Exhibit 99.1

Exhibit 99.1

INDEX

|

|

PAGE(S) |

|

|

|

|

Company Today |

3-4 |

|

|

|

|

Focus List |

5 - 6 |

|

|

|

|

NYC and NJ Waterfront Synergy |

7 |

|

|

|

|

Economic Incentives and Programs |

8 - 9 |

|

|

|

|

Spotlight on: |

|

|

|

|

|

Results |

10 - 13 |

|

|

|

|

Leasing |

14 - 21 |

|

|

|

|

Earnings |

22 - 32 |

|

|

|

|

Financials |

33 - 35 |

|

|

|

|

Portfolio |

36 - 37 |

|

|

|

|

Details on: |

|

|

|

|

|

Leasing |

38 - 43 |

|

|

|

|

Earnings |

44 |

|

|

|

|

Financials |

45 - 49 |

|

|

|

|

Portfolio |

50 - 56 |

|

|

|

|

Company Information |

57 - 58 |

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

REIT publicly traded on NYSE (“CLI”)

Substantial development opportunities for multi-family

Apartment platform managed by Roseland Residential Trust (“RRT”)

|

|

|

4Q 2016 |

|

3Q 2016 |

|

|

|

|

|

|

|

|

|

Market capitalization: |

|

$5.3 billion |

|

$5.2 billion |

|

|

|

|

|

|

|

|

|

Square feet of office space: |

|

21.0 million |

|

23.4 million |

|

|

|

|

|

|

|

|

|

% leased for Core/Waterfront/Flex: |

|

90.6 |

% |

90.3 |

% |

|

|

|

|

|

|

|

|

GAAP rental rate roll-up |

|

12.0 |

% |

9.1 |

% |

|

|

|

|

|

|

|

|

Operating multi-family units: |

|

5,614 |

|

5,214 |

|

|

|

|

|

|

|

|

|

% leased for stabilized multi-family: |

|

96.3 |

% |

97.7 |

% |

|

|

|

|

|

|

|

|

Sr. unsecured debt ratings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

(S&P/Moody’s/Fitch) |

|

BBB-/Baa3/BB+ |

|

BBB-/Baa3/BB+ |

|

|

|

|

|

|

101 Wood Avenue South, Iselin, NJ (Acquired June 2016) |

|

Portside at East Pier, East Boston, MA (Full interest acquired April 2016) |

|

|

|

|

|

|

|

|

|

The Chase at Overlook Ridge, Malden, MA (Full interest acquired January 2016) |

|

111 River Street, Hoboken, NJ (Acquired July 2016) |

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

2017 & 2018 Objectives

|

Completed/Underway (Generated Significant Increased Cash Flow)

|

1. Staffing levels — reduced by 125 positions or $15M, hiring freeze in place, expect further reductions if more sales completed

2. Cost of operations — reduced by $10M, with continued focus on expenses

3. Continued expense reductions as we reduce the size of the office platform (underway)

4. Expect continued margin improvement (currently approx. 60%, up from 54% two years ago) with increased rental rates and occupancy in core markets and reduced costs

5. Refinance debt for savings — new 5-year unsecured term loan for $350M at 3.13% in Jan 2016. $250M secured financing at 3.197%. Bought back $250M of 7.75% bonds due August of 2019 and repaid $300M mortgage debt with interest rates ranging from LIBOR+1.75 to 11.3 percent. $925M unsecured credit facilities signed in Jan. 2017

6. Increase occupancy — 90.6% at 12/31/16, met our objective of 90% leased by year end. Was 90.3% at 9/30/16; 89.1% at 12/31/15; 84.2% at 12/31/14

7. Planned dispositions — $745M closed in 2016 & early 2017; $600M for remainder of 2017

|

Next 12 — 24 Months (Balance Sheet / Capital Expenditures / Long-term Cash Flow)

|

8. Exited NYC, DC, and certain NJ suburban markets, focus on our key markets Waterfront, Short Hill, Metropark, Parsippany and Monmouth

9. Funding and growth of the Roseland operations — Rockpoint Capital LLC to invest $300M as development capital

|

24 Months (Long-term Strategy Execution)

|

10. Reposition assets to class A quality — six major capital investment programs currently in place. Totally renovate Plaza I - Harborside in Jersey City

11. New capital investment — we look for 6% initial yield and 11% IRR on new investments. Purchased 101 Wood Avenue in Iselin, NJ and 111 River Street in Hoboken, NJ; Closing in 2017: Red Bank, Short Hills, Madison and Jersey City purchases

12. Quality of earnings will continue to improve as the portfolio is increasingly comprised of high quality Hudson River waterfront and transit oriented office properties and best in class luxury multi-family properties in those same markets. We project to be in the top 20% of REITs for FFO and AFFO growth

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Significant progress made on 2017 expirations during 2016:

· Remaining 2017 expirations aggregate 2.1 million square feet (net of 512,000 square feet in properties we plan to sell/repurpose):

Represent 11.2% of our Core/Waterfront/Flex portfolio;

699,398 SF remaining on Waterfront, with a growing backlog of tenant demand;

639,154 SF in Flex space, with historically high retention and occupancy rates; and

793,718 SF in Core suburban properties, represents a manageable 8.9% of Core suburban portfolio

· 2017 expirations were reduced by one million square feet during 2016 and can be reduced by an additional 300,000 square feet from additional assets sales in 2017.

· Reduction was achieved through both focused leasing efforts and disposition of non-core assets.

· One million square feet do not expire until the fourth quarter.

· Space leased at year-end 2016 is 90.6%; at that level will backfill any vacant space quickly.

· Moving forward, our goal in re-shaping the portfolio through sales, strategic acquisitions and selective leasing is to generate longer leases with less costs per square-foot per year and a more manageable lease expiration schedule of no more than 12% each year.

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

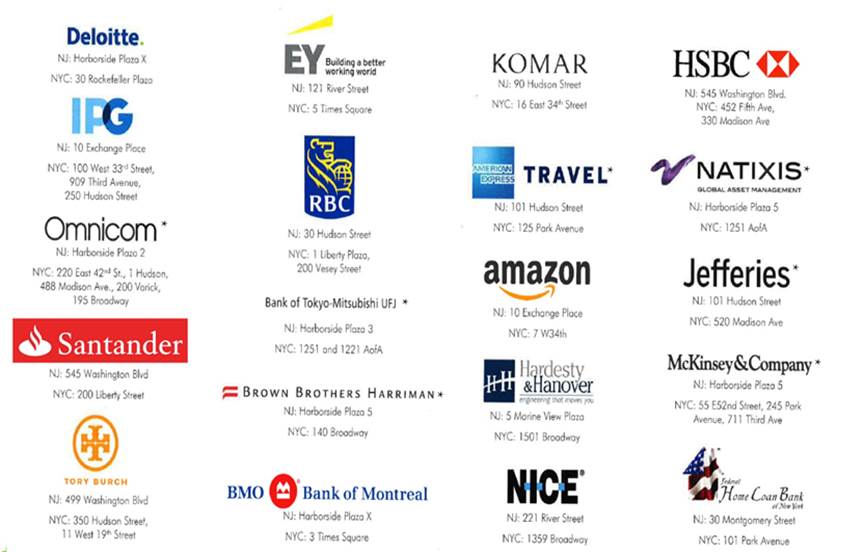

*CLI tenants

Source: CBRE Market and Asset Discussion January 27, 2017.

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

The State of New Jersey currently offers a compelling incentive program to attract and retain businesses in the State through its “Grow New Jersey” program. Below is a program summary and example of an incentive calculation.

|

Grow NJ

|

|

· Provides job-based tax credits for job creation and retention

· Tax credits of $5,000 to $9,750 per job/per year, for up to 10 years for new jobs to the state

· Limited to specific “Qualified Incentive Areas”

· Urban Transit Hub municipalities (“UTH”)

· ‘Mega projects’—logistics, manufacturing, energy, defense, or maritime businesses in a port district

· Distressed municipalities

· Projects in other priority areas

· Eligibility:

· Minimum 35 new jobs and/or 50 retained jobs for most commercial projects

|

Example — New Tenant to Jersey City

|

|

· New jobs at a 6 employees (EEs) per 1,000sf density

|

# of |

|

|

|

Starting |

|

Base |

| |

|

New EEs |

|

SF |

|

Rental Rate |

|

Rent/yr |

| |

|

|

|

60,000 |

|

$40/sf |

|

$ |

2,400,000 |

|

|

360 |

|

|

|

|

|

(2,880,000 |

) | |

|

|

|

Effective rent after incentive |

|

(480,000 |

) | |||

|

Base award (UTH) |

|

$ |

5,000 |

|

|

Bonuses |

|

|

| |

|

Within 0.5 miles of transit station |

|

$ |

2,000 |

|

|

251-400 jobs |

|

500 |

| |

|

Targeted Industry |

|

500 |

| |

|

|

|

$ |

8,000 |

per job/per year |

|

|

|

or |

| |

|

|

|

$ |

2,880,000 |

per year |

· If occupancy is higher than 6 EEs per 1,000 sf, the tenant receives the further benefit, which adds to their NOI

· Award based on targeted industry

· Tenant must commit to 1.5 years of term to qualify for 1 year of benefit

· Urban Transit Hub location

· Doesn’t include increases in fixed rent or additional rent payable under the lease

· Retention benefit could be substantially less than as illustrated

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

|

Tenants Taking Advantage of NJ Incentives |

|

|

Company |

|

Size (SF) |

|

Address |

|

Number of Employees |

|

Incentive (Millions) |

| |

|

JP Morgan Chase (Purchase) |

|

1,098,265 |

|

575 Washington Street |

|

3,612 |

|

$ |

224.9 |

|

|

JP Morgan Chase |

|

305,069 |

|

545 Washington Street |

|

2,150 |

|

$ |

187.8 |

|

|

RBC |

|

206,861 |

|

30 Hudson Street |

|

900 |

|

$ |

78.7 |

|

|

WeWork (Joint Venture) |

|

75,000 |

|

1 Journal Square |

|

723 |

|

$ |

59.0 |

|

|

Ernst & Young |

|

168,165 |

|

121 River Street |

|

430 |

|

$ |

39.8 |

|

|

Omnicom Group* |

|

79,771 |

|

Harborside Plaza 2 |

|

493 |

|

$ |

39.4 |

|

|

Charles Komar |

|

159,141 |

|

90 Hudson Street |

|

480 |

|

$ |

37.2 |

|

|

New York Life |

|

114,691 |

|

30 Hudson Street |

|

625 |

|

$ |

33.8 |

|

|

Fidessa Corporation |

|

51,824 |

|

70 Hudson Street |

|

340 |

|

$ |

30.0 |

|

|

Zurich Insurance * |

|

64,413 |

|

Harborside Plaza 2 |

|

314 |

|

$ |

28.2 |

|

|

Forbes Media |

|

93,000 |

|

499 Washington Blvd. |

|

350 |

|

$ |

27.1 |

|

|

Newell Rubbermaid |

|

99,975 |

|

221 River Street |

|

300 |

|

$ |

27.0 |

|

|

Thomas Reuters |

|

71,224 |

|

121 River Street |

|

450 |

|

$ |

26.0 |

|

*CLI tenants

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Results

Operating Highlights

Net income available to common shareholders for the quarter ended December 31, 2016 amounted to $15.2 million, or $0.17 per share, as compared to a net loss of $31.7 million, or $0.35 per share, for the quarter ended December 31, 2015. For the year ended December 31, 2016, net income available to common shareholders equaled $117.2 million, or $1.30 per share, as compared to a net loss of $125.8 million, or $1.41 per share, for full year 2015.

Funds from operations (FFO) for the quarter ended December 31, 2016 amounted to $32.8 million, or $0.33 per share, as compared to $46.9 million, or $0.47 per share, for the quarter ended December 31, 2015. For the year ended December 31, 2016, FFO equaled $205 million, or $2.04 per share, as compared to $188.1 million, or $1.88 per share, for full year 2015.

For the fourth quarter 2016, Core FFO was $0.56 per share after adjusting for certain items, primarily a $23.7 million loss from extinguishment of debt. The quarter’s Core FFO per share of $0.56 increased 19.1 percent from the same quarter last year primarily due to increased base rents in 2016.

Mack-Cali’s consolidated Core, Waterfront and Flex properties were 90.6 percent leased at December 31, 2016, as compared to 90.3 percent leased at September 30, 2016 and 89.1 percent leased at December 31, 2015.

For the quarter ended December 31, 2016, the Company executed 55 leases at its consolidated in-service commercial portfolio totaling 320,605 square feet. Of these totals, 45 percent were for new leases and 55 percent were for lease renewals and other tenant retention transactions. For the year ended December 31, 2016, the Company executed 273 lease transactions totaling 2,769,608 square feet. Of these totals, 35 percent were for new leases and 65 percent were for renewals and other tenant retention transactions. Rental rate roll up for fourth quarter 2016 transactions in the Company’s Core, Waterfront and Flex properties was 3.5 percent on a cash basis and 12.2 percent on a GAAP basis. Rental rate roll up for all 2016 transactions in the Company’s Core, Waterfront and Flex properties was 10.9 percent on a cash basis and 20 percent on a GAAP basis.

All per share amounts presented above are on a diluted basis.

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Results

Rental Property Acquisitions

For the year ended December 31, 2016

|

|

|

|

|

|

|

|

|

Rentable |

|

|

| |

|

Acquisition |

|

|

|

|

|

# of |

|

Square |

|

Purchase |

| |

|

Date |

|

Property/Address |

|

Location |

|

Buildings |

|

Feet |

|

Price |

| |

|

04/04/16 |

|

11 Martine Avenue (a) |

|

White Plains, New York |

|

1 |

|

82,000 |

|

$ |

10,750 |

|

|

04/07/16 |

|

320, 321 University Avenue (b) |

|

Newark, New Jersey |

|

2 |

|

147,406 |

|

23,000 |

| |

|

06/02/16 |

|

101 Wood Avenue South (c) |

|

Iselin, New Jersey |

|

1 |

|

262,841 |

|

82,300 |

| |

|

07/01/16 |

|

111 River Street (c) |

|

Hoboken, New Jersey |

|

1 |

|

566,215 |

|

235,000 |

(d) | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total Acquisitions: |

|

|

|

|

|

5 |

|

1,058,462 |

|

$ |

351,050 |

|

|

(a) |

|

Acquisition represented four units of condominium interests which collectively comprise floors 2 through 5. Upon completion of the acquisition, the Company owns the entire 14-story 262,000 square-foot building. The acquisition was funded using available cash. |

|

(b) |

|

This acquisition was funded through borrowings under the Company’s unsecured revolving credit facility. |

|

(c) |

|

This acquisition was funded using available cash and through borrowings under the Company’s unsecured revolving credit facility. |

|

(d) |

|

The Company paid $210.8 million at closing, net of purchase credits. |

Thus far in 2017, the Company acquired or contracted to acquire nine office properties totaling approximately 1.4 million square feet located in Red Bank, Short Hills and Madison, New Jersey for approximately $394.8 million.

On January 5, 2016, the Company, which held a 50 percent subordinated joint venture interest in the unconsolidated Overlook Ridge Apartment Investors LLC, 371-unit multi-family operating property located in Malden, Massachusetts, acquired the remaining interest for $39.8 million in cash plus the assumption of a first mortgage loan secured by the property with a principal balance of $52.7 million. The cash portion of the acquisition was funded primarily through borrowings under the Company’s unsecured revolving credit facility.

On April 1, 2016, the Company, which held a 38.25 percent subordinated joint venture interest in the unconsolidated Portside Apartment Developers, LLC, a joint venture which owns a 175-unit operating multi-family property located in East Boston, Massachusetts, acquired the remaining interests of its joint venture partners for $39.6 million in cash plus the assumption of a first mortgage loan secured by the property with a principal balance of $42.5 million and interest at LIBOR plus 215 basis points, with a floor of 275 basis points, maturing in December 2017. The cash portion of the acquisition was funded primarily through borrowings under the Company’s unsecured revolving credit facility.

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Results

Rental Property Sales/Dispositions

(dollars in thousands)

The Company disposed of approximately $690 million of assets in 2016. Thus far in 2017, the Company sold or contracted to sell nine office properties for $54 million.

For the year ended December 31, 2016

|

Sale |

|

|

|

|

|

Realized |

| |

|

Date |

|

Property/Address |

|

Location |

|

Gain (loss) |

| |

|

03/11/16 |

|

2 Independence Way |

|

Princeton, New Jersey |

|

$ |

(164 |

) |

|

03/24/16 |

|

1201 Connecticut Avenue, NW |

|

Washington, D.C. |

|

58,764 |

| |

|

04/26/16 |

|

125 Broad Street |

|

New York, New York |

|

(7,860 |

) | |

|

05/09/16 |

|

9200 Edmonston Road |

|

Greenbelt, Maryland |

|

246 |

| |

|

05/18/16 |

|

1400 L Street |

|

Washington, D.C. |

|

38,346 |

| |

|

07/14/16 |

|

600 Parsippany Road |

|

Parsippany, New Jersey |

|

4,590 |

| |

|

07/14/16 |

|

4, 5, 6 Century Drive |

|

Parsippany, New Jersey |

|

(2,775 |

) | |

|

08/11/16 |

|

Andover Place |

|

Andover, Massachusetts |

|

2,713 |

| |

|

09/26/16 |

|

222, 223 Mount Airy Road |

|

Basking Ridge, New Jersey |

|

(222 |

) | |

|

09/27/16 |

|

10 Mountainview Road |

|

Upper Saddle River, New Jersey |

|

(581 |

) | |

|

11/07/16 |

|

100 Willowbrook, 2, 3, 4 Paragon |

|

Freehold, New Jersey |

|

(4,743 |

) | |

|

12/05/16 |

|

4 Becker Farm Road |

|

Roseland, New Jersey |

|

10,399 |

| |

|

12/09/16 |

|

101, 103, 105 Eisenhower Parkway |

|

Roseland, New Jersey |

|

424 |

| |

|

12/22/16 |

|

Capital Office Park, Ivy Lane |

|

Greenbelt, Maryland |

|

(18,494 |

) | |

|

12/22/16 |

|

100 Walnut Avenue |

|

Clark, New Jersey |

|

20,899 |

| |

|

12/22/16 |

|

20 Commerce Drive |

|

Cranford, New Jersey |

|

15,807 |

| |

|

12/29/16 |

|

4200 Parliament Place |

|

Lanham, Maryland |

|

(18 |

) | |

|

Sub-total |

|

|

|

|

|

$ |

117,331 |

|

|

|

|

|

|

|

|

|

| |

|

Unrealized losses on properties held for sale |

|

|

|

|

|

(7,665 |

) | |

|

|

|

|

|

|

|

|

| |

|

Total Gains, net: |

|

|

|

|

|

$ |

109,666 |

|

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Results

Balance Sheet/Capital Markets

As of December 31, 2016, the Company had a debt-to-undepreciated assets ratio of 41.6 percent. The Company had an interest coverage ratio of 3.5 times for the quarter ended December 31, 2016.

In January 2017, the Company closed on senior unsecured credit facilities totaling $925 million with a group of 13 lenders, with Wells Fargo Securities, LLC; J.P. Morgan Chase Bank, N.A. and Merrill Lynch, Pierce, Fenner & Smith Incorporated as joint lead arrangers and joint bookrunners; and Capital One, National Association and U.S. Bank National Association as joint lead arrangers.

The credit facilities are comprised of a renewal and extension of the Company’s existing $600 million unsecured revolving facility and a new $325 million unsecured delayed-draw term loan. The $600 million credit facility carries an interest rate equal to LIBOR plus 120 basis points and a facility fee of 25 basis points. The facility has a term of four years with two six-month extension options. The new $325 million delayed-draw term loan can be drawn over time within 12 months of closing with no requirement to be drawn in full. The loan carries an interest rate equal to LIBOR plus 140 basis points and a ticking fee of 25 basis points on any undrawn balance during the first 12 months after closing. The term loan matures in three years with two one-year extension options. The interest rate on the revolving credit facility and new term loan and the facility fee on the revolving credit facility are subject to adjustment, on a sliding scale, based upon the Company’s unsecured debt ratings, or at the Company’s option, based on a defined leverage ratio.

The credit facilities also contain accordion features providing for expansion of the facilities up to a total of $1.275 billion.

Also in January 2017, the Company closed on a $100 million mortgage loan, secured by Alterra at Overlook Ridge, its 722 unit multi-family community located in Revere, MA. The mortgage loan carries a fixed interest rate of 3.75 percent per annum and is interest only for its seven year term.

In December 2016, the Company redeemed for cash all $135 million outstanding principal amount of its 7.75 percent Notes due in August 2019. The Notes were redeemed on December 29, 2016. The redemption price for the Notes, including a make-whole premium, was 115.3 percent of the principal amount of the Notes, plus any accrued and unpaid interest.

Also during the fourth quarter 2016, the Company repaid mortgage debt on nine assets aggregating $200 million that carried interest rates ranging from 6.3 percent to 11.3 percent, The Company disposed of two of the assets and seven became unencumbered.

Pro forma, with the execution of these financing activities, the Company’s $2.4 billion total debt carries a weighted average interest rate of 3.8 percent. Additionally, with remaining maturities of up to 12 years, the weighted average maturity of its indebtedness is now 4.4 years.

Dividends

In December, the Company’s Board of Directors declared a cash dividend of $0.15 per common share (indicating an annual rate of $0.60 per common share) for the fourth quarter 2016, which was paid on January 13, 2017 to shareholders of record as of January 5, 2017. The Company’s Core FFO dividend payout ratio for the quarter was 26.9 percent.

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Leasing - Quarter in Review

Consolidated Commercial Leasing Summary

The Company had another successful year of leasing with solid activity in the Core, Waterfront and Flex portfolios.

Portfolio Summary

|

|

|

12/31/16 |

|

9/30/16 |

|

6/30/16 |

|

3/31/16 |

|

12/31/15 |

|

|

Number of buildings |

|

190 |

|

207 |

|

212 |

|

215 |

|

217 |

|

|

Total square feet |

|

20,951,376 |

|

23,355,409 |

|

23,463,605 |

|

23,974,930 |

|

24,211,880 |

|

|

Square feet leased |

|

18,756,661 |

|

20,473,696 |

|

20,342,158 |

|

20,910,999 |

|

20,865,233 |

|

|

Square feet vacant |

|

2,194,715 |

|

2,881,713 |

|

3,121,447 |

|

3,063,931 |

|

3,346,647 |

|

|

Number of tenants |

|

1,253 |

|

1,490 |

|

1,542 |

|

1,588 |

|

1,611 |

|

Summary of Leasing Transaction Activity

For the three months ended December 31, 2016

See detail on pages 34-35

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wtd. |

|

Wtd. Avg. |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Avg. |

|

Costs Per |

| ||

|

|

|

Number of |

|

Total |

|

Sq. Ft. |

|

Sq. Ft. Renewed |

|

Average |

|

Weighted Avg. |

|

Base |

|

Sq. Ft. |

| ||

|

|

|

Transactions |

|

Sq. Ft. |

|

New Leases |

|

and Other Retained |

|

Sq. Ft. |

|

Term (Yrs) |

|

Rent |

|

Per Year |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Core |

|

22 |

|

122,851 |

|

39,432 |

|

83,419 |

|

5,584 |

|

7.4 |

|

$ |

32.74 |

|

$ |

2.93 |

|

|

Waterfront |

|

5 |

|

31,355 |

|

31,355 |

|

— |

|

6,271 |

|

6.9 |

|

45.92 |

|

5.92 |

| ||

|

Flex |

|

18 |

|

120,447 |

|

72,563 |

|

47,884 |

|

2,660 |

|

5.5 |

|

18.00 |

|

3.57 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Sub-Total |

|

45 |

|

274,653 |

|

143,350 |

|

131,303 |

|

6,103 |

|

6.5 |

|

27.78 |

|

3.55 |

| ||

|

Non-Core |

|

10 |

|

45,952 |

|

1,021 |

|

44,931 |

|

4,493 |

|

4.3 |

|

25.50 |

|

4.98 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

TOTALS |

|

55 |

|

320,605 |

|

144,371 |

|

176,234 |

|

3,204 |

|

6.2 |

|

$ |

27.45 |

|

$ |

3.91 |

|

For the year ended December 31, 2016

See detail on pages 38-39

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wtd. |

|

Wtd. Avg. |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Avg. |

|

Costs Per |

| ||

|

|

|

Number of |

|

Total |

|

Sq. Ft. |

|

Sq. Ft. Renewed |

|

Average |

|

Weighted Avg. |

|

Base |

|

Sq. Ft. |

| ||

|

|

|

Transactions |

|

Sq. Ft. |

|

New Leases |

|

and Other Retained |

|

Sq. Ft. |

|

Term (Yrs) |

|

Rent |

|

Per Year |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Core |

|

106 |

|

900,151 |

|

229,105 |

|

671,046 |

|

8,492 |

|

6.0 |

|

$ |

29.18 |

|

$ |

4.18 |

|

|

Waterfront |

|

19 |

|

861,228 |

|

331,319 |

|

529,909 |

|

45,328 |

|

10.1 |

|

40.23 |

|

6.78 |

| ||

|

Flex |

|

84 |

|

668,529 |

|

265,245 |

|

403,284 |

|

7,959 |

|

4.7 |

|

17.35 |

|

2.86 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Sub-Total |

|

209 |

|

2,429,908 |

|

825,669 |

|

1,604,239 |

|

11,626 |

|

7.1 |

|

29.84 |

|

4.80 |

| ||

|

Non-Core |

|

64 |

|

339,700 |

|

148,420 |

|

191,280 |

|

5,308 |

|

4.8 |

|

23.76 |

|

4.49 |

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

TOTALS |

|

273 |

|

2,769,608 |

|

974,089 |

|

1,795,519 |

|

10,145 |

|

6.8 |

|

$ |

29.10 |

|

$ |

5.21 |

|

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Leasing - Quarter in Review

Consolidated Commercial Leasing Summary (continued)

For the three months ended December 31, 2016

|

|

|

|

|

Number of |

|

Number of |

|

Number of |

|

|

|

|

|

|

GAAP |

|

Transactions |

|

Transactions |

|

Transactions |

|

|

|

|

|

|

Roll Up/(Down) |

|

Rolled Up |

|

Flat |

|

Rolled Down |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

9.8 |

% |

10 |

|

— |

|

5 |

|

15 |

|

|

Renew/Other Retained |

|

13.3 |

% |

28 |

|

1 |

|

— |

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

12.0 |

% |

38 |

|

1 |

|

5 |

|

44 |

|

For the year ended December 31, 2016

|

|

|

|

|

Number of |

|

Number of |

|

Number of |

|

|

|

|

|

|

GAAP |

|

Transactions |

|

Transactions |

|

Transactions |

|

|

|

|

|

|

Roll Up/(Down) |

|

Rolled Up |

|

Flat |

|

Rolled Down |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

9.0 |

% |

34 |

|

— |

|

8 |

|

42 |

|

|

Renew/Other Retained |

|

19.6 |

% |

143 |

|

5 |

|

14 |

|

162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

18.3 |

% |

177 |

|

5 |

|

22 |

|

204 |

|

Core, Waterfront and Flex Properties

For the three months ended December 31, 2016

|

|

|

|

|

Number of |

|

Number of |

|

Number of |

|

|

|

|

|

|

GAAP |

|

Transactions |

|

Transactions |

|

Transactions |

|

|

|

|

|

|

Roll Up/(Down) |

|

Rolled Up |

|

Flat |

|

Rolled Down |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

9.5 |

% |

9 |

|

— |

|

5 |

|

14 |

|

|

Renew/Other Retained |

|

14.3 |

% |

22 |

|

— |

|

— |

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

12.2 |

% |

31 |

|

— |

|

5 |

|

36 |

|

For the year ended December 31, 2016

|

|

|

|

|

Number of |

|

Number of |

|

Number of |

|

|

|

|

|

|

GAAP |

|

Transactions |

|

Transactions |

|

Transactions |

|

|

|

|

|

|

Roll Up/(Down) |

|

Rolled Up |

|

Flat |

|

Rolled Down |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

11.7 |

% |

28 |

|

— |

|

7 |

|

35 |

|

|

Renew/Other Retained |

|

20.9 |

% |

114 |

|

3 |

|

7 |

|

124 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

20.0 |

% |

142 |

|

3 |

|

14 |

|

159 |

|

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Leasing - Rollforwards

(for the three months ended December 31, 2016)

Leasing Activity

See detail on pages 32-33

Significant strides in disposition of non-core assets produced a 190-basis-point gain in space leased during the fourth quarter.

|

|

|

|

|

|

|

Sq. Ft. |

|

Inventory |

|

Leased Sq. Ft. |

|

|

|

|

|

Net |

|

|

|

Sq. Ft. |

|

|

|

|

|

|

Pct. Leased |

|

Inventory |

|

Leased |

|

Acquired/Disposed |

|

Acquired/Disposed |

|

Expiring/ |

|

Incoming |

|

Leasing |

|

Inventory |

|

Leased |

|

Pct. Leased |

|

|

|

|

09/30/16 |

|

09/30/16 |

|

09/30/16 |

|

or Reclassed |

|

or Reclassed |

|

Adj. Sq. Ft. |

|

Sq. Ft. |

|

Activity |

|

12/31/16 |

|

12/31/16 |

|

12/31/16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

86.7 |

% |

9,663,946 |

|

8,380,026 |

|

(770,094 |

) |

(641,294 |

) |

(123,413 |

) |

122,851 |

|

(562 |

) |

8,893,852 |

|

7,738,170 |

|

87.0 |

% |

|

Waterfront |

|

94.6 |

% |

4,884,193 |

|

4,620,324 |

` |

— |

|

— |

|

(42,753 |

) |

31,355 |

|

(11,398 |

) |

4,884,193 |

|

4,608,926 |

|

94.4 |

% |

|

Flex |

|

92.9 |

% |

5,216,213 |

|

4,844,377 |

` |

6,965 |

|

— |

|

(108,928 |

) |

120,447 |

|

11,519 |

|

5,223,178 |

|

4,855,896 |

|

93.1 |

%* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sub-Total |

|

90.3 |

% |

19,764,352 |

|

17,844,727 |

|

(763,129 |

) |

(641,294 |

) |

(275,094 |

) |

274,653 |

|

(441 |

) |

19,001,223 |

|

17,202,992 |

|

90.6 |

%* |

|

Non-Core |

|

73.2 |

% |

3,591,057 |

|

2,628,969 |

|

(1,640,904 |

) |

(1,063,591 |

) |

(57,661 |

) |

45,952 |

|

(11,709 |

) |

1,950,153 |

|

1,553,669 |

|

79.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals |

|

87.7 |

% |

23,355,409 |

|

20,473,696 |

|

(2,404,033 |

) |

(1,704,885 |

) |

(332,755 |

) |

320,605 |

|

(12,150 |

) |

20,951,376 |

|

18,756,661 |

|

89.6 |

%* |

Percentage Leased

|

|

|

Pct. Leased |

|

Impact of |

|

Impact of |

|

Pct. Leased |

|

|

|

|

09/30/16 |

|

Portfolio Changes |

|

Leasing Activity |

|

12/31/16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

86.7 |

% |

— |

|

— |

|

87.0 |

% |

|

Waterfront |

|

94.6 |

% |

— |

|

— |

|

94.4 |

% |

|

Flex |

|

92.9 |

% |

— |

|

— |

|

93.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Sub-Total |

|

90.3 |

% |

— |

|

— |

|

90.6 |

% |

|

Non-Core |

|

73.2 |

% |

5.1 |

% |

(0.3 |

)% |

79.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Totals |

|

87.7 |

% |

1.9 |

% |

— |

|

89.6 |

% |

|

“Core” |

|

Long-term hold office properties (excluding Waterfront locations) |

|

“Waterfront” |

|

Office assets located on NJ Hudson River waterfront |

|

“Flex” |

|

Non-office commercial assets, primarily office/flex properties |

|

“Non-Core” |

|

Properties designated for eventual sale/disposition or repositioning |

|

* |

|

Excludes 6,965 square feet of retail space placed in service in 4th quarter 2016 and currently in lease-up. |

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Leasing - Expirations by Type

The following table sets forth a schedule of lease expirations for all consolidated properties beginning January 1, 2017, assuming that none of the tenants exercise renewal or termination options:

|

|

|

|

|

|

|

Percentage of Total |

|

|

|

Average Annualized Base |

|

|

|

|

|

|

|

|

Net Rentable Area |

|

Leased Square Feet |

|

Annualized Base |

|

Rent Per Net Rentable |

|

Percentage of Annual |

|

|

Year of |

|

Number of |

|

Subject to Expiring |

|

Represented by |

|

Rental Revenue Under |

|

Square Foot Represented |

|

Base Rent Under |

|

|

Expiration/Market |

|

Leases Expiring (a) |

|

Leases (Sq. Ft.) |

|

Expiring Leases (%) |

|

Expiring Leases ($) (b) |

|

by Expiring Leases ($) |

|

Expiring Leases (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

122 |

|

793,718 |

|

4.3 |

|

21,004,678 |

|

26.46 |

|

4.6 |

|

|

Waterfront |

|

25 |

|

699,398 |

|

3.8 |

|

25,867,076 |

|

36.98 |

|

5.7 |

|

|

Flex |

|

82 |

|

639,154 |

|

3.5 |

|

9,031,334 |

|

14.13 |

|

2.0 |

|

|

Sub-Total |

|

229 |

|

2,132,270 |

|

11.6 |

|

55,903,088 |

|

26.22 |

|

12.3 |

|

|

Non-Core |

|

43 |

|

512,244 |

|

2.8 |

|

12,918,022 |

|

25.22 |

|

2.9 |

|

|

TOTAL — 2017 |

|

272 |

|

2,644,514 |

|

14.4 |

|

68,821,110 |

|

26.02 |

|

15.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

106 |

|

742,554 |

|

4.0 |

|

20,335,620 |

|

27.39 |

|

4.5 |

|

|

Waterfront |

|

16 |

|

608,014 |

|

3.3 |

|

22,055,114 |

|

36.27 |

|

4.9 |

|

|

Flex |

|

101 |

|

1,143,867 |

|

6.2 |

|

15,007,835 |

|

13.12 |

|

3.3 |

|

|

Sub-Total |

|

223 |

|

2,494,435 |

|

13.5 |

|

57,398,569 |

|

23.01 |

|

12.7 |

|

|

Non-Core |

|

35 |

|

269,676 |

|

1.5 |

|

6,885,675 |

|

25.53 |

|

1.5 |

|

|

TOTAL — 2018 |

|

258 |

|

2,764,111 |

|

15.0 |

|

64,284,244 |

|

23.26 |

|

14.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

112 |

|

1,108,781 |

|

6.0 |

|

29,525,388 |

|

26.63 |

|

6.5 |

|

|

Waterfront |

|

12 |

|

197,972 |

|

1.1 |

|

6,391,332 |

|

32.28 |

|

1.4 |

|

|

Flex |

|

74 |

|

942,109 |

|

5.1 |

|

13,049,496 |

|

13.85 |

|

2.9 |

|

|

Sub-Total |

|

198 |

|

2,248,862 |

|

12.2 |

|

48,966,216 |

|

21.77 |

|

10.8 |

|

|

Non-Core |

|

30 |

|

149,885 |

|

0.8 |

|

3,574,261 |

|

23.85 |

|

0.8 |

|

|

TOTAL — 2019 |

|

228 |

|

2,398,747 |

|

13.0 |

|

52,540,477 |

|

21.90 |

|

11.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

109 |

|

963,504 |

|

5.1 |

|

23,853,137 |

|

24.76 |

|

5.2 |

|

|

Waterfront |

|

8 |

|

70,779 |

|

0.4 |

|

2,517,518 |

|

35.57 |

|

0.5 |

|

|

Flex |

|

53 |

|

431,851 |

|

2.4 |

|

5,717,423 |

|

13.24 |

|

1.3 |

|

|

Sub-Total |

|

170 |

|

1,466,134 |

|

7.9 |

|

32,088,078 |

|

21.89 |

|

7.0 |

|

|

Non-Core |

|

26 |

|

212,879 |

|

1.2 |

|

5,662,688 |

|

26.60 |

|

1.3 |

|

|

TOTAL — 2020 |

|

196 |

|

1,679,013 |

|

9.1 |

|

37,750,766 |

|

22.48 |

|

8.3 |

|

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Leasing - Expirations by Type (continued)

|

|

|

|

|

|

|

Percentage of Total |

|

|

|

Average Annualized Base |

|

|

|

|

|

|

|

|

Net Rentable Area |

|

Leased Square Feet |

|

Annualized Base |

|

Rent Per Net Rentable |

|

Percentage of Annual |

|

|

Year of |

|

Number of |

|

Subject to Expiring |

|

Represented by |

|

Rental Revenue Under |

|

Square Foot Represented |

|

Base Rent Under |

|

|

Expiration/Market |

|

Leases Expiring (a) |

|

Leases (Sq. Ft.) |

|

Expiring Leases (%) |

|

Expiring Leases ($) (b) |

|

by Expiring Leases ($) |

|

Expiring Leases (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

63 |

|

408,135 |

|

2.2 |

|

10,911,849 |

|

26.74 |

|

2.4 |

|

|

Waterfront |

|

17 |

|

387,675 |

|

2.1 |

|

13,555,112 |

|

34.97 |

|

3.0 |

|

|

Flex |

|

51 |

|

491,264 |

|

2.7 |

|

6,375,777 |

|

12.98 |

|

1.4 |

|

|

Sub-Total |

|

131 |

|

1,287,074 |

|

7.0 |

|

30,842,738 |

|

23.96 |

|

6.8 |

|

|

Non-Core |

|

17 |

|

105,068 |

|

0.6 |

|

2,455,932 |

|

23.37 |

|

0.5 |

|

|

TOTAL — 2021 |

|

148 |

|

1,392,142 |

|

7.6 |

|

33,298,670 |

|

23.92 |

|

7.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

61 |

|

499,066 |

|

2.6 |

|

13,400,876 |

|

26.85 |

|

3.1 |

|

|

Waterfront |

|

11 |

|

252,201 |

|

1.4 |

|

7,817,279 |

|

31.00 |

|

1.7 |

|

|

Flex |

|

32 |

|

273,764 |

|

1.5 |

|

3,793,583 |

|

13.86 |

|

0.9 |

|

|

Sub-Total |

|

104 |

|

1,025,031 |

|

5.5 |

|

25,011,738 |

|

24.40 |

|

5.7 |

|

|

Non-Core |

|

14 |

|

159,615 |

|

0.9 |

|

3,967,294 |

|

24.86 |

|

0.7 |

|

|

TOTAL — 2022 |

|

118 |

|

1,184,646 |

|

6.4 |

|

28,979,032 |

|

24.46 |

|

6.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

53 |

|

883,487 |

|

4.8 |

|

20,325,060 |

|

23.01 |

|

4.5 |

|

|

Waterfront |

|

9 |

|

329,554 |

|

1.8 |

|

10,559,632 |

|

32.04 |

|

2.3 |

|

|

Flex |

|

16 |

|

244,842 |

|

1.3 |

|

3,590,009 |

|

14.66 |

|

0.8 |

|

|

Sub-Total |

|

78 |

|

1,457,883 |

|

7.9 |

|

34,474,701 |

|

23.65 |

|

7.6 |

|

|

Non-Core |

|

4 |

|

84,636 |

|

0.5 |

|

1,926,439 |

|

22.76 |

|

0.4 |

|

|

TOTAL — 2023 |

|

82 |

|

1,542,519 |

|

8.4 |

|

36,401,140 |

|

23.60 |

|

8.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

33 |

|

655,254 |

|

3.6 |

|

16,890,965 |

|

25.78 |

|

3.8 |

|

|

Waterfront |

|

7 |

|

168,810 |

|

0.9 |

|

5,993,971 |

|

35.51 |

|

1.3 |

|

|

Flex |

|

21 |

|

269,628 |

|

1.5 |

|

4,048,021 |

|

15.01 |

|

0.9 |

|

|

Sub-Total |

|

61 |

|

1,093,692 |

|

6.0 |

|

26,932,957 |

|

24.63 |

|

6.0 |

|

|

Non-Core |

|

1 |

|

3,401 |

|

(d) |

|

85,025 |

|

25.00 |

|

(d) |

|

|

TOTAL — 2024 |

|

62 |

|

1,097,093 |

|

6.0 |

|

27,017,982 |

|

24.63 |

|

6.0 |

|

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Leasing - Expirations by Type (continued)

|

|

|

|

|

|

|

Percentage of Total |

|

|

|

Average Annualized Base |

|

|

|

|

|

|

|

|

Net Rentable Area |

|

Leased Square Feet |

|

Annualized Base |

|

Rent Per Net Rentable |

|

Percentage of Annual |

|

|

Year of |

|

Number of |

|

Subject to Expiring |

|

Represented by |

|

Rental Revenue Under |

|

Square Foot Represented |

|

Base Rent Under |

|

|

Expiration/Market |

|

Leases Expiring (a) |

|

Leases (Sq. Ft.) |

|

Expiring Leases (%) |

|

Expiring Leases ($) (b) |

|

by Expiring Leases ($) |

|

Expiring Leases (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

13 |

|

334,187 |

|

1.9 |

|

8,238,338 |

|

24.65 |

|

1.8 |

|

|

Waterfront |

|

5 |

|

98,748 |

|

0.5 |

|

3,130,374 |

|

31.70 |

|

0.7 |

|

|

Flex |

|

15 |

|

225,070 |

|

1.2 |

|

2,935,942 |

|

13.04 |

|

0.7 |

|

|

Sub-Total |

|

33 |

|

658,005 |

|

3.6 |

|

14,304,654 |

|

21.74 |

|

3.2 |

|

|

Non-Core |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

TOTAL — 2025 |

|

33 |

|

658,005 |

|

3.6 |

|

14,304,654 |

|

21.74 |

|

3.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

21 |

|

389,860 |

|

2.1 |

|

11,284,499 |

|

28.95 |

|

2.5 |

|

|

Waterfront |

|

10 |

|

257,653 |

|

1.4 |

|

8,779,328 |

|

34.07 |

|

1.9 |

|

|

Flex |

|

10 |

|

83,616 |

|

0.5 |

|

1,249,199 |

|

14.94 |

|

0.3 |

|

|

Sub-Total |

|

41 |

|

731,129 |

|

4.0 |

|

21,313,026 |

|

29.15 |

|

4.7 |

|

|

Non-Core |

|

1 |

|

5,848 |

|

|

(d) |

128,656 |

|

22.00 |

|

|

(d) |

|

TOTAL — 2026 |

|

42 |

|

736,977 |

|

4.0 |

|

21,441,682 |

|

29.09 |

|

4.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2027 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

9 |

|

374,639 |

|

2.1 |

|

9,185,763 |

|

24.52 |

|

2.0 |

|

|

Waterfront |

|

13 |

|

566,711 |

|

3.1 |

|

15,403,916 |

|

27.18 |

|

3.4 |

|

|

Flex |

|

7 |

|

43,347 |

|

0.2 |

|

966,031 |

|

22.29 |

|

0.2 |

|

|

Sub-Total |

|

29 |

|

984,697 |

|

5.4 |

|

25,555,710 |

|

25.95 |

|

5.6 |

|

|

Non-Core |

|

1 |

|

26,315 |

|

0.1 |

|

526,300 |

|

20.00 |

|

0.1 |

|

|

TOTAL — 2027 |

|

30 |

|

1,011,012 |

|

5.5 |

|

26,082,010 |

|

25.80 |

|

5.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2028 and thereafter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

9 |

|

386,034 |

|

2.1 |

|

9,358,317 |

|

24.24 |

|

2.1 |

|

|

Waterfront |

|

10 |

|

867,927 |

|

4.7 |

|

32,399,734 |

|

37.33 |

|

7.1 |

|

|

Flex |

|

2 |

|

35,260 |

|

0.2 |

|

650,076 |

|

18.44 |

|

0.1 |

|

|

Sub-Total |

|

21 |

|

1,289,221 |

|

7.0 |

|

42,408,127 |

|

32.89 |

|

9.3 |

|

|

Non-Core |

|

1 |

|

9,300 |

|

|

(d) |

330,150 |

|

35.50 |

|

0.1 |

|

|

TOTAL — 2028 and thereafter |

|

22 |

|

1,298,521 |

|

7.0 |

|

42,738,277 |

|

32.91 |

|

9.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals/Weighted Average |

|

1,491 |

|

18,407,300 |

(c) |

100.0 |

|

453,660,044 |

|

24.65 |

|

100.0 |

|

Totals/Weighted Average by type, along with footnotes, on following page.

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Leasing - Expirations by Type (continued)

|

|

|

|

|

|

|

Percentage of Total |

|

|

|

Average Annualized Base |

|

|

|

|

|

|

|

|

Net Rentable Area |

|

Leased Square Feet |

|

Annualized Base |

|

Rent Per Net Rentable |

|

Percentage of Annual |

|

|

Year of |

|

Number of |

|

Subject to Expiring |

|

Represented by |

|

Rental Revenue Under |

|

Square Foot Represented |

|

Base Rent Under |

|

|

Expiration/Market |

|

Leases Expiring (a) |

|

Leases (Sq. Ft.) |

|

Expiring Leases (%) |

|

Expiring Leases ($) (b) |

|

by Expiring Leases ($) |

|

Expiring Leases (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS BY TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

711 |

|

7,539,219 |

|

41.0 |

|

194,314,490 |

|

25.77 |

|

42.8 |

|

|

Waterfront |

|

143 |

|

4,505,442 |

|

24.5 |

|

154,470,386 |

|

34.29 |

|

34.0 |

|

|

Flex |

|

464 |

|

4,823,772 |

|

26.2 |

|

66,414,726 |

|

13.77 |

|

14.6 |

|

|

Sub-Total |

|

1,318 |

|

16,868,433 |

|

91.7 |

|

415,199,602 |

|

24.61 |

|

91.4 |

|

|

Non-Core |

|

173 |

|

1,538,867 |

|

8.3 |

|

38,460,442 |

|

24.99 |

|

8.6 |

|

|

Totals/Weighted Average |

|

1,491 |

|

18,407,300 |

|

100.0 |

|

453,660,044 |

|

24.65 |

|

100.0 |

|

|

(a) |

|

Includes office, office/flex, industrial/warehouse and stand-alone retail property tenants only. Excludes leases for amenity, retail, parking and month-to-month tenants. Some tenants have multiple leases. |

|

(b) |

|

Annualized base rental revenue is based on actual December 2016 billings times 12. For leases whose rent commences after January 1, 2017 annualized base rental revenue is based on the first full month’s billing times 12. As annualized base rental revenue is not derived from historical GAAP results, historical results may differ from those set forth above. |

|

(c) |

|

Includes leases expiring December 31, 2016 aggregating 151,655 square feet and representing annualized rent of $2,630,824 for which no new leases were signed. |

|

(d) |

|

Represents 0.05% or less. |

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Leasing - Rental Rate Effects

The following schedule sets forth the percentage change in GAAP rent for transactions signed within the period. Transactions signed for space which has been vacant for longer than 12 months are excluded.

|

|

|

Transaction Type |

|

1st Qtr ‘16 |

|

2nd Qtr ‘16 |

|

3rd Qtr ‘16 |

|

4th Qtr ‘16 |

|

Full Year 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

2.7 |

% |

6.9 |

% |

10.0 |

% |

9.2 |

% |

5.3 |

% |

|

|

|

Renew/Other Retained |

|

7.7 |

% |

9.7 |

% |

7.9 |

% |

15.7 |

% |

9.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

7.0 |

% |

9.7 |

% |

8.0 |

% |

15.5 |

% |

9.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Waterfront |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

N/A |

|

23.3 |

% |

N/A |

|

10.0 |

% |

10.8 |

% |

|

|

|

Renew/Other Retained |

|

26.7 |

% |

70.6 |

% |

N/A |

|

N/A |

|

39.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

26.7 |

% |

69.8 |

% |

N/A |

|

10.0 |

% |

37.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Flex |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

32.9 |

% |

9.1 |

% |

18.0 |

% |

8.9 |

% |

13.2 |

% |

|

|

|

Renew/Other Retained |

|

12.9 |

% |

6.7 |

% |

10.1 |

% |

9.6 |

% |

9.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

14.9 |

% |

7.4 |

% |

12.0 |

% |

9.2 |

% |

10.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sub-Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

9.7 |

% |

9.9 |

% |

17.0 |

% |

9.5 |

% |

11.7 |

% |

|

|

|

Renew/Other Retained |

|

19.9 |

% |

32.1 |

% |

8.6 |

% |

14.3 |

% |

20.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

19.4 |

% |

30.5 |

% |

9.3 |

% |

12.2 |

% |

20.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Core |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

10.3 |

% |

(14.1 |

)% |

7.0 |

% |

41.7 |

% |

(1.7 |

)% |

|

|

|

Renew/Other Retained |

|

3.9 |

% |

3.8 |

% |

5.4 |

% |

10.1 |

% |

5.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

4.3 |

% |

(1.6 |

)% |

5.6 |

% |

10.7 |

% |

3.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New |

|

9.7 |

% |

2.2 |

% |

16.2 |

% |

9.8 |

% |

9.0 |

% |

|

|

|

Renew/Other Retained |

|

18.9 |

% |

29.9 |

% |

8.3 |

% |

13.3 |

% |

19.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

18.4 |

% |

27.3 |

% |

9.1 |

% |

12.0 |

% |

18.3 |

% |

Mack-Cali Realty Corporation Supplemental Operating and Financial Data for the Quarter Ended December 31, 2016

Spotlight on Earnings - FFO, Core FFO & AFFO

(in thousands, except per share/unit amounts) (unaudited)

Core FFO per share for 4Q-16 was $0.56 an increase of $0.09 per share over 4Q-15. Rental rate increases boosted current quarter results and projects to provide growth into 2017.

|

|

|

Three Months Ended |

|

Year Ended |

| ||||||||

|

|

|

December 31, |

|

December 31, |

| ||||||||

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

| ||||

|

Net income (loss) available to common shareholders |

|

$ |

15,181 |

|

$ |

(31,718 |

) |

$ |

117,224 |

|

$ |

(125,752 |

) |

|

Add (deduct): Noncontrolling interest in Operating Partnership |

|

1,774 |

|

(3,795 |

) |

13,721 |

|

(15,256 |

) | ||||

|

Real estate-related depreciation and amortization on continuing operations (a) |

|

56,874 |

|

48,707 |

|

204,746 |

|

190,875 |

| ||||

|

Impairments |

|

— |

|

33,743 |

|

— |

|

197,919 |

| ||||

|

Gain on change of control of interests |

|

— |

|

— |

|

(15,347 |

) |

— |

| ||||

|

Realized (gains) losses and unrealized losses on disposition of rental property, net |

|

(41,002 |

) |

— |

|

(109,666 |

) |

(53,261 |

) | ||||

|

Gain on sale of investment in unconsolidated joint venture |

|

— |

|

— |

|

(5,670 |

) |

(6,448 |

) | ||||

|

Funds from operations (b) |

|

$ |

32,827 |

|

$ |

46,937 |

|

$ |

205,008 |

|

$ |

188,077 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Add: |

|

|

|

|

|

|

|

|

| ||||

|

Acquisition-related costs |

|

$ |

26 |

|

$ |

1,449 |

|

$ |

2,880 |

|

$ |

1,560 |

|

|

Dead deal costs |

|

282 |

|

— |

|

1,073 |

|

— |

| ||||

|

Severance/separation costs |

|

— |

|

— |

|

0 |

|

2,000 |

| ||||

|

Mark-to-market interest rate swap |

|

(631 |

) |

— |

|

(631 |

) |

— |

| ||||

|

Deduct: |

|

|

|

|

|

|

|

|

| ||||

|

Net real estate tax appeal proceeds |

|

(71 |

) |

(808 |

) |

(817 |

) |

(5,000 |

) | ||||

|

Equity in earnings from joint venture refinancing proceeds |

|

— |

|

— |

|

(21,708 |

) |

(3,700 |

) | ||||

|

Loss from extinguishment of debt, net |

|

23,658 |

|

— |

|

30,540 |

|

— |

| ||||

|

Core FFO |

|

$ |

56,091 |

|

$ |

47,578 |

|

$ |

216,345 |

|

$ |

182,937 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Add (Deduct) Non-Cash Items: |

|

|

|

|

|

|

|

|

| ||||

|

Straight-line rent adjustments (c) |

|

$ |

(3,792 |

) |

$ |

(3,256 |

) |

$ |

(15,123 |

) |

$ |

(4,592 |

) |

|

Amortization of market lease intangibles, net (d) |

|

(772 |

) |

(35 |

) |

(2,260 |

) |

(587 |

) | ||||

|

Amortization of stock compensation |

|

1,433 |

|

820 |

|

6,018 |

|

2,616 |

| ||||

|

Non real estate depreciation and amortization |

|

395 |

|

232 |

|

1,112 |

|

954 |

| ||||

|

Amortization of debt discount/(premium) and mark-to-market, net |

|

269 |

|

594 |

|

1,686 |

|

3,386 |

| ||||

|

Amortization of deferred financing costs |

|

999 |

|

944 |

|

4,582 |

|

3,790 |

| ||||

|

Deduct: |

|

|

|

|

|

|

|

|

| ||||

|

Non-incremental revenue generating capital expenditures: |

|

|

|

|

|

|

|

|

| ||||

|

Building improvements |

|

(8,975 |

) |

(8,954 |

) |

(23,364 |

) |

(29,147 |

) | ||||

|

Tenant improvements and leasing commissions (e) |

|

(5,599 |

) |

(8,488 |

) |

(40,616 |

) |

(27,705 |

) | ||||

|

Tenant improvements and leasing commissions on space vacant for more than one year |

|

(14,522 |

) |

(10,928 |

) |

(64,909 |

) |

(35,727 |

) | ||||

|

Adjusted FFO (b) |

|

$ |

25,527 |

|

$ |

18,507 |

|

$ |

83,471 |

(j) |

$ |

95,925 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Core FFO (calculated above) |

|

$ |

56,091 |

|

$ |