Exhibit 99.2

Roseland Residential Trust Supplemental Operating and Financial Data 1Q 2016

Exhibit 99.2

Roseland Residential Trust Supplemental Operating and Financial Data 1Q 2016

2 Monaco 523 apartments operating Marbella 412 apartments operating URL® Harborside – I 763 apartments Q4 2016 opening San Remo 250 apartments 2017 start Marbella 2 311 apartments Q2 2016 opening Jersey City Waterfront RRT Holdings URL® Harborside – II & III 1,500 apartments 2018 start Plaza 8 / 9 1,300 apartments Future development

Portside at Pier One The Chase at Overlook Ridge Metropolitan at 40 Park Index RRT Overview Company Highlights Portfolio Overview NAV Breakdown RRT Financial Schedules Balance Sheet Income Statement Same Store Results Operating & Lease-Up Communities Subordinated Interest Communities In-Construction Communities Predevelopment and Future Communities Station House 3 Q1 2016

Roseland Residential Trust Overview Q1 2016

The Company- Roseland Residential Trust 5 Q1 2016 Roseland Residential Trust (RRT or Roseland), Mack-Cali’s multi-family platform, is a premier full-service residential and mixed-use developer in the Northeast with an industry-leading reputation for successful conception, execution, and management of class A residential developments RRT’s scalable and integrated business platform oversees the Company’s operating and in-construction assets, geographically desirable land portfolio, sourcing of new development and acquisition opportunities, and repurposing activities RRT was formed on December 31, 2015 as a separate subsidiary of Mack-Cali to further facilitate disclosures, transparency, and capital flexibility of the residential platform. RRT contains all of Mack-Cali’s residential holdings, including partially filled or empty office assets with likely residential repurposing potential RRT’s executive leadership, a cohesive team since 2003, has an average experience of 18 years at Roseland and 27 years in the industry: Marshall Tycher Founder & Chairman Michael DeMarco Chief Executive Officer Andrew Marshall President & Chief Operating Officer Ivan Baron Chief Legal Counsel Bob Cappy Chief Financial Officer Gabriel Shiff Chief Investment Officer Brenda Cioce President, Roseland Residential Services RRT is governed by a Board of Directors consisting of: William Mack, David Mack, Michael DeMarco, Mitchell Rudin, and Marshall Tycher

Roseland Overview- Management’s Discussion & Objectives 6 Q1 2016 RRT oversees Mack-Cali’s continued expansion into the residential sector where fundamentals and macroeconomic trends in our core geographies continue to show strength. RRT manages a growing portfolio of owned, under construction, and future development assets on the New Jersey Waterfront, Boston, Philadelphia and Washington D.C, with the remaining holdings primarily in suburban locations in high income areas in New Jersey. RRT is well positioned to benefit from the demographics and shortage of housing in these markets. Rents in our primary sub-markets, markets that will fuel much of our future development activity, have demonstrated growth over the last year: Jersey City at 5.3%; Port Imperial at 1.5% and Overlook Ridge at 4.5% Current Portfolio: Roseland’s high-barrier-to-entry portfolio is at the forefront of characteristics supportive of market-leading valuations and competitive with leading publicly traded residential REITs: (i) top in market rents (ii) young, and trending lower, average building age (iii) geographically concentrated exclusively in the Northeast. As highlighted in Subsequent Events, Roseland is exploring alternatives to further expand its portfolio ownership Target Portfolio: RRT projects approximately 14,000 operating and in-construction apartments by year-end 2018. This growth of approximately 6,000 apartments will be achieved primarily through development and repurposing activities from Roseland’s valuable land holdings Portfolio growth is not subject to acquisition risk as Roseland controls a sizable future development portfolio including highly accretive repurposing activities (approximately ten sites are active) Future development is substantially in communities where Roseland has developed before, or more specifically adjacent to existing developments. This allows RRT to have intimate knowledge on operating expenses and construction costs, and most importantly, achievable rent thresholds. This dramatically reduces our development risk Market Conditions: We are seeing continued strength in our key markets, with increasing rents and strong absorption. Our 2016 deliveries have projected opening rent schedules approximately 10% higher than pre-construction underwriting Geography: Consistent with its history, Roseland plans to develop the finest residential portfolio in the Northeast focused on transit-based / urban locations. RRT developments will be concentrated around the following principal locations: New Jersey Waterfront (Jersey City and Port Imperial), Boston Region, Suburban New York/New Jersey, Washington, DC, and Philadelphia

Roseland Overview- Recent Highlights - 1Q Trust Formation: On December 31, 2015 Mack-Cali formed Roseland Residential Trust, a wholly owned Mack-Cali entity dedicated to the execution of its residential growth strategy, including: the buildout of Roseland’s land portfolio, the repurposing of non-strategic Mack-Cali office holdings, and the sourcing of new marketplace development and acquisition opportunities Acquisitions: In January 2016, RRT acquired the remaining JV partner interest in The Chase at Overlook Ridge based on a project valuation of $104 million. RRT will recognize initial returns on its net $21 million cash investment of approximately 14%. RRT was able to unlock $10.2 million of promote value that was applied towards the acquisition price Construction Starts: RRT commenced construction on RiverHouse 11 at Port Imperial, where current market rents are approximately $40 per square foot: In-Construction Activities: RRT advanced construction on eight additional projects, including three 2016 deliveries: Project Location Apts Ownership Projected Total Costs Projected Stabilized NOI Projected Stabilized Yield RiverHouse 11 Weehawken, NJ 295 100% (1) $118,875 $7,542 6.34% (2) 7 Q1 2016 Subsequent to quarter end, RRT acquired joint venture partner interest in RiverHouse 11. Represents untrended yield. 2016 Deliveries Future Deliveries Marbella 2 (311) Marriot Hotels at Port Imperial (364) URL® Harborside (763) Worcester – I (237) Quarry Place at Tuckahoe (108) The Chase II at Overlook Ridge (292) Portside 5/6 (296) Signature Place at Morris Plains (197) Subtotal: 1,181 apartments Subtotal: 1,022 apartments ; 364 keys

Roseland Overview- Recent Highlights - Subsequent Events 8 Q1 2016 A primary objective of RRT is to simplify and expand its portfolio ownership, particularly in its core markets. To that end, and as highlighted in its April 18, 2016 press release, subsequent to quarter-end: Portside at East Pier – East Boston, MA: Roseland acquired its partner’s senior interest in the 175 apartment community located on the East Boston waterfront, thereby increasing Roseland’s interest to 85%. Roseland’s share of the acquisition purchase price was approximately $32 million. Roseland, on a 85% basis, is also currently constructing the adjacent 296-apartment community and upon completion intends to operate the combined 471 apartment Portside community together. A stabilized 4.8% capitalization rate, before Portside 5/6 operational efficiencies, was used for valuation purposes Port Imperial – West New York, NJ Roseland acquired its partner’s 25 percent subordinate interest in RiverTrace, a 316-apartment stabilized community. Roseland now holds a 50 percent subordinate interest in the joint venture with UBS. The cost of the acquisition was approximately $11.3 million, based on a 4.7% capitalization rate. The valuation equated to $531,000/unit in a waterfront marketplace where valuations are approximately $600,000/unit Port Imperial - Weehawken, NJ: Roseland (i) acquired its historical land partner’s interest across five waterfront development parcels, including the recently started RiverHouse 11, thereby increasing its ownership to 100% (ii) acquired its historical land partner’s interest in Port Imperial South Garage and Retail, thereby increasing its ownership to 70% (iii) transferred a sixth waterfront parcel, Parcel 2, to a new 50/50 heads-up entity View from acquired sites RiverTrace at Port Imperial Portside at East Pier

____________________________ Based on RRT portfolio as of March 31, 2016, including Subsequent Events. Year-end 2018 projections based on execution of Roseland’s development/operating plan described herein. Includes subordinated joint venture apartments Actual Growth: Since Mack-Cali’s acquisition over three years ago, Roseland has exhibited material growth across key financial metrics Projected Growth: Roseland forecasts continued growth through completion and lease-up of its active construction portfolio (2,863 apartments and keys) and construction starts of its remaining 2016 development schedule Roseland Overview- NAV and Cash Flow Growth 9 Q1 2016 October 2012 March 2016 (1) Year End 2018 (1) (2) Total Oct-2012 Variance Total Oct-2012 Variance Operating & Construction Apts. (3) 3,533 8,502 4,969 13,994 10,461 Future Development Apts. 7,086 10,849 3,763 5,357 (1,729) Subordinated Interests Apts. 3,533 2,654 (879) 1,751 (1,782) Average Operating and Construction Ownership 22.3% 59.8% 37.5% 69.9% 47.6% Annual Property Cash Flow ($ in millions) $0.5 $21.1 $20.6 NAV ($ in millions) $115 $1,149 $1,034 Projected Growth Actual Growth

Portfolio Overview Roseland will seek continuous production from its portfolio: Roseland envisions significant value creation through this continuous evolution: Includes 364 hotel keys. Subsequent to quarter end, RRT’s subordinated interests reduced to 2,479. Includes 1,242 apartments of Identified Repurposing pursuits. Classification Operating Communities In-Construction Communities (1) Subordinated Interests (2) Predevelopment and Future Communities (3) Total Current Portfolio 2,985 2,863 2,654 10,849 19,351 Y/E 2016 Portfolio 4,950 3,027 2,163 9,211 19,351 Y/E 2017 Portfolio 5,855 6,107 1,751 5,638 19,351 Y/E 2018 Portfolio 8,701 3,542 1,751 5,357 19,351 10 Q1 2016

Portfolio Overview- Net Asset Value (NAV) Breakdown As reflected below, primary contributors to Roseland’s approximate $1.15 billion NAV are: Markets: Geographically concentrated on the Hudson Waterfront and Boston Metro markets (~76%) Status: Majority in Operating and In-Construction communities (~82%) Ownership: Predominantly wholly-owned and joint venture interests (~91%) 11 Q1 2016 ____________________________ Includes Philadelphia metro area, Central/Northern New Jersey (non-Waterfront) and Westchester County. Number of Estimated Roseland Properties / Gross Asset Net Asset Projects Units Value Value Total Hudson River Waterfront 32 10,011 $2,215 $493 43.0% Boston Metro 12 3,391 534 383 33.4% Washington, D.C. 7 2,124 524 105 9.2% Northeast Corridor (1) 21 3,825 317 150 13.1% Subtotal 72 19,351 $3,589 $1,132 98.7% Operating Properties 23 5,639 $2,504 $536 46.8% In-Construction 9 2,863 673 401 35.0% Pre / Future Development 40 10,849 413 195 17.0% Subtotal 72 19,351 $3,589 $1,132 98.7% Wholly-Owned 28 6,569 $615 $512 44.6% Joint Venture 34 10,128 1,493 527 46.0% Subordinated Interest 10 2,654 1,481 93 8.1% Subtotal 72 19,351 $3,589 $1,132 98.7% Fee Income Business / Platform $15 $15 1.3% Total Total $3,604 $1,147 100.0% Fee Business Ownership ($ in millions) Number of % of Markets Status

Portfolio Overview- In Construction Assets 12 Q1 2016 Quarry Place at Tuckahoe 108 apartments Tuckahoe, NY Initial Occupancy: Q3 2016 M2 at Marbella 311 apartments Jersey City, NJ Initial Occupancy: Q2 2016 Portside 5/6 296 apartments East Boston, MA Initial Occupancy: Q1 2018 Roseland has nine (9) projects representing 2,499 apartments and a 364-key hotel at Port Imperial under construction. RRT forecasts approximately $355 million of value creation from these active developments, with its share at 84% RiverHouse 11 at Port Imperial 295 apartments Weehawken, NJ Initial Occupancy: Q1 2018 URL® Harborside 763 apartments Jersey City, NJ Initial Occupancy: Q4 2016 Value Creation Summary ($ in millions) Projected Development Yield - Residential 6.56% Projected Development Yield - Hotel 10.03% Projected Development Yield - Total 7.00% Projected NOI - Total $73,957 Gross Value @ 5.00% Cap $1,479,140 Less: Projected Costs (1,056,849) Net Value Creation @ 100% $422,291 RRT Share @ 84% $354,969

Portfolio Overview- Repurposing Candidates RRT is actively repurposing select Mack-Cali office holdings to residential use, with Signature Place at Morris Plains currently in construction and two scheduled starts: Roseland is seeking approvals on multiple additional repurposing developments We anticipate repurposing activities will provide material value creation. For example, the Short Hills value creation is: Current office book basis: $4.1 million Via the rezoning process, Roseland has received approvals for the repurposing of the site for 200 apartments (170 market-rate) and 225 hotel keys The combined features of the hotel, luxury multi-family, and 255,000 square foot Class A Mack-Cali office will be one of the finest mixed-use developments in the region As approved, the estimated value of the Short Hills repurposing is approximately: $23.1 million (net ~$19 million) 13 Short Hills, NJ Apts: 200 Target Start: 2017 Signature Place at Morris Plains, NJ Apts: 197 Started: 4Q 2015 Bala Cynwyd, PA Apts: 206 Target Start: 2016 Q1 2016

RRT will continue maximizing its ownership and economic participation on future communities while evaluating conversions of existing subordinated interests Portfolio Overview- Ownership Objectives 14 Portfolio Ownership (Apartments) Portfolio Ownership (Cash Flow Contribution) Q1 2016 ____________________________ Includes closed acquisitions subsequent to quarter-end.

Financial Schedules Q1 2016

Financial Highlights- RRT Balance Sheet 16 $ in thousands Q1 2016 __________________________ (1) Increase primarily resulting from Chase I acquisition ($101 million) and in-construction development and repurposing expenditures ($24 million). (2) Increase primarily resulting from Chase I permanent loan ($72 million) and borrowings under the Mack-Cali line of credit ($37 million, of which $25 million was used to fund Development Capital). AS OF AS OF MAR 31, 2016 DEC 31, 2015 ASSETS Rental Property Land and leasehold interests $188,657 $177,579 Buildings and improvements 606,762 495,243 Furniture, Fixtures and Equipment 14,780 12,737 Total Gross Rental Property (1) 810,199 685,559 Less: Accumulated Depreciation (30,320) (30,642) Net Investment in Rental Property 779,879 654,917 Total Property Investments 779,879 654,917 Cash and cash equivalents 7,077 6,802 Investments in unconsolidated JV's 225,595 227,317 Unbilled rents receivable, net 34 43 Deferred Charges & Other Assets 25,405 28,589 Restricted Cash 3,390 2,607 Accounts receivable, net of allowance 1,966 1,815 Total Assets $1,043,346 $922,089 LIABILITIES & EQUITY LIABILITIES Mortgages, loans payable & other oblig (2) $229,739 $113,715 Accounts pay, accrued exp and other liab 29,776 32,569 Rents recv'd in advance & security deposits 2,171 1,713 Accrued interest payable 543 282 Total Liabilities 262,229 148,279 EQUITY Partner's Capital/Stockholders' Equity 723,595 716,608 Minority interests 57,523 57,202 Total equity 781,118 773,810 Total Liabilities & Equity $1,043,346 $922,089

Financial Highlights- RRT Income Statement 17 $ in thousands Q1 2016 1Q 2016 ACTUAL REVENUE: Base Rents $8,203 Escalation & Recoveries from Tenants 287 Real Estate Services 5,990 Parking Income 1,327 Other Income 474 Total Revenue 16,281 EXPENSES: Real Estate Taxes 2,064 Utilities 681 Operating Services 2,869 Real Estate Service Salaries 6,671 General and Administrative 3,255 Acquisition Costs - Depreciation & Amortization 5,732 Total Expenses 21,274 Operating Income (Loss) (4,993) OTHER (EXPENSE) INCOME: Interest Expense (1,441) Interest and other investment income 1 Equity in Earnings (Loss) in Unconsol JV's (1,231) Gain on Change of Control of Interests 10,156 Gain on Sale - Other - Total Other (Expense) Income 7,485 Income from Continuing Operations 2,492 Net Income (Loss) $2,492 Non-controlling Interest in Consolid JV's 681 Net Income (Loss) Available to Common Shareholders $3,173

Financial Highlights- Same Store Comparison 18 $ in thousands Q1 2016 ____________________________ (1) March 31, 2016 Revenues, upon accounting for offline renovation units at Crystal House, would generate a Revenue increase of $200,000, thereby reducing the percent change to -0.29% (Net Operating Income increase to +1.76%). (2) March 31, 2016 Revenues, upon accounting for offline renovation units at Crystal House, would generate a Revenue increase of $350,000, thereby increasing the percent change to 1.17%. (Net Operating Income change to +0.10%). Sequential Quarter Comparison Quarter Ended Quarter Ended % March 31, 2016 December 31, 2015 Change Number of Homes 5,021 Revenue Per Home $2,463 $2,412 2.11% Revenues $34,938 $35,243 -0.87% (1) Operating Expenses 13,451 13,930 -3.44% Net Operating Income $21,487 $21,313 0.82% Calendar Quarter Comparison Quarter Ended Quarter Ended % March 31, 2016 March 31, 2015 Change Number of Homes 3,746 Revenue Per Home $2,416 $2,295 5.27% Revenues $25,375 $25,433 -0.23% (2) Operating Expenses 10,107 9,825 2.87% Net Operating Income $15,268 $15,609 -2.18%

Equity Raise: The Company has engaged Eastdil Secured to raise approximately $300-$350 million in direct equity investment in RRT. The form of this investment would be common equity with co-investment equity from Mack-Cali. Equity raise efforts launched in February 2016. 2016 Highlights 19 Q1 2016 Portfolio: Remaining 2016 construction start activity of 1,638 apartments will produce a target operating and in-construction portfolio at year-end 2016 of approximately 10,140 apartments: Capital Commitments: Roseland projects its capital commitments for its in-construction and remaining 2016 start portfolio is approximately $209 million: Category In-Construction Portfolio (Remaining Commitment) 2016 Remaining Starts* Total Apts/Keys 2,853 1,668 4,521 Amount ($M) $89 120 $209 * Of which approximately $79 million is estimated to be spent in 2016.

Financial Highlights- Operating & Lease-Up Communities As of March 31, 2016, Roseland had: Wholly owned or joint venture interest in 2,607 stabilized operating apartments and 378 lease-up apartments The stabilized portfolio had a leased percentage of 96.3%, compared to 95.9% in 4Q Station House, near Union Station in Washington, DC, had a leased percentage of 83.3%, compared to 73.3% in 4Q We envision stabilization of and meaningful FFO contribution from Station House in 2016 20 Q1 2016

Financial Highlights- Operating Communities 21 Q1 2016 Average Average Percentage Percentage Revenue Revenue Rentable Avg. Year Leased Leased Per Home Per Home NOI NOI NOI Operating Communities Location Ownership Apartments SF Size Complete Q1 2016 Q4 2015 Q1 2016 Q4 2015 Q1 2016 Q4 2015 YTD 2016 Consolidated Alterra at Overlook Ridge (1) Revere, MA 100.00% 722 663,139 918 2008 96.0% 96.5% $1,838 $1,839 $2,305 $2,155 $2,305 The Chase at Overlook Ridge Malden, MA 100.00% 371 337,060 909 2014 98.4% 96.2% 1,939 1,967 1,287 1,381 1,287 Park Square Rahway, NJ 100.00% 159 184,957 1,163 2009 96.2% 95.0% 2,151 2,165 416 521 416 Riverw atch (1) New Brunswick, NJ 100.00% 200 147,852 739 1997 97.0% 94.0% 1,695 1,699 312 392 312 Andover Pla ce (1) Andover, MA 100.00% 220 178,101 810 1989 97.7% 99.1% 1,446 1,418 465 432 465 Consolidated 100.00% 1,672 1,511,109 904 96.9% 96.3% $1,821 $1,826 $4,785 $4,881 $4,785 Joint Ventures Crystal House (1)(2) Arlington, VA 25.00% 794 738,786 930 1962 96.3% 95.1% $1,809 $1,787 $2,076 $2,212 $2,076 RiverPark at Harrison Harrison, NJ 45.00% 141 125,498 890 2014 90.1% 95.9% 2,394 2,155 445 484 445 Joint Ventures 28.02% 935 864,284 924 95.4% 95.2% $1,897 $1,842 $2,521 $2,696 $2,521 Total Residential - Stabilized 74.18% 2,607 2,375,393 911 96.3% 95.9% $1,849 $1,832 $7,306 $7,577 $7,306 Lease-up Joint Ventures Station House Washington, DC 50.00% 378 290,348 768 2015 83.3% 73.3% NA NA $1,257 $583 $1,257 Joint Ventures 50.00% 378 290,348 768 83.3% 73.3% NA NA $1,257 $583 $1,257 Total Residential - Operating Communities (3) 71.12% 2,985 2,665,741 893 NA NA NA NA $8,563 $8,160 $8,563 Parking Commercial Spaces Port Imperial Garage South (4) Weehawken, NJ 43.75% 800 320,426 2013 NA NA NA NA $386 $569 $386 Port Imperial Retail South (4) Weehawken, NJ 43.75% 16,736 2013 53.5% 52.2% NA NA (27) (7) (27) Port Imperial Garage North Weehawken, NJ 100.00% 786 304,617 2015 NA NA NA NA 240 0 240 Port Imperial Retail North Weehawken, NJ 100.00% 8,365 2015 100.0% 0.0% NA NA 0 0 0 Total Commercial Communities 70.83% 1,586 650,144 69.00% 34.8% NA NA $599 $562 $599 Notes: (1) Assets planned for or currently undergoing repositioning. (2) Unit count excludes 31 apartments offline until completion of all renovations; Percentage Leased excludes 78 units undergoing renovation. (3) Excludes approximately 39,310 SF of ground floor retail. (4) Subsequent to quarter-end, RRT ownership increased to 70%. Operating Highlights

Financial Highlights- Operating Communities 22 Q1 2016 Third Outstanding Maximum Maturity Interest MCRC Party Return Operating Communities Ownership Apartments Balance Balance Date Rate Capital Capital Rate Notes Consolidated Alterra at Overlook Ridge 100.00% 722 $0 $0 The Chase at Overlook Ridge 100.00% 371 72,500 72,500 2/1/2023 3.625% Park Square 100.00% 159 27,500 27,500 4/10/2019 L + 1.75% Riverw atch 100.00% 200 0 0 Andover Pla ce 100.00% 220 0 0 Consolidated 100.00% 1,672 $100,000 $100,000 Joint Ventures Crystal House 25.00% 794 $165,000 $165,500 4/1/2020 3.17% $24,448 $73,342 (1) RiverPark at Harrison 45.00% 141 30,000 30,000 8/1/2025 3.70% 1,537 2,002 Joint Ventures 28.02% 935 $195,000 $195,500 $25,985 $75,344 Total Residential - Stabilized 74.18% 2,607 $295,000 $295,500 $25,985 $75,344 Lease-up Joint Ventures Station House 50.00% 378 $100,700 $100,700 7/1/2033 4.82% $46,663 $46,506 Joint Ventures 50.00% 378 $100,700 $100,700 $46,663 $46,506 Total Residential - Operating Communities 71.12% 2,985 $395,700 $396,200 $72,648 $121,850 Parking Commercial Spaces Port Imperial Garage South (2) 43.75% 800 $32,600 $32,600 12/1/2029 4.78% $541 $4,739 Port Imperial Retail South (2) 43.75% 4,000 4,000 12/1/2021 4.41% 0 0 Port Imperial Garage North 100.00% 786 0 0 Port Imperial Retail North 100.00% 0 0 Total Commercial Communities 71.63% 1,586 $36,600 $36,600 $541 $4,739 Notes: (1) Upon a capital event, the Company receives a promoted additional 25 percent interest over a 9.00 percent IRR to heads-up capital accounts. (2) Subsequent to quarter-end, RRT ownership increased to 70%. Project Debt Capital Balance Overview

Financial Highlights- In-Construction Communities As of March 31, 2016, Roseland had: Wholly owned or joint venture interests in 2,863 in-construction apartments and hotel keys (9 projects), including one community (RiverHouse 11) that commenced construction in Q1 2016 The in-construction portfolio is projected to produce stabilized NOI of $74.0 million; Roseland’s average ownership is approximately 84% We envision lease-up commencement of M2 at Marbella in Q2 2016, with commencements at URL® Harborside and Quarry Place at Tuckahoe also in 2016 Roseland has a remaining capital commitment to the buildout of this portfolio of approximately $89 million: 23 Q1 2016 RiverHouse 11 $34 Portside 5/6 27 Signature Place 12 Worcester I 9 Other Projects (each under $5 million) 7 Total $89

Financial Highlights- In-Construction Communities 24 Q1 2016 Third Projected Projected Apartment MCRC Party MCRC Initial Project Stabilized Stabilized Community Location Ownership Homes/Keys Costs Debt Capital Capital Costs Capital Start Occupancy Stabilization NOI Yield Consolidated Quarry Place at Tuckahoe Eastchester, NY 76.25% 108 $49,950 $28,750 $20,941 $259 $32,438 $16,076 Q1 2014 Q3 2016 Q1 2017 $3,448 6.90% Marriott Hotels at Port Imperial Weehawken, NJ 90.00% 364 129,600 94,000 32,040 3,560 34,143 31,945 Q3 2015 Q1 2018 Q1 2019 13,000 10.03% The Chase II at Overlook Ridge Malden, MA 100.00% 292 74,900 48,000 26,900 0 26,367 26,344 Q3 2015 Q4 2016 Q4 2017 4,873 6.51% Worcester - I Worcester, MA 100.00% 237 59,963 41,500 18,463 0 10,060 9,268 Q3 2015 Q3 2017 Q3 2018 3,819 6.37% Signature Place at Morris Plains (1) Morris Plains, NJ 100.00% 197 58,743 42,000 16,743 0 5,120 4,749 Q4 2015 Q4 2017 Q3 2018 3,940 6.71% Portside 5/6 (1) East Boston, MA 85.00% 296 112,412 73,000 33,500 5,912 8,499 6,176 Q4 2015 Q1 2018 Q1 2019 6,866 6.11% RiverHouse 11 at Port Imperial (2) Weehawken, NJ 100.00% 295 118,876 78,000 40,876 0 6,633 6,633 Q1 2016 Q1 2018 Q1 2019 7,542 6.34% Consolidated 94.05% 1,789 $604,444 $405,250 $189,463 $9,731 $123,260 $101,191 $43,488 7.16% Joint Ventures M2 at Marbella Jersey City, NJ 24.27% 311 $132,100 $77,400 $13,271 $41,429 $124,923 $12,232 Q3 2013 Q2 2016 Q1 2017 $8,666 6.56% URL® Harborside - I Jersey City, NJ 85.00% 763 320,305 192,000 109,059 19,246 238,112 109,059 Q4 2013 Q4 2016 Q3 2018 21,803 6.81% Joint Ventures 67.41% 1,074 $452,405 $269,400 $122,330 $60,675 $363,035 $121,291 $30,469 6.73% Total Residential Communities 84.06% 2,863 $1,056,849 $674,650 $311,793 $70,406 $486,295 $222,482 $73,957 7.00% (3) Development Schedule Project Capitalization - Total Capital as of Q1-16 Notes: (1) Project level debt represents target commitments scheduled to close in 2Q 2016. (2) Subsequent to quarter end, Roseland acquired partner interst thereby increasing its ownership from 50%. (3) Projected stabilized yield without the hotel project is 6.56%.

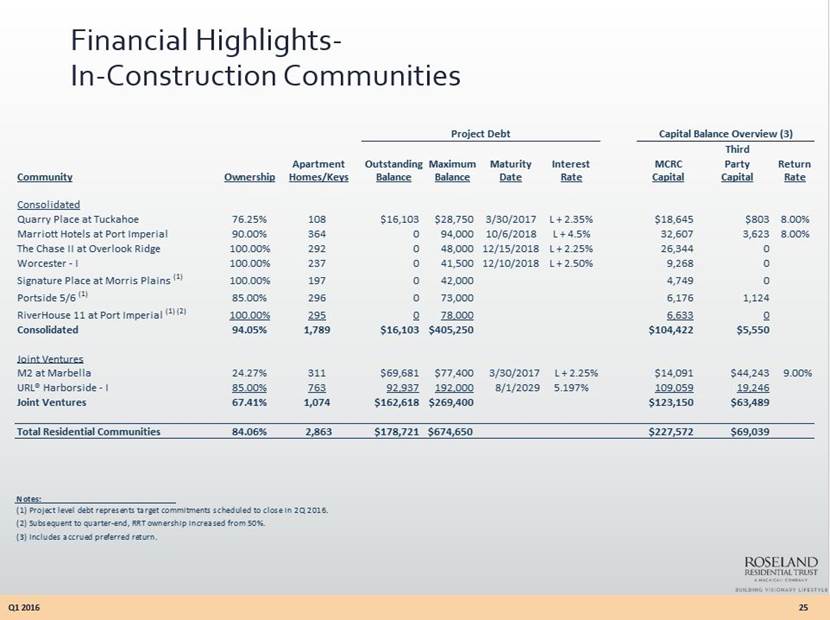

Financial Highlights- In-Construction Communities 25 Q1 2016 Third Apartment Outstanding Maximum Maturity Interest MCRC Party Return Community Ownership Homes/Keys Balance Balance Date Rate Capital Capital Rate Consolidated Quarry Place at Tuckahoe 76.25% 108 $16,103 $28,750 3/30/2017 L + 2.35% $18,645 $803 8.00% Marriott Hotels at Port Imperial 90.00% 364 0 94,000 10/6/2018 L + 4.5% 32,607 3,623 8.00% The Chase II at Overlook Ridge 100.00% 292 0 48,000 12/15/2018 L + 2.25% 26,344 0 Worcester - I 100.00% 237 0 41,500 12/10/2018 L + 2.50% 9,268 0 Signature Place at Morris Plains (1) 100.00% 197 0 42,000 4,749 0 Portside 5/6 (1) 85.00% 296 0 73,000 6,176 1,124 RiverHouse 11 at Port Imperial (1) (2) 100.00% 295 0 78,000 6,633 0 Consolidated 94.05% 1,789 $16,103 $405,250 $104,422 $5,550 Joint Ventures M2 at Marbella 24.27% 311 $69,681 $77,400 3/30/2017 L + 2.25% $14,091 $44,243 9.00% URL® Harborside - I 85.00% 763 92,937 192,000 8/1/2029 5.197% 109,059 19,246 Joint Ventures 67.41% 1,074 $162,618 $269,400 $123,150 $63,489 Total Residential Communities 84.06% 2,863 $178,721 $674,650 $227,572 $69,039 Notes: (1) Project level debt represents target commitments scheduled to close in early 2Q 2016. (2) Subsequent to quarter-end, RRT ownership increased from 50%. (3) Includes accrued preferred return. Project Debt Capital Balance Overview (3) Notes: (1) Project level debt represents target commitments scheduled to close in 2Q 2016. (2) Subsequent to quarter-end, RRT ownership increased from 50%. (3) Includes accrued preferred return.

Financial Highlights- Subordinated Interest Communities As of March 31, 2016, Roseland had: Subordinated interests in 2,654 stabilized operating apartments The subordinated stabilized portfolio had a leased percentage of 96.9%, compared to 97.4% in Q4 2015 Roseland is actively evaluating converting its promoted interests via disposition, acquisition or ownership buy-ups across all its subordinated interest communities, including: The Chase at Overlook Ridge - I: On January 5, 2016 Roseland acquired its JV partner’s interest. By utilizing its in-place promoted interest, the valuation approximated to a 5.75% capitalization rate investment. Prudential Acquisitions: Subsequent to quarter-end, acquired Prudential’s senior interest in the 175-apartment Portside at Pier One. Roseland’s interest in Portside at Pier One and at the adjacent Portside 5/6 development is currently 85% Subsequent to quarter-end, acquired Prudential’s subordinate interest in RiverTrace at Port Imperial At year-end 2016, we forecast the subordinate interest residential portfolio will include no more than four (4) projects as compared to nine (9) projects at year-end 2015 26 Q1 2016

Financial Highlights- Subordinated Interest Communities 27 Q1 2016 Average Average Percentage Percentage Revenue Revenue Rentable Avg. Year Leased Leased Per Home Per Home NOI NOI NOI Location Ownership (1) Apartments SF Size Complete Q1 2016 Q4 2015 Q1 2016 Q4 2015 Q1 2016 Q4 2015 YTD 2016 Stabilize d Marbella Jersey City, NJ 24.27% 412 369,515 897 2003 96.4% 96.8% $3,092 $3,071 $2,515 $2,353 $2,515 Monaco Jersey City, NJ 15.00% 523 475,742 910 2011 96.7% 97.3% 3,428 3,398 3,668 3,634 3,668 RiversEdge at Port Imperial Weehawken, NJ 50.00% 236 214,963 911 2009 96.2% 98.3% 3,056 2,903 1,076 763 1,076 RiverTrace at Port Imperial (2) West New York, NJ 25.00% 316 295,767 936 2014 96.5% 96.5% 3,212 3,190 1,831 1,805 1,831 The Estuary Weehawken, NJ 7.50% 582 530,587 912 2014 97.4% 97.4% 3,154 2,924 3,410 3,167 3,410 RiverParc at Port Imperial Weehawken, NJ 20.00% 280 255,828 914 2015 97.1% 96.4% 3,034 NA 1,475 814 1,475 Metropolitan at 40 Park Morristown, NJ 12.50% 130 124,237 956 2010 97.7% 100.0% 3,250 3,224 755 741 755 Portside at East Pier - 7 (3) East Boston, MA 38.25% 175 156,091 892 2015 98.3% 98.9% 2,352 2,295 901 938 901 Subtotal - Stabilized 21.04% 2,654 2,422,730 913 96.9% 97.4% $3,136 $2,735 $15,631 $14,215 $15,631 Total Residential Operating Communities (4) 21.04% 2,654 2,422,730 913 96.9% 97.4% $3,136 $2,735 $15,631 $14,215 $15,631 Commercial Comm SF Shops at 40 Park Morristown, NJ 12.50% 50,973 2010 60.4% 60.4% NA NA $228 $206 $228 Riverwalk at Port Imperial West New York, NJ 20.00% 30,745 2008 64.0% 64.0% NA NA 160 155 160 Total Commercial Communities 15.32% 81,718 61.8% 61.8% NA NA $388 $361 $388 Notes: (1) Ownership represents Company participation after satisfaction of Priority Capital. See Capitalization Details schedule herein. (2) Subsequent to quarter-end, RRT ownership increased to 50%. (3) Subsequent to quarter-end, RRT ownership increased to 85%. (4) Excludes approximately 34,350 SF of ground floor retail. Operating Highlights

Financial Highlights- Subordinated Interest Communities 28 Q1 2016 Third Outstanding Maximum Maturity Interest MCRC Party Return Location Ownership Apartments Balance Balance Date Rate Capital Capital Rate Notes Stabilize d Marbella Jersey City, NJ 24.27% 412 $95,000 $95,000 5/1/2018 4.99% $125 $7,567 9.50% (1) Monaco Jersey City, NJ 15.00% 523 165,000 165,000 2/1/2021 4.19% 0 83,636 9.00% RiversEdge at Port Imperial Weehawken, NJ 50.00% 236 57,500 57,500 9/1/2020 4.32% 0 45,299 9.00% RiverTrace at Port Imperial Weehawken, NJ 25.00% 316 79,393 80,249 7/15/2021 6.00% 0 47,036 7.75% The Estuary Weehawken, NJ 7.50% 582 210,000 210,000 3/1/2030 4.00% 0 18,546 8.50% RiverParc at Port Imperial Weehawken, NJ 20.00% 280 70,731 73,350 6/27/2016 L + 2.15% 2,457 55,231 9.00% (2) Metropolitan at 40 Park Morristown, NJ 12.50% 130 38,218 38,218 9/1/2020 3.25% 695 21,248 9.00% (3) Portside at East Pier - 7 East Boston, MA 38.25% 175 42,500 42,500 12/4/2017 L + 2.50% 0 29,445 9.00% Subtotal - Stabilized 21.04% 2,654 $758,342 $761,817 $3,277 $308,008 Total Residential Operating Communities 21.04% 2,654 $758,342 $761,817 $3,277 $308,008 Commercial Shops at 40 Park Morristown, NJ 12.50% $6,421 $6,421 8/13/2018 3.63% 0 0 (3) Riverwalk at Port Imperial West New York, NJ 20.00% 0 0 0 6,050 9.00% Total Commercial Communities 15.32% $6,421 $6,421 $0 $6,050 Project Debt Capital Balance Overview (4) Notes: (1) The MCRC Balance represents capital account held by Marbella Rosegarden, L.L.C., of which the Company owns a 48.53 percent interest. (2) PruRose 13 entered into an interest rate swap agreement with a commercial bank. The swap agreement fixes the all-in rate to 2.79 percent per annum for the period thru January 1, 2016. (4) Includes accrued preferred return. (3) Equity Capital balances apply to Metropolitan at 40 Park and Shops at 40 Park. The MCRC balance represents capital account held by Rosewood Epsteins, L.L.C., of which the Company owns a 50 percent interest.

Financial Highlights- 2016 Starts As of March 31, 2016 the Company had a future development portfolio of approximately 10,849 apartments comprised of: Predevelopment (1,638 apartments): Communities with likely starts through year-end 2016 Future Developments (9,211 apartments): Roseland owned/controlled future development sites, includes 1,242 Identified Repurposing apartments Remaining 2016 starts are projected to generate approximately $102 million in value creation for RRT: 29 Q1 2016 Roseland has a signed acquisition agreement, subject to certain conditions. Current Scheduled 2016 Starts Location Apartments Ownership Start Costs MC Capital NOI Yield PI South - Building 11 Weehawken, NJ 295 100.00% Started $118,876 $40,876 $7,542 6.34% 2016 Starts (Started) 295 100.00% $118,876 $40,876 $7,542 6.34% Lofts at 40 Park Morristown, NJ 59 25.00% Q3 2016 17,365 1,091 1,159 6.67% 150 Monument Road (repurposing) Bala Cynwyd, PA 206 100.00% Q3 2016 53,974 18,891 3,394 6.29% Conshohocken Conshohocken, PA 310 100.00% Q4 2016 85,947 18,230 5,192 6.04% Freehold (1) Freehold, NJ 400 100.00% Q4 2016 97,641 34,174 6,294 6.45% Overlook IIIC Malden, MA 300 100.00% Q4 2016 75,000 29,378 4,899 6.53% PI North - Building C West New York, NJ 363 20.00% Q4 2016 150,037 18,004 9,461 6.31% 2016 Starts (remaining) 1,638 79.57% $479,964 $119,768 $30,399 6.33% Projected Projected Value Creation Summary Projected Average Yield 6.33% Projected NOI $30,399 Gross Value @ 5.00% Cap $607,980 Less: Projected Costs (479,964) Net Value Creation @ 100% $128,016 RRT Share @ 79.57% $101,862

Financial Highlights- Future Start Communities 30 Q1 2016 Current Projected Approved / Future Developments Location Apartment Ownership Const Start Entitled Worcester - II Worcester, MA 128 100.00% 2017 fully Identified Repurposing A Northern NJ 300 100.00% 2017 none 233 Canoe Brook Road (1) (repurposing) Short Hills, NJ 200 100.00% 2017 partial San Remo (2) Jersey City, NJ 250 33.33% 2017 partial 709 Chestnut (3) Philadelphia, PA 273 75.00% 2017 fully Crystal House - III Arlington, VA 252 50.00% 2017 partial Liberty Landing Phase I Jersey City, NJ 265 50.00% 2017 partial PI South - Building 8/9 (4) Weehawken, NJ 275 50.00% 2017 partial Subtotal - 2017 Starts 1,943 1633 Littleton (repurposing) Parsippany, NJ 200 100.00% Future fully Capital Office Park Greenbelt, MD 400 100.00% Future none Crystal House - Future Arlington, VA 300 50.00% Future partial Plaza 8 Jersey City, NJ 650 100.00% Future none Plaza 9 Jersey City, NJ 650 100.00% Future none Liberty Landing - Future Phases Jersey City, NJ 585 50.00% Future partial Overlook IIIA Malden, MA 445 100.00% Future partial Overlook IV Malden, MA 45 100.00% Future partial PI North - Building I West New York, NJ 224 20.00% Future partial PI North - Building J West New York, NJ 141 20.00% Future partial PI North - Riverbend 6 West New York, NJ 471 20.00% Future partial PI South - Building 16 (4) Weehawken, NJ 131 50.00% Future partial PI South - Building 2 (5) Weehawken, NJ 200 50.00% Future partial PI South - Office 1/3 (4) Weehawken, NJ N/A 50.00% Future partial PI South - Park Parcel (4) Weehawken, NJ 224 50.00% Future partial Portside 1-4 East Boston, MA 160 85.00% Future none URL ® Harborside - II Jersey City, NJ 750 85.00% Future partial URL ® Harborside - III Jersey City, NJ 750 85.00% Future partial Identified Repurposing B Northern NJ 120 100.00% Future none Identified Repurposing C Northern NJ 150 100.00% Future none Identified Repurposing D - I Northern NJ 220 100.00% Future none Identified Repurposing D2 Northern NJ 220 100.00% Future none Identified Repurposing E Westchester, NY 232 100.00% Future none RRT Future Developments 9,211 Total Predevelopment and Future Developments (6) 10,849 Notes: (1) Target approvals will likely also include approximately 225 hotel keys. (2) Ownership subject to change based on final negotiation. (3) Roseland has a signed acquisition agreement, subject to certain conditions. (4) Subsequent to quarter-end, RRT ownership increased to 100%. (5) Subsequent to quarter-end, RRT ownership converted to heads-up 50/50. (6) Includes 1,242 Identified Repurposing opportunities

Definitions 31 Q1 2016 Average Revenue Per Home: Calculated as total apartment revenue for the quarter ended March 31, 2016, divided by the average percent occupied for the quarter ended March 31, 2016, divided by the number of apartments and divided by three. Percentage Leased: The percentage of apartments that are either currently occupied or vacant apartments leased for future occupancy. Consolidated Operating Communities: Wholly owned communities and communities whereby the Company has a controlling interest. Predevelopment Communities: Communities where the Company has commenced predevelopment activities that have a near-term projected project start. Future Development: Represents land inventory currently owned or controlled by the Company. Project Completion: As evidenced by a certificate of completion by a certified architect or issuance of a final or temporary certificate of occupancy. Identified Repurposing Communities: Communities not currently owned by RRT, which have been identified for transfer from Mack-Cali to RRT for residential repurposing. Project Stabilization: Lease-Up communities that have achieved over 95 Percent Leased for six consecutive weeks. In-Construction Communities: Communities that are under construction and have not yet commenced initial leasing activities. Projected Stabilized NOI: Pro forma NOI for Lease-Up, In-Construction or Future Development communities upon achieving Project Stabilization Lease-Up Communities: Communities that have commenced initial operations but have not yet achieved Project Stabilization. Projected Stabilized Yield: Represents Projected Stabilized NOI divided by Total Costs. MCRC Capital: Represents cash equity that the Company has contributed or has a future obligation to contribute to a project. Repurposing Communities: Commercial holdings of the Company which have been targeted for rezoning from their existing office to new multi-family use and have a likelihood of achieving desired rezoning and project approvals. Net Asset Value (NAV): We consider NAV to be a useful metric for investors to estimate the fair value of the Roseland platform. The metric represents the net projected value of the Company’s interest after accounting for all priority debt and equity payments. The metric includes capital invested by the Company. Subordinated Joint Ventures: Joint Venture communities where the Company's ownership distributions are subordinate to payment of priority capital preferred returns. Net Operating Income (NOI): Total property revenues less real estate taxes, utilities and operating expenses. Third Party Capital: Capital invested other than MCRC Capital. Operating Communities: Communities that have achieved Project Stabilization. Total Costs: Represents full project budget, including land and developer fees, and interest expense through Project Completion.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS The Company considers portions of this information, including the documents incorporated by reference, to be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of such act. Such forward-looking statements relate to, without limitation, our future economic performance, plans and objectives for future operations and projections of revenue and other financial items. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “potential,” “projected,” “should,” “expect,” “anticipate,” “estimate,” “target”, “continue” or comparable terminology. Forward-looking statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions at the time made, the Company can give no assurance that such expectations will be achieved. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements. Among the factors about which the Company has made assumptions are: -risks and uncertainties affecting the general economic climate and conditions, which in turn may have a negative effect on the fundamentals of the Company’s business and the financial condition of the Company’s tenants and residents; -the value of the Company’s real estate assets, which may limit the Company’s ability to dispose of assets at attractive prices or obtain or maintain debt financing secured by our properties or on an unsecured basis; -the extent of any tenant bankruptcies or of any early lease terminations; -The Company’s ability to lease or re-lease space at current or anticipated rents; -changes in the supply of and demand for the Company’s properties; -changes in interest rate levels and volatility in the securities markets; -The Company’s ability to complete construction and development activities on time and within budget, including without limitation obtaining regulatory permits and the availability and cost of materials, labor and equipment; -forward-looking financial and operational information, including information relating to future development projects, potential acquisitions or dispositions, and projected revenue and income; -changes in operating costs; -The Company’s ability to obtain adequate insurance, including coverage for terrorist acts; -The Company’s credit worthiness and the availability of financing on attractive terms or at all, which may adversely impact our ability to pursue acquisition and development opportunities and refinance existing debt and the Company’s future interest expense; -changes in governmental regulation, tax rates and similar matters; and -other risks associated with the development and acquisition of properties, including risks that the development may not be completed on schedule, that the tenants or residents will not take occupancy or pay rent, or that development or operating costs may be greater than anticipated. For further information on factors which could impact us and the statements contained herein, see Item 1A: Risk Factors in MCRC’s Annual Report on Form 10-K for the year ended December 31, 2015. We assume no obligation to update and supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise. This Supplemental Operating and Financial Data is not an offer to sell or solicitation to buy any securities of the Mack-Cali Reality Corporation (“MCRC”). Any offers to sell or solicitations of the MCRC shall be made by means of a prospectus. The information in this Supplemental Package must be read in conjunction with, and is modified in its entirety by, the Quarterly on Form 10-Q (the “10-Q”) filed by the MCRC for the same period with the Securities and Exchange Commission (the “SEC”) and all of the MCRC’s other public filings with the SEC (the “Public Filings”). In particular, the financial information contained herein is subject to and qualified by reference to the financial statements contained in the 10-Q, the footnotes thereto and the limitations set forth therein. Investors may not rely on the Supplemental Package without reference to the 10-Q and the Public Filings. Any investors’ receipt of, or access to, the information contained herein is subject to this qualification. 32 Q1 2016

Q1 2016