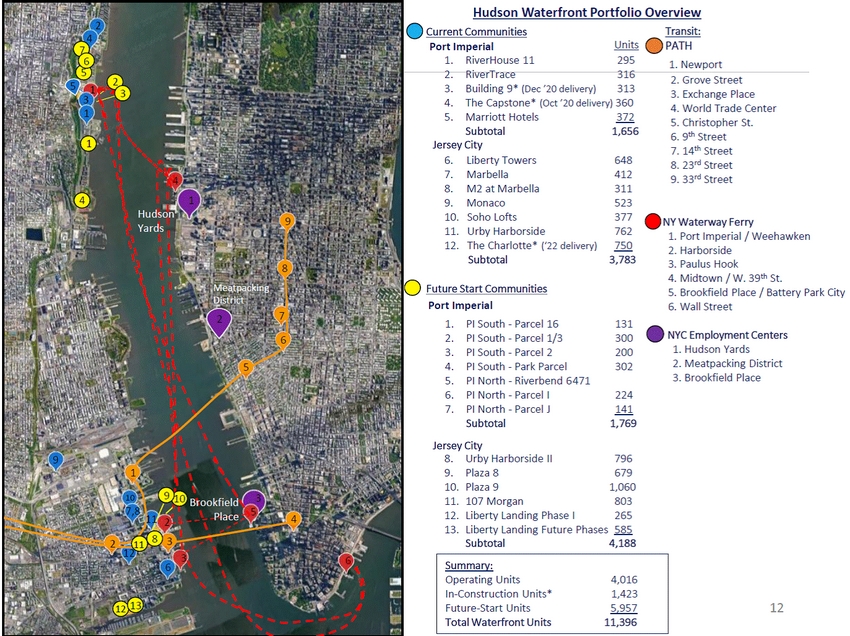

Current Communities Transit: 5 3.Building 9* (Dec ’20 delivery) 313 3. Exchange Place 5.Marriott Hotels 372 5. Christopher St. Jersey City 7. 14th Street 7.Marbella 412 9. 33rd Street 10. Soho Lofts 377 1. Port Imperial / Weehawken Subtotal 3,783 3. Paulus Hook ark City Port Imperial 6. Wall Street NYC Employment Centers 2. PI South - Parcel 1/3 300 2. Meatpacking District 4. PI South - Park Parcel 302 11. 107 Morgan 803 13. Liberty Landing Future Phases 585 12 3 6 2 4 7 6 Hudson Waterfront Portfolio Overview Port ImperialUnits PATH 1.RiverHouse 112951. Newport 52 313 1 1 4 41 Hudson9 Yards 8 Meatpacking District 27 6 5 9 1 109 10 Brookfield3 7,8 11 254 211 8 3 6 12 13 2.RiverTrace3162. Grove Street 4.The Capstone* (Oct ’20 delivery) 3604. World Trade Center Subtotal1,6566. 9th Street 6.Liberty Towers6488. 23rd Street 8.M2 at Marbella311 9.Monaco523 11. Urby Harborside762NY Waterway Ferry 12. The Charlotte* (‘22 delivery)750 2. Harborside 4. Midtown / W. 39th St. Future Start Communities 5. Brookfield Place / Battery P 1.PI South - Parcel 16131 3.PI South - Parcel 22001. Hudson Yards 5.PI North - Riverbend 64713. Brookfield Place 6.PI North - Parcel I224 7.PI North - Parcel J141 Subtotal1,769 Jersey City 8.Urby Harborside II796 9.Plaza 8679 10. Plaza 91,060 12. Liberty Landing Phase I265 Subtotal4,188 12 Summary: Operating Units4,016 In-Construction Units*1,423 Future-Start Units5,957 Total Waterfront Units11,396 Place

New York City: Market Overview NYC Job Growth is moving west and south, thereby aligning with our holdings. # of Tenants RSF Relocations: 100,000 RSF and Greater (2013 to 2020) Source: CBRE Research. Data as of February 1, 2020. 1 13 From –(1)(172,352) Hudson Yards To +238,894,681 Net Total228,722,329 From –(7)(2,173,341) Downtown To +215,313,348 Net Total143,140,007

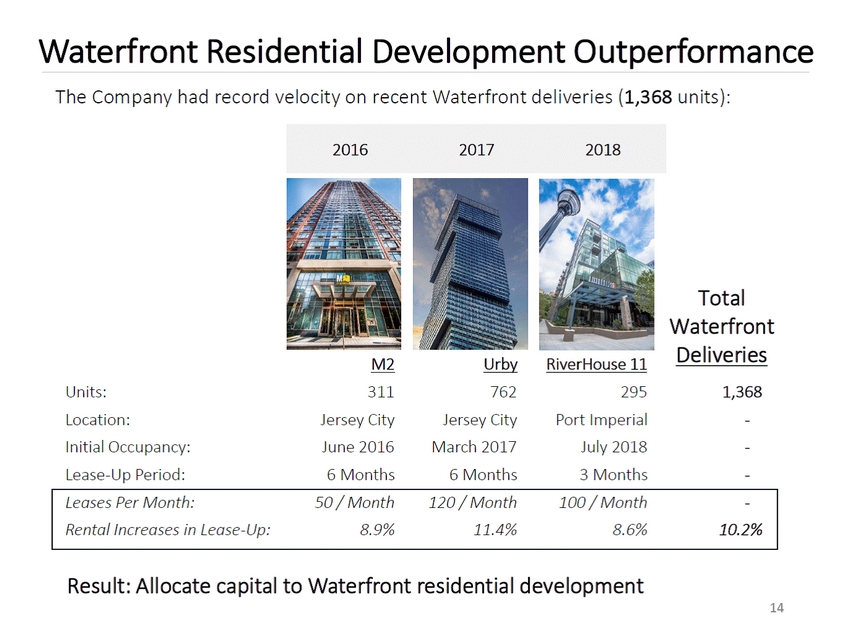

Waterfront Residential Development Outperformance The Company had record velocity on recent Waterfront deliveries (1,368 units): Total Waterfront Deliveries 1,368 - - - M2 311 Jersey City June 2016 6 Months Urby 762 Jersey City March 2017 6 Months RiverHouse 11 Units: Location: Initial Occupancy: Lease-Up Period: 295 Port Imperial July 2018 3 Months Result: Allocate capital to Waterfront residential development 14 Leases Per Month:50 / Month120 / Month100 / Month-Rental Increases in Lease-Up:8.9%11.4%8.6%10.2% 201620172018

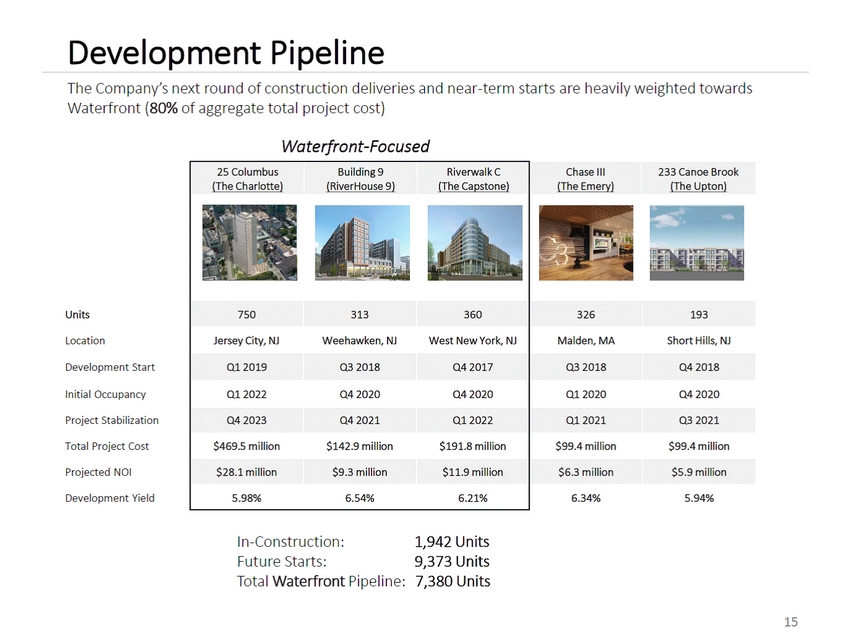

Development Pipeline The Company’s next round of construction deliveries and near-term starts are heavily weighted towards Waterfront (80% of aggregate total project cost) Waterfront-Focused In-Construction: Future Starts: Total Waterfront Pipeline: 1,942 Units 9,373 Units 7,380 Units 15 25 Columbus (The Charlotte) Building 9 (RiverHouse 9) Riverwalk C (The Capstone) Chase III (The Emery) 233 Canoe Brook (The Upton) Units 750 313 360 326 193 Location Jersey City, NJ Weehawken, NJ West New York, NJ Malden, MA Short Hills, NJ Development Start Q1 2019 Q3 2018 Q4 2017 Q3 2018 Q4 2018 Initial Occupancy Q1 2022 Q4 2020 Q4 2020 Q1 2020 Q4 2020 Project Stabilization Q4 2023 Q4 2021 Q1 2022 Q1 2021 Q3 2021 Total Project Cost $469.5 million $142.9 million $191.8 million $99.4 million $99.4 million Projected NOI $28.1 million $9.3 million $11.9 million $6.3 million $5.9 million Development Yield 5.98% 6.54% 6.21% 6.34% 5.94%

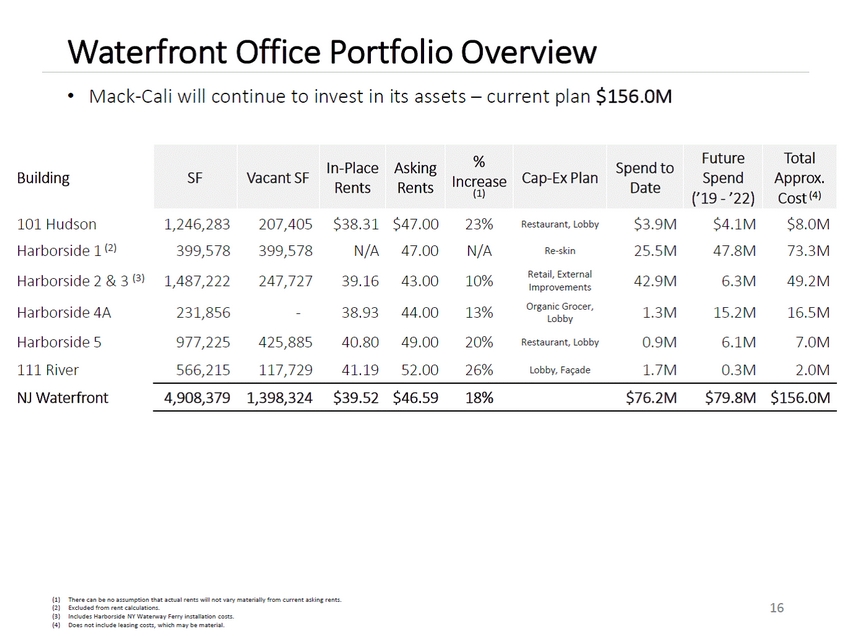

Waterfront Office Portfolio Overview • Mack-Cali will continue to invest in its assets – current plan $156.0M Approx. Date (1) (2) (3) (4) There can be no assumption that actual rents will not vary materially from current asking rents. Excluded from rent calculations. Includes Harborside NY Waterway Ferry installation costs. Does not include leasing costs, which may be material. 16 Building SF Vacant SF In-Place Rents Asking Rents % Increase (1) Cap-Ex Plan Spend to Future Spend (’19 - ’22) Total Cost (4) 101 Hudson 1,246,283 207,405 $38.31 $47.00 23% Restaurant, Lobby $3.9M $4.1M $8.0M Harborside 1 (2) 399,578 399,578 N/A 47.00 N/A Re-skin 25.5M 47.8M 73.3M Harborside 2 & 3 (3) 1,487,222 247,727 39.16 43.00 10% Retail, External Improvements 42.9M 6.3M 49.2M Harborside 4A 231,856 - 38.93 44.00 13% Organic Grocer, Lobby 1.3M 15.2M 16.5M Harborside 5 111 River NJ Waterfront 977,225425,88540.8049.0020%Restaurant, Lobby0.9M6.1M7.0M 566,215117,72941.1952.0026%Lobby, Façade1.7M0.3M2.0M 4,908,3791,398,324$39.52$46.5918%$76.2M$79.8M$156.0M

Appendix 17

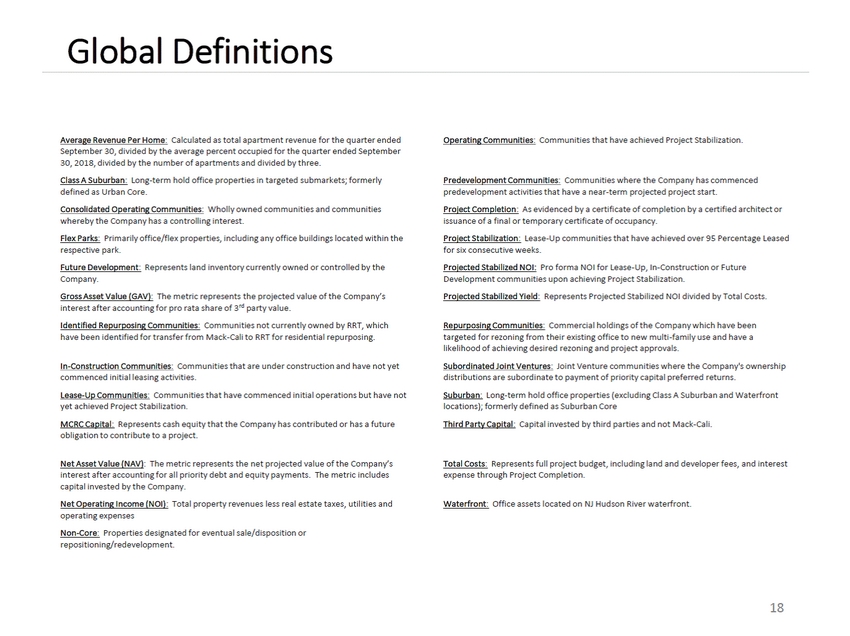

Global Definitions Average Revenue Per Home: Calculated as total apartment revenue for the quarter ended Operating Communities: Communities that have achieved Project Stabilization. September 30, divided by the average percent occupied for the quarter ended September 30, 2018, divided by the number of apartments and divided by three. Class A Suburban: Long-term hold office properties in targeted submarkets; formerly Predevelopment Communities: Communities where the Company has commenced defined as Urban Core. Consolidated Operating Communities: Wholly owned communities and communities predevelopment activities that have a near-term projected project start. Project Completion: As evidenced by a certificate of completion by a certified architect or whereby the Company has a controlling interest. Flex Parks: Primarily office/flex properties, including any office buildings located within the issuance of a final or temporary certificate of occupancy. Project Stabilization: Lease-Up communities that have achieved over 95 Percentage Leased respective park. Future Development: Represents land inventory currently owned or controlled by the for six consecutive weeks. Projected Stabilized NOI: Pro forma NOI for Lease-Up, In-Construction or Future Company. Gross Asset Value (GAV): The metric represents the projected value of the Company’s Development communities upon achieving Project Stabilization. Projected Stabilized Yield: Represents Projected Stabilized NOI divided by Total Costs. interest after accounting for pro rata share of 3rd party value. Identified Repurposing Communities: Communities not currently owned by RRT, which Repurposing Communities: Commercial holdings of the Company which have been have been identified for transfer from Mack-Cali to RRT for residential repurposing. targeted for rezoning from their existing office to new multi-family use and have a likelihood of achieving desired rezoning and project approvals. Subordinated Joint Ventures: Joint Venture communities where the Company's ownership In-Construction Communities: Communities that are under construction and have not yet commenced initial leasing activities. Lease-Up Communities: Communities that have commenced initial operations but have not distributions are subordinate to payment of priority capital preferred returns. Suburban: Long-term hold office properties (excluding Class A Suburban and Waterfront locations); formerly defined as Suburban Core Third Party Capital: Capital invested by third parties and not Mack-Cali. yet achieved Project Stabilization. MCRC Capital: Represents cash equity that the Company has contributed or has a future obligation to contribute to a project. Net Asset Value (NAV): The metric represents the net projected value of the Company’s Total Costs: Represents full project budget, including land and developer fees, and interest interest after accounting for all priority debt and equity payments. The metric includes capital invested by the Company. Net Operating Income (NOI): Total property revenues less real estate taxes, utilities and expense through Project Completion. Waterfront: Office assets located on NJ Hudson River waterfront. operating expenses Non-Core: Properties designated for eventual sale/disposition or repositioning/redevelopment. 18

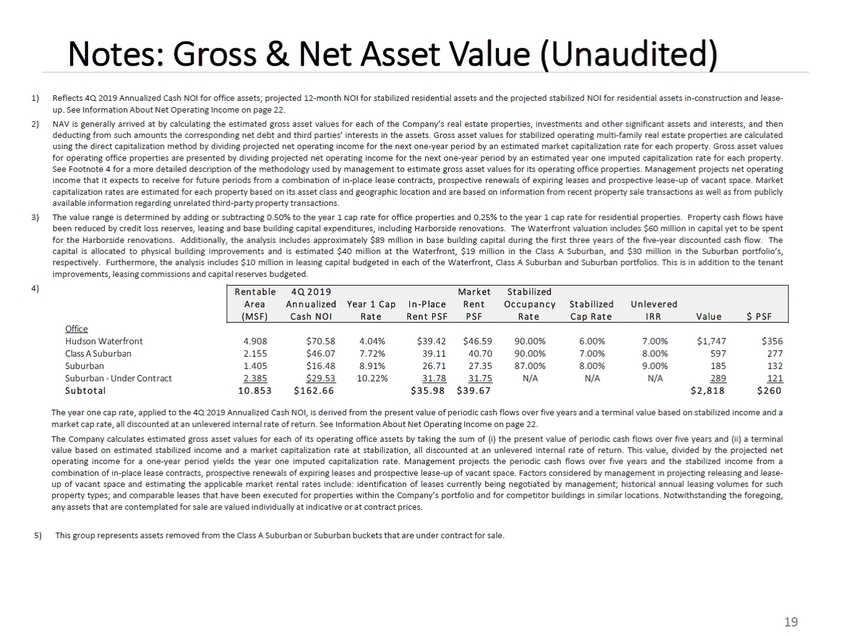

Notes: Gross & Net Asset Value (Unaudited) 1) Reflects 4Q 2019 Annualized Cash NOI for office assets; projected 12-month NOI for stabilized residential assets and the projected stabilized NOI for residential assets in-construction and lease-up. See Information About Net Operating Income on page 22. NAV is generally arrived at by calculating the estimated gross asset values for each of the Company’s real estate properties, investments and other significant assets and interests, and then deducting from such amounts the corresponding net debt and third parties’ interests in the assets. Gross asset values for stabilized operating multi-family real estate properties are calculated using the direct capitalization method by dividing projected net operating income for the next one-year period by an estimated market capitalization rate for each property. Gross asset values for operating office properties are presented by dividing projected net operating income for the next one-year period by an estimated year one imputed capitalization rate for each property. See Footnote 4 for a more detailed description of the methodology used by management to estimate gross asset values for its operating office properties. Management projects net operating income that it expects to receive for future periods from a combination of in-place lease contracts, prospective renewals of expiring leases and prospective lease-up of vacant space. Market capitalization rates are estimated for each property based on its asset class and geographic location and are based on information from recent property sale transactions as well as from publicly available information regarding unrelated third-party property transactions. The value range is determined by adding or subtracting 0.50% to the year 1 cap rate for office properties and 0.25% to the year 1 cap rate for residential properties. Property cash flows have been reduced by credit loss reserves, leasing and base building capital expenditures, including Harborside renovations. The Waterfront valuation includes $60 million in capital yet to be spent for the Harborside renovations. Additionally, the analysis includes approximately $89 million in base building capital during the first three years of the five-year discounted cash flow. The capital is allocated to physical building improvements and is estimated $40 million at the Waterfront, $19 million in the Class A Suburban, and $30 million in the Suburban portfolio’s, respectively. Furthermore, the analysis includes $10 million in leasing capital budgeted in each of the Waterfront, Class A Suburban and Suburban portfolios. This is in addition to the tenant improvements, leasing commissions and capital reserves budgeted. 2) 3) 4) Office Hudson Waterfront Class A Suburban Suburban Suburban - Under Contract S u b t o t a l 4.908 2.155 1.405 2.385 1 0 . 8 5 3 $70.58 $46.07 $16.48 $29.53 $ 1 6 2 . 6 6 4.04% 7.72% 8.91% 10.22% $39.42 39.11 26.71 31.78 $ 3 5 . 9 8 $46.59 40.70 27.35 31.75 $ 3 9 . 6 7 90.00% 90.00% 87.00% N/A 6.00% 7.00% 8.00% N/A 7.00% 8.00% 9.00% N/A $1,747 597 185 289 $ 2 , 8 1 8 $356 277 132 121 $260 The year one cap rate, applied to the 4Q 2019 Annualized Cash NOI, is derived from the present value of periodic cash flows over five years and a terminal value based on stabilized income and a market cap rate, all discounted at an unlevered internal rate of return. See Information About Net Operating Income on page 22. The Company calculates estimated gross asset values for each of its operating office assets by taking the sum of (i) the present value of periodic cash flows over five years and (ii) a terminal value based on estimated stabilized income and a market capitalization rate at stabilization, all discounted at an unlevered internal rate of return. This value, divided by the projected net operating income for a one-year period yields the year one imputed capitalization rate. Management projects the periodic cash flows over five years and the stabilized income from a combination of in-place lease contracts, prospective renewals of expiring leases and prospective lease-up of vacant space. Factors considered by management in projecting releasing and lease-up of vacant space and estimating the applicable market rental rates include: identification of leases currently being negotiated by management; historical annual leasing volumes for such property types; and comparable leases that have been executed for properties within the Company’s portfolio and for competitor buildings in similar locations. Notwithstanding the foregoing, any assets that are contemplated for sale are valued individually at indicative or at contract prices. 5) This group represents assets removed from the Class A Suburban or Suburban buckets that are under contract for sale. 19 R en t a b le 4 Q 2 0 1 9 M a r k et S t a b iliz ed A r ea A n n u a liz ed Y ea r 1 C a p I n -P la c e R en t O c c u p a n c y S t a b iliz ed U n lev er ed ( M S F ) C a s h N O I R a t e R en t P S F P S F R a t e C a p R a t e I R R V a lu e $ P S F

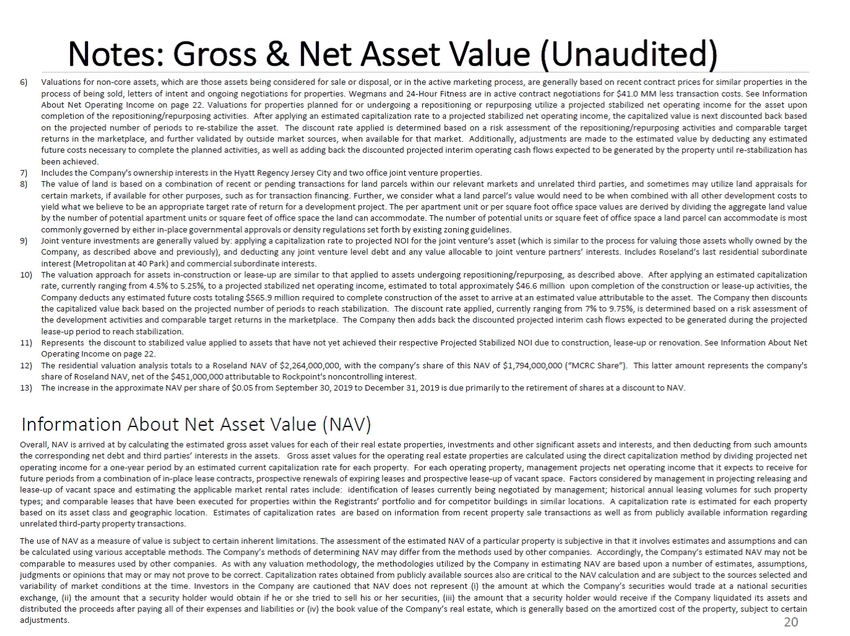

Notes: Gross & Net Asset Value (Unaudited) 6) Valuations for non-core assets, which are those assets being considered for sale or disposal, or in the active marketing process, are generally based on recent contract prices for similar properties in the process of being sold, letters of intent and ongoing negotiations for properties. Wegmans and 24-Hour Fitness are in active contract negotiations for $41.0 MM less transaction costs. See Information About Net Operating Income on page 22. Valuations for properties planned for or undergoing a repositioning or repurposing utilize a projected stabilized net operating income for the asset upon completion of the repositioning/repurposing activities. After applying an estimated capitalization rate to a projected stabilized net operating income, the capitalized value is next discounted back based on the projected number of periods to re-stabilize the asset. The discount rate applied is determined based on a risk assessment of the repositioning/repurposing activities and comparable target returns in the marketplace, and further validated by outside market sources, when available for that market. Additionally, adjustments are made to the estimated value by deducting any estimated future costs necessary to complete the planned activities, as well as adding back the discounted projected interim operating cash flows expected to be generated by the property until re-stabilization has been achieved. Includes the Company's ownership interests in the Hyatt Regency Jersey City and two office joint venture properties. The value of land is based on a combination of recent or pending transactions for land parcels within our relevant markets and unrelated third parties, and sometimes may utilize land appraisals for certain markets, if available for other purposes, such as for transaction financing. Further, we consider what a land parcel’s value would need to be when combined with all other development costs to yield what we believe to be an appropriate target rate of return for a development project. The per apartment unit or per square foot office space values are derived by dividing the aggregate land value by the number of potential apartment units or square feet of office space the land can accommodate. The number of potential units or square feet of office space a land parcel can accommodate is most commonly governed by either in-place governmental approvals or density regulations set forth by existing zoning guidelines. Joint venture investments are generally valued by: applying a capitalization rate to projected NOI for the joint venture’s asset (which is similar to the process for valuing those assets wholly owned by the Company, as described above and previously), and deducting any joint venture level debt and any value allocable to joint venture partners’ interests. Includes Roseland’s last residential subordinate interest (Metropolitan at 40 Park) and commercial subordinate interests. The valuation approach for assets in-construction or lease-up are similar to that applied to assets undergoing repositioning/repurposing, as described above. After applying an estimated capitalization rate, currently ranging from 4.5% to 5.25%, to a projected stabilized net operating income, estimated to total approximately $46.6 million upon completion of the construction or lease-up activities, the Company deducts any estimated future costs totaling $565.9 million required to complete construction of the asset to arrive at an estimated value attributable to the asset. The Company then discounts the capitalized value back based on the projected number of periods to reach stabilization. The discount rate applied, currently ranging from 7% to 9.75%, is determined based on a risk assessment of the development activities and comparable target returns in the marketplace. The Company then adds back the discounted projected interim cash flows expected to be generated during the projected lease-up period to reach stabilization. Represents the discount to stabilized value applied to assets that have not yet achieved their respective Projected Stabilized NOI due to construction, lease-up or renovation. See Information About Net Operating Income on page 22. The residential valuation analysis totals to a Roseland NAV of $2,264,000,000, with the company’s share of this NAV of $1,794,000,000 (“MCRC Share”). This latter amount represents the company's share of Roseland NAV, net of the $451,000,000 attributable to Rockpoint's noncontrolling interest. The increase in the approximate NAV per share of $0.05 from September 30, 2019 to December 31, 2019 is due primarily to the retirement of shares at a discount to NAV. 7) 8) 9) 10) 11) 12) 13) Information About Net Asset Value (NAV) Overall, NAV is arrived at by calculating the estimated gross asset values for each of their real estate properties, investments and other significant assets and interests, and then deducting from such amounts the corresponding net debt and third parties’ interests in the assets. Gross asset values for the operating real estate properties are calculated using the direct capitalization method by dividing projected net operating income for a one-year period by an estimated current capitalization rate for each property. For each operating property, management projects net operating income that it expects to receive for future periods from a combination of in-place lease contracts, prospective renewals of expiring leases and prospective lease-up of vacant space. Factors considered by management in projecting releasing and lease-up of vacant space and estimating the applicable market rental rates include: identification of leases currently being negotiated by management; historical annual leasing volumes for such property types; and comparable leases that have been executed for properties within the Registrants’ portfolio and for competitor buildings in similar locations. A capitalization rate is estimated for each property based on its asset class and geographic location. Estimates of capitalization rates are based on information from recent property sale transactions as well as from publicly available information regarding unrelated third-party property transactions. The use of NAV as a measure of value is subject to certain inherent limitations. The assessment of the estimated NAV of a particular property is subjective in that it involves estimates and assumptions and can be calculated using various acceptable methods. The Company’s methods of determining NAV may differ from the methods used by other companies. Accordingly, the Company’s estimated NAV may not be comparable to measures used by other companies. As with any valuation methodology, the methodologies utilized by the Company in estimating NAV are based upon a number of estimates, assumptions, judgments or opinions that may or may not prove to be correct. Capitalization rates obtained from publicly available sources also are critical to the NAV calculation and are subject to the sources selected and variability of market conditions at the time. Investors in the Company are cautioned that NAV does not represent (i) the amount at which the Company’s securities would trade at a national securities exchange, (ii) the amount that a security holder would obtain if he or she tried to sell his or her securities, (iii) the amount that a security holder would receive if the Company liquidated its assets and distributed the proceeds after paying all of their expenses and liabilities or (iv) the book value of the Company’s real estate, which is generally based on the amortized cost of the property, subject to certain adjustments. 20

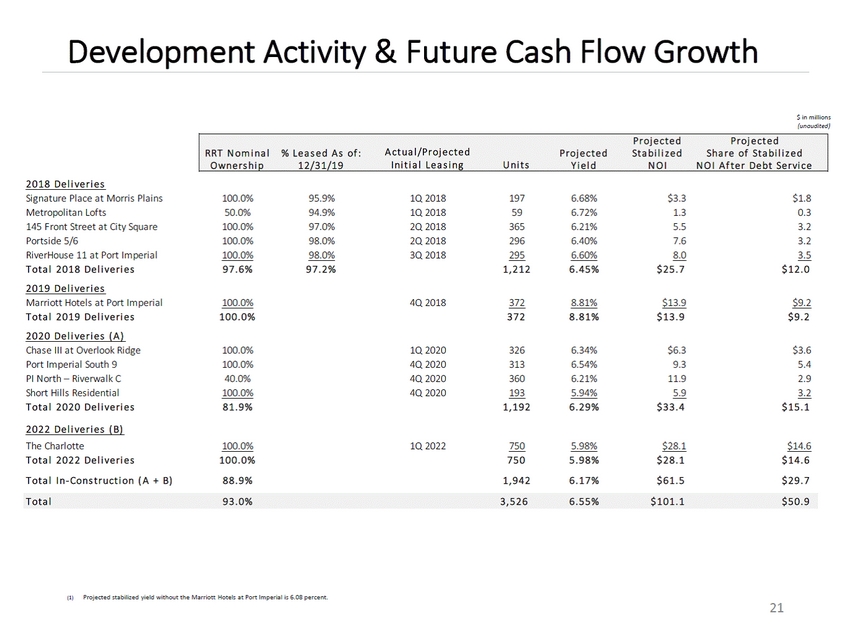

Development Activity & Future Cash Flow Growth $ in millions (unaudited) 2 0 1 8 D e l i v e r i e s Signature Place at Morris Plains Metropolitan Lofts 145 Front Street at City Square Portside 5/6 RiverHouse 11 at Port Imperial T o t a l 2 0 1 8 D e l i v e r i e s 2 0 1 9 D e l i v e r i e s 100.0% 50.0% 100.0% 100.0% 100.0% 9 7 . 6 % 95.9% 94.9% 97.0% 98.0% 98.0% 9 7 . 2 % 1Q 2018 1Q 2018 2Q 2018 2Q 2018 3Q 2018 197 59 365 296 295 1 , 2 1 2 6.68% 6.72% 6.21% 6.40% 6.60% 6 . 4 5 % $3.3 1.3 5.5 7.6 8.0 $ 2 5 . 7 $1.8 0.3 3.2 3.2 3.5 $ 1 2 . 0 Marriott Hotels at Port Imperial T o t a l 2 0 1 9 D e l i v e r i e s 2 0 2 0 D e l i v e r i e s ( A ) 100.0% 1 0 0 . 0 % 4Q 2018 372 372 8.81% 8 . 8 1 % $13.9 $ 1 3 . 9 $9.2 $ 9 . 2 Chase III at Overlook Ridge Port Imperial South 9 PI North – Riverwalk C Short Hills Residential T o t a l 2 0 2 0 D e l i v e r i e s 100.0% 100.0% 40.0% 100.0% 8 1 . 9 % 1Q 2020 4Q 2020 4Q 2020 4Q 2020 326 313 360 193 1 , 1 9 2 6.34% 6.54% 6.21% 5.94% 6 . 2 9 % $6.3 9.3 11.9 5.9 $ 3 3 . 4 $3.6 5.4 2.9 3.2 $ 1 5 . 1 2 0 2 2 D e l i v e r i e s ( B ) The Charlotte T o t a l 2 0 2 2 D e l i v e r i e s T o t a l I n - Co n s t r u c t i o n ( A + B) 100.0% 1 0 0 .. 0 % 8 8 . 9 % 1Q 2022 750 750 1 , 9 4 2 5.98% 5 . 9 8 % 6 . 1 7 % $28.1 $ 2 8 . 1 $ 6 1 . 5 $14.6 $ 1 4 . 6 $ 2 9 . 7 (1) Projected stabilized yield without the Marriott Hotels at Port Imperial is 6.08 percent. 21 T o t a l9 3 . 0 %3 , 5 2 66 . 5 5 %$ 1 0 1 . 1$ 5 0 . 9 P r o j e c t e dP r o j e c t e d RRT N o m i n a l% L e a s e d A s o f :A c t u a l /P r o j e c t e dP r o j e c t e dSt a b i l i z e dSh a r e o f St a b i l i z e d O wn e r s h i p1 2 /3 1 /1 9I n i t i a l L e a s i n gU n i t sY i e l dN O IN O I A f t e r D e b t Se r v i c e

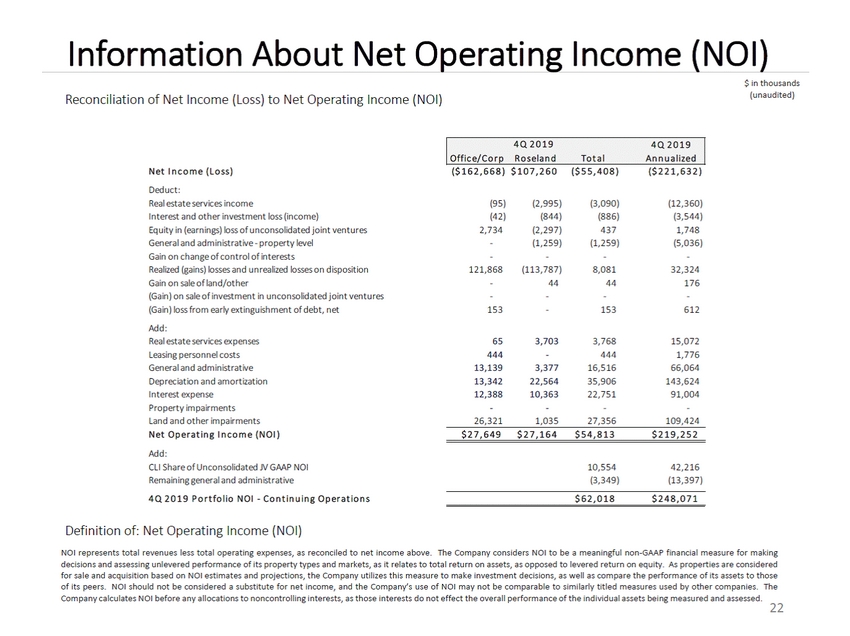

Information About Net Operating Income (NOI) $ in thousands (unaudited) Reconciliation of Net Income (Loss) to Net Operating Income (NOI) N et I n c o m e ( L o s s ) Deduct: Real estate services income Interest and other investment loss (income) Equity in (earnings) loss of unconsolidated joint ventures General and administrative - property level Gain on change of control of interests Realized (gains) losses and unrealized losses on disposition Gain on sale of land/other (Gain) on sale of investment in unconsolidated joint ventures (Gain) loss from early extinguishment of debt, net Add: Real estate services expenses Leasing personnel costs General and administrative Depreciation and amortization Interest expense Property impairments Land and other impairments N et O p er a t in g I n c o m e ( N O I ) Add: CLI Share of Unconsolidated JV GAAP NOI Remaining general and administrative 4 Q 2 0 1 9 P o r t f o lio N O I - C o n t in u in g O p er a t io n s ( $ 1 6 2 , 6 6 8 ) $ 1 0 7 , 2 6 0 ( $ 5 5 , 4 0 8 ) ( $ 2 2 1 , 6 3 2 ) (95) (42) 2,734 - - 121,868 - - 153 (2,995) (844) (2,297) (1,259) - (113,787) 44 - - (3,090) (886) 437 (1,259) - 8,081 44 - 153 (12,360) (3,544) 1,748 (5,036) - 32,324 176 - 612 65 444 13,139 13,342 12,388 - 26,321 3,703 - 3,377 22,564 10,363 - 1,035 3,768 444 16,516 35,906 22,751 - 27,356 15,072 1,776 66,064 143,624 91,004 - 109,424 $ 2 7 , 6 4 9 $ 2 7 , 1 6 4 $ 5 4 , 8 1 3 $ 2 1 9 , 2 5 2 10,554 (3,349) 42,216 (13,397) $ 6 2 , 0 1 8 $ 2 4 8 , 0 7 1 Definition of: Net Operating Income (NOI) NOI represents total revenues less total operating expenses, as reconciled to net income above. The Company considers NOI to be a meaningful non-GAAP financial measure for making decisions and assessing unlevered performance of its property types and markets, as it relates to total return on assets, as opposed to levered return on equity. As properties are considered for sale and acquisition based on NOI estimates and projections, the Company utilizes this measure to make investment decisions, as well as compare the performance of its assets to those of its peers. NOI should not be considered a substitute for net income, and the Company’s use of NOI may not be comparable to similarly titled measures used by other companies. The Company calculates NOI before any allocations to noncontrolling interests, as those interests do not effect the overall performance of the individual assets being measured and assessed. 22 4 Q 2 0 1 9 4 Q 2 0 1 9 O f f ic e/ C o r p R o s ela n d T o t a l A n n u a liz ed