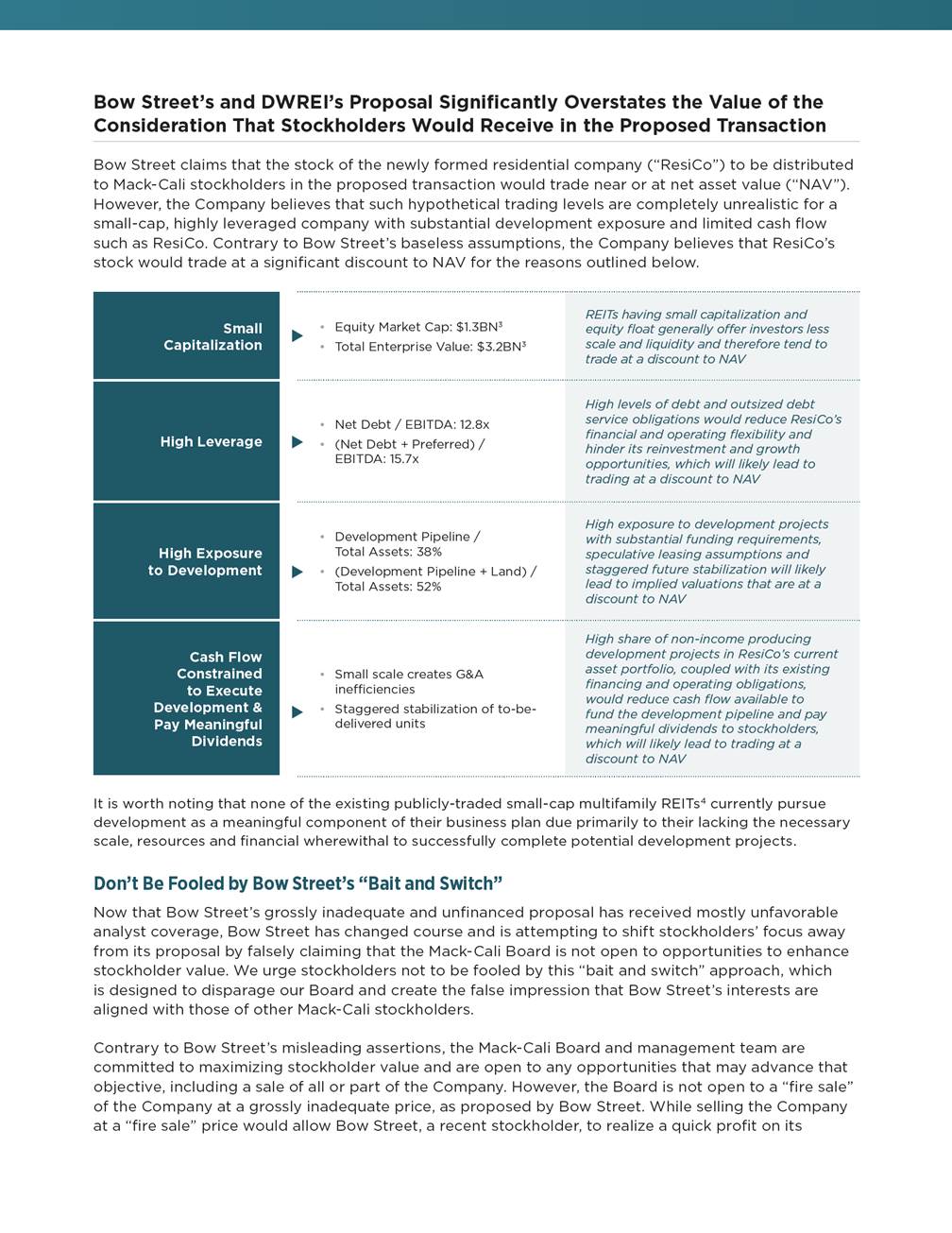

Mack-Cali Stockholders: Bow Street’s Proxy Contest Is Simply An Attempt To Acquire Mack-Cali’s Premium Office Assets at a Lowball Price or Force a “Fire Sale” of the Company Bow Street Special Opportunities Fund XV, LP (“Bow Street”) has nominated four candidates to stand for election to the Mack-Cali Board of Directors at the Company’s upcoming 2019 annual meeting of stockholders on June 12, 2019. Bow Street launched its proxy contest after the Mack-Cali Board carefully considered and unanimously rejected Bow Street’s and David Werner Real Estate Investments’ (“DWREI”) grossly inadequate, illusory, unworkable and unfinanced proposal to acquire the Company’s suburban and waterfront office assets, hotel joint venture interests and retail assets at a price far below fair market value. Now, Bow Street has flip-flopped its position and urges the Board to immediately announce a process to explore all strategic alternatives. In the course of its campaign, Bow Street has falsely stated it is seeking to maximize value for all Mack-Cali stockholders. Despite these misstatements, Bow Street’s actions make one thing clear: Bow Street’s true objective is to acquire Mack-Cali’s premium assets at a lowball price or, failing that, make a quick profit on its recent investment by forcing a “fire sale” of the Company, at the expense of all other Mack-Cali stockholders. Bow Street’s and DWREI’s Proposal Would Shortchange Other Mack-Cali Stockholders While the proposed transaction would be a “steal” for Bow Street and DWREI, the Company believes that it is highly unlikely to deliver aggregate consideration to other Mack-Cali stockholders that would be anywhere near the hypothetical value of up to $27-$29 per share that Bow Street has suggested. Bow Street’s and DWREI’s Proposal Grossly Undervalues Mack-Cali’s Core Office Portfolio CORE OFFICE PORTFOLIO VALUATION TOTAL | PER SQUARE FEET (“PSF”) Bow Street’s and DWREI’s proposal implies a gross asset valuation for Mack-Cali’s core office portfolio that is approximately $1 billion lower than management’s estimate, which has been confirmed by a recently performed independent valuation. Company Estimate1 (midpoint) HFF Estimate2 Bow Street Proposal (midpoint) Mack-Cali is poised to unlock tremendous near-term value through its Waterfront Strategy $3.0BN $273PSF $3.0BN $274PSF $2.0BN $182 PSF ~$1BN DISCOUNT TO COMPANY & HFF VALUE ESTIMATES