Exhibit 99.1

|

. Mack-Cali Realty Corporation Supplemental Operating and Financial Data 4Q 2019 |

|

Table of Contents Company Highlights Page 4 6 7 11 21 25 26 ▪ Company Overview Key Financial Metrics Net Asset Value Financial Schedules Debt Statistics Unconsolidated Joint Ventures Transaction Activity ▪ ▪ ▪ Building 9 at Port Imperial-Weehawken, NJ (In-Construction) ▪ ▪ ▪ ▪ Office Portfolio ▪ Property Listing Office Operating Schedules 28 30 ▪ ▪ The Charlotte - Jersey City, NJ (In-Construction) Roseland Residential Portfolio ▪ Roseland Operating Schedules Financial Statements 36 41 ▪ ▪ This Supplemental Operating and Financial Data should be read in connection with the company’s forth quarter 2019 earnings press release (included as Exhibit 99.2 of the company’s Current Report on Form 8-K, filed on February 26, 2020) as certain disclosures, definitions and reconciliations in such announcement have not been included in this Supplemental Operating and Financial Data. Harborside 2 & 3 - Jersey City, NJ 4Q 2019 2 |

|

Company Highlights 4Q 2019 3 |

|

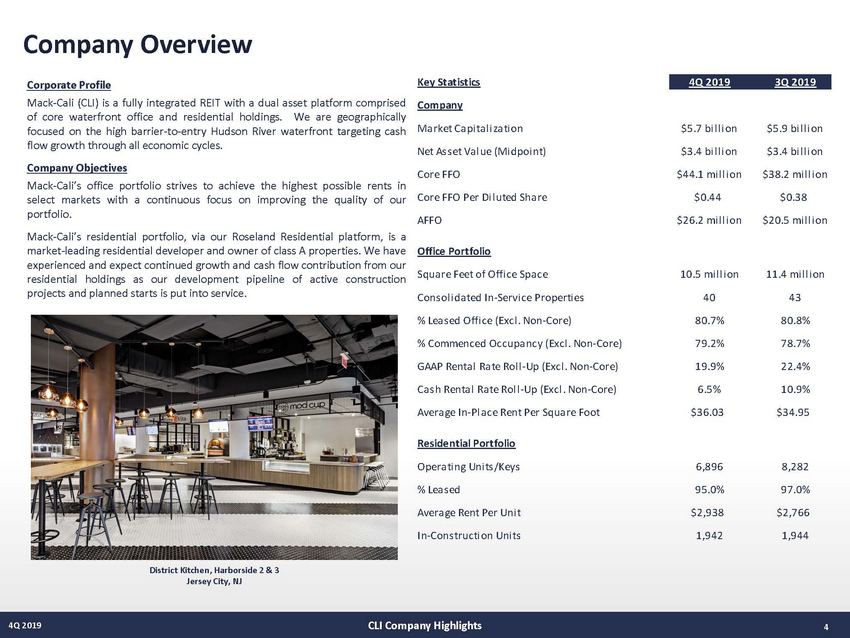

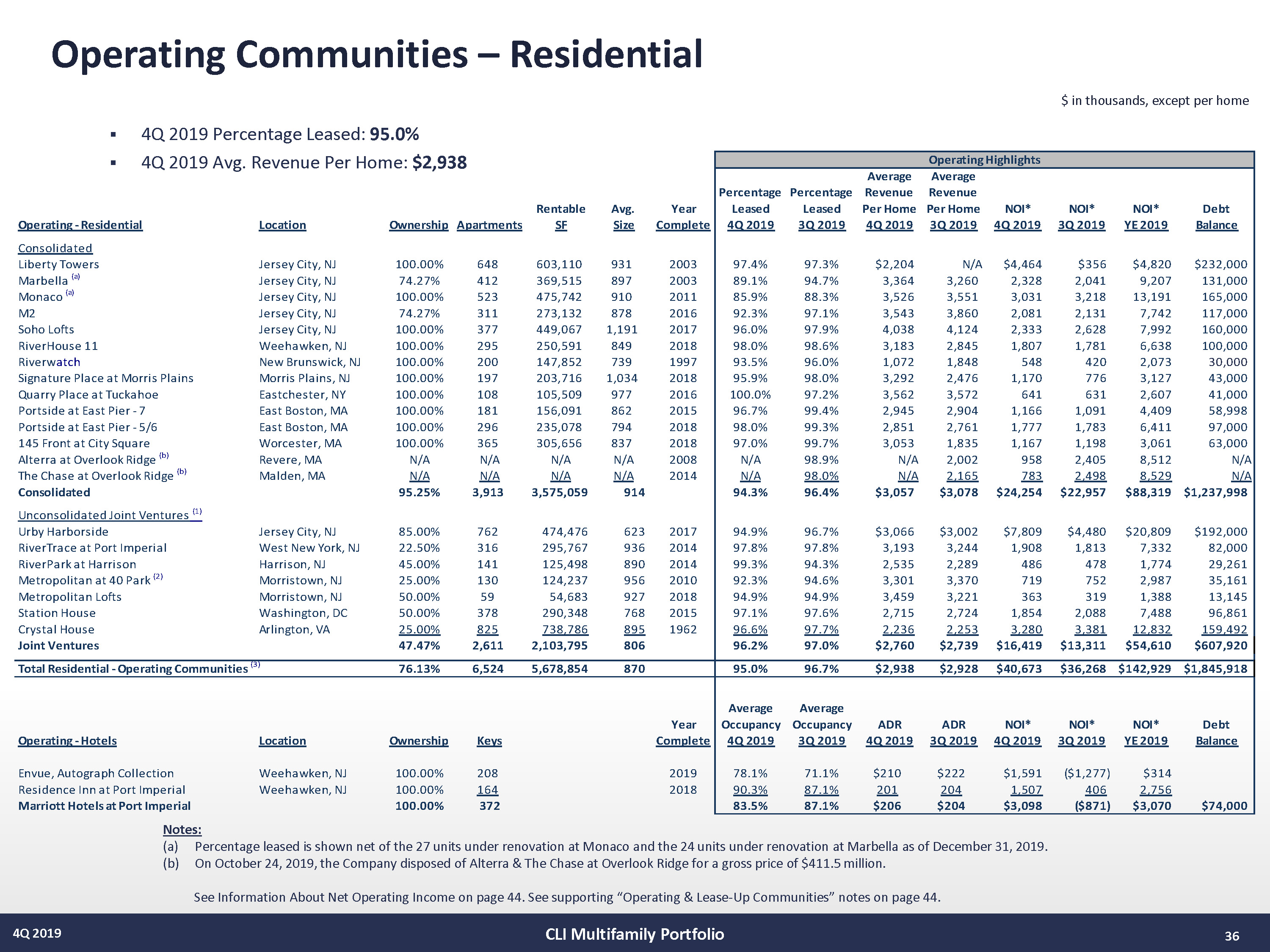

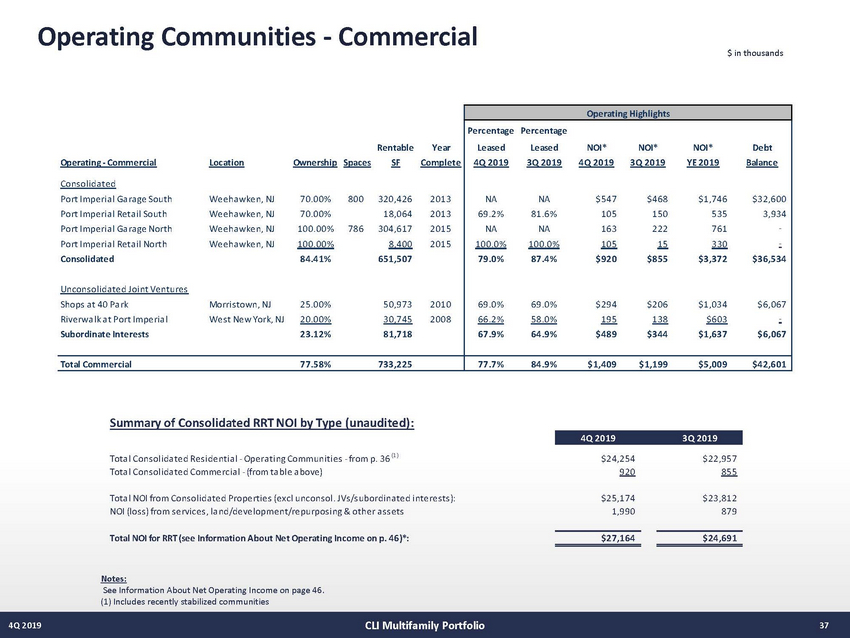

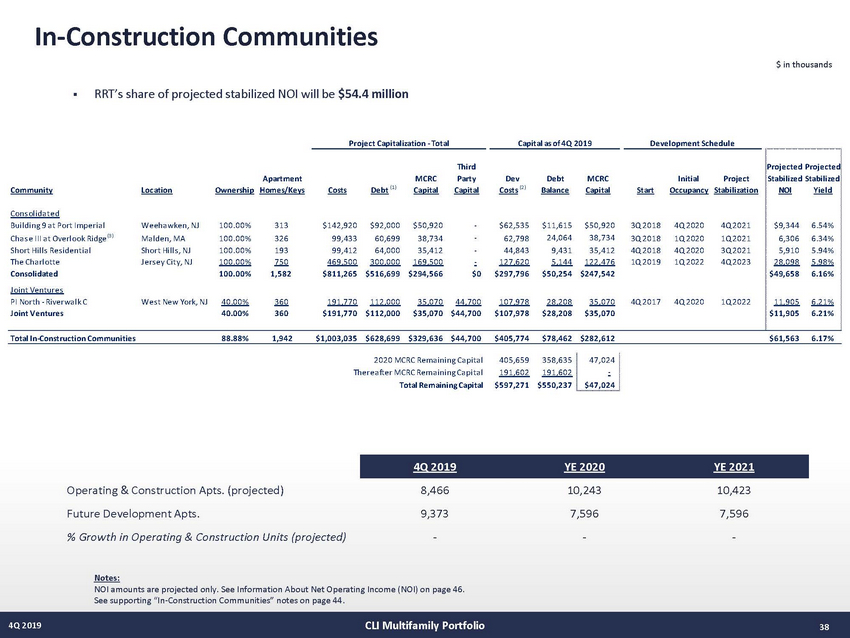

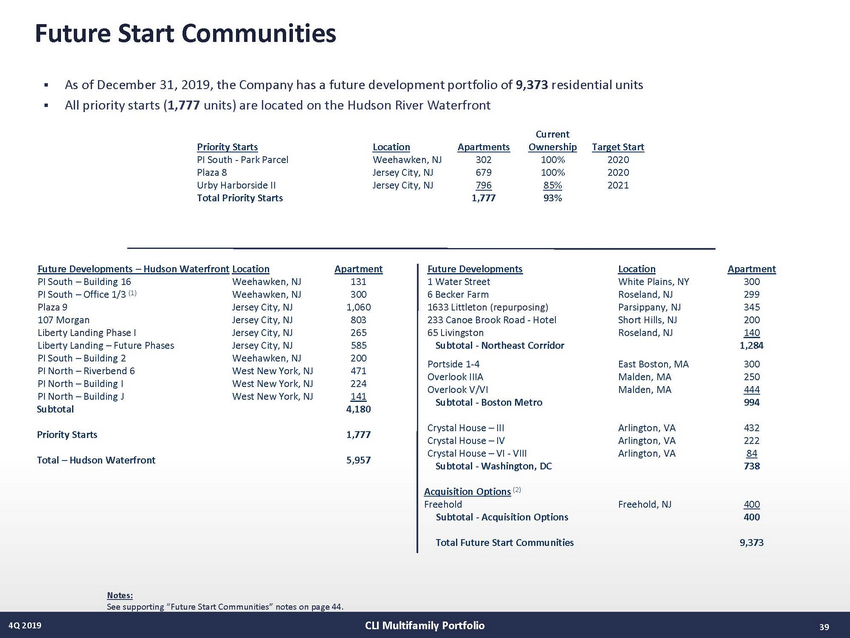

Company Overview Corporate Profile Key Statistics Mack-Cali (CLI) is a fully integrated REIT with a dual asset platform comprised of core waterfront office and residential holdings. We are geographically focused on the high barrier-to-entry Hudson River waterfront targeting cash flow growth through all economic cycles. Company Objectives Company Ma rket Ca pi ta l i za ti on Net As s et Va l ue (Mi dpoi nt) Core FFO Core FFO Per Di l uted Sha re AFFO $5.7 bi l l i on $3.4 bi l l i on $44.1 mi l l i on $0.44 $26.2 mi l l i on $5.9 bi l l i on $3.4 bi l l i on $38.2 mi l l i on $0.38 $20.5 mi l l i on Mack-Cali’s office portfolio strives to achieve the highest possible rents in select markets with a continuous focus on improving the quality of our portfolio. Mack-Cali’s residential portfolio, via our Roseland Residential platform, is a market-leading residential developer and owner of class A properties. We have experienced and expect continued growth and cash flow contribution from our Office Portfolio Squa re Feet of Offi ce Spa ce Cons ol i da ted In-Servi ce Properti es % Lea s ed Offi ce (Excl . Non-Core) % Commenced Occupa ncy (Excl . Non-Core) GAAP Renta l Ra te Rol l -Up (Excl . Non-Core) Ca s h Renta l Ra te Rol l -Up (Excl . Non-Core) Avera ge In-Pl a ce Rent Per Squa re Foot 10.5 mi l l i on 40 80.7% 79.2% 19.9% 6.5% $36.03 11.4 mi l l i on 43 80.8% 78.7% 22.4% 10.9% $34.95 residential holdings as our development pipeline projects and planned starts is put into service. of active construction Residential Portfolio Opera ti ng Uni ts /Keys % Lea s ed Avera ge Rent Per Uni t In-Cons tructi on Uni ts 6,896 95.0% $2,938 1,942 8,282 97.0% $2,766 1,944 District Kitchen, Harborside 2 & 3 Jersey City, NJ CLI Company Highlights 4Q 2019 4 4Q 2019 3Q 2019 |

|

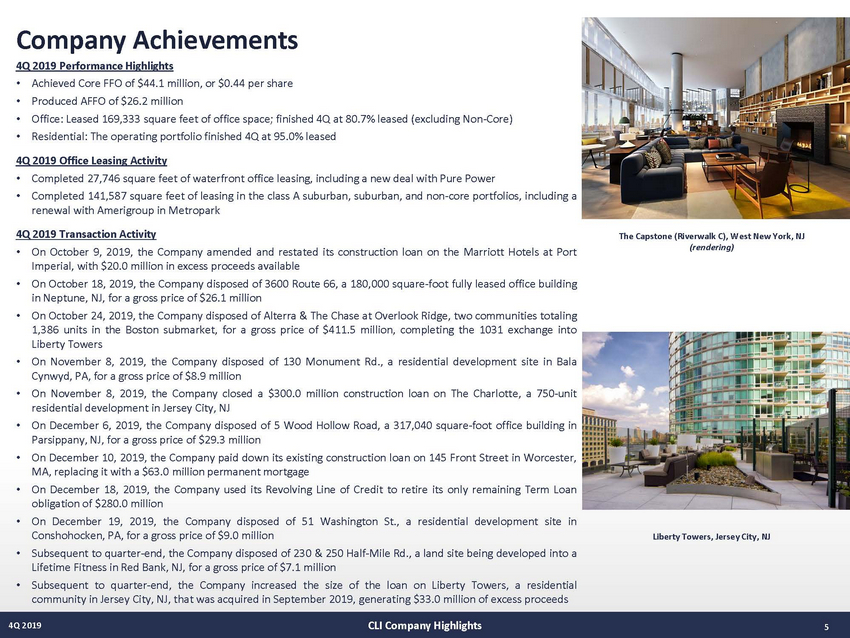

Company Achievements 4Q 2019 Performance Highlights • • • • Achieved Core FFO of $44.1 million, or $0.44 per share Produced AFFO of $26.2 million Office: Leased 169,333 square feet of office space; finished 4Q at 80.7% leased (excluding Non-Core) Residential: The operating portfolio finished 4Q at 95.0% leased 4Q 2019 Office Leasing Activity •Completed 27,746 square feet of waterfront office leasing, including a new deal with Pure Power •Completed 141,587 square feet of leasing in the class A suburban, suburban, and non-core portfolios, including a renewal with Amerigroup in Metropark 4Q 2019 Transaction Activity The Capstone (Riverwalk C), West New York, NJ (rendering) • On October 9, 2019, the Company amended and restated its construction loan on the Marriott Hotels at Port Imperial, with $20.0 million in excess proceeds available On October 18, 2019, the Company disposed of 3600 Route 66, a 180,000 square-foot fully leased office building in Neptune, NJ, for a gross price of $26.1 million On October 24, 2019, the Company disposed of Alterra & The Chase at Overlook Ridge, two communities totaling 1,386 units in the Boston submarket, for a gross price of $411.5 million, completing the 1031 exchange into Liberty Towers On November 8, 2019, the Company disposed of 130 Monument Rd., a residential development site in Bala Cynwyd, PA, for a gross price of $8.9 million On November 8, 2019, the Company closed a $300.0 million construction loan on The Charlotte, a 750-unit residential development in Jersey City, NJ On December 6, 2019, the Company disposed of 5 Wood Hollow Road, a 317,040 square-foot office building in Parsippany, NJ, for a gross price of $29.3 million On December 10, 2019, the Company paid down its existing construction loan on 145 Front Street in Worcester, MA, replacing it with a $63.0 million permanent mortgage On December 18, 2019, the Company used its Revolving Line of Credit to retire its only remaining Term Loan obligation of $280.0 million On December 19, 2019, the Company disposed of 51 Washington St., a residential development site in Conshohocken, PA, for a gross price of $9.0 million Subsequent to quarter-end, the Company disposed of 230 & 250 Half-Mile Rd., a land site being developed into a Lifetime Fitness in Red Bank, NJ, for a gross price of $7.1 million Subsequent to quarter-end, the Company increased the size of the loan on Liberty Towers, a residential community in Jersey City, NJ, that was acquired in September 2019, generating $33.0 million of excess proceeds • • • • • • • • Liberty Towers, Jersey City, NJ • • CLI Company Highlights 4Q 2019 5 |

|

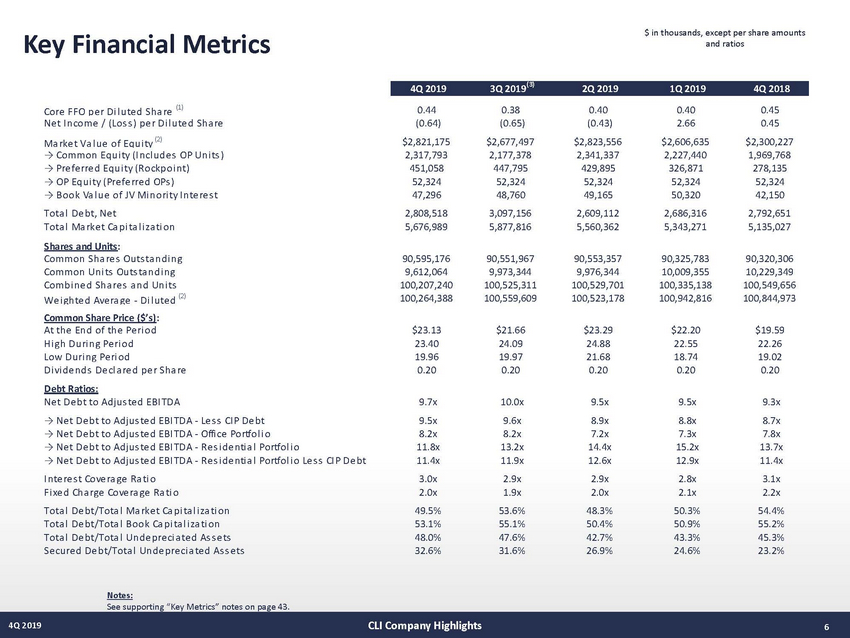

$ in thousands, except per share amounts and ratios Key Financial Metrics Core FFO pe r Di l ute d Sha re (1) Ne t I ncome / (Los s ) pe r Di l ute d Sha re Ma rke t Va l ue of Equi ty (2) → Common Equi ty (I ncl ude s OP Uni ts ) → Pre fe rre d Equi ty (Rockpoi nt) → OP Equi ty (Pre fe rre d OPs ) → Book Va l ue of JV Mi nori ty I nte re s t Tota l De bt, Ne t Tota l Ma rke t Ca pi ta l i za ti on Shares and Units: 0.44 (0.64) $2,821,175 2,317,793 451,058 52,324 47,296 2,808,518 5,676,989 0.38 (0.65) $2,677,497 2,177,378 447,795 52,324 48,760 3,097,156 5,877,816 0.40 (0.43) $2,823,556 2,341,337 429,895 52,324 49,165 2,609,112 5,560,362 0.40 2.66 $2,606,635 2,227,440 326,871 52,324 50,320 2,686,316 5,343,271 0.45 0.45 $2,300,227 1,969,768 278,135 52,324 42,150 2,792,651 5,135,027 Common Sha re s Ou ts ta ndi ng Common Uni ts Ou ts ta ndi ng Combi ne d Sha re s a nd Uni ts We i ghte d Ave ra ge - Di l ute d (2) Com m on S ha re Pri ce ( $’s ) : 90,595,176 9,612,064 100,207,240 100,264,388 90,551,967 9,973,344 100,525,311 100,559,609 90,553,357 9,976,344 100,529,701 100,523,178 90,325,783 10,009,355 100,335,138 100,942,816 90,320,306 10,229,349 100,549,656 100,844,973 At the End of the Pe ri od Hi gh Duri ng Pe ri od Low Duri ng Pe ri od Di vi de nds De cl a re d pe r Sha re Debt Ratios: $23.13 23.40 19.96 0.20 $21.66 24.09 19.97 0.20 $23.29 24.88 21.68 0.20 $22.20 22.55 18.74 0.20 $19.59 22.26 19.02 0.20 Ne t De bt to Ad jus te d EBI TDA → Ne t De bt to Ad jus te d EBI TDA - Le s s CI P De bt → Ne t De bt to Ad jus te d EBI TDA - Offi ce Portfol i o → Ne t De bt to Ad jus te d EBI TDA - Re s i de nti a l Portfol i o → Ne t De bt to Ad jus te d EBI TDA - Re s i de nti a l Portfol i o Le s s CI P De bt I nte re s t Cove ra ge Ra ti o Fi xe d Cha rge Cove ra ge Ra ti o Tota l De bt/Tota l Ma rke t Ca pi ta l i za ti on Tota l De bt/Tota l Book Ca pi ta l i za ti on Tota l De bt/Tota l Unde pre ci a te d As s e ts Se cure d De bt/Tota l Unde pre ci a te d As s e ts 9.7x 9.5x 8.2x 11.8x 11.4x 3.0x 2.0x 49.5% 53.1% 48.0% 32.6% 10.0x 9.6x 8.2x 13.2x 11.9x 2.9x 1.9x 53.6% 55.1% 47.6% 31.6% 9.5x 8.9x 7.2x 14.4x 12.6x 2.9x 2.0x 48.3% 50.4% 42.7% 26.9% 9.5x 8.8x 7.3x 15.2x 12.9x 2.8x 2.1x 50.3% 50.9% 43.3% 24.6% 9.3x 8.7x 7.8x 13.7x 11.4x 3.1x 2.2x 54.4% 55.2% 45.3% 23.2% Notes: See supporting “Key Metrics” notes on page 43. CLI Company Highlights 4Q 2019 6 4Q 20193Q 2019( 3)2Q 20191Q 20194Q 2018 |

|

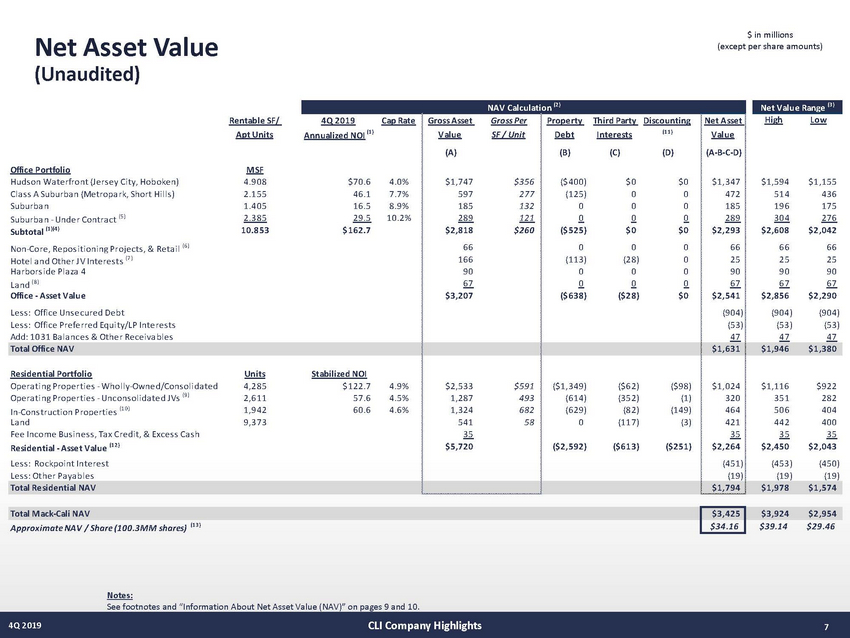

$ in millions (except per share amounts) Net Asset (Unaudited) Value Notes: See footnotes and “Information About Net Asset Value (NAV)” on pages 9 and 10. CLI Company Highlights 4Q 2019 7 Total Mack-Cali NAV $3,425 $3,924$2,954 Approximate NAV / Share (100.3MM shares) (1 3 ) $34.16 $39.14$29.46 NAV Calculation (2 ) HighLow $1,594$1,155 514436 196175 304276 $2,608$2,042 6666 2525 9090 6767 $2,856$2,290 (904)(904) (53)(53) 4747 Rentable SF/ 4Q 2019Cap Rate Apt UnitsAnnualized NOI (1 ) Office Portfolio MSF Huds on Wa terfront (Jers ey City, Hoboken) 4.908 $70.6 4.0% Cla s s A Suburba n (Metropa rk, Short Hills ) 2.155 46.1 7.7% Suburba n 1.405 16.5 8.9% Suburba n - Under Contra ct (5 ) 2.385 29.5 10.2% Subtotal (1 )(4 ) 10.853 $162.7 Non-Core, Repos itioning Projects , & Reta il (6 ) Hotel a nd Other JV Interes ts (7 ) Ha rbors ide Pla za 4 La nd (8 ) Office - Asset Value Les s : Office Uns ecured Debt Les s : Office Preferred Equity/LP Interes ts Add: 1031 Ba la nces & Other Receiva bles Gross AssetGross Per ValueSF / Unit (A) $1,747$356 597277 185132 289121 $2,818$260 66 166 90 67 $3,207 Property Third Party Discounting DebtInterests(1 1 ) (B)(C)(D) ($400)$0$0 (125) 00 000 000 ($525)$0$0 000 (113)(28)0 000 000 ($638)($28)$0 Net Asset Value (A-B-C-D) $1,347 472 185 289 $2,293 66 25 90 67 $2,541 (904) (53) 47 Total Office NAV $1,631 $1,946$1,380 Residential Portfolio Units Stabilized NOI Opera ting Properties - Wholly-Owned/Cons olida ted 4,285 $122.7 4.9% Opera ting Properties - Uncons olida ted JVs (9 ) 2,611 57.6 4.5% In-Cons truction Properties (1 0 ) 1,942 60.6 4.6% La nd 9,373 Fee Income Bus ines s , Ta x Credit, & Exces s Ca s h Residential - Asset Value (1 2 ) Les s : Rockpoint Interes t Les s : Other Pa ya bles $2,533$591 1,287493 1,324682 54158 35 $5,720 ($1,349) ($62) ($98) (614) (352) (1) (629) (82) (149) 0(117)(3) ($2,592)($613)($251) $1,024 320 464 421 35 $2,264 (451) (19) $1,116$922 351282 506404 442400 3535 $2,450$2,043 (453)(450) (19)(19) Total Residential NAV $1,794 $1,978$1,574 Net Value Range (3 ) |

|

Net Asset Value – Residential Breakdown (Unaudited) Top NAV (net equity) Contributors $ in millions Operating Properties Urby Ha rbors i de Li be rty Towe rs Mona co Ports i de 7 & 5/6 a t Ea s t Pi e r Ma rri ott Hote l s a t Port I mpe ri a l Subtotal Current/Future Development Properties $197 177 167 109 92 $742 11% 10% 9% 6% 5% 41% NAV by Market New York Washington, Metro, 1% NJ Corridor, D.C., 5% 7% The Cha rl otte Pl a za 8/9 (l a nd) Bui l di ng 9 a t Port I mpe ri a l 107 Morga n Urby Future Pha s e s Subtotal Top Contributing Assets $205 130 97 67 52 $551 $1,293 11% 7% 5% 4% 3% 30% 71% Boston Metro, 11% Gross Portfolio Value Hudson River Waterfront, 76% Stabilized Gross Asset Value Le s s : Di s cou n t for CI P Di s cou n te d Gros s As s e t Va l u e $5,720 (251) $5,469 Le s s : Exi s ti n g De b t Le s s : 3rd Pa rty I n te re s ts & Oth e r Ob l i ga ti on s Le s s : Rockp oi n t Sh a re MCRC Share of Residential NAV (2,592) (632) (451) $1,794 Notes: See footnotes and “Information About Net Asset Value (NAV)” on pages 9 and 10. CLI Company Highlights 4Q 2019 8 |

|

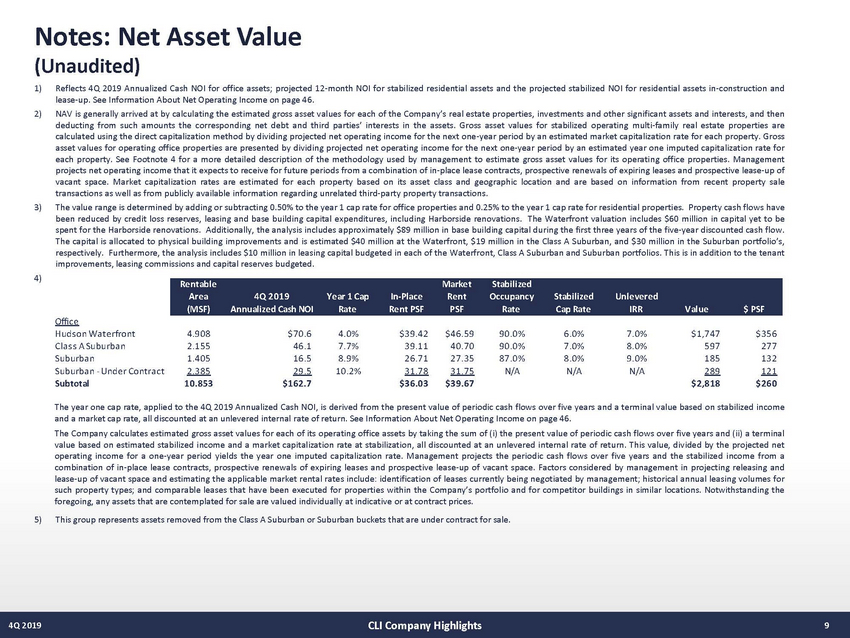

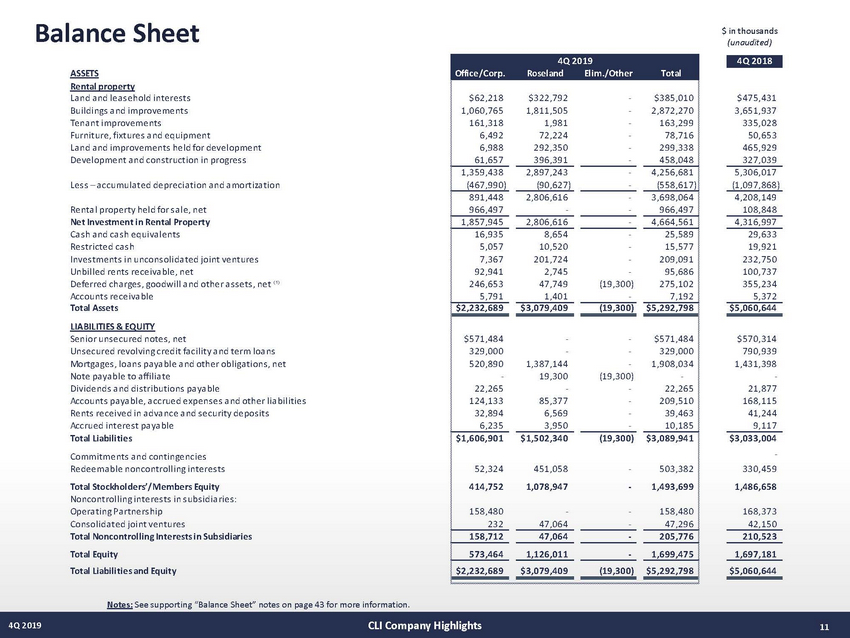

Notes: Net Asset Value (Unaudited) lease-up. See Information About Net Operating Income on page 46. 1) Reflects 4Q 2019 Annualized Cash NOI for office assets; projected 12-month NOI for stabilized residential assets and the projected stabilized NOI for residential assets in-construction and 2) NAV is generally arrived at by calculating the estimated gross asset values for each of the Company’s real estate properties, investments and other significant assets and interests, and then deducting from such amounts the corresponding net debt and third parties’ interests in the assets. Gross asset values for stabilized operating multi-family real estate properties are calculated using the direct capitalization method by dividing projected net operating income for the next one-year period by an estimated market capitalization rate for each property. Gross asset values for operating office properties are presented by dividing projected net operating income for the next one-year period by an estimated year one imputed capitalization rate for each property. See Footnote 4 for a more detailed description of the methodology used by management to estimate gross asset values for its operating office properties. Management projects net operating income that it expects to receive for future periods from a combination of in-place lease contracts, prospective renewals of expiring leases and prospective lease-up of vacant space. Market capitalization rates are estimated for each property based on its asset class and geographic location and are based on information from recent property sale transactions as well as from publicly available information regarding unrelated third-party property transactions. The value range is determined by adding or subtracting 0.50% to the year 1 cap rate for office properties and 0.25% to the year 1 cap rate for residential properties. Property cash flows have been reduced by credit loss reserves, leasing and base building capital expenditures, including Harborside renovations. The Waterfront valuation includes $60 million in capital yet to be spent for the Harborside renovations. Additionally, the analysis includes approximately $89 million in base building capital during the first three years of the five-year discounted cash flow. The capital is allocated to physical building improvements and is estimated $40 million at the Waterfront, $19 million in the Class A Suburban, and $30 million in the Suburban portfolio’s, respectively. Furthermore, the analysis includes $10 million in leasing capital budgeted in each of the Waterfront, Class A Suburban and Suburban portfolios. This is in addition to the tenant improvements, leasing commissions and capital reserves budgeted. 3) 4) Office Huds on Wa terfront Cla s s A Suburba n Suburba n Suburba n - Under Contra ct Subtotal 4.908 2.155 1.405 2.385 10.853 $70.6 46.1 16.5 29.5 $162.7 4.0% 7.7% 8.9% 10.2% $39.42 39.11 26.71 31.78 $36.03 $46.59 40.70 27.35 31.75 $39.67 90.0% 90.0% 87.0% N/A 6.0% 7.0% 8.0% N/A 7.0% 8.0% 9.0% N/A $1,747 597 185 289 $2,818 $356 277 132 121 $260 The year one cap rate, applied to the 4Q 2019 Annualized Cash NOI, is derived from the present value of periodic cash flows over five years and a terminal value based on stabilized income and a market cap rate, all discounted at an unlevered internal rate of return. See Information About Net Operating Income on page 46. The Company calculates estimated gross asset values for each of its operating office assets by taking the sum of (i) the present value of periodic cash flows over five years and (ii) a terminal value based on estimated stabilized income and a market capitalization rate at stabilization, all discounted at an unlevered internal rate of return. This value, divided by the projected net operating income for a one-year period yields the year one imputed capitalization rate. Management projects the periodic cash flows over five years and the stabilized income from a combination of in-place lease contracts, prospective renewals of expiring leases and prospective lease-up of vacant space. Factors considered by management in projecting releasing and lease-up of vacant space and estimating the applicable market rental rates include: identification of leases currently being negotiated by management; historical annual leasing volumes for such property types; and comparable leases that have been executed for properties within the Company’s portfolio and for competitor buildings in similar locations. Notwithstanding the foregoing, any assets that are contemplated for sale are valued individually at indicative or at contract prices. This group represents assets removed from the Class A Suburban or Suburban buckets that are under contract for sale. 5) CLI Company Highlights 4Q 2019 9 Rentable Market Stabilized Area 4Q 2019 Year 1 Cap In-Place Rent Occupancy Stabilized Unlevered (MSF) Annualized Cash NOI Rate Rent PSF PSF Rate Cap Rate IRR Value $ PSF |

|

Notes: Net Asset Value (Unaudited) Valuations for non-core assets, which are those assets being considered for sale or disposal, or in the active marketing process, are generally based on recent contract prices for similar properties in the process of being sold, letters of intent and ongoing negotiations for properties. Wegmans and 24-Hour Fitness are in active contract negotiations for $41.0 MM less transaction costs. See Information About Net Operating Income on page 46. Valuations for properties planned for or undergoing a repositioning or repurposing utilize a projected stabilized net operating income for the asset upon completion of the repositioning/repurposing activities. After applying an estimated capitalization rate to a projected stabilized net operating income, the capitalized value is next discounted back based on the projected number of periods to re-stabilize the asset. The discount rate applied is determined based on a risk assessment of the repositioning/repurposing activities and comparable target returns in the marketplace, and further validated by outside market sources, when available for that market. Additionally, adjustments are made to the estimated value by deducting any estimated future costs necessary to complete the planned activities, as well as adding back the discounted projected interim operating cash flows expected to be generated by the property until re-stabilization has been achieved. Includes the Company's ownership interests in the Hyatt Regency Jersey City and two office joint venture properties. The value of land is based on a combination of recent or pending transactions for land parcels within our relevant markets and unrelated third parties, and sometimes may utilize land appraisals for certain markets, if available for other purposes, such as for transaction financing. Further, we consider what a land parcel’s value would need to be when combined with all other development costs to yield what we believe to be an appropriate target rate of return for a development project. The per apartment unit or per square foot office space values are derived by dividing the aggregate land value by the number of potential apartment units or square feet of office space the land can accommodate. The number of potential units or square feet of office space a land parcel can accommodate is most commonly governed by either in-place governmental approvals or density regulations set forth by existing zoning guidelines. Joint venture investments are generally valued by: applying a capitalization rate to projected NOI for the joint venture’s asset (which is similar to the process for valuing those assets wholly owned by the Company, as described above and previously), and deducting any joint venture level debt and any value allocable to joint venture partners’ interests. Includes Roseland’s last residential subordinate interest (Metropolitan at 40 Park) and commercial subordinate interests. The valuation approach for assets in-construction or lease-up are similar to that applied to assets undergoing repositioning/repurposing, as described above. After applying an estimated capitalization rate, currently ranging from 4.5% to 5.25%, to a projected stabilized net operating income, estimated to total approximately $46.6 million upon completion of the construction or lease-up activities, the Company deducts any estimated future costs totaling $565.9 million required to complete construction of the asset to arrive at an estimated value attributable to the asset. The Company then discounts the capitalized value back based on the projected number of periods to reach stabilization. The discount rate applied, currently ranging from 7% to 9.75%, is determined based on a risk assessment of the development activities and comparable target returns in the marketplace. The Company then adds back the discounted projected interim cash flows expected to be generated during the projected lease-up period to reach stabilization. Represents the discount to stabilized value applied to assets that have not yet achieved their respective Projected Stabilized NOI due to construction, lease-up or renovation. See Information About Net Operating Income on page 46. The residential valuation analysis totals to a Roseland NAV of $2,264,000,000, with the company’s share of this NAV of $1,794,000,000 (“MCRC Share”). This latter amount represents the company's share of Roseland NAV, net of the $451,000,000 attributable to Rockpoint's noncontrolling interest. The increase in the approximate NAV per share of $0.05 from September 30, 2019 to December 31, 2019 is due primarily to the retirement of shares at a discount to NAV. 6) 7) 8) 9) 10) 11) 12) 13) Information About Net Asset Value (NAV) Overall, NAV is arrived at by calculating the estimated gross asset values for each of their real estate properties, investments and other significant assets and interests, and then deducting from such amounts the corresponding net debt and third parties’ interests in the assets. Gross asset values for the operating real estate properties are calculated using the direct capitalization method by dividing projected net operating income for a one-year period by an estimated current capitalization rate for each property. For each operating property, management projects net operating income that it expects to receive for future periods from a combination of in-place lease contracts, prospective renewals of expiring leases and prospective lease-up of vacant space. Factors considered by management in projecting releasing and lease-up of vacant space and estimating the applicable market rental rates include: identification of leases currently being negotiated by management; historical annual leasing volumes for such property types; and comparable leases that have been executed for properties within the Registrants’ portfolio and for competitor buildings in similar locations. A capitalization rate is estimated for each property based on its asset class and geographic location. Estimates of capitalization rates are based on information from recent property sale transactions as well as from publicly available information regarding unrelated third-party property transactions. The use of NAV as a measure of value is subject to certain inherent limitations. The assessment of the estimated NAV of a particular property is subjective in that it involves estimates and assumptions and can be calculated using various acceptable methods. The Company’s methods of determining NAV may differ from the methods used by other companies. Accordingly, the Company’s estimated NAV may not be comparable to measures used by other companies. As with any valuation methodology, the methodologies utilized by the Company in estimating NAV are based upon a number of estimates, assumptions, judgments or opinions that may or may not prove to be correct. Capitalization rates obtained from publicly available sources also are critical to the NAV calculation and are subject to the sources selected and variability of market conditions at the time. Investors in the Company are cautioned that NAV does not represent (i) the amount at which the Company’s securities would trade at a national securities exchange, (ii) the amount that a security holder would obtain if he or she tried to sell his or her securities, (iii) the amount that a security holder would receive if the Company liquidated its assets and distributed the proceeds after paying all of their expenses and liabilities or (iv) the book value of the Company’s real estate, which is generally based on the amortized cost of the property, subject to certain adjustments. CLI Company Highlights 4Q 2019 10 |

|

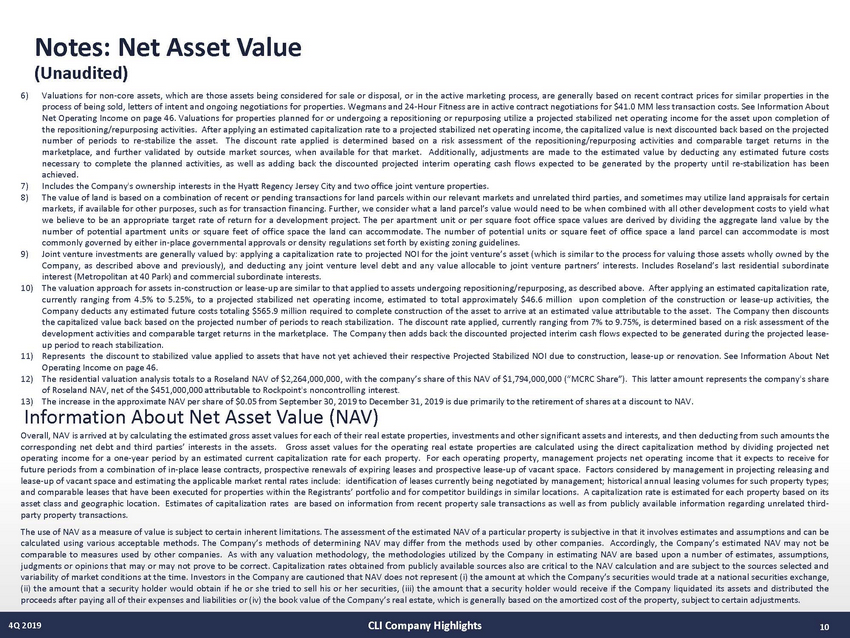

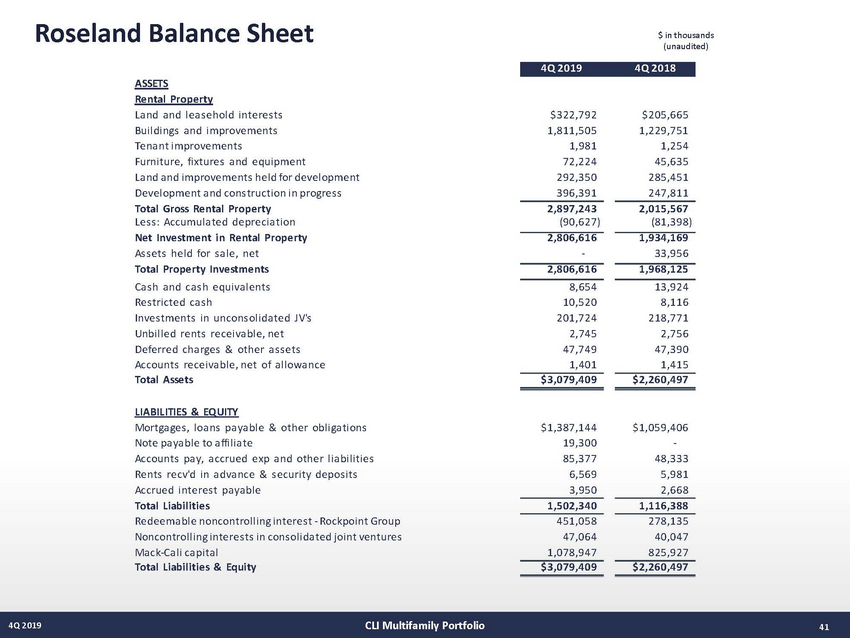

Balance Sheet ASSETS Rental property $ in thousands (unaudited) La nd a nd lea s ehold interes ts Buildings a nd improvements Tena nt improvements Furniture, fixtures a nd equipment La nd a nd improvements held for development Development a nd cons truction in progres s $475,431 3,651,937 335,028 50,653 465,929 327,039 5,306,017 (1,097,868) Les s – a ccumula ted deprecia tion a nd a mortiza tion 4,208,149 108,848 Renta l property held for s a le, net Net Investment in Rental Property Ca s h a nd ca s h equiva lents Res tricted ca s h Inves tments in uncons olida ted joint ventures Unbilled rents receiva ble, net Deferred cha rges , goodwill a nd other a s s ets , net ( 1) Accounts receiva ble Total Assets LIABILITIES & EQUITY 4,316,997 29,633 19,921 232,750 100,737 355,234 5,372 $5,060,644 Senior uns ecured notes , net Uns ecured revolving credit fa cility a nd term loa ns Mortga ges , loa ns pa ya ble a nd other obliga tions , net Note pa ya ble to a ffilia te Dividends a nd dis tributions pa ya ble Accounts pa ya ble, a ccrued expens es a nd other lia bilities Rents received in a dva nce a nd s ecurity depos its Accrued interes t pa ya ble Total Liabilities Commitments a nd contingencies Redeema ble noncontrolling interes ts Total Stockholders’/Members Equity Noncontrolling interes ts in s ubs idia ries : Opera ting Pa rtners hip Cons olida ted joint ventures Total Noncontrolling Interests in Subsidiaries Total Equity Total Liabilities and Equity $570,314 790,939 1,431,398 - 21,877 168,115 41,244 9,117 $3,033,004 - 330,459 1,486,658 168,373 42,150 210,523 1,697,181 $5,060,644 Notes: See supporting “Balance Sheet” notes on page 43 for more information. CLI Company Highlights 4Q 2019 11 4Q 2018 4Q 2019 Office/Corp. Roseland Elim./Other Total $62,218 1,060,765 161,318 6,492 6,988 61,657 $322,792 - 1,811,505 - 1,981 - 72,224 - 292,350 - 396,391 - 2,897,243 - (90,627) - 2,806,616 - - - 2,806,616 - 8,654 - 10,520 - 201,724 - 2,745 - 47,749 (19,300) 1,401 - $3,079,409 (19,300) - - - - 1,387,144 - 19,300 (19,300) - - 85,377 - 6,569 - 3,950 - $1,502,340 (19,300) 451,058 - 1,078,947 - - - 47,064 - 47,064 - 1,126,011 - $3,079,409 (19,300) $385,010 2,872,270 163,299 78,716 299,338 458,048 1,359,438 (467,990) 4,256,681 (558,617) 891,448 966,497 3,698,064 966,497 1,857,945 4,664,561 16,935 5,057 7,367 92,941 246,653 5,791 25,589 15,577 209,091 95,686 275,102 7,192 $2,232,689 $5,292,798 $571,484 329,000 520,890 - 22,265 124,133 32,894 6,235 $571,484 329,000 1,908,034 - 22,265 209,510 39,463 10,185 $1,606,901 52,324 414,752 158,480 232 $3,089,941 503,382 1,493,699 158,480 47,296 158,712 205,776 573,464 1,699,475 $2,232,689 $5,292,798 |

|

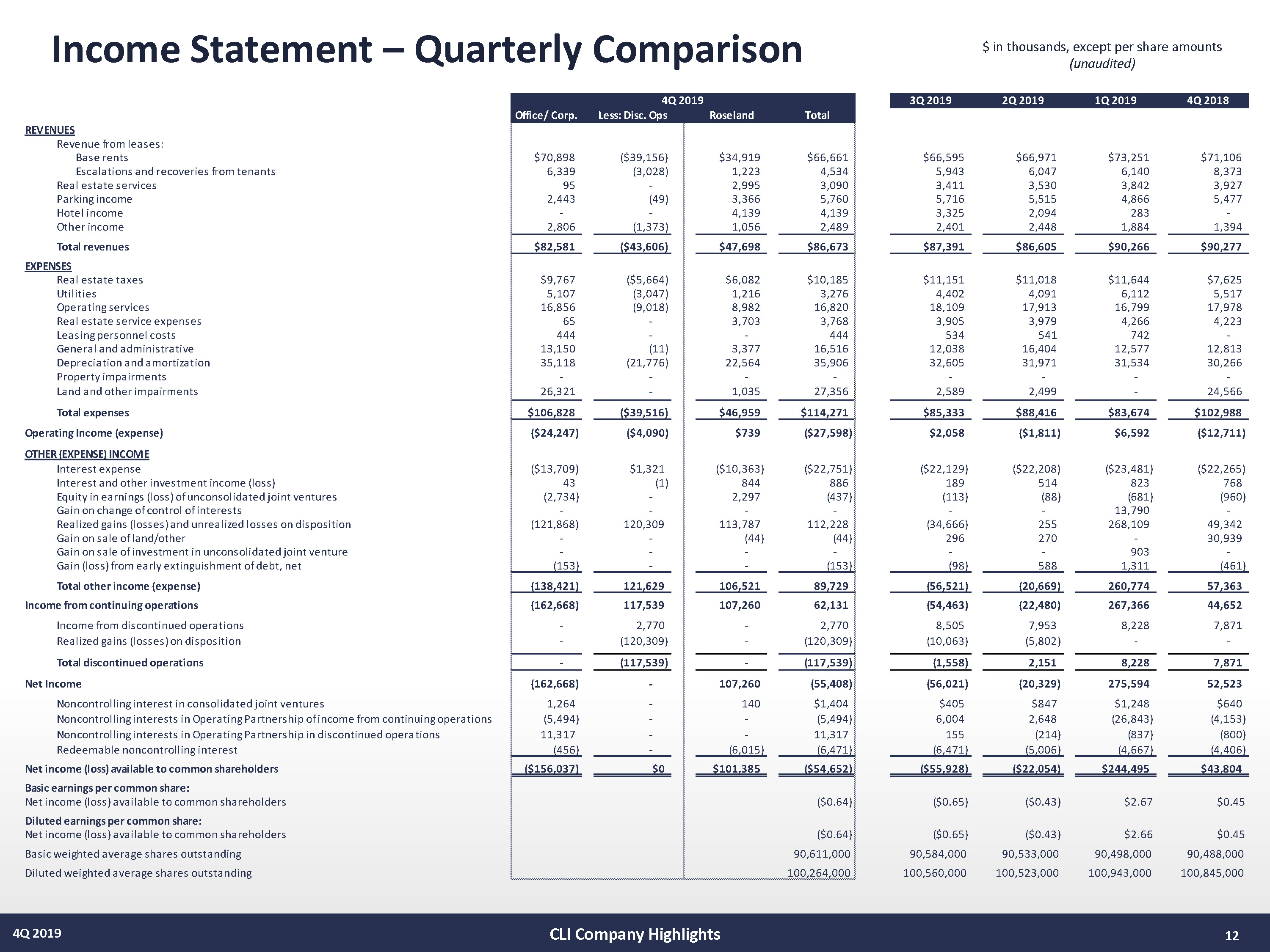

1 2 4Q 2019 Income Statement – Quarterly Comparison $ in thousands, except per share amounts (unaudited) CLI Company Highlights 3Q 2019 2Q 2019 1Q 2019 4Q 2018 Office/ Corp. Less: Disc. Ops Roseland Total REVENUES Revenue from leases: Base rents $70,898 ($39,156) $34,919 $66,661 $66,595 $66,971 $73,251 $71,106 Escalations and recoveries from tenants 6,339 (3,028) 1,223 4,534 5,943 6,047 6,140 8,373 Real estate services 95 - 2,995 3,090 3,411 3,530 3,842 3,927 Parking income 2,443 (49) 3,366 5,760 5,716 5,515 4,866 5,477 Hotel income - - 4,139 4,139 3,325 2,094 283 - Other income 2,806 (1,373) 1,056 2,489 2,401 2,448 1,884 1,394 Total revenues $82,581 ($43,606) $47,698 $86,673 $87,391 $86,605 $90,266 $90,277 EXPENSES Real estate taxes $9,767 ($5,664) $6,082 $10,185 $11,151 $11,018 $11,644 $7,625 Utilities 5,107 (3,047) 1,216 3,276 4,402 4,091 6,112 5,517 Operating services 16,856 (9,018) 8,982 16,820 18,109 17,913 16,799 17,978 Real estate service expenses 65 - 3,703 3,768 3,905 3,979 4,266 4,223 Leasing personnel costs 444 - - 444 534 541 742 - General and administrative 13,150 (11) 3,377 16,516 12,038 16,404 12,577 12,813 Depreciation and amortization 35,118 (21,776) 22,564 35,906 32,605 31,971 31,534 30,266 Property impairments - - - - - - - - Land and other impairments 26,321 - 1,035 27,356 2,589 2,499 - 24,566 Total expenses $106,828 ($39,516) $46,959 $114,271 $85,333 $88,416 $83,674 $102,988 Operating Income (expense) ($24,247) ($4,090) $739 ($27,598) $2,058 ($1,811) $6,592 ($12,711) OTHER (EXPENSE) INCOME Interest expense ($13,709) $1,321 ($10,363) ($22,751) ($22,129) ($22,208) ($23,481) ($22,265) Interest and other investment income (loss) 43 (1) 844 886 189 514 823 768 Equity in earnings (loss) of unconsolidated joint ventures (2,734) - 2,297 (437) (113) (88) (681) (960) Gain on change of control of interests - - - - - - 13,790 - Realized gains (losses) and unrealized losses on disposition (121,868) 120,309 113,787 112,228 (34,666) 255 268,109 49,342 Gain on sale of land/other - - (44) (44) 296 270 - 30,939 Gain on sale of investment in unconsolidated joint venture - - - - - - 903 - Gain (loss) from early extinguishment of debt, net (153) - - (153) (98) 588 1,311 (461) Total other income (expense) (138,421) 121,629 106,521 89,729 (56,521) (20,669) 260,774 57,363 Income from continuing operations (162,668) 117,539 107,260 62,131 (54,463) (22,480) 267,366 44,652 Income from discontinued operations - 2,770 - 2,770 8,505 7,953 8,228 7,871 Realized gains (losses) on disposition - (120,309) - (120,309) (10,063) (5,802) - - Total discontinued operations - (117,539) - (117,539) (1,558) 2,151 8,228 7,871 Net Income (162,668) - 107,260 (55,408) (56,021) (20,329) 275,594 52,523 Noncontrolling interest in consolidated joint ventures 1,264 - 140 $1,404 $405 $847 $1,248 $640 Noncontrolling interests in Operating Partnership of income from continuing operations (5,494) - - (5,494) 6,004 2,648 (26,843) (4,153) Noncontrolling interests in Operating Partnership in discontinued operations 11,317 - - 11,317 155 (214) (837) (800) Redeemable noncontrolling interest (456) - (6,015) (6,471) (6,471) (5,006) (4,667) (4,406) Net income (loss) available to common shareholders ($156,037) $0 $101,385 ($54,652) ($55,928) ($22,054) $244,495 $43,804 Basic earnings per common share: Net income (loss) available to common shareholders ($0.64) ($0.65) ($0.43) $2.67 $0.45 Diluted earnings per common share: Net income (loss) available to common shareholders ($0.64) ($0.65) ($0.43) $2.66 $0.45 Basic weighted average shares outstanding 90,611,000 90,584,000 90,533,000 90,498,000 90,488,000 Diluted weighted average shares outstanding 100,264,000 100,560,000 100,523,000 100,943,000 100,845,000 4Q 2019 |

|

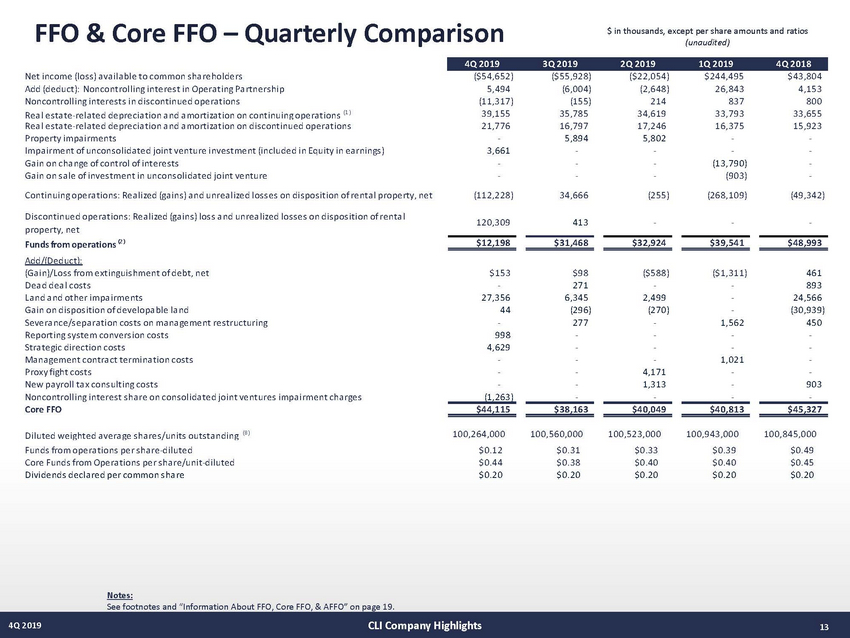

FFO & Core FFO – Quarterly Net income (los s ) a va ila ble to common s ha reholders Add (deduct): Noncontrolling interes t in Opera ting Pa rtners hip Noncontrolling interes ts in dis continued opera tions Rea l es ta te-rela ted deprecia tion a nd a mortiza tion on continuing opera tions (1 ) Rea l es ta te-rela ted deprecia tion a nd a mortiza tion on dis continued opera tions Property impa irments Comparison $ in thousands, except per share amounts and ratios (unaudited) ($54,652) 5,494 (11,317) 39,155 21,776 - 3,661 - - (112,228) ($55,928) (6,004) (155) 35,785 16,797 5,894 - - - 34,666 ($22,054) (2,648) 214 34,619 17,246 5,802 - - - (255) $244,495 26,843 837 33,793 16,375 - - (13,790) (903) (268,109) $43,804 4,153 800 33,655 15,923 - - - - (49,342) Impa irment of uncons olida ted joint venture inves tment (included in Equity in ea rnings ) Ga in on cha nge of control of interes ts Ga in on s a le of inves tment in uncons olida ted joint venture Continuing opera tions : Rea lized (ga ins ) a nd unrea lized los s es on dis pos ition of renta l property, net Dis continued opera tions : Rea lized (ga ins ) los s a nd unrea lized los s es on dis pos ition of renta l property, net Funds from operations (2 ) Add/(De duct): 120,309 413 - - - $12,198 $31,468 $32,924 $39,541 $48,993 (Ga in)/Los s from extinguis hment of debt, net Dea d dea l cos ts La nd a nd other impa irments Ga in on dis pos ition of developa ble la nd Severa nce/s epa ra tion cos ts on ma na gement res tructuring Reporting s ys tem convers ion cos ts Stra tegic direction cos ts Ma na gement contra ct termina tion cos ts Proxy fight cos ts New pa yroll ta x cons ulting cos ts Noncontrolling interes t s ha re on cons olida ted joint ventures impa irment cha rges Core FFO $153 - 27,356 44 - 998 4,629 - - - (1,263) $98 271 6,345 (296) 277 - - - - - - ($588) - 2,499 (270) - - - - 4,171 1,313 - ($1,311) - - - 1,562 - - 1,021 - - - 461 893 24,566 (30,939) 450 - - - - 903 - $44,115 $38,163 $40,049 $40,813 $45,327 Diluted weighted a vera ge s ha res /units outs ta nding (8 ) Funds from opera tions per s ha re-diluted Core Funds from Opera tions per s ha re/unit-diluted Dividends decla red per common s ha re 100,264,000 $0.12 $0.44 $0.20 100,560,000 $0.31 $0.38 $0.20 100,523,000 $0.33 $0.40 $0.20 100,943,000 $0.39 $0.40 $0.20 100,845,000 $0.49 $0.45 $0.20 Notes: See footnotes and “Information About FFO, Core FFO, & AFFO” on page 19. CLI Company Highlights 4Q 2019 13 4Q 2019 3Q 2019 2Q 2019 1Q 2019 4Q 2018 |

|

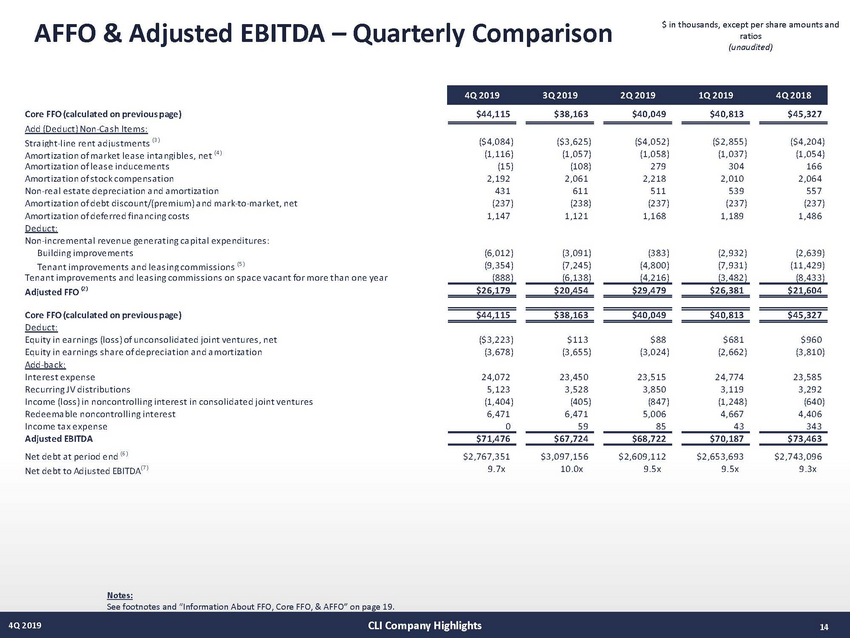

AFFO & Adjusted EBITDA – Quarterly Comparison $ in thousands, except per share amounts and ratios (unaudited) Core FFO (calculated on previous page) Add (De duct) Non-Ca s h Ite ms : $44,115 $38,163 $40,049 $40,813 $45,327 Stra ight-line rent a djus tments (3 ) Amortiza tion of ma rket lea s e inta ngibles , net (4 ) Amortiza tion of lea s e inducements Amortiza tion of s tock compens a tion Non-rea l es ta te deprecia tion a nd a mortiza tion Amortiza tion of debt dis count/(premium) a nd ma rk-to-ma rket, net Amortiza tion of deferred fina ncing cos ts De duct: ($4,084) (1,116) (15) 2,192 431 (237) 1,147 ($3,625) (1,057) (108) 2,061 611 (238) 1,121 ($4,052) (1,058) 279 2,218 511 (237) 1,168 ($2,855) (1,037) 304 2,010 539 (237) 1,189 ($4,204) (1,054) 166 2,064 557 (237) 1,486 Non-incrementa l revenue genera ting ca pita l expenditures : Building improvements Tena nt improvements a nd lea s ing commis s ions (5 ) Tena nt improvements a nd lea s ing commis s ions on s pa ce va ca nt for more tha n one yea r Adjusted FFO (2 ) (6,012) (9,354) (888) (3,091) (7,245) (6,138) (383) (4,800) (4,216) (2,932) (7,931) (3,482) (2,639) (11,429) (8,433) $26,179 $20,454 $29,479 $26,381 $21,604 Core FFO (calculated on previous page) De duct: $44,115 $38,163 $40,049 $40,813 $45,327 Equity in ea rnings (los s ) of uncons olida ted joint ventures , net Equity in ea rnings s ha re of deprecia tion a nd a mortiza tion Add-ba ck: ($3,223) (3,678) $113 (3,655) $88 (3,024) $681 (2,662) $960 (3,810) Interes t expens e Recurring JV dis tributions Income (los s ) in noncontrolling interes t in cons olida ted joint ventures Redeema ble noncontrolling interes t Income ta x expens e Adjusted EBITDA Net debt a t period end (6 ) Net debt to Adjus ted EBITDA(7 ) 24,072 5,123 (1,404) 6,471 0 23,450 3,528 (405) 6,471 59 23,515 3,850 (847) 5,006 85 24,774 3,119 (1,248) 4,667 43 23,585 3,292 (640) 4,406 343 $71,476 $67,724 $68,722 $70,187 $73,463 $2,767,351 9.7x $3,097,156 10.0x $2,609,112 9.5x $2,653,693 9.5x $2,743,096 9.3x Notes: See footnotes and “Information About FFO, Core FFO, & AFFO” on page 19. CLI Company Highlights 4Q 2019 14 4Q 2019 3Q 2019 2Q 2019 1Q 2019 4Q 2018 |

|

$ in thousands (unaudited) EBITDAre – Quarterly Net Income (los s ) a va ila ble to common s ha reholders Comparison ($54,652) ($55,928) ($22,054) $244,495 $43,804 Add/(De duct): Noncontrolling interes t in opera ting pa rtners hip Noncontrolling interes t in dis continued opera tions Noncontrolling interes t in cons olida ted joint ventures (a ) Redeema ble noncontrolling interes t Interes t expens e Income ta x expens e Deprecia tion a nd a mortiza tion De duct: 5,494 (11,317) (1,404) 6,471 24,072 1 57,684 (6,004) (155) (405) 6,471 23,450 59 49,538 (2,648) 214 (847) 5,006 23,515 85 49,352 26,843 837 (1,248) 4,667 24,774 43 48,046 4,153 800 (640) 4,406 23,586 343 46,324 Rea lized (ga ins ) los s es a nd unrea lized los s es on dis pos ition of renta l property, net (Ga in)/los s on s a le of inves tment in uncons olida ted joint ventures (Ga in)/los s on cha nge of control of interes t Equity in (ea rnings ) los s of uncons olida ted joint ventures Add: Property Impa irments Compa ny's s ha re of property NOI's in uncons olida ted joint ventures (1 ) EBITDAre Add: Los s from extinguis hment of debt, net Severa nce/Sepa ra tion cos ts on ma na gement res tructuring Ma na gement contra ct termina tion cos ts Stra tegic direction cos ts Reporting s ys tems convers ion cos t Dea d dea l cos ts La nd a nd other impa irments Ga in on dis pos ition of developa ble la nd Proxy fight cos ts New pa yroll ta x cons ulting cos ts Adjusted EBITDAre 8,081 - - 437 35,079 - - 113 (255) - - 88 (268,109) (903) (13,790) 681 (49,342) - - 960 - 12,819 5,894 9,612 5,802 9,287 - 7,385 - 9,028 $47,686 $67,724 $67,545 $73,721 $83,422 153 - - 4,629 998 - 27,356 44 - - 98 277 - - - 271 6,345 (296) - - (588) - - - - - 2,499 (270) 4,171 1,313 (1,311) 1,562 1,021 - - - - - - - 461 450 - - - 893 24,566 (30,939) - 903 $80,866 $74,419 $74,670 $74,993 $79,756 Noncontrolling interests in consolidated joint ventures (a): Ma rbella M2 a t Ma rbella Port Imperia l Ga ra ge South Port Imperia l Reta il South Res idence Inn Hotel Other cons olida ted joint ventures Net los s es in noncontrolling interes ts Add: Deprecia tion in noncontrolling interes t in cons olida ted JV's Funds from operations - noncontrolling interest in consolidated JV's Add: Interes t expens e in noncontrolling interes t in cons olida ted JV's Net operating income before debt service in consolidated JV's (44) (51) (18) (8) - (1,283) (115) (234) (42) 5 - (19) (209) (560) (50) 12 - (40) (583) (496) (94) (7) (19) (49) (590) - (5) (4) - (41) ($1,404) ($405) ($847) ($1,248) ($640) 645 838 1,424 1,522 955 ($759) $433 $577 $274 $315 806 806 806 691 484 $47 $1,239 $1,383 $965 $799 Notes: (1)See unconsolidated joint venture NOI details on page 25 for 4Q 2019. See Information About EBITDAre on page 19. CLI Company Highlights 4Q 2019 15 4Q 2019 3Q 2019 2Q 2019 1Q 2019 4Q 2018 |

|

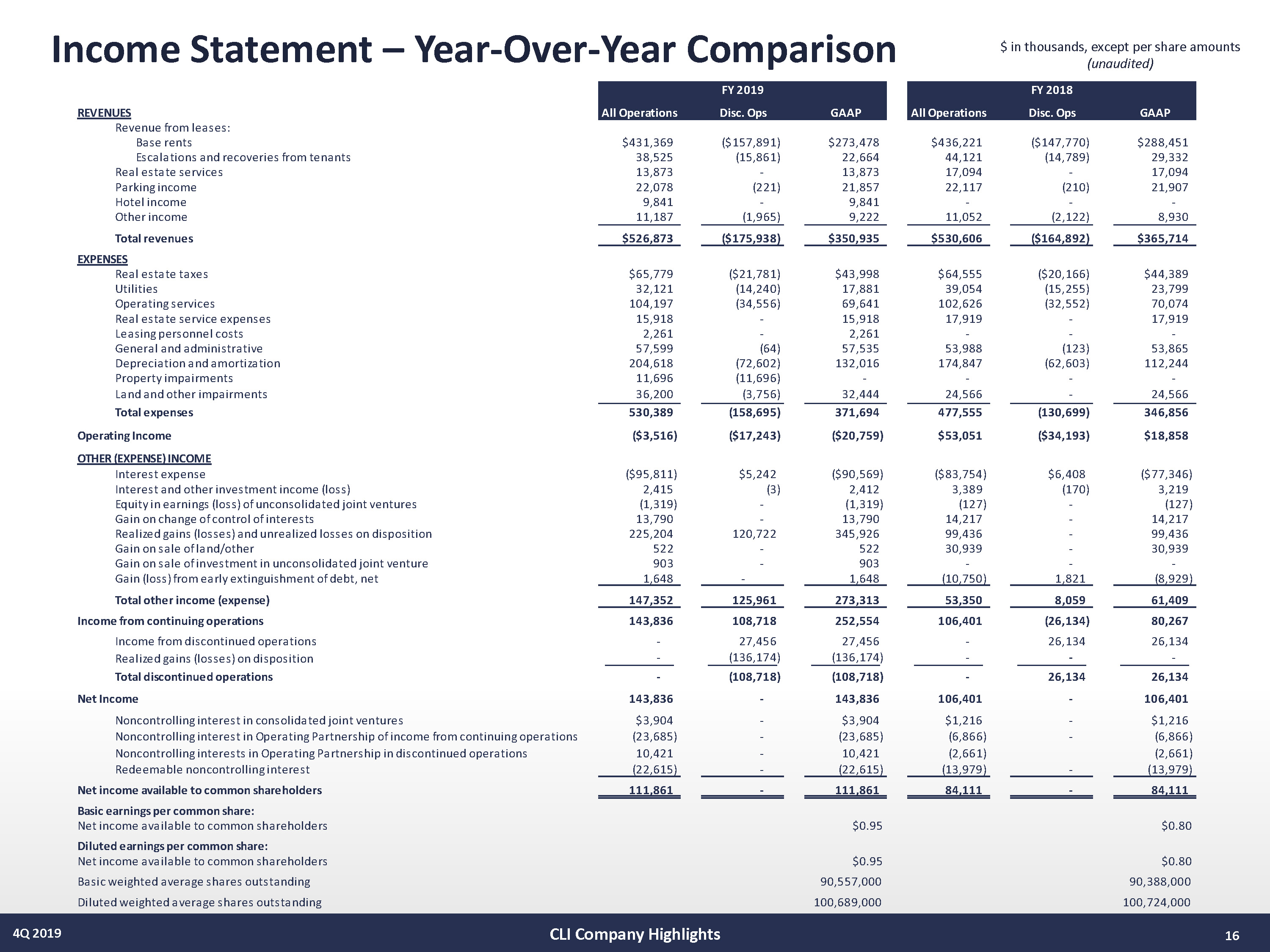

16 4Q 2019 Income Statement – Year - Over - Year Comparison $ in thousands, except per share amounts (unaudited) CLI Company Highlights REVENUES All Operations Disc. Ops GAAP All Operations Disc. Ops GAAP Revenue from leases: Base rents $431,369 ($157,891) $273,478 $436,221 ($147,770) $288,451 Escalations and recoveries from tenants 38,525 (15,861) 22,664 44,121 (14,789) 29,332 Real estate services 13,873 - 13,873 17,094 - 17,094 Parking income 22,078 (221) 21,857 22,117 (210) 21,907 Hotel income 9,841 - 9,841 - - - Other income 11,187 (1,965) 9,222 11,052 (2,122) 8,930 Total revenues $526,873 ($175,938) $350,935 $530,606 ($164,892) $365,714 EXPENSES Real estate taxes $65,779 ($21,781) $43,998 $64,555 ($20,166) $44,389 Utilities 32,121 (14,240) 17,881 39,054 (15,255) 23,799 Operating services 104,197 (34,556) 69,641 102,626 (32,552) 70,074 Real estate service expenses 15,918 - 15,918 17,919 - 17,919 Leasing personnel costs 2,261 - 2,261 - - - General and administrative 57,599 (64) 57,535 53,988 (123) 53,865 Depreciation and amortization 204,618 (72,602) 132,016 174,847 (62,603) 112,244 Property impairments 11,696 (11,696) - - - - Land and other impairments 36,200 (3,756) 32,444 24,566 - 24,566 Total expenses 530,389 (158,695) 371,694 477,555 (130,699) 346,856 Operating Income ($3,516) ($17,243) ($20,759) $53,051 ($34,193) $18,858 OTHER (EXPENSE) INCOME Interest expense ($95,811) $5,242 ($90,569) ($83,754) $6,408 ($77,346) Interest and other investment income (loss) 2,415 (3) 2,412 3,389 (170) 3,219 Equity in earnings (loss) of unconsolidated joint ventures (1,319) - (1,319) (127) - (127) Gain on change of control of interests 13,790 - 13,790 14,217 - 14,217 Realized gains (losses) and unrealized losses on disposition 225,204 120,722 345,926 99,436 - 99,436 Gain on sale of land/other 522 - 522 30,939 - 30,939 Gain on sale of investment in unconsolidated joint venture 903 - 903 - - - Gain (loss) from early extinguishment of debt, net 1,648 - 1,648 (10,750) 1,821 (8,929) Total other income (expense) 147,352 125,961 273,313 53,350 8,059 61,409 Income from continuing operations 143,836 108,718 252,554 106,401 (26,134) 80,267 Income from discontinued operations - 27,456 27,456 - 26,134 26,134 Realized gains (losses) on disposition - (136,174) (136,174) - - - Total discontinued operations - (108,718) (108,718) - 26,134 26,134 Net Income 143,836 - 143,836 106,401 - 106,401 Noncontrolling interest in consolidated joint ventures $3,904 - $3,904 $1,216 - $1,216 Noncontrolling interest in Operating Partnership of income from continuing operations (23,685) - (23,685) (6,866) - (6,866) Noncontrolling interests in Operating Partnership in discontinued operations 10,421 - 10,421 (2,661) (2,661) Redeemable noncontrolling interest (22,615) - (22,615) (13,979) - (13,979) Net income available to common shareholders 111,861 - 111,861 84,111 - 84,111 Basic earnings per common share: Net income available to common shareholders $0.95 $0.80 Diluted earnings per common share: Net income available to common shareholders $0.95 $0.80 Basic weighted average shares outstanding 90,557,000 90,388,000 Diluted weighted average shares outstanding 100,689,000 100,724,000 FY 2019 FY 2018 |

|

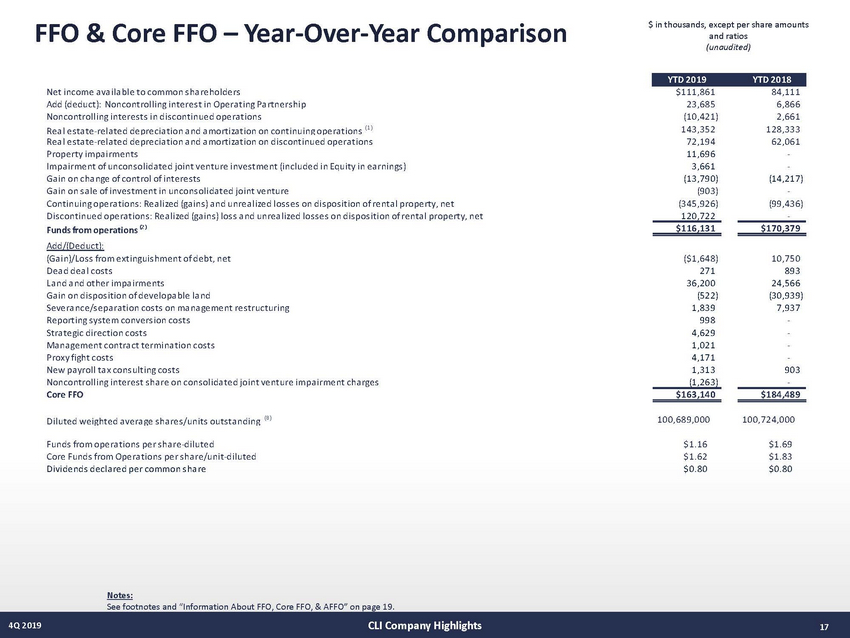

FFO & Core FFO – Year-Over-Year Comparison $ in thousands, except per share amounts and ratios (unaudited) Net income a va ila ble to common s ha reholders Add (deduct): Noncontrolling interes t in Opera ting Pa rtners hip Noncontrolling interes ts in dis continued opera tions Rea l es ta te-rela ted deprecia tion a nd a mortiza tion on continuing opera tions (1 ) Rea l es ta te-rela ted deprecia tion a nd a mortiza tion on dis continued opera tions Property impa irments Impa irment of uncons olida ted joint venture inves tment (included in Equity in ea rnings ) Ga in on cha nge of control of interes ts Ga in on s a le of inves tment in uncons olida ted joint venture Continuing opera tions : Rea lized (ga ins ) a nd unrea lized los s es on dis pos ition of renta l property, net Dis continued opera tions : Rea lized (ga ins ) los s a nd unrea lized los s es on dis pos ition of renta l property, net Funds from operations (2 ) Add/(De duct): $111,861 23,685 (10,421) 143,352 72,194 11,696 3,661 (13,790) (903) (345,926) 120,722 84,111 6,866 2,661 128,333 62,061 - - (14,217) - (99,436) - $116,131 $170,379 (Ga in)/Los s from extinguis hment of debt, net Dea d dea l cos ts La nd a nd other impa irments Ga in on dis pos ition of developa ble la nd Severa nce/s epa ra tion cos ts on ma na gement res tructuring Reporting s ys tem convers ion cos ts Stra tegic direction cos ts Ma na gement contra ct termina tion cos ts Proxy fight cos ts New pa yroll ta x cons ulting cos ts Noncontrolling interes t s ha re on cons olida ted joint venture impa irment cha rges Core FFO ($1,648) 271 36,200 (522) 1,839 998 4,629 1,021 4,171 1,313 (1,263) 10,750 893 24,566 (30,939) 7,937 - - - - 903 - $163,140 $184,489 Diluted weighted a vera ge s ha res /units outs ta nding (8 ) 100,689,000 100,724,000 Funds from opera tions per s ha re-diluted Core Funds from Opera tions per s ha re/unit-diluted Dividends decla red per common s ha re $1.16 $1.62 $0.80 $1.69 $1.83 $0.80 Notes: See footnotes and “Information About FFO, Core FFO, & AFFO” on page 19. CLI Company Highlights 4Q 2019 17 YTD 2019 YTD 2018 |

|

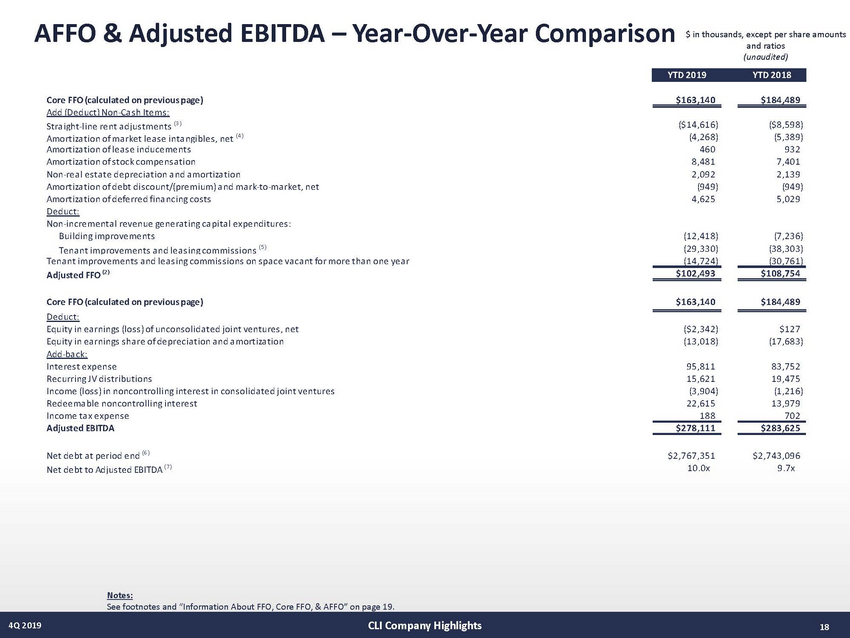

AFFO & Adjusted EBITDA – Year-Over-Year Comparison $ in thousands, except per share amounts and ratios (unaudited) Core FFO (calculated on previous page) Add (De duct) Non-Ca s h Ite ms : $163,140 $184,489 Stra ight-line rent a djus tments (3 ) Amortiza tion of ma rket lea s e inta ngibles , net (4 ) Amortiza tion of lea s e inducements Amortiza tion of s tock compens a tion Non-rea l es ta te deprecia tion a nd a mortiza tion Amortiza tion of debt dis count/(premium) a nd ma rk-to-ma rket, net Amortiza tion of deferred fina ncing cos ts De duct: ($14,616) (4,268) 460 8,481 2,092 (949) 4,625 ($8,598) (5,389) 932 7,401 2,139 (949) 5,029 Non-incrementa l revenue genera ting ca pita l expenditures : Building improvements Tena nt improvements a nd lea s ing commis s ions (5 ) Tena nt improvements a nd lea s ing commis s ions on s pa ce va ca nt for more tha n one yea r Adjusted FFO (2 ) (12,418) (29,330) (14,724) (7,236) (38,303) (30,761) $102,493 $108,754 Core FFO (calculated on previous page) De duct: $163,140 $184,489 Equity in ea rnings (los s ) of uncons olida ted joint ventures , net Equity in ea rnings s ha re of deprecia tion a nd a mortiza tion Add-ba ck: ($2,342) (13,018) $127 (17,683) Interes t expens e Recurring JV dis tributions Income (los s ) in noncontrolling interes t in cons olida ted joint ventures Redeema ble noncontrolling interes t Income ta x expens e Adjusted EBITDA 95,811 15,621 (3,904) 22,615 188 83,752 19,475 (1,216) 13,979 702 $278,111 $283,625 Net debt a t period end (6 ) Net debt to Adjus ted EBITDA (7 ) $2,767,351 10.0x $2,743,096 9.7x Notes: See footnotes and “Information About FFO, Core FFO, & AFFO” on page 19. CLI Company Highlights 4Q 2019 18 YTD 2019 YTD 2018 |

|

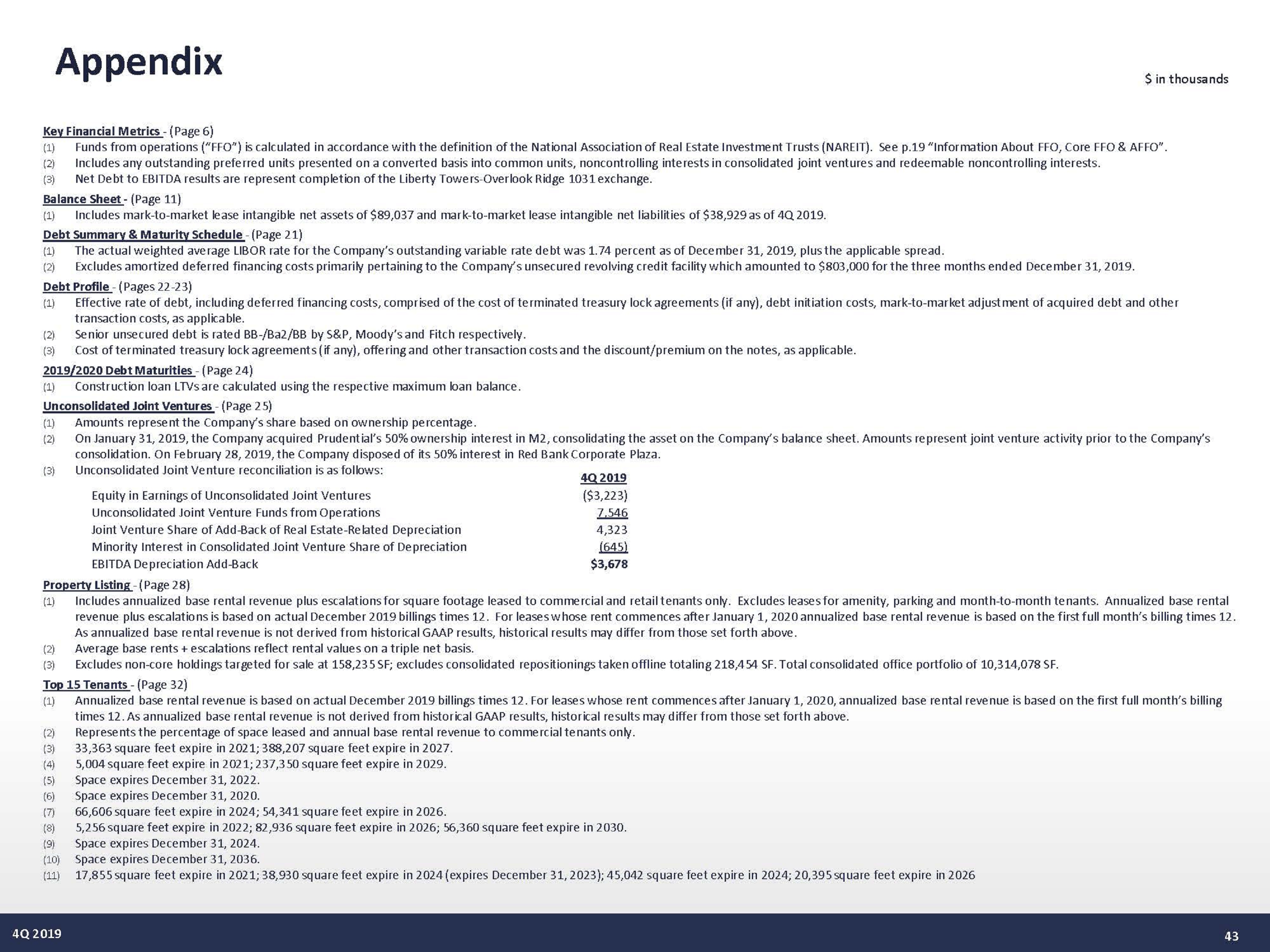

FFO, Core FFO & AFFO (Notes) Notes (1) Includes the Company’s share from unconsolidated joint ventures, and adjustments for noncontrolling interest, of $3,677 and $3,810 for the three months ended December 31, 2019 and 2018, respectively, and $13,018 and $17,683 for the twelve months ended December 31, 2019 and 2018, respectively. Excludes non-real estate-related depreciation and amortization of $431 and $557 for the three months ended December 31, 2019 and 2018, respectively, and $2,092 and $2,139 for the twelve months ended December 31, 2019 and 2018, respectively. (2) Funds from operations is calculated in accordance with the definition of FFO of the National Association of Real Estate Investment Trusts (NAREIT). See “Information About FFO, Core FFO and AFFO” below. (3) Includes free rent of $5,329 and $4,428 for the three months ended December 31, 2019 and 2018, respectively, and $21,424 and $16,545 for the twelve months ended December 31, 2019 and 2018, respectively. Also includes the Company's share from unconsolidated joint ventures of $186 and ($165) for the three months ended December 31, 2019 and 2018, respectively, and $127 and ($955) for the twelve months ended December 31, 2019 and 2018, respectively. (4) Includes the Company's share from unconsolidated joint ventures of $0 and $0 for the three months ended December 31, 2019 and 2018, respectively, and $0 and $107 for the twelve months ended December 31, 2019 and 2018, respectively. (5) Excludes expenditures for tenant spaces in properties that have not been owned by the Company for at least a year. (6) Net Debt calculated by taking the sum of senior unsecured notes, unsecured revolving credit facility, and mortgages, loans payable and other obligations, and deducting cash and cash equivalents and restricted cash, all at period end. (7) Net Debt to EBITDA results represent completion of the Liberty Towers-Overlook Ridge 1031 exchange. (8) Calculated based on weighted average common shares outstanding, assuming redemption of Operating Partnership common units into common shares 9,530 and 10,176 for the three months ended December 31, 2019 and 2018, respectively, and 9,852 and 10,204 for the twelve months ended December 31, 2019 and 2018, respectively). Information About FFO, Core FFO and AFFO Funds from operations (“FFO”) is defined as net income (loss) before noncontrolling interests of unitholders, computed in accordance with generally accepted accounting principles (“GAAP”), excluding gains or losses from depreciable rental property transactions (including both acquisitions and dispositions), and impairments related to depreciable rental property, plus real estate-related depreciation and amortization. The Company believes that FFO per share is helpful to investors as one of several measures of the performance of an equity REIT. The Company further believes that as FFO per share excludes the effect of depreciation, gains (or losses) from property transactions and impairments related to depreciable rental property (all of which are based on historical costs which may be of limited relevance in evaluating current performance), FFO per share can facilitate comparison of operating performance between equity REITs. FFO per share should not be considered as an alternative to net income available to common shareholders per share as an indication of the Company’s performance or to cash flows as a measure of liquidity. FFO per share presented herein is not necessarily comparable to FFO per share presented by other real estate companies due to the fact that not all real estate companies use the same definition. However, the Company’s FFO per share is comparable to the FFO per share of real estate companies that use the current definition of the National Association of Real Estate Investment Trusts (“NAREIT”). A reconciliation of net income per share to FFO per share is included in the financial tables above. Core FFO is defined as FFO, as adjusted for items that may distort the comparative measurement of the Company’s performance over time. Adjusted FFO ("AFFO") is defined as Core FFO less (i) recurring tenant improvements, leasing commissions and capital expenditures, (ii) straight-line rents and amortization of acquired above/below-market leases, net, and (iii) other non-cash income, plus (iv) other non-cash charges. Core FFO and AFFO are both non-GAAP financial measures that are not intended to represent cash flow and are not indicative of cash flows provided by operating activities as determined in accordance with GAAP. Core FFO and AFFO are presented solely as supplemental disclosures that the Company’s management believes provides useful information regarding the Company's operating performance and its ability to fund its dividends. There are not generally accepted definitions established for Core FFO or AFFO. Therefore, the Company's measures of Core FFO and AFFO may not be comparable to the Core FFO and AFFO reported by other REITs. A reconciliation of net income to Core FFO and AFFO are included in the financial tables above. Information About EBITDAre EBITDAre is a non-GAAP financial measure. The Company computes EBITDAre in accordance with standards established by the National Association of Real Estate Investment Trusts, or NAREIT, which may not be comparable to EBITDAre reported by other REITs that do not compute EBITDAre in accordance with the NAREIT definition, or that interpret the NAREIT definition differently than the Company does. The White Paper on EBITDAre approved by the Board of Governors of NAREIT in September 2017 defines EBITDAre as net income (loss) (computed in accordance with Generally Accepted Accounting Principles, or GAAP), plus interest expense, plus income tax expense, plus depreciation and amortization, plus (minus) losses and gains on the disposition of depreciated property, plus impairment write-downs of depreciated property and investments in unconsolidated joint ventures, plus adjustments to reflect the entity's share of EBITDAre of unconsolidated joint ventures. The Company presents EBITDAre, because the Company believes that EBITDAre, along with cash flow from operating activities, investing activities and financing activities, provides investors with an additional indicator of the Company’s ability to incur and service debt. EBITDAre should not be considered as an alternative to net income (determined in accordance with GAAP), as an indication of the Company’s financial performance, as an alternative to net cash flows from operating activities (determined in accordance with GAAP), or as a measure of the Company’s liquidity. CLI Company Highlights 4Q 2019 19 |

|

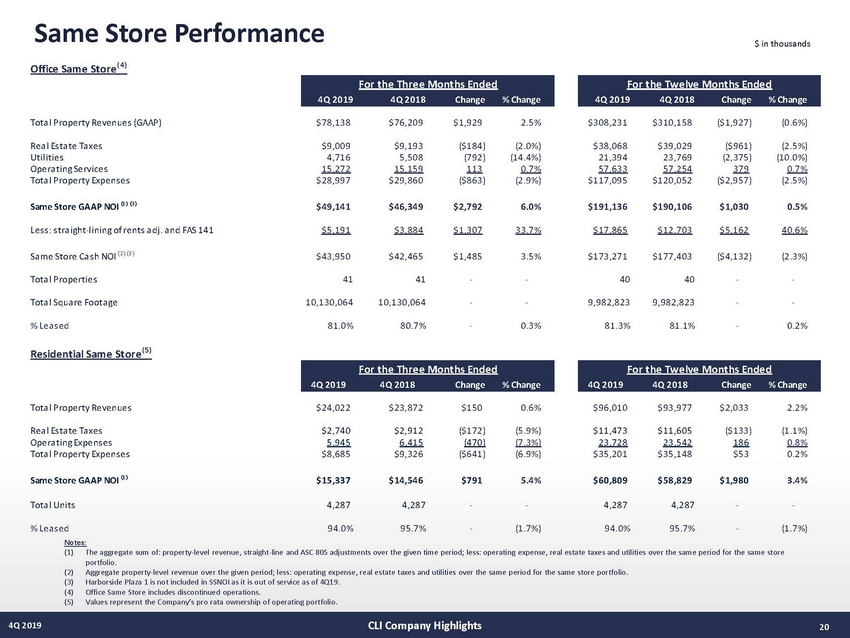

Same Store Office Same Store (4 ) Performance $ in thousands Tota l Property Revenues (GAAP) $78,138 $76,209 $1,929 2.5% $308,231 $310,158 ($1,927) (0.6%) Rea l Es ta te Ta xes Utilities Opera ting Services Tota l Property Expens es $9,009 4,716 15,272 $28,997 $9,193 5,508 15,159 $29,860 ($184) (792) 113 ($863) (2.0%) (14.4%) 0.7% (2.9%) $38,068 21,394 57,633 $117,095 $39,029 23,769 57,254 $120,052 ($961) (2,375) 379 ($2,957) (2.5%) (10.0%) 0.7% (2.5%) Same Store GAAP NOI (1 ) (3 ) $49,141 $46,349 $2,792 6.0% $191,136 $190,106 $1,030 0.5% Les s : s tra ight-lining of rents a dj. a nd FAS 141 $5,191 $3,884 $1,307 33.7% $17,865 $12,703 $5,162 40.6% Sa me Store Ca s h NOI (2 ) (3 ) $43,950 $42,465 $1,485 3.5% $173,271 $177,403 ($4,132) (2.3%) Tota l Properties 41 41 - - 40 40 - - Tota l Squa re Foota ge 10,130,064 10,130,064 - - 9,982,823 9,982,823 - - % Lea s ed 81.0% 80.7% - 0.3% 81.3% 81.1% - 0.2% Residential Same Store (5 ) Tota l Property Revenues $24,022 $23,872 $150 0.6% $96,010 $93,977 $2,033 2.2% Rea l Es ta te Ta xes Opera ting Expens es Tota l Property Expens es $2,740 5,945 $8,685 $2,912 6,415 $9,326 ($172) (470) ($641) (5.9%) (7.3%) (6.9%) $11,473 23,728 $35,201 $11,605 23,542 $35,148 ($133) 186 $53 (1.1%) 0.8% 0.2% Same Store GAAP NOI (1 ) $15,337 $14,546 $791 5.4% $60,809 $58,829 $1,980 3.4% Tota l Units 4,287 4,287 - - 4,287 4,287 - - % Lea s ed Notes: 94.0% 95.7% - (1.7%) 94.0% 95.7% - (1.7%) (1) The aggregate sum of: property-level revenue, straight-line and ASC 805 adjustments over the given time period; less: operating expense, real estate taxes and utilities over the same period for the same store portfolio. Aggregate property-level revenue over the given period; less: operating expense, real estate taxes and utilities over the same period for the same store portfolio. Harborside Plaza 1 is not included in SSNOI as it is out of service as of 4Q19. Office Same Store includes discontinued operations. Values represent the Company’s pro rata ownership of operating portfolio. (2) (3) (4) (5) CLI Company Highlights 4Q 2019 20 For the Twelve Months Ended 4Q 2019 4Q 2018 Change % Change For the Three Months Ended 4Q 2019 4Q 2018 Change % Change For the Twelve Months Ended 4Q 2019 4Q 2018 Change % Change For the Three Months Ended 4Q 2019 4Q 2018 Change % Change |

|

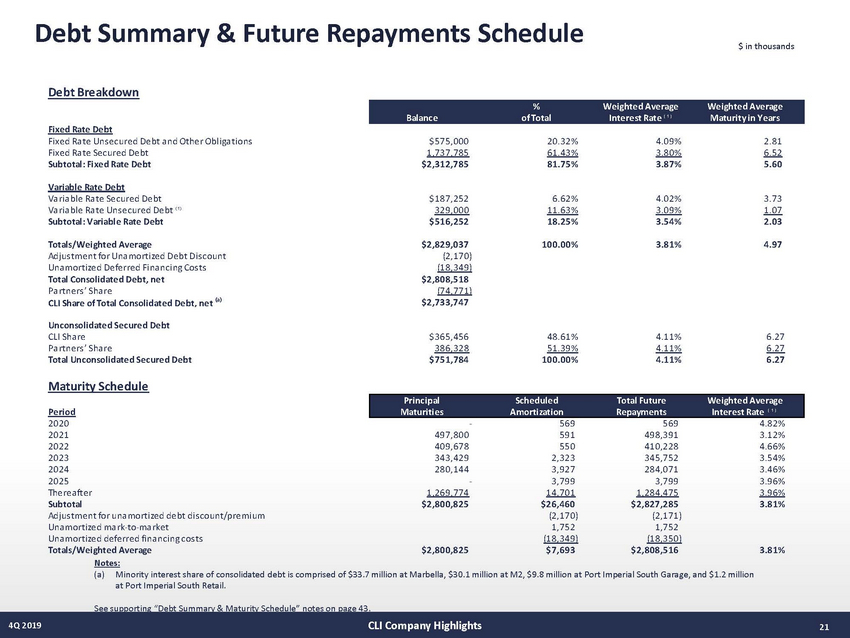

Debt Summary & Future Repayments Schedule $ in thousands Debt Breakdown Fixed Rate Debt Fixed Ra te Uns ecured Debt a nd Other Obliga tions Fixed Ra te Secured Debt Subtotal: Fixed Rate Debt $575,000 1,737,785 $2,312,785 20.32% 61.43% 81.75% 4.09% 3.80% 3.87% 2.81 6.52 5.60 Variable Rate Debt Va ria ble Ra te Secured Debt Va ria ble Ra te Uns ecured Debt ( 1) Subtotal: Variable Rate Debt $187,252 329,000 $516,252 6.62% 11.63% 18.25% 4.02% 3.09% 3.54% 3.73 1.07 2.03 Totals/Weighted Average Adjus tment for Una mortized Debt Dis count Una mortized Deferred Fina ncing Cos ts Total Consolidated Debt, net Pa rtners ’ Sha re CLI Share of Total Consolidated Debt, net (a) $2,829,037 (2,170) (18,349) $2,808,518 (74,771) $2,733,747 100.00% 3.81% 4.97 Unconsolidated Secured Debt CLI Sha re Pa rtners ’ Sha re Total Unconsolidated Secured Debt $365,456 386,328 $751,784 48.61% 51.39% 100.00% 4.11% 4.11% 4.11% 6.27 6.27 6.27 Maturity Schedule Period 2020 2021 2022 2023 2024 2025 Therea fter Subtotal Adjus tment for una mortized debt dis count/premium Una mortized ma rk-to-ma rket Una mortized deferred fina ncing cos ts Totals/Weighted Average Notes: - 569 591 550 2,323 3,927 3,799 14,701 $26,460 (2,170) 1,752 (18,349) $7,693 569 498,391 410,228 345,752 284,071 3,799 1,284,475 $2,827,285 (2,171) 1,752 (18,350) $2,808,516 4.82% 3.12% 4.66% 3.54% 3.46% 3.96% 3.96% 3.81% 497,800 409,678 343,429 280,144 - 1,269,774 $2,800,825 $2,800,825 3.81% (a) Minority interest share of consolidated debt is comprised of $33.7 million at Marbella, $30.1 million at M2, $9.8 million at Port Imperial South Garage, and $1.2 million at Port Imperial South Retail. See supporting “Debt Summary & Maturity Schedule” notes on page 43. CLI Company Highlights 4Q 2019 21 Principal Scheduled Total Future Weighted Average Maturities Amortization Repayments Interest Rate ( 1 ) % Weighted Average Weighted Average Balance of Total Interest Rate ( 1 ) Maturity in Years |

|

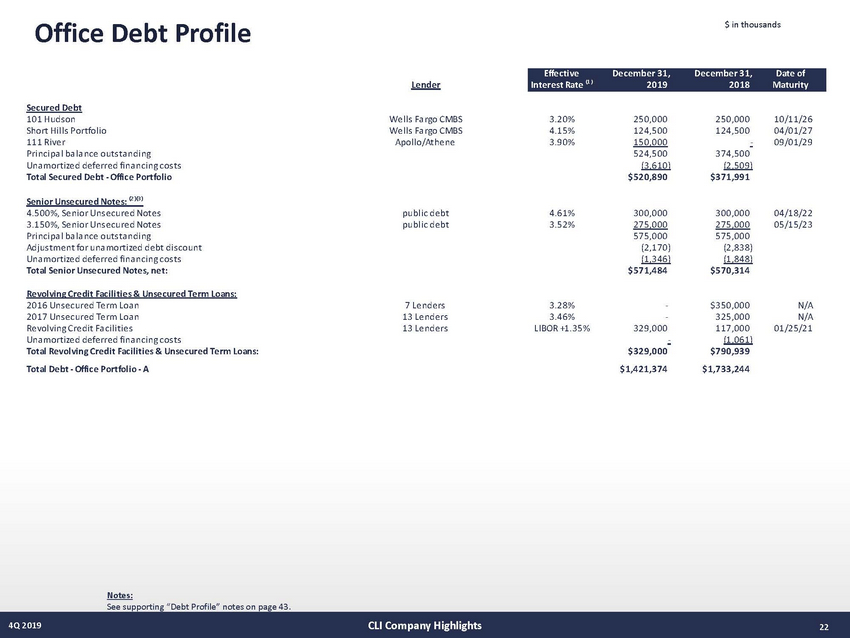

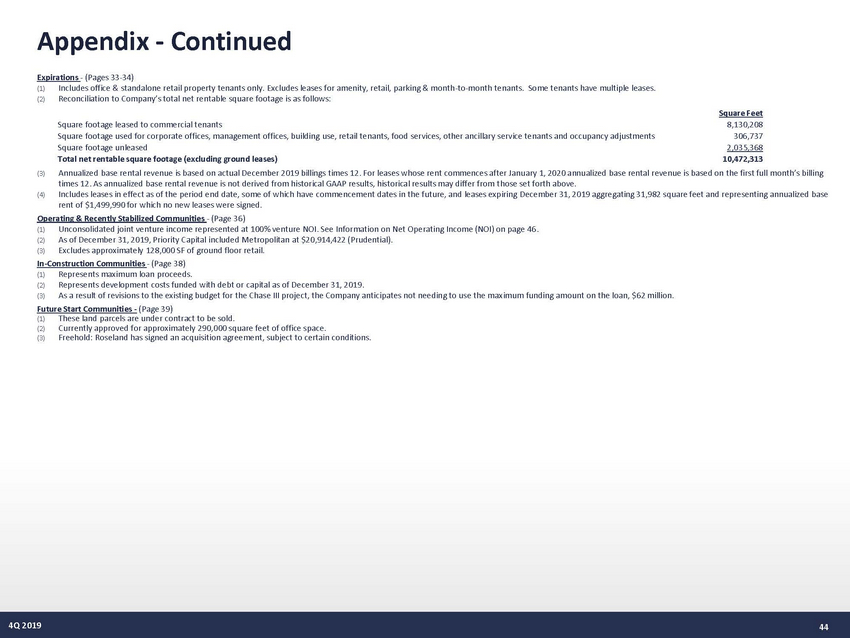

Office Debt Profile $ in thousands Lender Secured Debt 101 Huds on Short Hills Portfolio 111 River Principa l ba la nce outs ta nding Una mortized deferred fina ncing cos ts Total Secured Debt - Office Portfolio Wells Fa rgo CMBS Wells Fa rgo CMBS Apollo/Athene 3.20% 4.15% 3.90% 250,000 124,500 150,000 524,500 (3,610) $520,890 250,000 124,500 10/11/26 04/01/27 09/01/29 - 374,500 (2,509) $371,991 Senior Unsecured Notes: (2 )(3 ) 4.500%, Senior Uns ecured Notes 3.150%, Senior Uns ecured Notes Principa l ba la nce outs ta nding Adjus tment for una mortized debt dis count Una mortized deferred fina ncing cos ts Total Senior Unsecured Notes, net: public debt public debt 4.61% 3.52% 300,000 275,000 575,000 (2,170) (1,346) $571,484 300,000 275,000 575,000 (2,838) (1,848) $570,314 04/18/22 05/15/23 Revolving Credit Facilities & Unsecured Term Loans: 2016 Uns ecured Term Loa n 2017 Uns ecured Term Loa n Revolving Credit Fa cilities Una mortized deferred fina ncing cos ts Total Revolving Credit Facilities & Unsecured Term Loans: Total Debt - Office Portfolio - A 7 Lenders 13 Lenders 13 Lenders 3.28% 3.46% LIBOR +1.35% - - 329,000 - $350,000 325,000 117,000 (1,061) $790,939 $1,733,244 N/A N/A 01/25/21 $329,000 $1,421,374 Notes: See supporting “Debt Profile” notes on page 43. CLI Company Highlights 4Q 2019 22 Effective December 31, December 31, Date of Interest Rate (1 ) 2019 2018 Maturity |

|

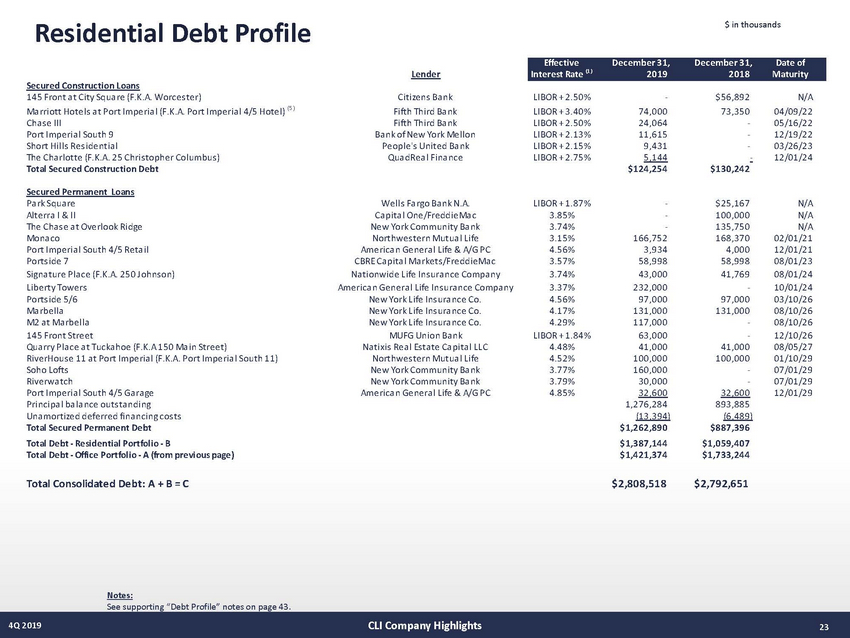

Residential Debt Profile $ in thousands Lender Secured Construction Loans 145 Front a t City Squa re (F.K.A. Worces ter) Ma rriott Hotels a t Port Imperia l (F.K.A. Port Imperia l 4/5 Hotel) (5 ) Cha s e III Port Imperia l South 9 Short Hills Res identia l The Cha rlotte (F.K.A. 25 Chris topher Columbus ) Total Secured Construction Debt Citizens Ba nk Fifth Third Ba nk Fifth Third Ba nk Ba nk of New York Mellon People's United Ba nk Qua dRea l Fina nce LIBOR + 2.50% LIBOR + 3.40% LIBOR + 2.50% LIBOR + 2.13% LIBOR + 2.15% LIBOR + 2.75% - 74,000 24,064 11,615 9,431 5,144 $124,254 $56,892 73,350 - - - - N/A 04/09/22 05/16/22 12/19/22 03/26/23 12/01/24 $130,242 Secured Permanent Loans Pa rk Squa re Alterra I & II The Cha s e a t Overlook Ridge Mona co Port Imperia l South 4/5 Reta il Ports ide 7 Signa ture Pla ce (F.K.A. 250 Johns on) Liberty Towers Ports ide 5/6 Ma rbella M2 a t Ma rbella 145 Front Street Qua rry Pla ce a t Tucka hoe (F.K.A 150 Ma in Street) RiverHous e 11 a t Port Imperia l (F.K.A. Port Imperia l South 11) Soho Lofts Riverwa tch Port Imperia l South 4/5 Ga ra ge Principa l ba la nce outs ta nding Una mortized deferred fina ncing cos ts Total Secured Permanent Debt Total Debt - Residential Portfolio - B Total Debt - Office Portfolio - A (from previous page) Wells Fa rgo Ba nk N.A. Ca pita l One/FreddieMa c New York Community Ba nk Northwes tern Mutua l Life America n Genera l Life & A/G PC CBRE Ca pita l Ma rkets /FreddieMa c Na tionwide Life Ins ura nce Compa ny America n Genera l Life Ins ura nce Compa ny New York Life Ins ura nce Co. New York Life Ins ura nce Co. New York Life Ins ura nce Co. MUFG Union Ba nk Na tixis Rea l Es ta te Ca pita l LLC Northwes tern Mutua l Life New York Community Ba nk New York Community Ba nk America n Genera l Life & A/G PC LIBOR + 1.87% 3.85% 3.74% 3.15% 4.56% 3.57% 3.74% 3.37% 4.56% 4.17% 4.29% LIBOR + 1.84% 4.48% 4.52% 3.77% 3.79% 4.85% - - - 166,752 3,934 58,998 43,000 232,000 97,000 131,000 117,000 63,000 41,000 100,000 160,000 30,000 32,600 1,276,284 (13,394) $1,262,890 $1,387,144 $1,421,374 $25,167 100,000 135,750 168,370 4,000 58,998 41,769 - 97,000 131,000 - - 41,000 100,000 - - 32,600 893,885 (6,489) $887,396 $1,059,407 $1,733,244 N/A N/A N/A 02/01/21 12/01/21 08/01/23 08/01/24 10/01/24 03/10/26 08/10/26 08/10/26 12/10/26 08/05/27 01/10/29 07/01/29 07/01/29 12/01/29 Total Consolidated Debt: A + B = C $2,808,518 $2,792,651 Notes: See supporting “Debt Profile” notes on page 43. CLI Company Highlights 4Q 2019 23 Effective December 31, December 31, Date of Interest Rate (1 ) 2019 2018 Maturity |

|

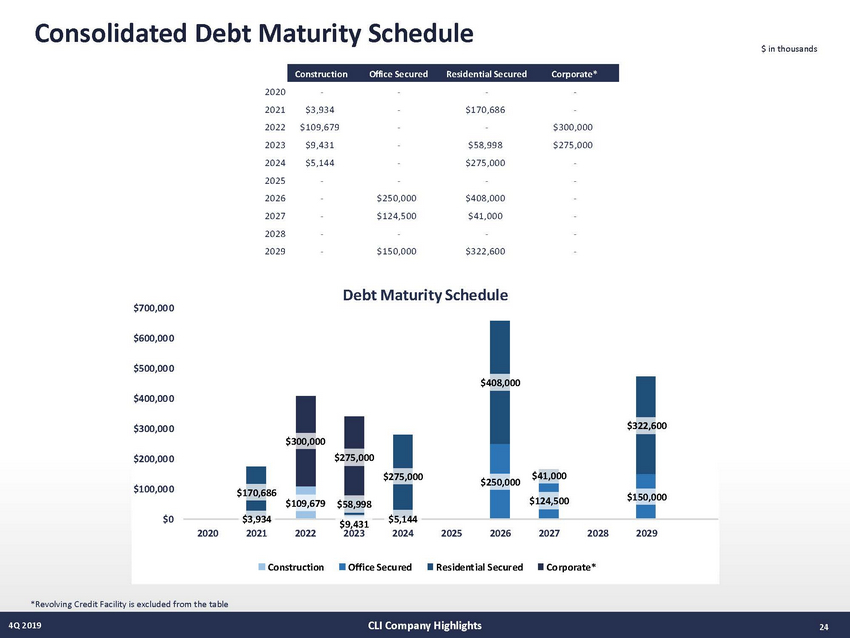

Consolidated Debt Maturity Schedule $ in thousands 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 - $3,934 $109,679 $9,431 $5,144 - - - - - - - - - - - $250,000 $124,500 - $150,000 - $170,686 - $58,998 $275,000 - $408,000 $41,000 - $322,600 - - $300,000 $275,000 - - - - - - Debt Maturity Schedule $700,00 0 $600,00 0 $500,00 0 $408,000 $400,00 0 $322,600 $300,00 0 $300,000 $275,000 $200,00 0 $41,000 $275,000 $250,000 $100,00 0 $170,686 $109,679 $58,998 $0 $3,934 $5,144 $9,431 2023 2020 2021 2022 2024 2025 2026 2027 2028 2029 Construction Office Secured Resident ial Secur ed Corporate* *Revolving Credit Facility is excluded from the table CLI Company Highlights 4Q 2019 24 $124,500$150,000 Construction Office Secured Residential Secured Corporate* |

|

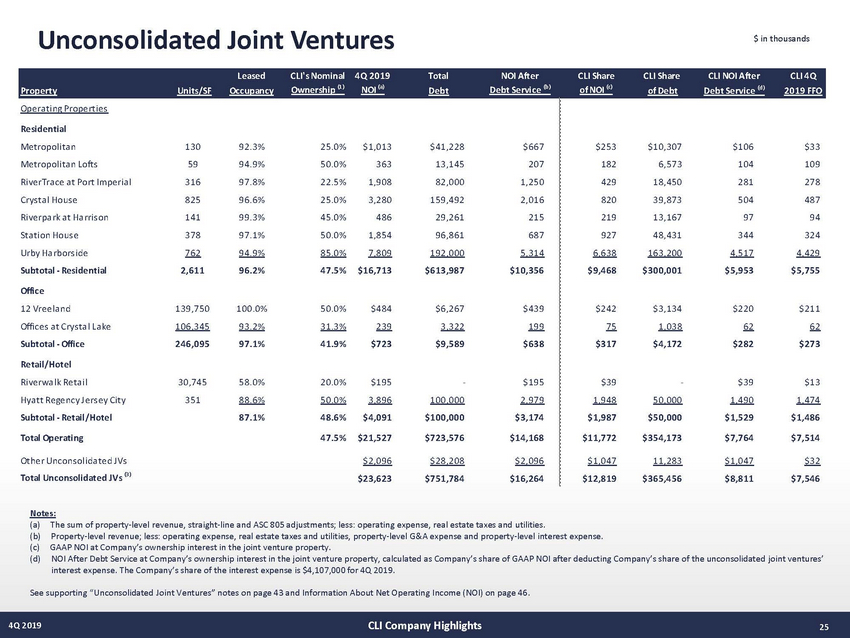

Unconsolidated Joint Ventures $ in thousands Ope ra ting Prope rtie s Residential Metropolita n Metropolita n Lofts RiverTra ce a t Port Imperia l Crys ta l Hous e Riverpa rk a t Ha rris on Sta tion Hous e Urby Ha rbors ide Subtotal - Residential 130 59 316 825 141 378 762 2,611 92.3% 25.0% 50.0% 22.5% 25.0% 45.0% 50.0% 85.0% 47.5% $1,013 363 1,908 3,280 486 1,854 7,809 $16,713 $41,228 13,145 82,000 159,492 29,261 96,861 192,000 $613,987 $667 207 1,250 2,016 215 687 5,314 $10,356 $253 182 429 820 219 927 6,638 $9,468 $10,307 6,573 18,450 39,873 13,167 48,431 163,200 $300,001 $106 104 281 504 97 344 4,517 $5,953 $33 109 278 487 94 324 4,429 $5,755 94.9% 97.8% 96.6% 99.3% 97.1% 94.9% 96.2% Office 12 Vreela nd Offices a t Crys ta l La ke Subtotal - Office 139,750 106,345 246,095 100.0% 93.2% 97.1% 50.0% 31.3% 41.9% $484 239 $723 $6,267 3,322 $9,589 $439 199 $638 $242 75 $317 $3,134 1,038 $4,172 $220 62 $282 $211 62 $273 Retail/Hotel Riverwa lk Reta il Hya tt Regency Jers ey City Subtotal - Retail/Hotel 30,745 351 58.0% 88.6% 87.1% 20.0% 50.0% 48.6% $195 3,896 $4,091 - 100,000 $100,000 $195 2,979 $3,174 $39 1,948 $1,987 - 50,000 $50,000 $39 1,490 $1,529 $13 1,474 $1,486 Total Operating 47.5% $21,527 $723,576 $14,168 $11,772 $354,173 $7,764 $7,514 Other Uncons olida ted JVs Total Unconsolidated JVs (3 ) $2,096 $23,623 $28,208 $751,784 $2,096 $16,264 $1,047 $12,819 11,283 $365,456 $1,047 $8,811 $32 $7,546 Notes: (a) (b) (c) (d) The sum of property-level revenue, straight-line and ASC 805 adjustments; less: operating expense, real estate taxes and utilities. Property-level revenue; less: operating expense, real estate taxes and utilities, property-level G&A expense and property-level interest expense. GAAP NOI at Company’s ownership interest in the joint venture property. NOI After Debt Service at Company’s ownership interest in the joint venture property, calculated as Company’s share of GAAP NOI after deducting Company’s share of the unconsolidated joint ventures’ interest expense. The Company’s share of the interest expense is $4,107,000 for 4Q 2019. See supporting “Unconsolidated Joint Ventures” notes on page 43 and Information About Net Operating Income (NOI) on page 46. CLI Company Highlights 4Q 2019 25 Leased CLI's Nominal 4Q 2019 Total NOI After CLI Share CLI Share CLI NOI After CLI 4Q Property Units/SF Occupancy Ownership (1 ) NOI (a) Debt Debt Service (b) of NOI (c) of Debt Debt Service (d) 2019 FFO |

|

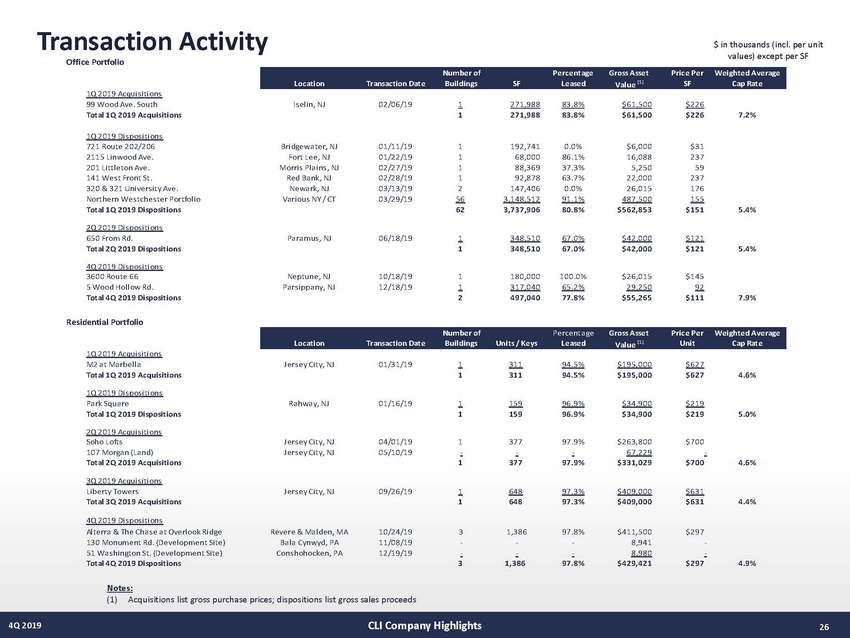

Transaction Activity $ in thousands (incl. per unit values) except per SF Office Portfolio 1Q 2019 Acquis itions 99 Wood Ave. South Total 1Q 2019 Acquisitions Is elin, NJ 02/06/19 1 271,988 271,988 83.8% 83.8% $61,500 $61,500 $226 $226 1 7.2% 1Q 2019 Dis pos itions 721 Route 202/206 2115 Linwood Ave. 201 Littleton Ave. 141 Wes t Front St. 320 & 321 Univers ity Ave. Northern Wes tches ter Portfolio Total 1Q 2019 Dispositions Bridgewa ter, NJ Fort Lee, NJ Morris Pla ins , NJ Red Ba nk, NJ Newa rk, NJ Va rious NY / CT 01/11/19 01/22/19 02/27/19 02/28/19 03/13/19 03/29/19 1 1 1 1 2 56 62 192,741 68,000 88,369 92,878 147,406 3,148,512 3,737,906 0.0% 86.1% 37.3% 63.7% 0.0% 91.1% 80.8% $6,000 16,088 5,250 22,000 26,015 487,500 $562,853 $31 237 59 237 176 155 $151 5.4% 2Q 2019 Dis pos itions 650 From Rd. Total 2Q 2019 Dispositions Pa ra mus , NJ 06/18/19 1 348,510 348,510 67.0% 67.0% $42,000 $42,000 $121 $121 1 5.4% 4Q 2019 Dis pos itions 3600 Route 66 5 Wood Hollow Rd. Total 4Q 2019 Dispositions Neptune, NJ Pa rs ippa ny, NJ 10/18/19 12/18/19 1 1 180,000 317,040 497,040 100.0% 65.2% 77.8% $26,015 29,250 $55,265 $145 92 $111 2 7.9% Residential Portfolio 1Q 2019 Acquis itions M2 a t Ma rbella Total 1Q 2019 Acquisitions Jers ey City, NJ 01/31/19 1 311 311 94.5% 94.5% $195,000 $195,000 $627 $627 1 4.6% 1Q 2019 Dis pos itions Pa rk Squa re Total 1Q 2019 Dispositions Ra hwa y, NJ 01/16/19 1 159 159 96.9% 96.9% $34,900 $34,900 $219 $219 1 5.0% 2Q 2019 Acquis itions Soho Lofts 107 Morga n (La nd) Total 2Q 2019 Acquisitions Jers ey City, NJ Jers ey City, NJ 04/01/19 05/10/19 1 - 377 - 97.9% - $263,800 67,229 $331,029 $700 - 1 377 97.9% $700 4.6% 3Q 2019 Acquis itions Liberty Towers Total 3Q 2019 Acquisitions Jers ey City, NJ 09/26/19 1 648 648 97.3% 97.3% $409,000 $409,000 $631 $631 1 4.4% 4Q 2019 Dis pos itions Alterra & The Cha s e a t Overlook Ridge 130 Monument Rd. (Development Site) 51 Wa s hington St. (Development Site) Total 4Q 2019 Dispositions Revere & Ma lden, MA Ba la Cynwyd, PA Cons hohocken, PA 10/24/19 11/08/19 12/19/19 3 - - 1,386 - - 97.8% - - $411,500 8,941 8,980 $429,421 $297 - - 3 1,386 97.8% $297 4.9% Notes: (1) Acquisitions list gross purchase prices; dispositions list gross sales proceeds CLI Company Highlights 4Q 2019 26 Number of Percenta ge Gross Asset Price Per Weighted Average Location Transaction Date Buildings Units / Keys Leased Value (1 ) Unit Cap Rate Number of Percentage Gross Asset Price Per Weighted Average Location Transaction Date Buildings SF Leased Value (1 ) SF Cap Rate |

|

Office Portfolio 4Q 2019 27 |

|

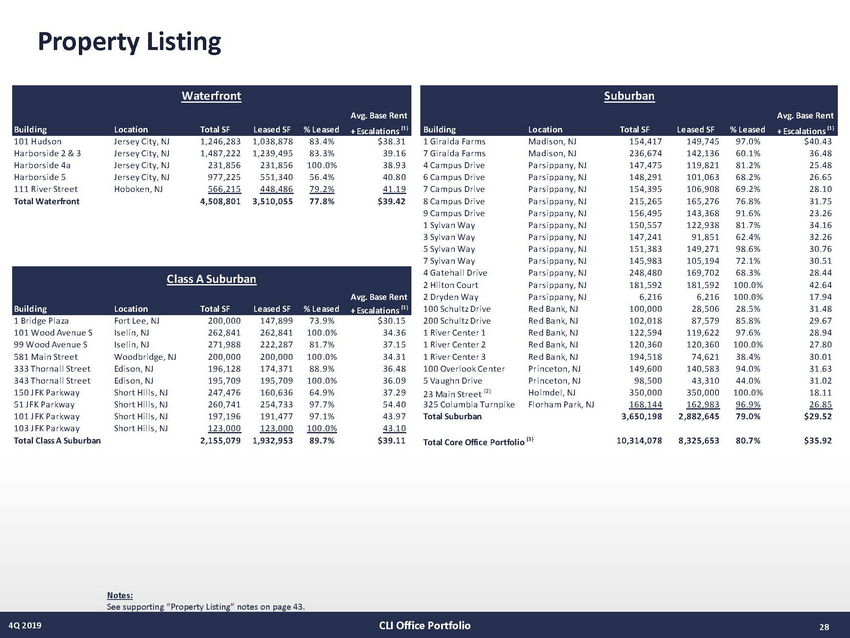

Property Listing 101 Huds on Ha rbors ide 2 & 3 Ha rbors ide 4a Ha rbors ide 5 111 River Street Total Waterfront Jers ey City, NJ Jers ey City, NJ Jers ey City, NJ Jers ey City, NJ Hoboken, NJ 1,246,283 1,487,222 231,856 977,225 566,215 4,508,801 1,038,878 1,239,495 231,856 551,340 448,486 3,510,055 83.4% 83.3% 100.0% 56.4% 79.2% 77.8% $38.31 39.16 38.93 40.80 41.19 $39.42 1 Gira lda Fa rms 7 Gira lda Fa rms 4 Ca mpus Drive 6 Ca mpus Drive 7 Ca mpus Drive 8 Ca mpus Drive 9 Ca mpus Drive 1 Sylva n Wa y 3 Sylva n Wa y 5 Sylva n Wa y 7 Sylva n Wa y 4 Ga teha ll Drive 2 Hilton Court 2 Dryden Wa y 100 Schultz Drive 200 Schultz Drive 1 River Center 1 1 River Center 2 1 River Center 3 100 Overlook Center 5 Va ughn Drive 23 Ma in Street (2 ) 325 Columbia Turnpike Total Suburban Ma dis on, NJ Ma dis on, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Red Ba nk, NJ Red Ba nk, NJ Red Ba nk, NJ Red Ba nk, NJ Red Ba nk, NJ Princeton, NJ Princeton, NJ Holmdel, NJ Florha m Pa rk, NJ 154,417 236,674 147,475 148,291 154,395 215,265 156,495 150,557 147,241 151,383 145,983 248,480 181,592 6,216 100,000 102,018 122,594 120,360 194,518 149,600 98,500 350,000 168,144 3,650,198 149,745 142,136 119,821 101,063 106,908 165,276 143,368 122,938 91,851 149,271 105,194 169,702 181,592 6,216 28,506 87,579 119,622 120,360 74,621 140,583 43,310 350,000 162,983 2,882,645 97.0% 60.1% 81.2% 68.2% 69.2% 76.8% 91.6% 81.7% 62.4% 98.6% 72.1% 68.3% 100.0% 100.0% 28.5% 85.8% 97.6% 100.0% 38.4% 94.0% 44.0% 100.0% 96.9% 79.0% $40.43 36.48 25.48 26.65 28.10 31.75 23.26 34.16 32.26 30.76 30.51 28.44 42.64 17.94 31.48 29.67 28.94 27.80 30.01 31.63 31.02 18.11 26.85 $29.52 1 Bridge Pla za 101 Wood Avenue S 99 Wood Avenue S 581 Ma in Street 333 Thorna ll Street 343 Thorna ll Street 150 JFK Pa rkwa y 51 JFK Pa rkwa y 101 JFK Pa rkwa y 103 JFK Pa rkwa y Total Class A Suburban Fort Lee, NJ Is elin, NJ Is elin, NJ Woodbridge, NJ Edis on, NJ Edis on, NJ Short Hills , NJ Short Hills , NJ Short Hills , NJ Short Hills , NJ 200,000 262,841 271,988 200,000 196,128 195,709 247,476 260,741 197,196 123,000 2,155,079 147,899 262,841 222,287 200,000 174,371 195,709 160,636 254,733 191,477 123,000 1,932,953 73.9% 100.0% 81.7% 100.0% 88.9% 100.0% 64.9% 97.7% 97.1% 100.0% 89.7% $30.15 34.36 37.15 34.31 36.48 36.09 37.29 54.40 43.97 43.10 $39.11 Total Core Office Portfolio (3 ) 10,314,078 8,325,653 80.7% $35.92 Notes: See supporting “Property Listing” notes on page 43. CLI Office Portfolio 4Q 2019 28 Class A Suburban Avg. Base Rent BuildingLocationTotal SFLeased SF% Leased + Escalations (1 ) Suburban Avg. Base Rent BuildingLocationTotal SFLeased SF% Leased + Escalations (1 ) Waterfront Avg. Base Rent BuildingLocationTotal SFLeased SF% Leased + Escalations (1 ) |

|

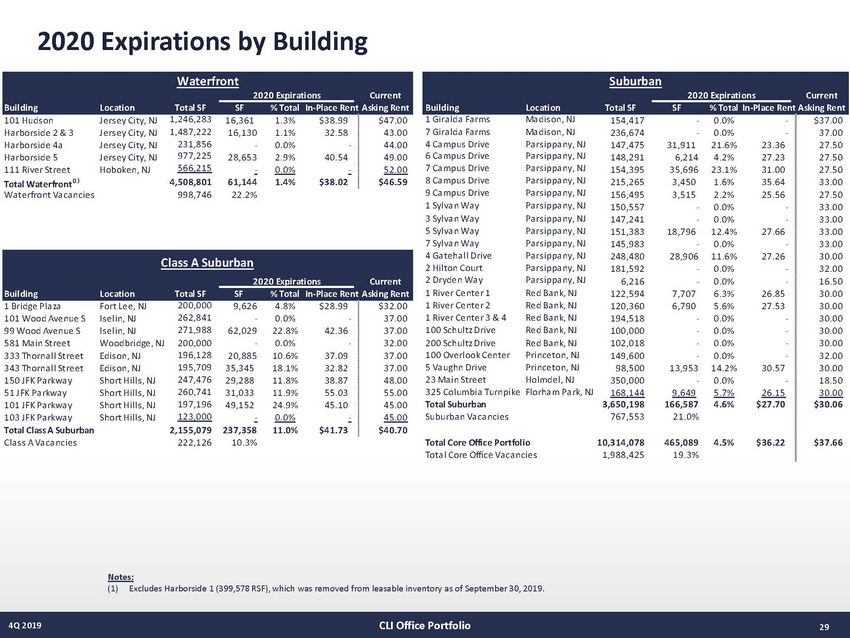

2020 Expirations by Building Waterfront 2020 Expirations Suburban 2020 Expirations Current Current Building Location Total SF SF % Total In-Place Rent Asking Rent Building Location Total SF SF % Total In-Place Rent Asking Rent 1,246,283 1,487,222 231,856 977,225 566,215 4,508,801 998,746 1 Gira lda Fa rms 7 Gira lda Fa rms 4 Ca mpus Drive 6 Ca mpus Drive 7 Ca mpus Drive 8 Ca mpus Drive 9 Ca mpus Drive 1 Sylva n Wa y 3 Sylva n Wa y 5 Sylva n Wa y 7 Sylva n Wa y 4 Ga teha ll Drive 2 Hilton Court 2 Dryden Wa y 1 River Center 1 1 River Center 2 1 River Center 3 & 4 100 Schultz Drive 200 Schultz Drive 100 Overlook Center 5 Va ughn Drive 23 Ma in Street Ma dis on, NJ Ma dis on, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Pa rs ippa ny, NJ Red Ba nk, NJ Red Ba nk, NJ Red Ba nk, NJ Red Ba nk, NJ Red Ba nk, NJ Princeton, NJ Princeton, NJ Holmdel, NJ 101 Huds on Ha rbors ide 2 & 3 Ha rbors ide 4a Ha rbors ide 5 111 River Street Total Waterfront(1 ) Wa terfront Va ca ncies Jers ey City, NJ Jers ey City, NJ Jers ey City, NJ Jers ey City, NJ Hoboken, NJ 16,361 16,130 - 28,653 - 1.3% 1.1% 0.0% 2.9% 0.0% 1.4% $38.99 32.58 $47.00 43.00 44.00 49.00 52.00 $46.59 154,417 236,674 147,475 148,291 154,395 215,265 156,495 150,557 147,241 151,383 145,983 248,480 181,592 6,216 122,594 120,360 194,518 100,000 102,018 149,600 98,500 350,000 168,144 3,650,198 767,553 - - 0.0% 0.0% 21.6% 4.2% 23.1% 1.6% 2.2% 0.0% 0.0% 12.4% 0.0% 11.6% 0.0% 0.0% 6.3% 5.6% 0.0% 0.0% 0.0% 0.0% 14.2% 0.0% 5.7% 4.6% - - $37.00 37.00 27.50 27.50 27.50 33.00 27.50 33.00 33.00 33.00 33.00 30.00 32.00 16.50 30.00 30.00 30.00 30.00 30.00 32.00 30.00 18.50 30.00 $30.06 - 31,911 6,214 35,696 3,450 3,515 - - 18,796 - 28,906 - - 7,707 6,790 - - - - 13,953 - 9,649 166,587 21.0% 23.36 27.23 31.00 35.64 25.56 40.54 - 61,144 22.2% $38.02 - - 27.66 - 27.26 Class A Suburban - - 2020 Expirations Current Building Location Total SF SF % Total In-Place Rent Asking Rent 26.85 27.53 200,000 262,841 271,988 1 Bridge Pla za 101 Wood Avenue S 99 Wood Avenue S 581 Ma in Street 333 Thorna ll Street 343 Thorna ll Street 150 JFK Pa rkwa y 51 JFK Pa rkwa y 101 JFK Pa rkwa y 103 JFK Pa rkwa y Total Class A Suburban Cla s s A Va ca ncies Fort Lee, NJ Is elin, NJ Is elin, NJ 9,626 - 62,029 - 20,885 35,345 29,288 31,033 49,152 - 4.8% 0.0% 22.8% 0.0% 10.6% 18.1% 11.8% 11.9% 24.9% 0.0% 11.0% $28.99 $32.00 37.00 37.00 32.00 37.00 37.00 48.00 55.00 45.00 45.00 $40.70 - - - - - 42.36 Woodbridge, NJ 200,000 - 196,128 195,709 247,476 260,741 197,196 123,000 2,155,079 222,126 Edis on, NJ Edis on, NJ Short Hills , NJ Short Hills , NJ Short Hills , NJ Short Hills , NJ 37.09 32.82 38.87 55.03 45.10 30.57 - 325 Columbia Turnpike Florha m Pa rk, NJ Total Suburban Suburba n Va ca ncies 26.15 $27.70 - 237,358 10.3% $41.73 Total Core Office Portfolio Tota l Core Office Va ca ncies 10,314,078 1,988,425 465,089 19.3% 4.5% $36.22 $37.66 Notes: (1) Excludes Harborside 1 (399,578 RSF), which was removed from leasable inventory as of September 30, 2019. CLI Office Portfolio 4Q 2019 29 |

|

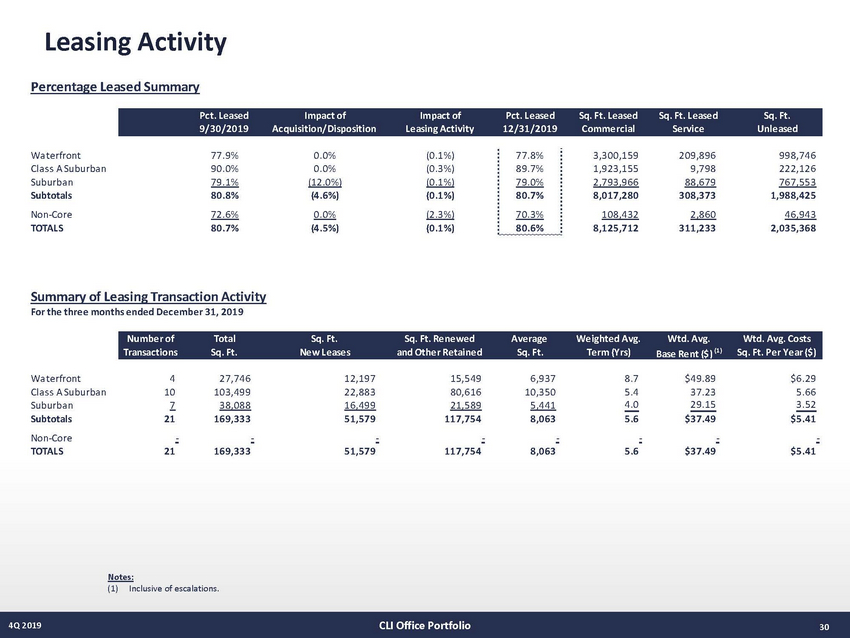

Leasing Activity Percentage Leased Summary Wa terfront Cla s s A Suburba n Suburba n Subtotals Non-Core TOTALS 77.9% 90.0% 79.1% 80.8% 72.6% 80.7% 0.0% 0.0% (12.0%) (4.6%) 0.0% (4.5%) (0.1%) (0.3%) (0.1%) (0.1%) (2.3%) (0.1%) 77.8% 89.7% 79.0% 80.7% 70.3% 80.6% 3,300,159 1,923,155 2,793,966 8,017,280 108,432 8,125,712 209,896 9,798 88,679 308,373 2,860 311,233 998,746 222,126 767,553 1,988,425 46,943 2,035,368 Summary of Leasing Transaction Activity For the three months ended December 31, 2019 Wa terfront Cla s s A Suburba n Suburba n Subtotals Non-Core TOTALS 4 10 7 21 27,746 103,499 38,088 169,333 12,197 22,883 16,499 51,579 15,549 80,616 21,589 117,754 6,937 10,350 5,441 8,063 8.7 5.4 4.0 $49.89 37.23 29.15 $6.29 5.66 3.52 5.6 $37.49 $5.41 - - - - - - - - 21 169,333 51,579 117,754 8,063 5.6 $37.49 $5.41 Notes: (1) Inclusive of escalations. CLI Office Portfolio 4Q 2019 30 Number of Total Sq. Ft. Sq. Ft. Renewed Average Weighted Avg. Wtd. Avg. Wtd. Avg. Costs Transactions Sq. Ft. New Leases and Other Retained Sq. Ft. Term (Yrs) Base Rent ($) (1 ) Sq. Ft. Per Year ($) Pct. Leased Impact of Impact of Pct. Leased Sq. Ft. Leased Sq. Ft. Leased Sq. Ft. 9/30/2019 Acquisition/Disposition Leasing Activity 12/31/2019 Commercial Service Unleased |

|

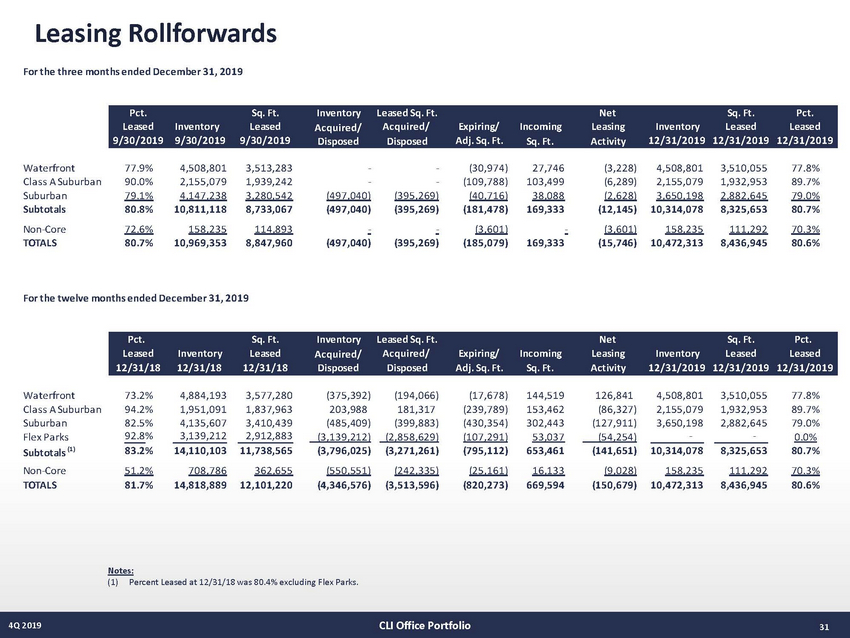

Leasing Rollforwards For the three months ended December 31, 2019 Wa terfront Cla s s A Suburba n Suburba n Subtotals Non-Core TOTALS 77.9% 90.0% 79.1% 80.8% 72.6% 80.7% 4,508,801 2,155,079 4,147,238 10,811,118 158,235 10,969,353 3,513,283 1,939,242 3,280,542 8,733,067 114,893 8,847,960 - - (497,040) (497,040) - - - (395,269) (395,269) - (30,974) (109,788) (40,716) (181,478) (3,601) (185,079) 27,746 103,499 38,088 169,333 (3,228) (6,289) (2,628) (12,145) (3,601) (15,746) 4,508,801 2,155,079 3,650,198 10,314,078 158,235 10,472,313 3,510,055 1,932,953 2,882,645 8,325,653 111,292 8,436,945 77.8% 89.7% 79.0% 80.7% 70.3% 80.6% - (497,040) (395,269) 169,333 For the twelve months ended December 31, 2019 Wa terfront Cla s s A Suburba n Suburba n Flex Pa rks Subtotals (1 ) Non-Core TOTALS 73.2% 94.2% 82.5% 92.8% 4,884,193 1,951,091 4,135,607 3,139,212 3,577,280 1,837,963 3,410,439 2,912,883 (375,392) 203,988 (485,409) (3,139,212) (194,066) 181,317 (399,883) (2,858,629) (17,678) (239,789) (430,354) (107,291) (795,112) (25,161) (820,273) 144,519 153,462 302,443 53,037 653,461 16,133 669,594 126,841 (86,327) (127,911) (54,254) 4,508,801 2,155,079 3,650,198 - 3,510,055 1,932,953 2,882,645 - 77.8% 89.7% 79.0% 0.0% 80.7% 70.3% 80.6% 83.2% 51.2% 81.7% 14,110,103 708,786 14,818,889 11,738,565 362,655 12,101,220 (3,796,025) (550,551) (4,346,576) (3,271,261) (242,335) (3,513,596) (141,651) (9,028) (150,679) 10,314,078 158,235 10,472,313 8,325,653 111,292 8,436,945 Notes: (1) Percent Leased at 12/31/18 was 80.4% excluding Flex Parks. CLI Office Portfolio 4Q 2019 31 Pct. Sq. Ft. Inventory Leased Sq. Ft. Net Sq. Ft. Pct. Leased Inventory Leased Acquired/ Acquired/ Expiring/ Incoming Leasing Inventory Leased Leased 12/31/18 12/31/18 12/31/18 Disposed Disposed Adj. Sq. Ft. Sq. Ft. Activity 12/31/2019 12/31/2019 12/31/2019 Pct. Sq. Ft. Inventory Leased Sq. Ft. Net Sq. Ft. Pct. Leased Inventory Leased Acquired/ Acquired/ Expiring/ Incoming Leasing Inventory Leased Leased 9/30/2019 9/30/2019 9/30/2019 Disposed Disposed Adj. Sq. Ft. Sq. Ft. Activity 12/31/2019 12/31/2019 12/31/2019 |

|

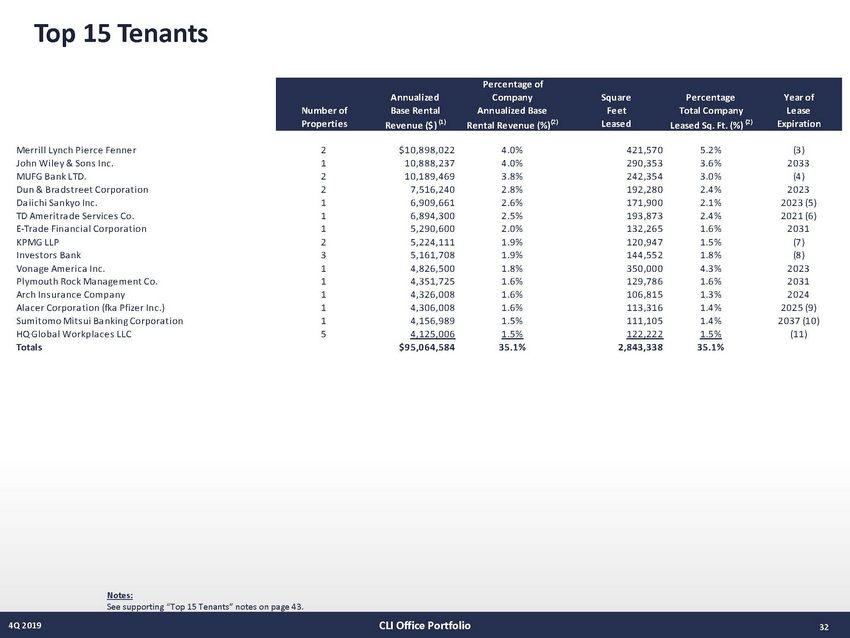

Top 15 Tenants Merrill Lynch Pierce Fenner John Wiley & Sons Inc. MUFG Ba nk LTD. Dun & Bra ds treet Corpora tion Da iichi Sa nkyo Inc. TD Ameritra de Services Co. E-Tra de Fina ncia l Corpora tion KPMG LLP Inves tors Ba nk Vona ge America Inc. Plymouth Rock Ma na gement Co. Arch Ins ura nce Compa ny Ala cer Corpora tion (fka Pfizer Inc.) Sumitomo Mits ui Ba nking Corpora tion HQ Globa l Workpla ces LLC Totals 2 1 2 2 1 1 1 2 3 1 1 1 1 1 5 $10,898,022 10,888,237 10,189,469 7,516,240 6,909,661 6,894,300 5,290,600 5,224,111 5,161,708 4,826,500 4,351,725 4,326,008 4,306,008 4,156,989 4,125,006 $95,064,584 4.0% 4.0% 3.8% 2.8% 2.6% 2.5% 2.0% 1.9% 1.9% 1.8% 1.6% 1.6% 1.6% 1.5% 1.5% 35.1% 421,570 290,353 242,354 192,280 171,900 193,873 132,265 120,947 144,552 350,000 129,786 106,815 113,316 111,105 122,222 2,843,338 5.2% 3.6% 3.0% 2.4% 2.1% 2.4% 1.6% 1.5% 1.8% 4.3% 1.6% 1.3% 1.4% 1.4% 1.5% 35.1% (3) 2033 (4) 2023 2023 (5) 2021 (6) 2031 (7) (8) 2023 2031 2024 2025 (9) 2037 (10) (11) Notes: See supporting “Top 15 Tenants” notes on page 43. CLI Office Portfolio 4Q 2019 32 Percentage of Annualized Company Square Percentage Year of Number of Base Rental Annualized Base Feet Total Company Lease Properties Revenue ($) (1 ) Rental Revenue (%)(2 ) Leased Leased Sq. Ft. (%) (2 ) Expiration |

|

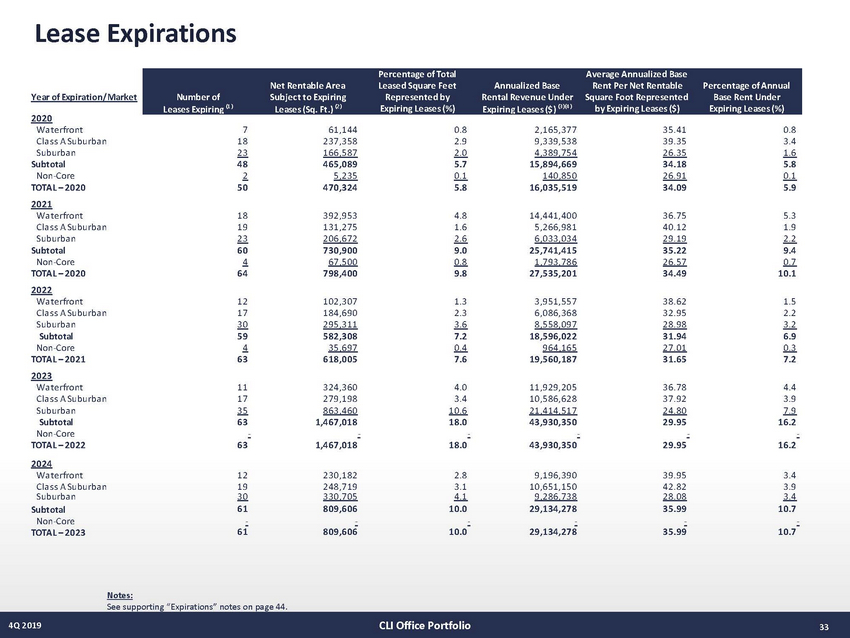

Lease Expirations Year of Expiration/Market 2020 Wa terfront Cla s s A Suburba n Suburba n Subtotal Non-Core TOTAL – 2020 2021 Wa terfront Cla s s A Suburba n Suburba n Subtotal Non-Core TOTAL – 2020 2022 Wa terfront Cla s s A Suburba n Suburba n Subtotal Non-Core TOTAL – 2021 2023 Wa terfront Cla s s A Suburba n Suburba n Subtotal Non-Core TOTAL – 2022 2024 Wa terfront Cla s s A Suburba n Suburba n Subtotal Non-Core TOTAL – 2023 7 18 23 48 2 50 61,144 237,358 166,587 465,089 5,235 470,324 0.8 2.9 2.0 5.7 0.1 5.8 2,165,377 9,339,538 4,389,754 15,894,669 140,850 16,035,519 35.41 39.35 26.35 34.18 26.91 34.09 0.8 3.4 1.6 5.8 0.1 5.9 18 19 23 60 4 64 392,953 131,275 206,672 730,900 67,500 798,400 4.8 1.6 2.6 9.0 0.8 9.8 14,441,400 5,266,981 6,033,034 25,741,415 1,793,786 27,535,201 36.75 40.12 29.19 35.22 26.57 34.49 5.3 1.9 2.2 9.4 0.7 10.1 12 17 30 59 4 63 102,307 184,690 295,311 582,308 35,697 618,005 1.3 2.3 3.6 7.2 0.4 7.6 3,951,557 6,086,368 8,558,097 18,596,022 964,165 19,560,187 38.62 32.95 28.98 31.94 27.01 31.65 1.5 2.2 3.2 6.9 0.3 7.2 11 17 35 63 - 324,360 279,198 863,460 1,467,018 4.0 3.4 10.6 18.0 11,929,205 10,586,628 21,414,517 43,930,350 36.78 37.92 24.80 29.95 4.4 3.9 7.9 16.2 - - - - - 63 1,467,018 18.0 43,930,350 29.95 16.2 12 19 30 61 - 230,182 248,719 330,705 809,606 - 2.8 3.1 4.1 10.0 9,196,390 10,651,150 9,286,738 29,134,278 - 39.95 42.82 28.08 35.99 - 3.4 3.9 3.4 10.7 - - 61 809,606 10.0 29,134,278 35.99 10.7 Notes: See supporting “Expirations” notes on page 44. CLI Office Portfolio 4Q 2019 33 Percentage of Total Average Annualized Base Net Rentable Area Leased Square Feet Annualized Base Rent Per Net Rentable Percentage of Annual Number of Subject to Expiring Represented by Rental Revenue Under Square Foot Represented Base Rent Under Leases Expiring (1 ) Leases (Sq. Ft.) (2 ) Expiring Leases (%) Expiring Leases ($) (3 )(4 ) by Expiring Leases ($) Expiring Leases (%) |

|