Supplemental Operating and Financial Data Q3 2023

Veris Residential Inc. (the “Company”, “VRE”, “we”, “our”, “us”) considers portions of this information, including the documents incorporated by reference, to be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of such act. Such forward-looking statements relate to, without limitation, our future economic performance, plans and objectives for future operations and projections of revenue and other financial items. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “potential,” “projected,” “should,” “expect,” “anticipate,” “estimate,” “target,” “continue” or comparable terminology. Forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although we believe that the expectations reflected in such forward- looking statements are based upon reasonable assumptions at the time made, we can give no assurance that such expectations will be achieved. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements. Among the factors about which we have made assumptions are: • risks and uncertainties affecting the general economic climate and conditions, which in turn may have a negative effect on the fundamentals of our business and the financial condition of our tenants and residents; • the value of our real estate assets, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing secured by our properties or on an unsecured basis; • the extent of any tenant bankruptcies or of any early lease terminations; • our ability to lease or re-lease space at current or anticipated rents; • changes in the supply of and demand for our properties; • changes in interest rate levels and volatility in the securities markets; • our ability to complete construction and development activities on time and within budget, including without limitation obtaining regulatory permits and the availability and cost of materials, labor and equipment; • our ability to attract, hire and retain qualified personnel; • forward-looking financial and operational information, including information relating to future development projects, potential acquisitions or dispositions, leasing activities, capitalization rates, and projected revenue and income; • changes in operating costs; • our ability to obtain adequate insurance, including coverage for natural disasters and terrorist acts; • our credit worthiness and the availability of financing on attractive terms or at all, which may adversely impact our ability to pursue acquisition and development opportunities and refinance existing debt and our future interest expense; • changes in governmental regulation, tax rates and similar matters; and • other risks associated with the development and acquisition of properties, including risks that the development may not be completed on schedule, that the tenants or residents will not take occupancy or pay rent, or that development or operating costs may be greater than anticipated. For further information on factors which could impact us and the statements contained herein, see Item 1A: Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2022. We assume no obligation to update and supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise. This Supplemental Operating and Financial Data is not an offer to sell or solicitation to buy any securities of VRE. Any offers to sell or solicitations of VRE shall be made by means of a prospectus. The information in this Supplemental Package must be read in conjunction with, and is modified in its entirety by, the Quarterly Report on Form 10-Q (the “10-Q”) filed by VRE for the same period with the Securities and Exchange Commission (the “SEC”) and all of the VRE’s other public filings with the SEC (the “Public Filings”). In particular, the financial information contained herein is subject to and qualified by reference to the financial statements contained in the 10-Q, the footnotes thereto and the limitations set forth therein. Investors may not rely on the Supplemental Package without reference to the 10-Q and the Public Filings. Any investors’ receipt of, or access to, the information contained herein is subject to this qualification. This Supplemental Operating and Financial Data should be read in connection with the Company’s third quarter 2023 earnings press release (included as Exhibit 99.2 of the Company’s Current Report on Form 8-K, filed on October 25, 2023, as certain disclosures, definitions and reconciliations in such announcement have not been included in this Supplemental Operating and Financial Data. Forward-Looking Statements 2

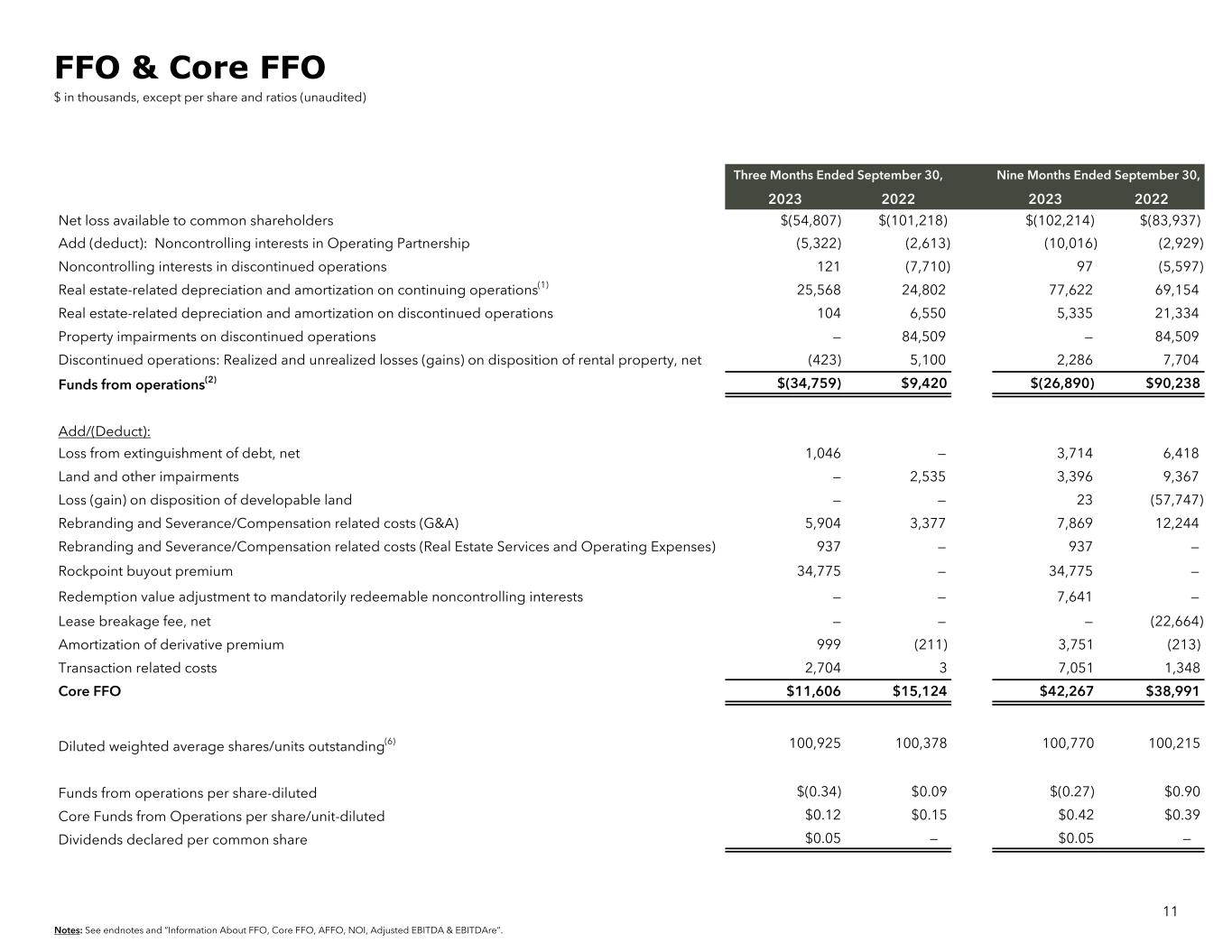

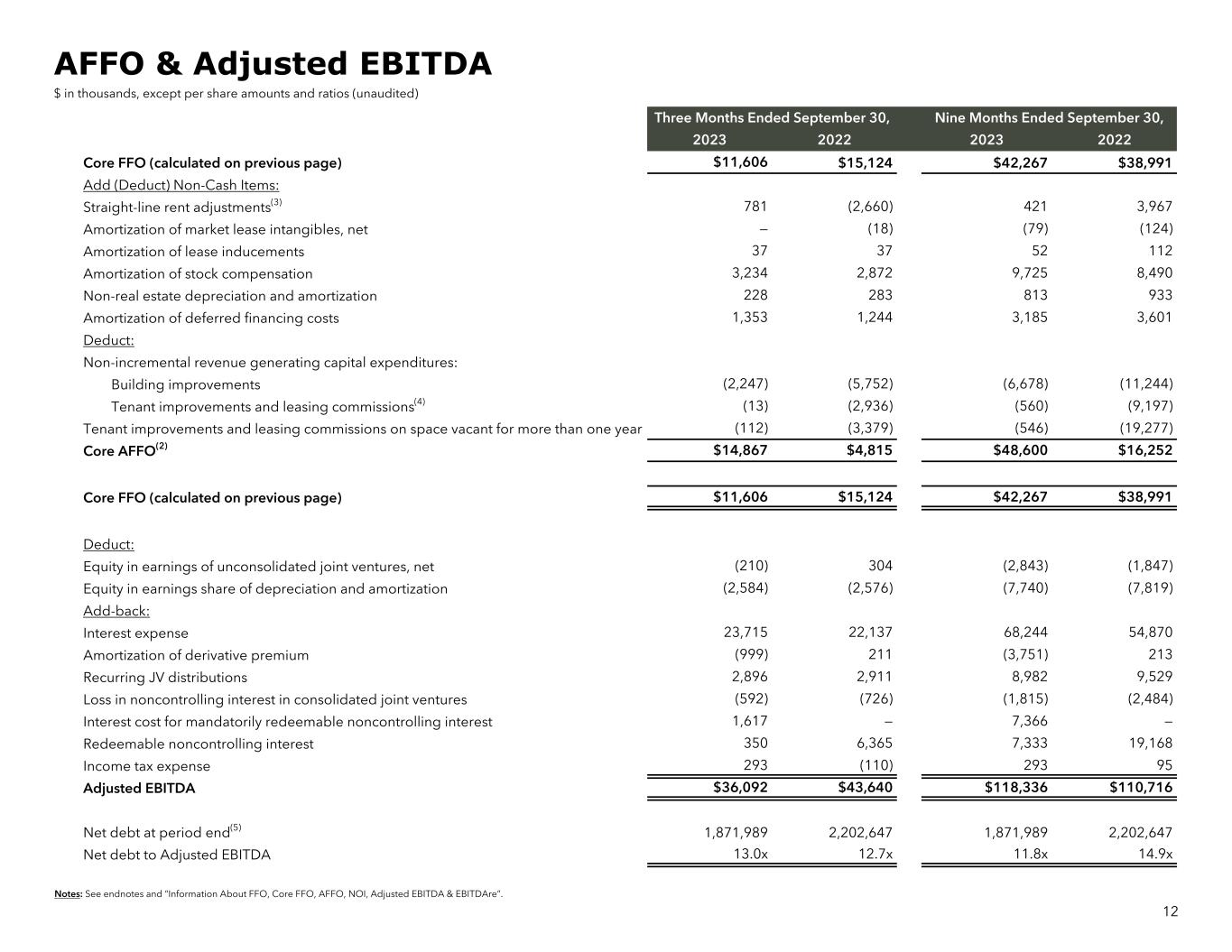

Funds from operations (“FFO”) is defined as net income (loss) before noncontrolling interests of unitholders, computed in accordance with generally accepted accounting principles (“GAAP”), excluding gains or losses from depreciable rental property transactions (including both acquisitions and dispositions), and impairments related to depreciable rental property, plus real estate-related depreciation and amortization. The Company believes that FFO per share is helpful to investors as one of several measures of the performance of an equity REIT. The Company further believes that as FFO per share excludes the effect of depreciation, gains (or losses) from property transactions and impairments related to depreciable rental property (all of which are based on historical costs which may be of limited relevance in evaluating current performance), FFO per share can facilitate comparison of operating performance between equity REITs. FFO per share should not be considered as an alternative to net income available to common shareholders per share as an indication of the Company’s performance or to cash flows as a measure of liquidity. FFO per share presented herein is not necessarily comparable to FFO per share presented by other real estate companies due to the fact that not all real estate companies use the same definition. However, the Company’s FFO per share is comparable to the FFO per share of real estate companies that use the current definition of the National Association of Real Estate Investment Trusts (“Nareit”). A reconciliation of net income per share to FFO per share is included in the financial tables below. Core FFO is defined as FFO, as adjusted for items that may distort the comparative measurement of the Company’s performance over time. Adjusted FFO ("AFFO") is defined as Core FFO less (i) recurring tenant improvements, leasing commissions and capital expenditures, (ii) straight-line rents and amortization of acquired above/below-market leases, net, and (iii) other non-cash income, plus (iv) other non-cash charges. Core FFO and AFFO are both non-GAAP financial measures that are not intended to represent cash flow and are not indicative of cash flows provided by operating activities as determined in accordance with GAAP. Core FFO and AFFO are presented solely as supplemental disclosures that the Company’s management believes provides useful information regarding the Company's operating performance and its ability to fund its dividends. There are not generally accepted definitions established for Core FFO or AFFO. Therefore, the Company's measures of Core FFO and AFFO may not be comparable to the Core FFO and AFFO reported by other REITs. A reconciliation of net income to Core FFO and AFFO are included in the financial tables below. Net operating income (“NOI”) represents total revenues less total operating expenses, as reconciled to net income above. Same Store GAAP NOI and Same Store Cash NOI are reconciled to Total Property Revenues. The Company considers NOI, Same Store GAAP NOI, and Same Store Cash NOI to be meaningful non-GAAP financial measures for making decisions and assessing unlevered performance of its property types and markets, as it relates to total return on assets, as opposed to levered return on equity. As properties are considered for sale and acquisition based on NOI estimates and projections, the Company utilizes this measure to make investment decisions, as well as compare the performance of its assets to those of its peers. NOI should not be considered a substitute for net income, and the Company’s use of NOI, Same Store GAAP NOI, Same Store Cash NOI may not be comparable to similarly titled measures used by other companies. The Company calculates NOI before any allocations to noncontrolling interests, as those interests do not affect the overall performance of the individual assets being measured and assessed. Same Store includes specific properties, which represent all in-service properties owned by the Company during the reported period, excluding properties sold, disposed of, held for sale, removed from service, or for any reason considered not stabilized, or being redeveloped or repositioned in the reporting period. Adjusted EBITDA is a non-GAAP financial measure. The Company computes Adjusted EBITDA in accordance with what it believes are industry standards for this type of measure, which may not be comparable to Adjusted EBITDA reported by other REITs. The Company defines Adjusted EBITDA as Core FFO , plus interest expense, plus income tax expense, plus income (loss) in noncontrolling interest in consolidated joint ventures, and plus adjustments to reflect the entity's share of Adjusted EBITDA of unconsolidated joint ventures. The Company presents Adjusted EBITDA because the Company believes that Adjusted EBITDA, along with cash flow from operating activities, investing activities and financing activities, provides investors with an additional indicator of the Company’s ability to incur and service debt. Adjusted EBITDA should not be considered as an alternative to net income (determined in accordance with GAAP), as an indication of the Company’s financial performance, as an alternative to net cash flows from operating activities (determined in accordance with GAAP), or as a measure of the Company’s liquidity. EBITDAre is a non-GAAP financial measure. The Company computes EBITDAre in accordance with standards established by the National Association of Real Estate Investment Trusts, or Nareit, which may not be comparable to EBITDAre reported by other REITs that do not compute EBITDAre in accordance with the Nareit definition, or that interpret the Nareit definition differently than the Company does. The White Paper on EBITDAre approved by the Board of Governors of Nareit in September 2017 defines EBITDAre as net income (loss) (computed in accordance with Generally Accepted Accounting Principles, or GAAP), plus interest expense, plus income tax expense, plus depreciation and amortization, plus (minus) losses and gains on the disposition of depreciated property, plus impairment write-downs of depreciated property and investments in unconsolidated joint ventures, plus adjustments to reflect the entity's share of EBITDAre of unconsolidated joint ventures. The Company presents EBITDAre, because the Company believes that EBITDAre, along with cash flow from operating activities, investing activities and financing activities, provides investors with an additional indicator of the Company’s ability to incur and service debt. EBITDAre should not be considered as an alternative to net income (determined in accordance with GAAP), as an indication of the Company’s financial performance, as an alternative to net cash flows from operating activities (determined in accordance with GAAP), or as a measure of the Company’s liquidity. 3 Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre

4 Company Highlights

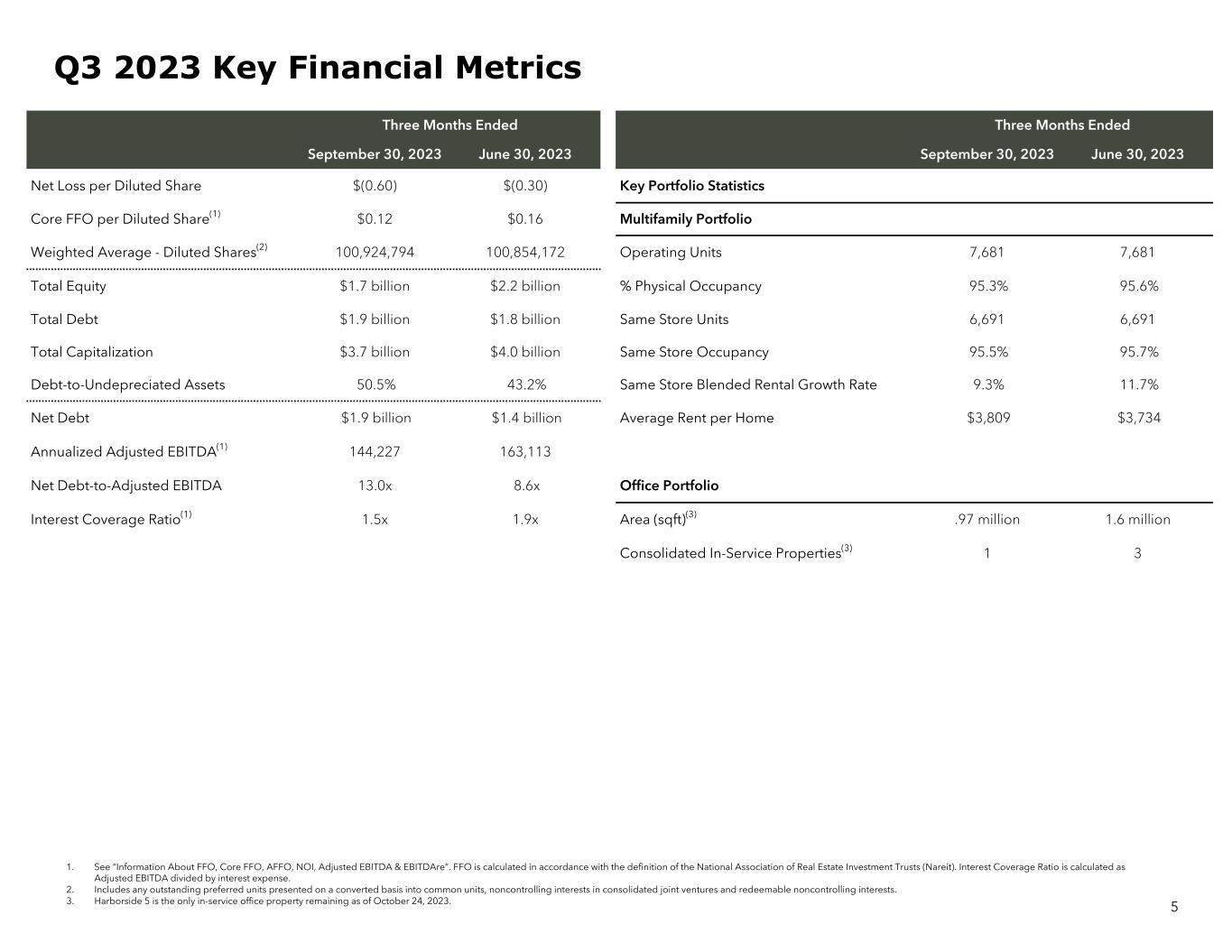

Three Months Ended Three Months Ended September 30, 2023 June 30, 2023 September 30, 2023 June 30, 2023 Net Loss per Diluted Share $(0.60) $(0.30) Key Portfolio Statistics Core FFO per Diluted Share(1) $0.12 $0.16 Multifamily Portfolio Weighted Average - Diluted Shares(2) 100,924,794 100,854,172 Operating Units 7,681 7,681 Total Equity $1.7 billion $2.2 billion % Physical Occupancy 95.3% 95.6% Total Debt $1.9 billion $1.8 billion Same Store Units 6,691 6,691 Total Capitalization $3.7 billion $4.0 billion Same Store Occupancy 95.5% 95.7% Debt-to-Undepreciated Assets 50.5% 43.2% Same Store Blended Rental Growth Rate 9.3% 11.7% Net Debt $1.9 billion $1.4 billion Average Rent per Home $3,809 $3,734 Annualized Adjusted EBITDA(1) 144,227 163,113 Net Debt-to-Adjusted EBITDA 13.0x 8.6x Office Portfolio Interest Coverage Ratio(1) 1.5x 1.9x Area (sqft)(3) .97 million 1.6 million Consolidated In-Service Properties(3) 1 3 5 Q3 2023 Key Financial Metrics 1. See “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. FFO is calculated in accordance with the definition of the National Association of Real Estate Investment Trusts (Nareit). Interest Coverage Ratio is calculated as Adjusted EBITDA divided by interest expense. 2. Includes any outstanding preferred units presented on a converted basis into common units, noncontrolling interests in consolidated joint ventures and redeemable noncontrolling interests. 3. Harborside 5 is the only in-service office property remaining as of October 24, 2023.

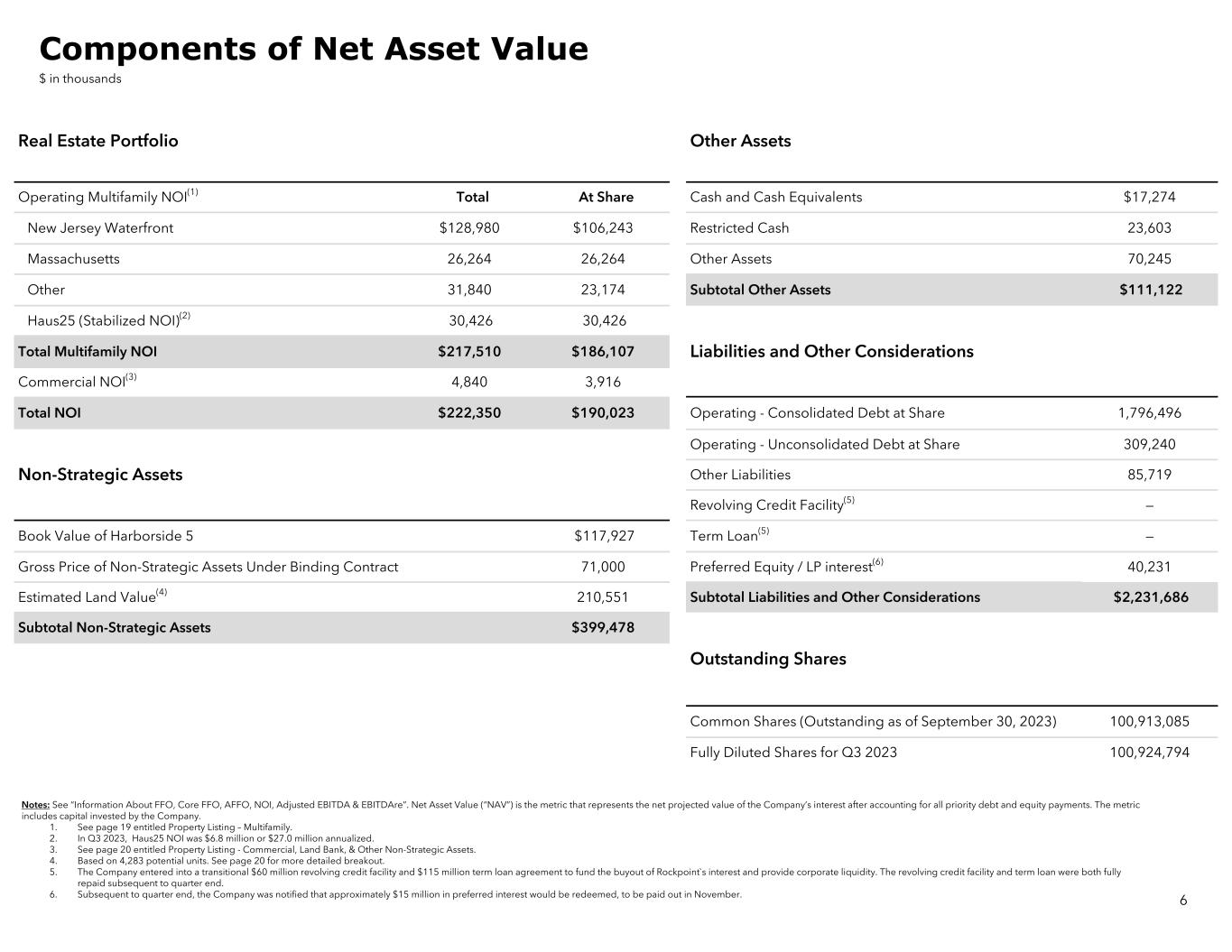

Notes: See “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. Net Asset Value (“NAV”) is the metric that represents the net projected value of the Company’s interest after accounting for all priority debt and equity payments. The metric includes capital invested by the Company. 1. See page 19 entitled Property Listing – Multifamily. 2. In Q3 2023, Haus25 NOI was $6.8 million or $27.0 million annualized. 3. See page 20 entitled Property Listing - Commercial, Land Bank, & Other Non-Strategic Assets. 4. Based on 4,283 potential units. See page 20 for more detailed breakout. 5. The Company entered into a transitional $60 million revolving credit facility and $115 million term loan agreement to fund the buyout of Rockpoint`s interest and provide corporate liquidity. The revolving credit facility and term loan were both fully repaid subsequent to quarter end. 6. Subsequent to quarter end, the Company was notified that approximately $15 million in preferred interest would be redeemed, to be paid out in November. Real Estate Portfolio Other Assets Operating Multifamily NOI(1) Total At Share Cash and Cash Equivalents $17,274 New Jersey Waterfront $128,980 $106,243 Restricted Cash 23,603 Massachusetts 26,264 26,264 Other Assets 70,245 Other 31,840 23,174 Subtotal Other Assets $111,122 Haus25 (Stabilized NOI)(2) 30,426 30,426 Total Multifamily NOI $217,510 $186,107 Liabilities and Other Considerations Commercial NOI(3) 4,840 3,916 Total NOI $222,350 $190,023 Operating - Consolidated Debt at Share 1,796,496 Operating - Unconsolidated Debt at Share 309,240 Non-Strategic Assets Other Liabilities 85,719 Revolving Credit Facility(5) — Book Value of Harborside 5 $117,927 Term Loan(5) — Gross Price of Non-Strategic Assets Under Binding Contract 71,000 Preferred Equity / LP interest(6) 40,231 Estimated Land Value(4) 210,551 Subtotal Liabilities and Other Considerations $2,231,686 Subtotal Non-Strategic Assets $399,478 Outstanding Shares Common Shares (Outstanding as of September 30, 2023) 100,913,085 Fully Diluted Shares for Q3 2023 100,924,794 6 Components of Net Asset Value $ in thousands

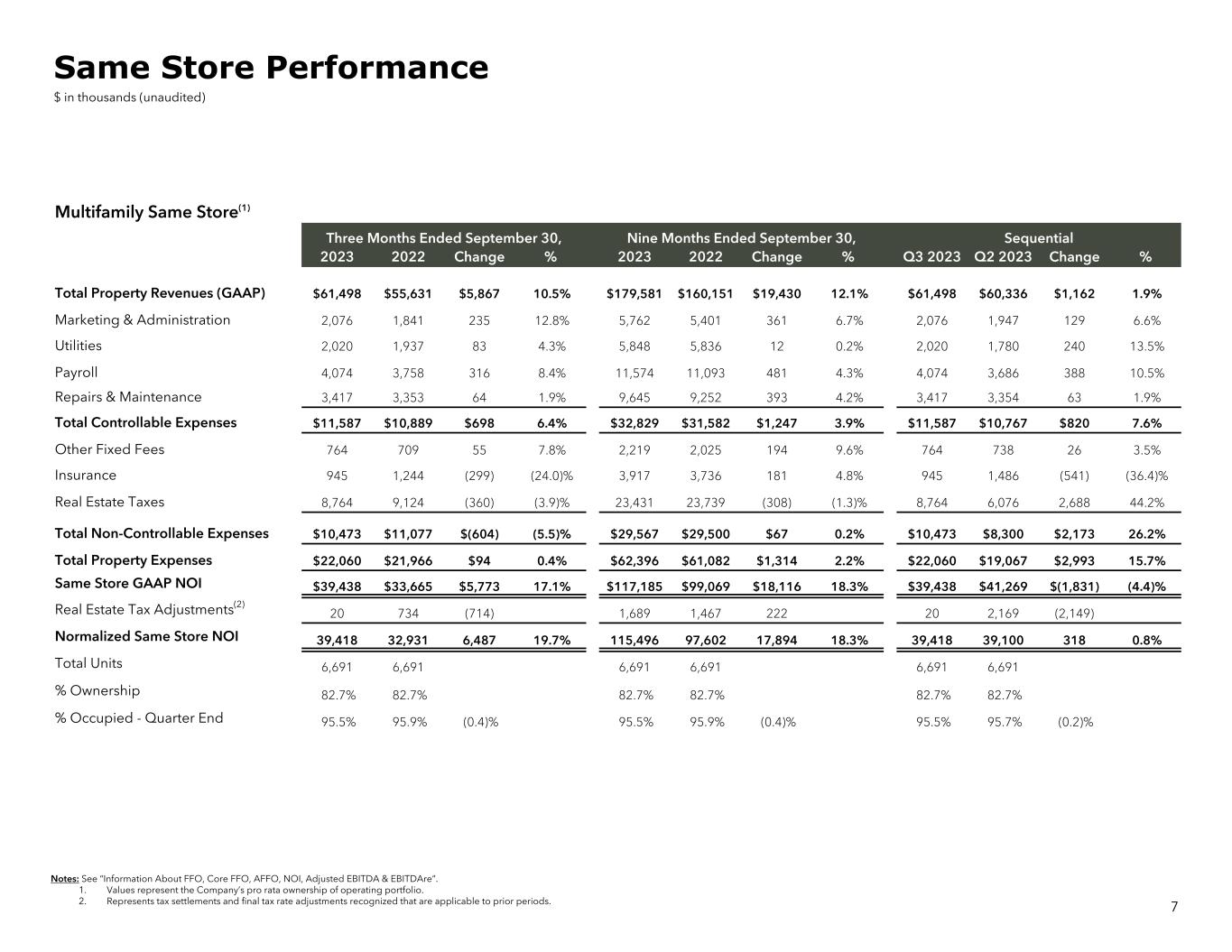

Multifamily Same Store(1) Three Months Ended September 30, Nine Months Ended September 30, Sequential 2023 2022 Change % 2023 2022 Change % Q3 2023 Q2 2023 Change % Total Property Revenues (GAAP) $61,498 $55,631 $5,867 10.5% $179,581 $160,151 $19,430 12.1% $61,498 $60,336 $1,162 1.9% Marketing & Administration 2,076 1,841 235 12.8% 5,762 5,401 361 6.7% 2,076 1,947 129 6.6% Utilities 2,020 1,937 83 4.3% 5,848 5,836 12 0.2% 2,020 1,780 240 13.5% Payroll 4,074 3,758 316 8.4% 11,574 11,093 481 4.3% 4,074 3,686 388 10.5% Repairs & Maintenance 3,417 3,353 64 1.9% 9,645 9,252 393 4.2% 3,417 3,354 63 1.9% Total Controllable Expenses $11,587 $10,889 $698 6.4% $32,829 $31,582 $1,247 3.9% $11,587 $10,767 $820 7.6% Other Fixed Fees 764 709 55 7.8% 2,219 2,025 194 9.6% 764 738 26 3.5% Insurance 945 1,244 (299) (24.0)% 3,917 3,736 181 4.8% 945 1,486 (541) (36.4)% Real Estate Taxes 8,764 9,124 (360) (3.9)% 23,431 23,739 (308) (1.3)% 8,764 6,076 2,688 44.2% Total Non-Controllable Expenses $10,473 $11,077 $(604) (5.5)% $29,567 $29,500 $67 0.2% $10,473 $8,300 $2,173 26.2% Total Property Expenses $22,060 $21,966 $94 0.4% $62,396 $61,082 $1,314 2.2% $22,060 $19,067 $2,993 15.7% Same Store GAAP NOI $39,438 $33,665 $5,773 17.1% $117,185 $99,069 $18,116 18.3% $39,438 $41,269 $(1,831) (4.4)% Real Estate Tax Adjustments(2) 20 734 (714) 1,689 1,467 222 20 2,169 (2,149) Normalized Same Store NOI 39,418 32,931 6,487 19.7% 115,496 97,602 17,894 18.3% 39,418 39,100 318 0.8% Total Units 6,691 6,691 6,691 6,691 6,691 6,691 % Ownership 82.7% 82.7% 82.7% 82.7% 82.7% 82.7% % Occupied - Quarter End 95.5% 95.9% (0.4)% 95.5% 95.9% (0.4)% 95.5% 95.7% (0.2)% Notes: See “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. 1. Values represent the Company’s pro rata ownership of operating portfolio. 2. Represents tax settlements and final tax rate adjustments recognized that are applicable to prior periods. 7 Same Store Performance $ in thousands (unaudited)

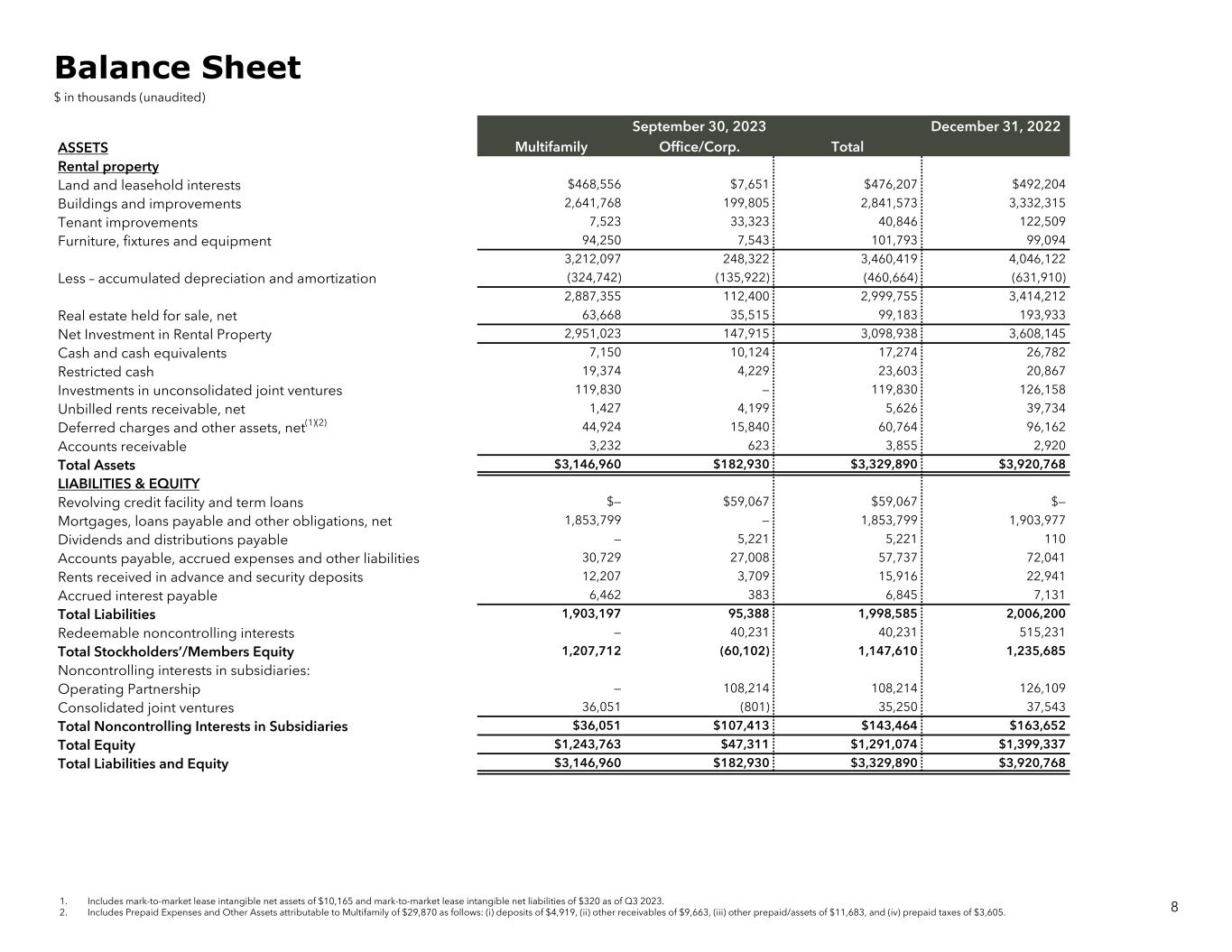

1. Includes mark-to-market lease intangible net assets of $10,165 and mark-to-market lease intangible net liabilities of $320 as of Q3 2023. 2. Includes Prepaid Expenses and Other Assets attributable to Multifamily of $29,870 as follows: (i) deposits of $4,919, (ii) other receivables of $9,663, (iii) other prepaid/assets of $11,683, and (iv) prepaid taxes of $3,605. September 30, 2023 December 31, 2022 ASSETS Multifamily Office/Corp. Total Rental property Land and leasehold interests $468,556 $7,651 $476,207 $492,204 Buildings and improvements 2,641,768 199,805 2,841,573 3,332,315 Tenant improvements 7,523 33,323 40,846 122,509 Furniture, fixtures and equipment 94,250 7,543 101,793 99,094 3,212,097 248,322 3,460,419 4,046,122 Less – accumulated depreciation and amortization (324,742) (135,922) (460,664) (631,910) 2,887,355 112,400 2,999,755 3,414,212 Real estate held for sale, net 63,668 35,515 99,183 193,933 Net Investment in Rental Property 2,951,023 147,915 3,098,938 3,608,145 Cash and cash equivalents 7,150 10,124 17,274 26,782 Restricted cash 19,374 4,229 23,603 20,867 Investments in unconsolidated joint ventures 119,830 — 119,830 126,158 Unbilled rents receivable, net 1,427 4,199 5,626 39,734 Deferred charges and other assets, net(1)(2) 44,924 15,840 60,764 96,162 Accounts receivable 3,232 623 3,855 2,920 Total Assets $3,146,960 $182,930 $3,329,890 $3,920,768 LIABILITIES & EQUITY Revolving credit facility and term loans $— $59,067 $59,067 $— Mortgages, loans payable and other obligations, net 1,853,799 — 1,853,799 1,903,977 Dividends and distributions payable — 5,221 5,221 110 Accounts payable, accrued expenses and other liabilities 30,729 27,008 57,737 72,041 Rents received in advance and security deposits 12,207 3,709 15,916 22,941 Accrued interest payable 6,462 383 6,845 7,131 Total Liabilities 1,903,197 95,388 1,998,585 2,006,200 Redeemable noncontrolling interests — 40,231 40,231 515,231 Total Stockholders’/Members Equity 1,207,712 (60,102) 1,147,610 1,235,685 Noncontrolling interests in subsidiaries: Operating Partnership — 108,214 108,214 126,109 Consolidated joint ventures 36,051 (801) 35,250 37,543 Total Noncontrolling Interests in Subsidiaries $36,051 $107,413 $143,464 $163,652 Total Equity $1,243,763 $47,311 $1,291,074 $1,399,337 Total Liabilities and Equity $3,146,960 $182,930 $3,329,890 $3,920,768 8 Balance Sheet $ in thousands (unaudited)

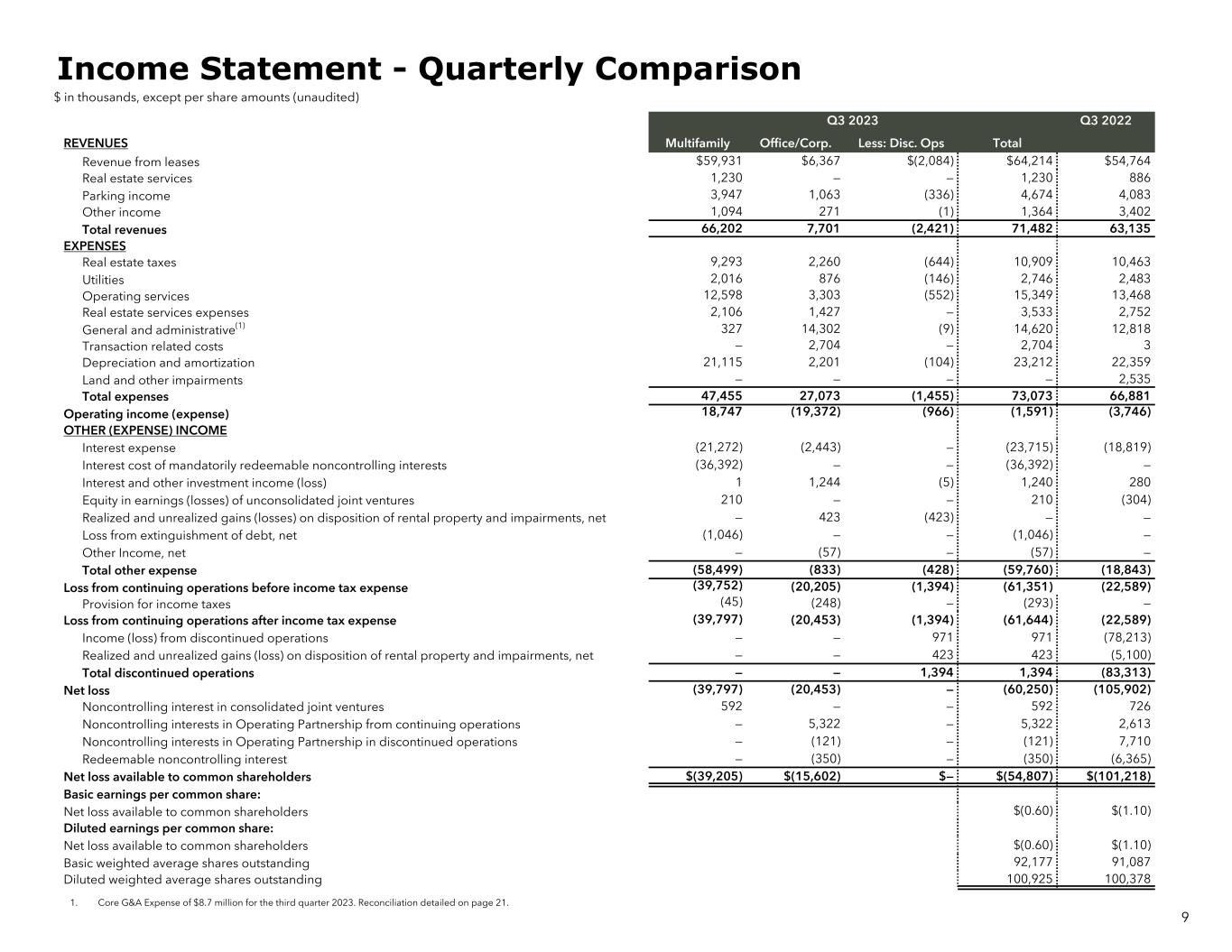

Q3 2023 Q3 2022 REVENUES Multifamily Office/Corp. Less: Disc. Ops Total Revenue from leases $59,931 $6,367 $(2,084) $64,214 $54,764 Real estate services 1,230 — — 1,230 886 Parking income 3,947 1,063 (336) 4,674 4,083 Other income 1,094 271 (1) 1,364 3,402 Total revenues 66,202 7,701 (2,421) 71,482 63,135 EXPENSES Real estate taxes 9,293 2,260 (644) 10,909 10,463 Utilities 2,016 876 (146) 2,746 2,483 Operating services 12,598 3,303 (552) 15,349 13,468 Real estate services expenses 2,106 1,427 — 3,533 2,752 General and administrative(1) 327 14,302 (9) 14,620 12,818 Transaction related costs — 2,704 — 2,704 3 Depreciation and amortization 21,115 2,201 (104) 23,212 22,359 Land and other impairments — — — — 2,535 Total expenses 47,455 27,073 (1,455) 73,073 66,881 Operating income (expense) 18,747 (19,372) (966) (1,591) (3,746) OTHER (EXPENSE) INCOME Interest expense (21,272) (2,443) — (23,715) (18,819) Interest cost of mandatorily redeemable noncontrolling interests (36,392) — — (36,392) — Interest and other investment income (loss) 1 1,244 (5) 1,240 280 Equity in earnings (losses) of unconsolidated joint ventures 210 — — 210 (304) Realized and unrealized gains (losses) on disposition of rental property and impairments, net — 423 (423) — — Loss from extinguishment of debt, net (1,046) — — (1,046) — Other Income, net — (57) — (57) — Total other expense (58,499) (833) (428) (59,760) (18,843) Loss from continuing operations before income tax expense (39,752) (20,205) (1,394) (61,351) (22,589) Provision for income taxes (45) (248) — (293) — Loss from continuing operations after income tax expense (39,797) (20,453) (1,394) (61,644) (22,589) Income (loss) from discontinued operations — — 971 971 (78,213) Realized and unrealized gains (loss) on disposition of rental property and impairments, net — — 423 423 (5,100) Total discontinued operations — — 1,394 1,394 (83,313) Net loss (39,797) (20,453) — (60,250) (105,902) Noncontrolling interest in consolidated joint ventures 592 — — 592 726 Noncontrolling interests in Operating Partnership from continuing operations — 5,322 — 5,322 2,613 Noncontrolling interests in Operating Partnership in discontinued operations — (121) — (121) 7,710 Redeemable noncontrolling interest — (350) — (350) (6,365) Net loss available to common shareholders $(39,205) $(15,602) $— $(54,807) $(101,218) Basic earnings per common share: Net loss available to common shareholders $(0.60) $(1.10) Diluted earnings per common share: Net loss available to common shareholders $(0.60) $(1.10) Basic weighted average shares outstanding 92,177 91,087 Diluted weighted average shares outstanding 100,925 100,378 9 Income Statement - Quarterly Comparison $ in thousands, except per share amounts (unaudited) 1. Core G&A Expense of $8.7 million for the third quarter 2023. Reconciliation detailed on page 21.

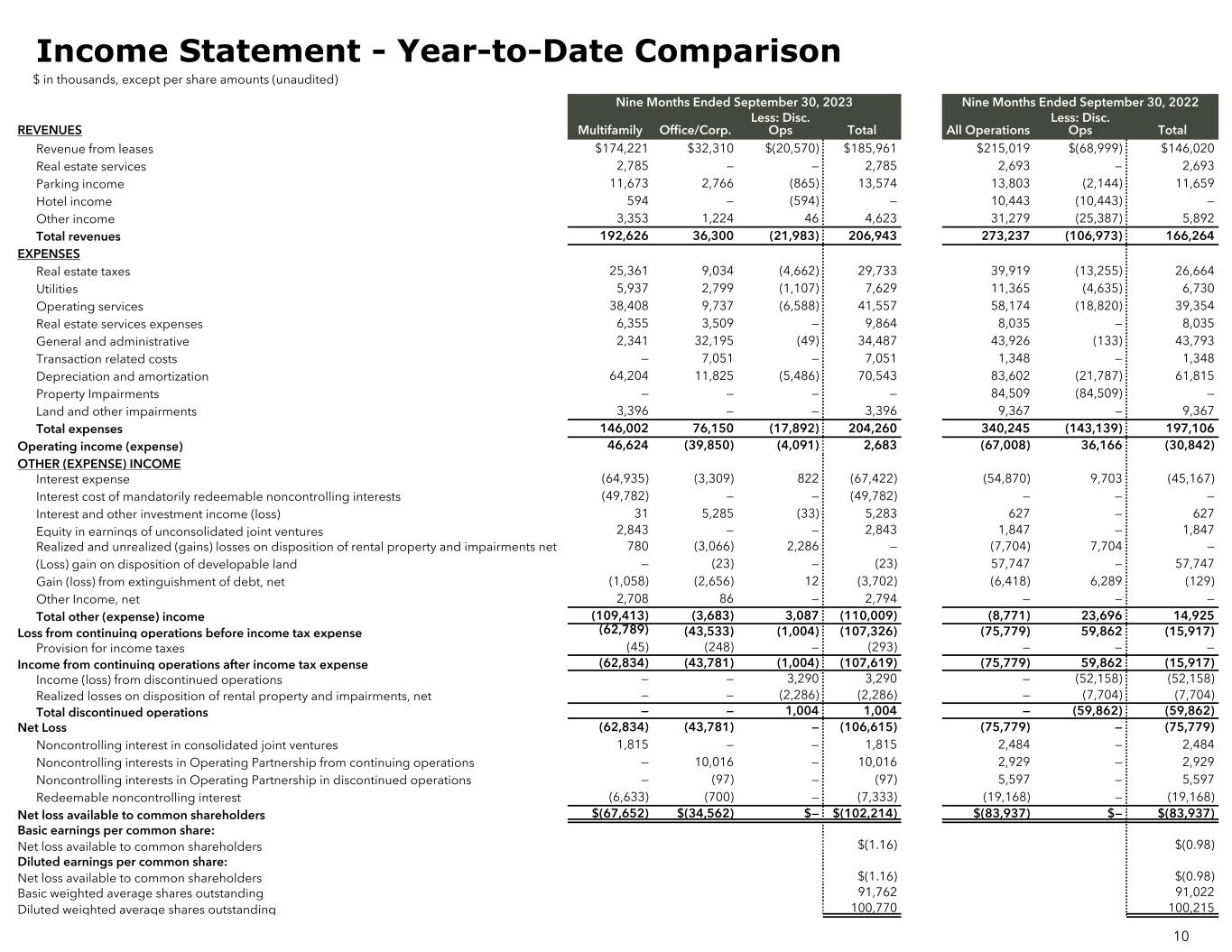

Nine Months Ended September 30, 2023 Nine Months Ended September 30, 2022 REVENUES Multifamily Office/Corp. Less: Disc. Ops Total All Operations Less: Disc. Ops Total Revenue from leases $174,221 $32,310 $(20,570) $185,961 $215,019 $(68,999) $146,020 Real estate services 2,785 — — 2,785 2,693 — 2,693 Parking income 11,673 2,766 (865) 13,574 13,803 (2,144) 11,659 Hotel income 594 — (594) — 10,443 (10,443) — Other income 3,353 1,224 46 4,623 31,279 (25,387) 5,892 Total revenues 192,626 36,300 (21,983) 206,943 273,237 (106,973) 166,264 EXPENSES Real estate taxes 25,361 9,034 (4,662) 29,733 39,919 (13,255) 26,664 Utilities 5,937 2,799 (1,107) 7,629 11,365 (4,635) 6,730 Operating services 38,408 9,737 (6,588) 41,557 58,174 (18,820) 39,354 Real estate services expenses 6,355 3,509 — 9,864 8,035 — 8,035 General and administrative 2,341 32,195 (49) 34,487 43,926 (133) 43,793 Transaction related costs — 7,051 — 7,051 1,348 — 1,348 Depreciation and amortization 64,204 11,825 (5,486) 70,543 83,602 (21,787) 61,815 Property Impairments — — — — 84,509 (84,509) — Land and other impairments 3,396 — — 3,396 9,367 — 9,367 Total expenses 146,002 76,150 (17,892) 204,260 340,245 (143,139) 197,106 Operating income (expense) 46,624 (39,850) (4,091) 2,683 (67,008) 36,166 (30,842) OTHER (EXPENSE) INCOME Interest expense (64,935) (3,309) 822 (67,422) (54,870) 9,703 (45,167) Interest cost of mandatorily redeemable noncontrolling interests (49,782) — — (49,782) — — — Interest and other investment income (loss) 31 5,285 (33) 5,283 627 — 627 Equity in earnings of unconsolidated joint ventures 2,843 — — 2,843 1,847 — 1,847 Realized and unrealized (gains) losses on disposition of rental property and impairments net 780 (3,066) 2,286 — (7,704) 7,704 — (Loss) gain on disposition of developable land — (23) — (23) 57,747 — 57,747 Gain (loss) from extinguishment of debt, net (1,058) (2,656) 12 (3,702) (6,418) 6,289 (129) Other Income, net 2,708 86 — 2,794 — — — Total other (expense) income (109,413) (3,683) 3,087 (110,009) (8,771) 23,696 14,925 Loss from continuing operations before income tax expense (62,789) (43,533) (1,004) (107,326) (75,779) 59,862 (15,917) Provision for income taxes (45) (248) — (293) — — — Income from continuing operations after income tax expense (62,834) (43,781) (1,004) (107,619) (75,779) 59,862 (15,917) Income (loss) from discontinued operations — — 3,290 3,290 — (52,158) (52,158) Realized losses on disposition of rental property and impairments, net — — (2,286) (2,286) — (7,704) (7,704) Total discontinued operations — — 1,004 1,004 — (59,862) (59,862) Net Loss (62,834) (43,781) — (106,615) (75,779) — (75,779) Noncontrolling interest in consolidated joint ventures 1,815 — — 1,815 2,484 — 2,484 Noncontrolling interests in Operating Partnership from continuing operations — 10,016 — 10,016 2,929 — 2,929 Noncontrolling interests in Operating Partnership in discontinued operations — (97) — (97) 5,597 — 5,597 Redeemable noncontrolling interest (6,633) (700) — (7,333) (19,168) — (19,168) Net loss available to common shareholders $(67,652) $(34,562) $— $(102,214) $(83,937) $— $(83,937) Basic earnings per common share: Net loss available to common shareholders $(1.16) $(0.98) Diluted earnings per common share: Net loss available to common shareholders $(1.16) $(0.98) Basic weighted average shares outstanding 91,762 91,022 Diluted weighted average shares outstanding 100,770 100,215 10 Income Statement - Year-to-Date Comparison $ in thousands, except per share amounts (unaudited)

Notes: See endnotes and “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Net loss available to common shareholders $(54,807) $(101,218) $(102,214) $(83,937) Add (deduct): Noncontrolling interests in Operating Partnership (5,322) (2,613) (10,016) (2,929) Noncontrolling interests in discontinued operations 121 (7,710) 97 (5,597) Real estate-related depreciation and amortization on continuing operations(1) 25,568 24,802 77,622 69,154 Real estate-related depreciation and amortization on discontinued operations 104 6,550 5,335 21,334 Property impairments on discontinued operations — 84,509 — 84,509 Discontinued operations: Realized and unrealized losses (gains) on disposition of rental property, net (423) 5,100 2,286 7,704 Funds from operations(2) $(34,759) $9,420 $(26,890) $90,238 Add/(Deduct): Loss from extinguishment of debt, net 1,046 — 3,714 6,418 Land and other impairments — 2,535 3,396 9,367 Loss (gain) on disposition of developable land — — 23 (57,747) Rebranding and Severance/Compensation related costs (G&A) 5,904 3,377 7,869 12,244 Rebranding and Severance/Compensation related costs (Real Estate Services and Operating Expenses) 937 — 937 — Rockpoint buyout premium 34,775 — 34,775 — Redemption value adjustment to mandatorily redeemable noncontrolling interests — — 7,641 — Lease breakage fee, net — — — (22,664) Amortization of derivative premium 999 (211) 3,751 (213) Transaction related costs 2,704 3 7,051 1,348 Core FFO $11,606 $15,124 $42,267 $38,991 Diluted weighted average shares/units outstanding(6) 100,925 100,378 100,770 100,215 Funds from operations per share-diluted $(0.34) $0.09 $(0.27) $0.90 Core Funds from Operations per share/unit-diluted $0.12 $0.15 $0.42 $0.39 Dividends declared per common share $0.05 — $0.05 — FFO & Core FFO $ in thousands, except per share and ratios (unaudited) 11

Notes: See endnotes and “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. 12 Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Core FFO (calculated on previous page) $11,606 $15,124 $42,267 $38,991 Add (Deduct) Non-Cash Items: Straight-line rent adjustments(3) 781 (2,660) 421 3,967 Amortization of market lease intangibles, net — (18) (79) (124) Amortization of lease inducements 37 37 52 112 Amortization of stock compensation 3,234 2,872 9,725 8,490 Non-real estate depreciation and amortization 228 283 813 933 Amortization of deferred financing costs 1,353 1,244 3,185 3,601 Deduct: Non-incremental revenue generating capital expenditures: Building improvements (2,247) (5,752) (6,678) (11,244) Tenant improvements and leasing commissions(4) (13) (2,936) (560) (9,197) Tenant improvements and leasing commissions on space vacant for more than one year (112) (3,379) (546) (19,277) Core AFFO(2) $14,867 $4,815 $48,600 $16,252 Core FFO (calculated on previous page) $11,606 $15,124 $42,267 $38,991 Deduct: Equity in earnings of unconsolidated joint ventures, net (210) 304 (2,843) (1,847) Equity in earnings share of depreciation and amortization (2,584) (2,576) (7,740) (7,819) Add-back: Interest expense 23,715 22,137 68,244 54,870 Amortization of derivative premium (999) 211 (3,751) 213 Recurring JV distributions 2,896 2,911 8,982 9,529 Loss in noncontrolling interest in consolidated joint ventures (592) (726) (1,815) (2,484) Interest cost for mandatorily redeemable noncontrolling interest 1,617 — 7,366 — Redeemable noncontrolling interest 350 6,365 7,333 19,168 Income tax expense 293 (110) 293 95 Adjusted EBITDA $36,092 $43,640 $118,336 $110,716 Net debt at period end(5) 1,871,989 2,202,647 1,871,989 2,202,647 Net debt to Adjusted EBITDA 13.0x 12.7x 11.8x 14.9x AFFO & Adjusted EBITDA $ in thousands, except per share amounts and ratios (unaudited)

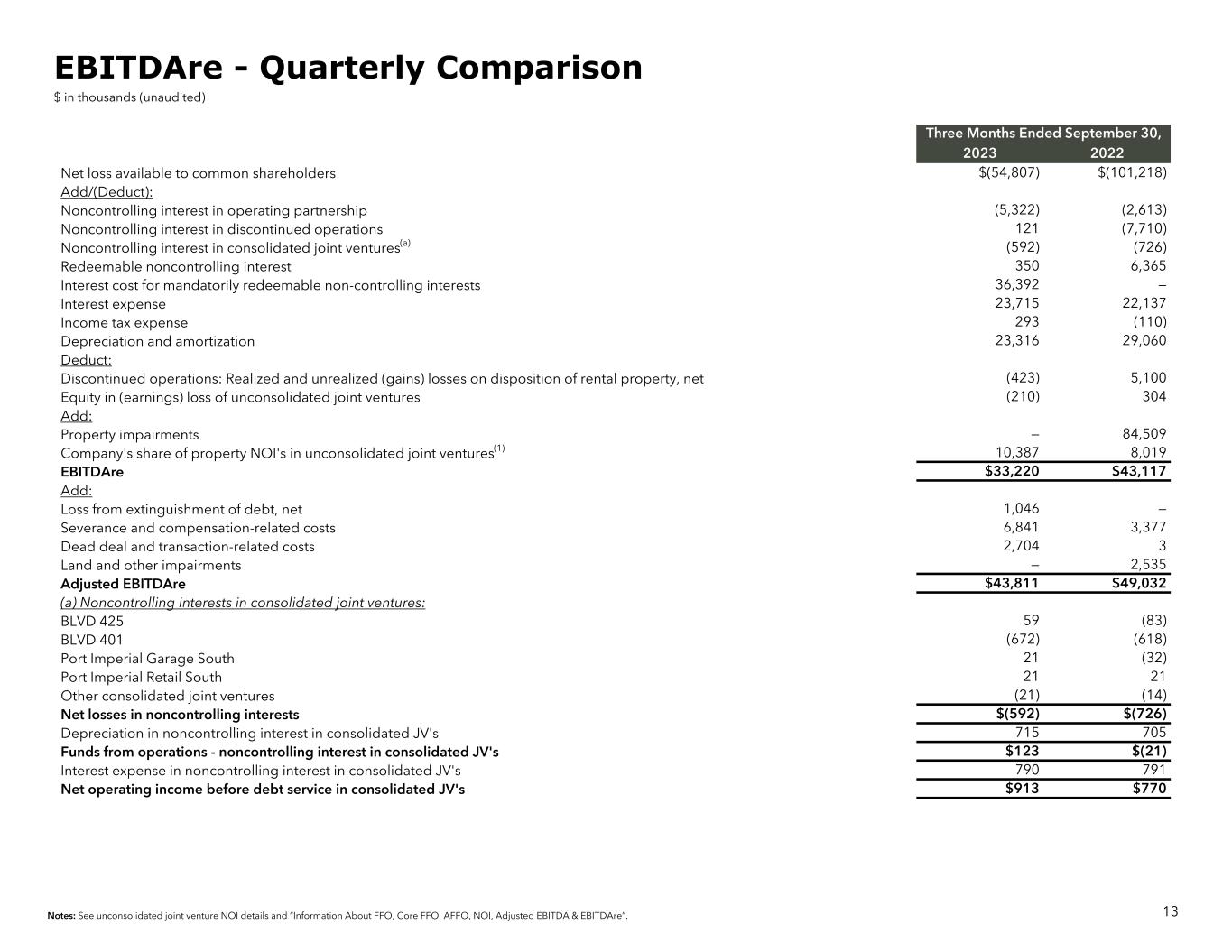

Notes: See unconsolidated joint venture NOI details and “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. 13 Three Months Ended September 30, 2023 2022 Net loss available to common shareholders $(54,807) $(101,218) Add/(Deduct): Noncontrolling interest in operating partnership (5,322) (2,613) Noncontrolling interest in discontinued operations 121 (7,710) Noncontrolling interest in consolidated joint ventures(a) (592) (726) Redeemable noncontrolling interest 350 6,365 Interest cost for mandatorily redeemable non-controlling interests 36,392 — Interest expense 23,715 22,137 Income tax expense 293 (110) Depreciation and amortization 23,316 29,060 Deduct: Discontinued operations: Realized and unrealized (gains) losses on disposition of rental property, net (423) 5,100 Equity in (earnings) loss of unconsolidated joint ventures (210) 304 Add: Property impairments — 84,509 Company's share of property NOI's in unconsolidated joint ventures(1) 10,387 8,019 EBITDAre $33,220 $43,117 Add: Loss from extinguishment of debt, net 1,046 — Severance and compensation-related costs 6,841 3,377 Dead deal and transaction-related costs 2,704 3 Land and other impairments — 2,535 Adjusted EBITDAre $43,811 $49,032 (a) Noncontrolling interests in consolidated joint ventures: BLVD 425 59 (83) BLVD 401 (672) (618) Port Imperial Garage South 21 (32) Port Imperial Retail South 21 21 Other consolidated joint ventures (21) (14) Net losses in noncontrolling interests $(592) $(726) Depreciation in noncontrolling interest in consolidated JV's 715 705 Funds from operations - noncontrolling interest in consolidated JV's $123 $(21) Interest expense in noncontrolling interest in consolidated JV's 790 791 Net operating income before debt service in consolidated JV's $913 $770 EBITDAre - Quarterly Comparison $ in thousands (unaudited)

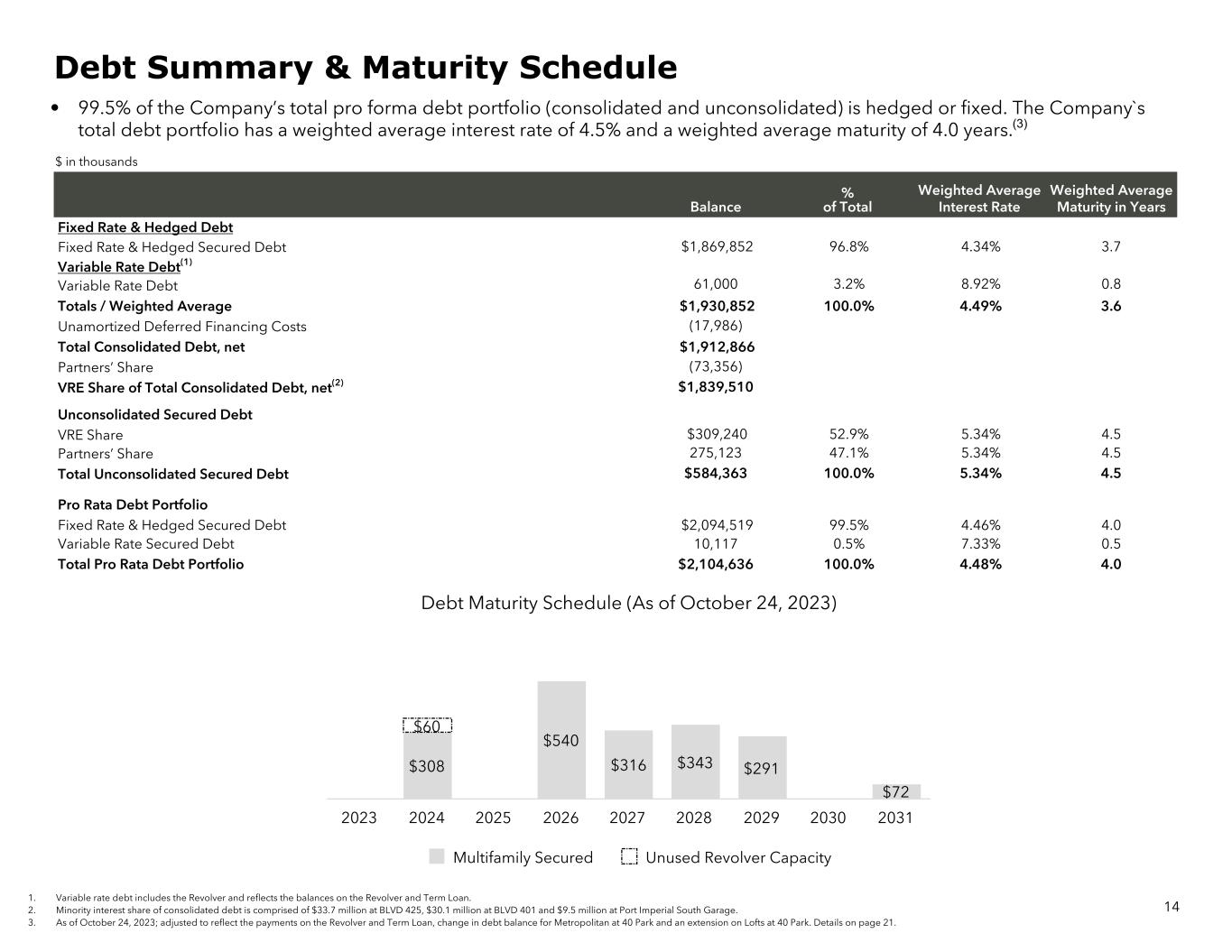

• 99.5% of the Company’s total pro forma debt portfolio (consolidated and unconsolidated) is hedged or fixed. The Company`s total debt portfolio has a weighted average interest rate of 4.5% and a weighted average maturity of 4.0 years.(3) $ in thousands 14 Balance % of Total Weighted Average Interest Rate Weighted Average Maturity in Years Fixed Rate & Hedged Debt Fixed Rate & Hedged Secured Debt $1,869,852 96.8% 4.34% 3.7 Variable Rate Debt(1) Variable Rate Debt 61,000 3.2% 8.92% 0.8 Totals / Weighted Average $1,930,852 100.0% 4.49% 3.6 Unamortized Deferred Financing Costs (17,986) Total Consolidated Debt, net $1,912,866 Partners’ Share (73,356) VRE Share of Total Consolidated Debt, net(2) $1,839,510 Unconsolidated Secured Debt VRE Share $309,240 52.9% 5.34% 4.5 Partners’ Share 275,123 47.1% 5.34% 4.5 Total Unconsolidated Secured Debt $584,363 100.0% 5.34% 4.5 Pro Rata Debt Portfolio Fixed Rate & Hedged Secured Debt $2,094,519 99.5% 4.46% 4.0 Variable Rate Secured Debt 10,117 0.5% 7.33% 0.5 Total Pro Rata Debt Portfolio $2,104,636 100.0% 4.48% 4.0 Debt Summary & Maturity Schedule 1. Variable rate debt includes the Revolver and reflects the balances on the Revolver and Term Loan. 2. Minority interest share of consolidated debt is comprised of $33.7 million at BLVD 425, $30.1 million at BLVD 401 and $9.5 million at Port Imperial South Garage. 3. As of October 24, 2023; adjusted to reflect the payments on the Revolver and Term Loan, change in debt balance for Metropolitan at 40 Park and an extension on Lofts at 40 Park. Details on page 21. Debt Maturity Schedule (As of October 24, 2023) $308 $540 $316 $343 $291 $72 $60 Multifamily Secured Unused Revolver Capacity 2023 2024 2025 2026 2027 2028 2029 2030 2031

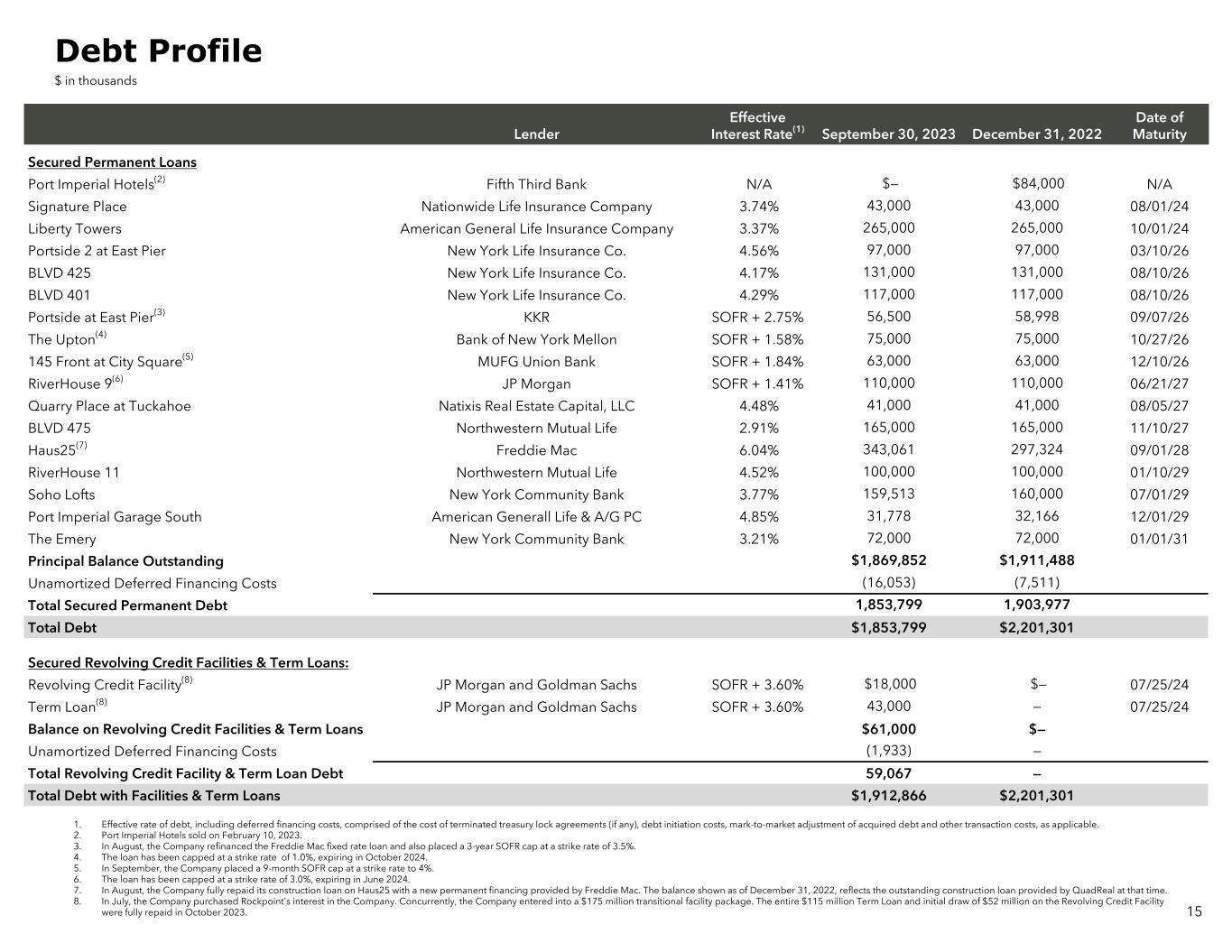

1. Effective rate of debt, including deferred financing costs, comprised of the cost of terminated treasury lock agreements (if any), debt initiation costs, mark-to-market adjustment of acquired debt and other transaction costs, as applicable. 2. Port Imperial Hotels sold on February 10, 2023. 3. In August, the Company refinanced the Freddie Mac fixed rate loan and also placed a 3-year SOFR cap at a strike rate of 3.5%. 4. The loan has been capped at a strike rate of 1.0%, expiring in October 2024. 5. In September, the Company placed a 9-month SOFR cap at a strike rate to 4%. 6. The loan has been capped at a strike rate of 3.0%, expiring in June 2024. 7. In August, the Company fully repaid its construction loan on Haus25 with a new permanent financing provided by Freddie Mac. The balance shown as of December 31, 2022, reflects the outstanding construction loan provided by QuadReal at that time. 8. In July, the Company purchased Rockpoint`s interest in the Company. Concurrently, the Company entered into a $175 million transitional facility package. The entire $115 million Term Loan and initial draw of $52 million on the Revolving Credit Facility were fully repaid in October 2023. 15 Lender Effective Interest Rate(1) September 30, 2023 December 31, 2022 Date of Maturity Secured Permanent Loans Port Imperial Hotels(2) Fifth Third Bank N/A $— $84,000 N/A Signature Place Nationwide Life Insurance Company 3.74% 43,000 43,000 08/01/24 Liberty Towers American General Life Insurance Company 3.37% 265,000 265,000 10/01/24 Portside 2 at East Pier New York Life Insurance Co. 4.56% 97,000 97,000 03/10/26 BLVD 425 New York Life Insurance Co. 4.17% 131,000 131,000 08/10/26 BLVD 401 New York Life Insurance Co. 4.29% 117,000 117,000 08/10/26 Portside at East Pier(3) KKR SOFR + 2.75% 56,500 58,998 09/07/26 The Upton(4) Bank of New York Mellon SOFR + 1.58% 75,000 75,000 10/27/26 145 Front at City Square(5) MUFG Union Bank SOFR + 1.84% 63,000 63,000 12/10/26 RiverHouse 9(6) JP Morgan SOFR + 1.41% 110,000 110,000 06/21/27 Quarry Place at Tuckahoe Natixis Real Estate Capital, LLC 4.48% 41,000 41,000 08/05/27 BLVD 475 Northwestern Mutual Life 2.91% 165,000 165,000 11/10/27 Haus25(7) Freddie Mac 6.04% 343,061 297,324 09/01/28 RiverHouse 11 Northwestern Mutual Life 4.52% 100,000 100,000 01/10/29 Soho Lofts New York Community Bank 3.77% 159,513 160,000 07/01/29 Port Imperial Garage South American Generall Life & A/G PC 4.85% 31,778 32,166 12/01/29 The Emery New York Community Bank 3.21% 72,000 72,000 01/01/31 Principal Balance Outstanding $1,869,852 $1,911,488 Unamortized Deferred Financing Costs (16,053) (7,511) Total Secured Permanent Debt 1,853,799 1,903,977 Total Debt $1,853,799 $2,201,301 Secured Revolving Credit Facilities & Term Loans: Revolving Credit Facility(8) JP Morgan and Goldman Sachs SOFR + 3.60% $18,000 $— 07/25/24 Term Loan(8) JP Morgan and Goldman Sachs SOFR + 3.60% 43,000 — 07/25/24 Balance on Revolving Credit Facilities & Term Loans $61,000 $— Unamortized Deferred Financing Costs (1,933) — Total Revolving Credit Facility & Term Loan Debt 59,067 — Total Debt with Facilities & Term Loans $1,912,866 $2,201,301 Debt Profile $ in thousands

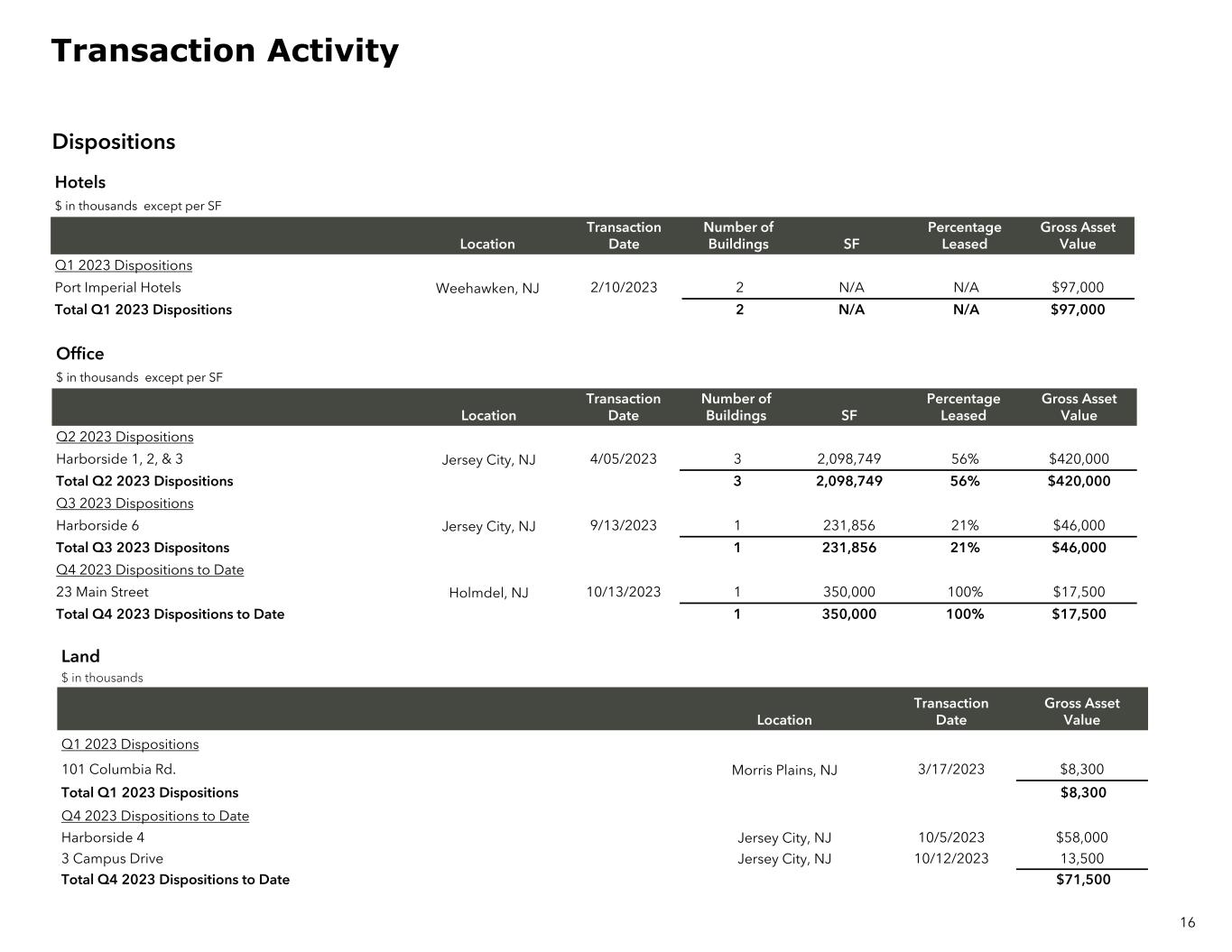

Hotels $ in thousands except per SF Location Transaction Date Number of Buildings SF Percentage Leased Gross Asset Value Q1 2023 Dispositions Port Imperial Hotels Weehawken, NJ 2/10/2023 2 N/A N/A $97,000 Total Q1 2023 Dispositions 2 N/A N/A $97,000 Land $ in thousands Location Transaction Date Gross Asset Value Q1 2023 Dispositions 101 Columbia Rd. Morris Plains, NJ 3/17/2023 $8,300 Total Q1 2023 Dispositions $8,300 Q4 2023 Dispositions to Date Harborside 4 Jersey City, NJ 10/5/2023 $58,000 3 Campus Drive Jersey City, NJ 10/12/2023 13,500 Total Q4 2023 Dispositions to Date $71,500 16 Transaction Activity Dispositions Office $ in thousands except per SF Location Transaction Date Number of Buildings SF Percentage Leased Gross Asset Value Q2 2023 Dispositions Harborside 1, 2, & 3 Jersey City, NJ 4/05/2023 3 2,098,749 56% $420,000 Total Q2 2023 Dispositions 3 2,098,749 56% $420,000 Q3 2023 Dispositions Harborside 6 Jersey City, NJ 9/13/2023 1 231,856 21% $46,000 Total Q3 2023 Dispositons 1 231,856 21% $46,000 Q4 2023 Dispositions to Date 23 Main Street Holmdel, NJ 10/13/2023 1 350,000 100% $17,500 Total Q4 2023 Dispositions to Date 1 350,000 100% $17,500

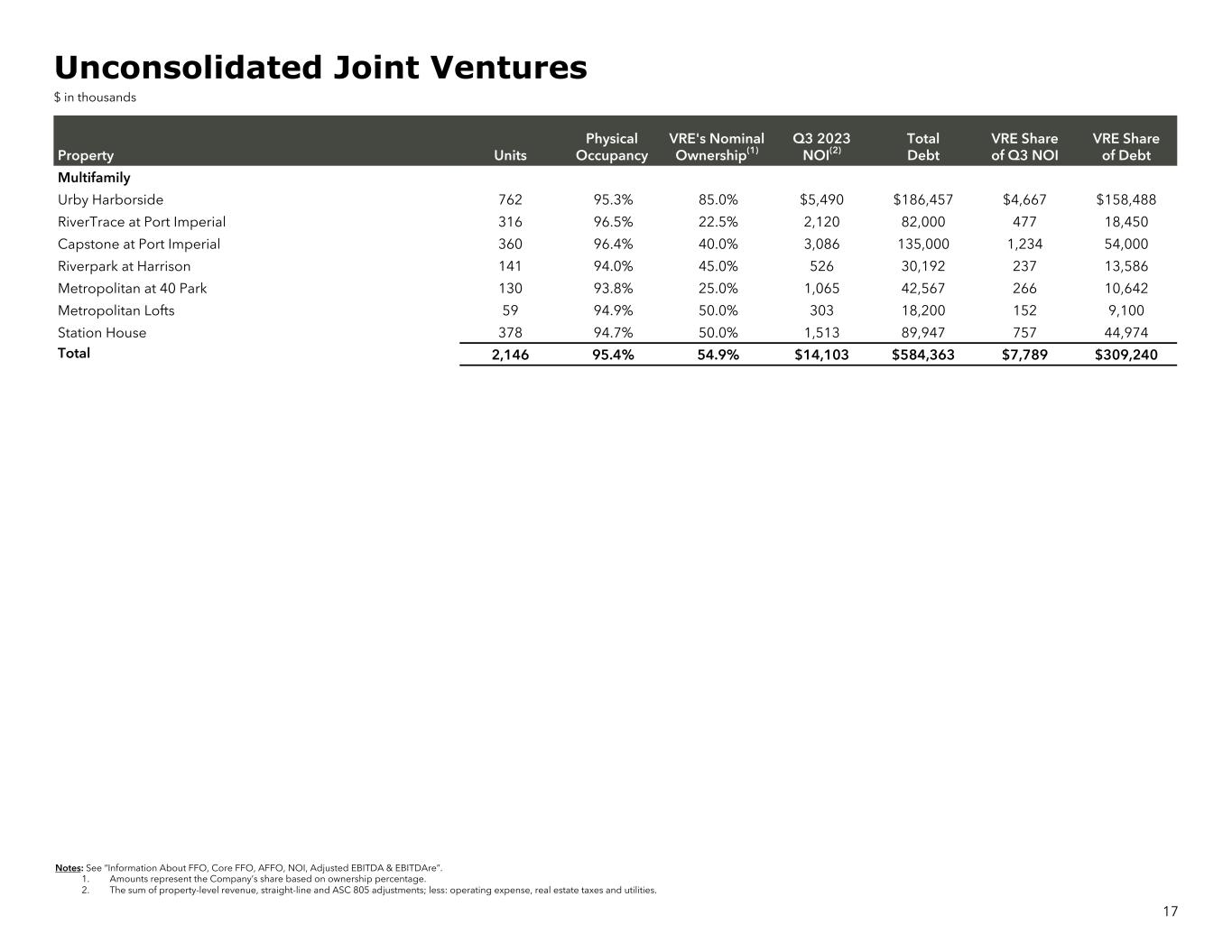

Property Units Physical Occupancy VRE's Nominal Ownership(1) Q3 2023 NOI(2) Total Debt VRE Share of Q3 NOI VRE Share of Debt Multifamily Urby Harborside 762 95.3% 85.0% $5,490 $186,457 $4,667 $158,488 RiverTrace at Port Imperial 316 96.5% 22.5% 2,120 82,000 477 18,450 Capstone at Port Imperial 360 96.4% 40.0% 3,086 135,000 1,234 54,000 Riverpark at Harrison 141 94.0% 45.0% 526 30,192 237 13,586 Metropolitan at 40 Park 130 93.8% 25.0% 1,065 42,567 266 10,642 Metropolitan Lofts 59 94.9% 50.0% 303 18,200 152 9,100 Station House 378 94.7% 50.0% 1,513 89,947 757 44,974 Total 2,146 95.4% 54.9% $14,103 $584,363 $7,789 $309,240 Notes: See “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. 1. Amounts represent the Company’s share based on ownership percentage. 2. The sum of property-level revenue, straight-line and ASC 805 adjustments; less: operating expense, real estate taxes and utilities. 17 Unconsolidated Joint Ventures $ in thousands

Operating Portfolio 18

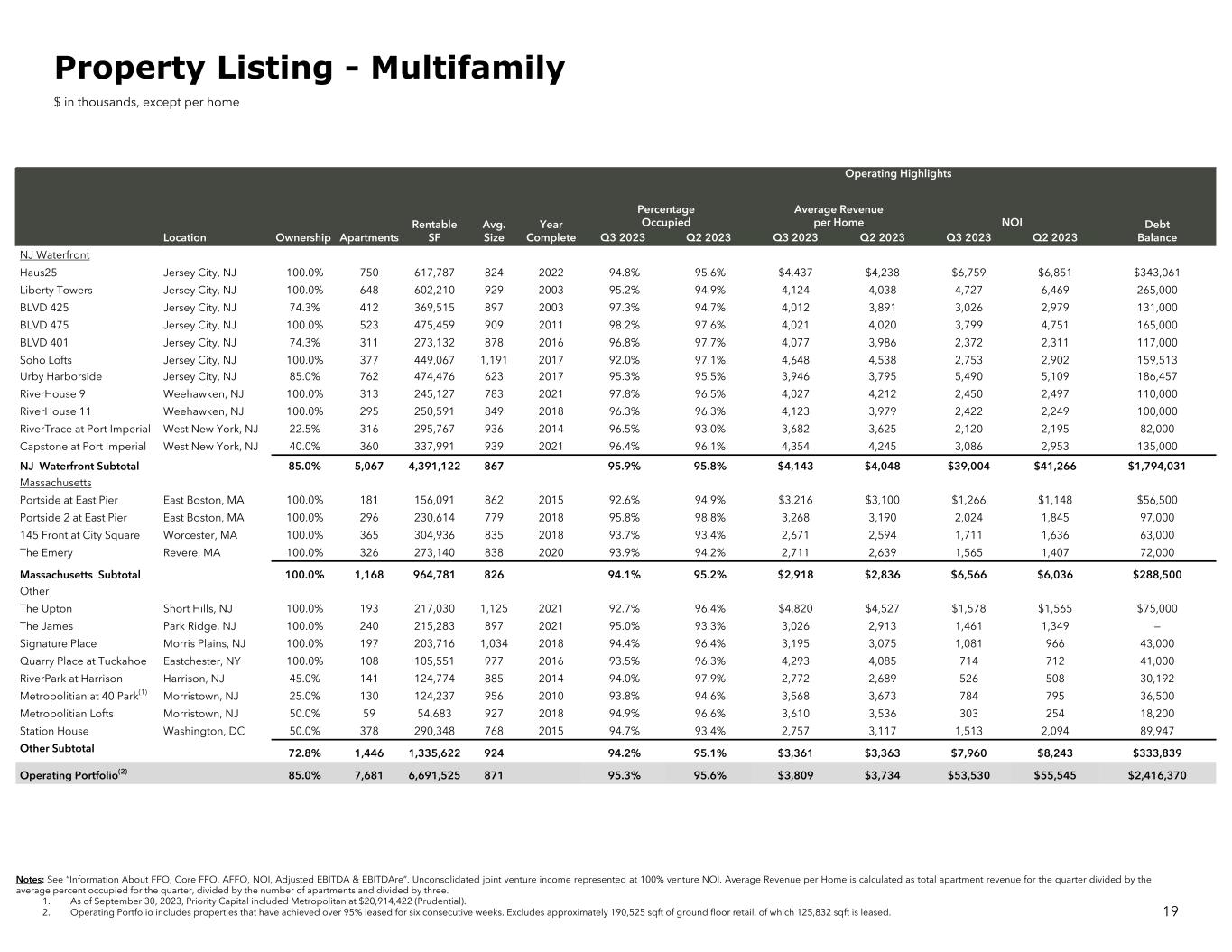

Operating Highlights Rentable SF Avg. Size Year Complete Percentage Occupied Average Revenue per Home NOI Debt BalanceLocation Ownership Apartments Q3 2023 Q2 2023 Q3 2023 Q2 2023 Q3 2023 Q2 2023 NJ Waterfront Haus25 Jersey City, NJ 100.0% 750 617,787 824 2022 94.8% 95.6% $4,437 $4,238 $6,759 $6,851 $343,061 Liberty Towers Jersey City, NJ 100.0% 648 602,210 929 2003 95.2% 94.9% 4,124 4,038 4,727 6,469 265,000 BLVD 425 Jersey City, NJ 74.3% 412 369,515 897 2003 97.3% 94.7% 4,012 3,891 3,026 2,979 131,000 BLVD 475 Jersey City, NJ 100.0% 523 475,459 909 2011 98.2% 97.6% 4,021 4,020 3,799 4,751 165,000 BLVD 401 Jersey City, NJ 74.3% 311 273,132 878 2016 96.8% 97.7% 4,077 3,986 2,372 2,311 117,000 Soho Lofts Jersey City, NJ 100.0% 377 449,067 1,191 2017 92.0% 97.1% 4,648 4,538 2,753 2,902 159,513 Urby Harborside Jersey City, NJ 85.0% 762 474,476 623 2017 95.3% 95.5% 3,946 3,795 5,490 5,109 186,457 RiverHouse 9 Weehawken, NJ 100.0% 313 245,127 783 2021 97.8% 96.5% 4,027 4,212 2,450 2,497 110,000 RiverHouse 11 Weehawken, NJ 100.0% 295 250,591 849 2018 96.3% 96.3% 4,123 3,979 2,422 2,249 100,000 RiverTrace at Port Imperial West New York, NJ 22.5% 316 295,767 936 2014 96.5% 93.0% 3,682 3,625 2,120 2,195 82,000 Capstone at Port Imperial West New York, NJ 40.0% 360 337,991 939 2021 96.4% 96.1% 4,354 4,245 3,086 2,953 135,000 NJ Waterfront Subtotal 85.0% 5,067 4,391,122 867 95.9% 95.8% $4,143 $4,048 $39,004 $41,266 $1,794,031 Massachusetts Portside at East Pier East Boston, MA 100.0% 181 156,091 862 2015 92.6% 94.9% $3,216 $3,100 $1,266 $1,148 $56,500 Portside 2 at East Pier East Boston, MA 100.0% 296 230,614 779 2018 95.8% 98.8% 3,268 3,190 2,024 1,845 97,000 145 Front at City Square Worcester, MA 100.0% 365 304,936 835 2018 93.7% 93.4% 2,671 2,594 1,711 1,636 63,000 The Emery Revere, MA 100.0% 326 273,140 838 2020 93.9% 94.2% 2,711 2,639 1,565 1,407 72,000 Massachusetts Subtotal 100.0% 1,168 964,781 826 94.1% 95.2% $2,918 $2,836 $6,566 $6,036 $288,500 Other The Upton Short Hills, NJ 100.0% 193 217,030 1,125 2021 92.7% 96.4% $4,820 $4,527 $1,578 $1,565 $75,000 The James Park Ridge, NJ 100.0% 240 215,283 897 2021 95.0% 93.3% 3,026 2,913 1,461 1,349 — Signature Place Morris Plains, NJ 100.0% 197 203,716 1,034 2018 94.4% 96.4% 3,195 3,075 1,081 966 43,000 Quarry Place at Tuckahoe Eastchester, NY 100.0% 108 105,551 977 2016 93.5% 96.3% 4,293 4,085 714 712 41,000 RiverPark at Harrison Harrison, NJ 45.0% 141 124,774 885 2014 94.0% 97.9% 2,772 2,689 526 508 30,192 Metropolitian at 40 Park(1) Morristown, NJ 25.0% 130 124,237 956 2010 93.8% 94.6% 3,568 3,673 784 795 36,500 Metropolitian Lofts Morristown, NJ 50.0% 59 54,683 927 2018 94.9% 96.6% 3,610 3,536 303 254 18,200 Station House Washington, DC 50.0% 378 290,348 768 2015 94.7% 93.4% 2,757 3,117 1,513 2,094 89,947 Other Subtotal 72.8% 1,446 1,335,622 924 94.2% 95.1% $3,361 $3,363 $7,960 $8,243 $333,839 Operating Portfolio(2) 85.0% 7,681 6,691,525 871 95.3% 95.6% $3,809 $3,734 $53,530 $55,545 $2,416,370 Notes: See “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. Unconsolidated joint venture income represented at 100% venture NOI. Average Revenue per Home is calculated as total apartment revenue for the quarter divided by the average percent occupied for the quarter, divided by the number of apartments and divided by three. 1. As of September 30, 2023, Priority Capital included Metropolitan at $20,914,422 (Prudential). 2. Operating Portfolio includes properties that have achieved over 95% leased for six consecutive weeks. Excludes approximately 190,525 sqft of ground floor retail, of which 125,832 sqft is leased. 19 Property Listing - Multifamily $ in thousands, except per home

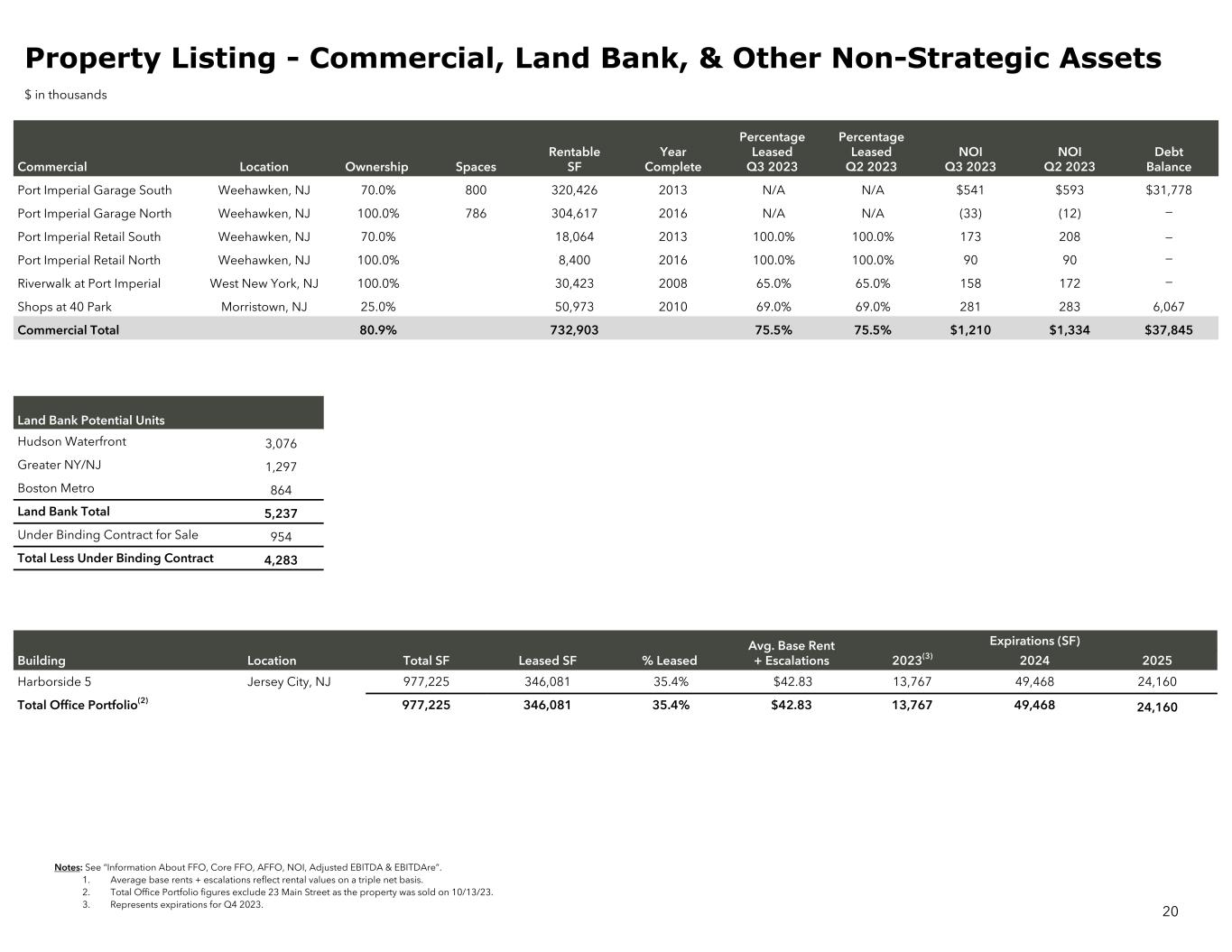

Commercial Location Ownership Spaces Rentable SF Year Complete Percentage Leased Q3 2023 Percentage Leased Q2 2023 NOI Q3 2023 NOI Q2 2023 Debt Balance Port Imperial Garage South Weehawken, NJ 70.0% 800 320,426 2013 N/A N/A $541 $593 $31,778 Port Imperial Garage North Weehawken, NJ 100.0% 786 304,617 2016 N/A N/A (33) (12) — Port Imperial Retail South Weehawken, NJ 70.0% 18,064 2013 100.0% 100.0% 173 208 — Port Imperial Retail North Weehawken, NJ 100.0% 8,400 2016 100.0% 100.0% 90 90 — Riverwalk at Port Imperial West New York, NJ 100.0% 30,423 2008 65.0% 65.0% 158 172 — Shops at 40 Park Morristown, NJ 25.0% 50,973 2010 69.0% 69.0% 281 283 6,067 Commercial Total 80.9% 732,903 75.5% 75.5% $1,210 $1,334 $37,845 Notes: See “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. 1. Average base rents + escalations reflect rental values on a triple net basis. 2. Total Office Portfolio figures exclude 23 Main Street as the property was sold on 10/13/23. 3. Represents expirations for Q4 2023. 20 Property Listing - Commercial, Land Bank, & Other Non-Strategic Assets $ in thousands Land Bank Potential Units Hudson Waterfront 3,076 Greater NY/NJ 1,297 Boston Metro 864 Land Bank Total 5,237 Under Binding Contract for Sale 954 Total Less Under Binding Contract 4,283 Avg. Base Rent + Escalations Expirations (SF) Building Location Total SF Leased SF % Leased 2023(3) 2024 2025 Harborside 5 Jersey City, NJ 977,225 346,081 35.4% $42.83 13,767 49,468 24,160 Total Office Portfolio(2) 977,225 346,081 35.4% $42.83 13,767 49,468 24,160

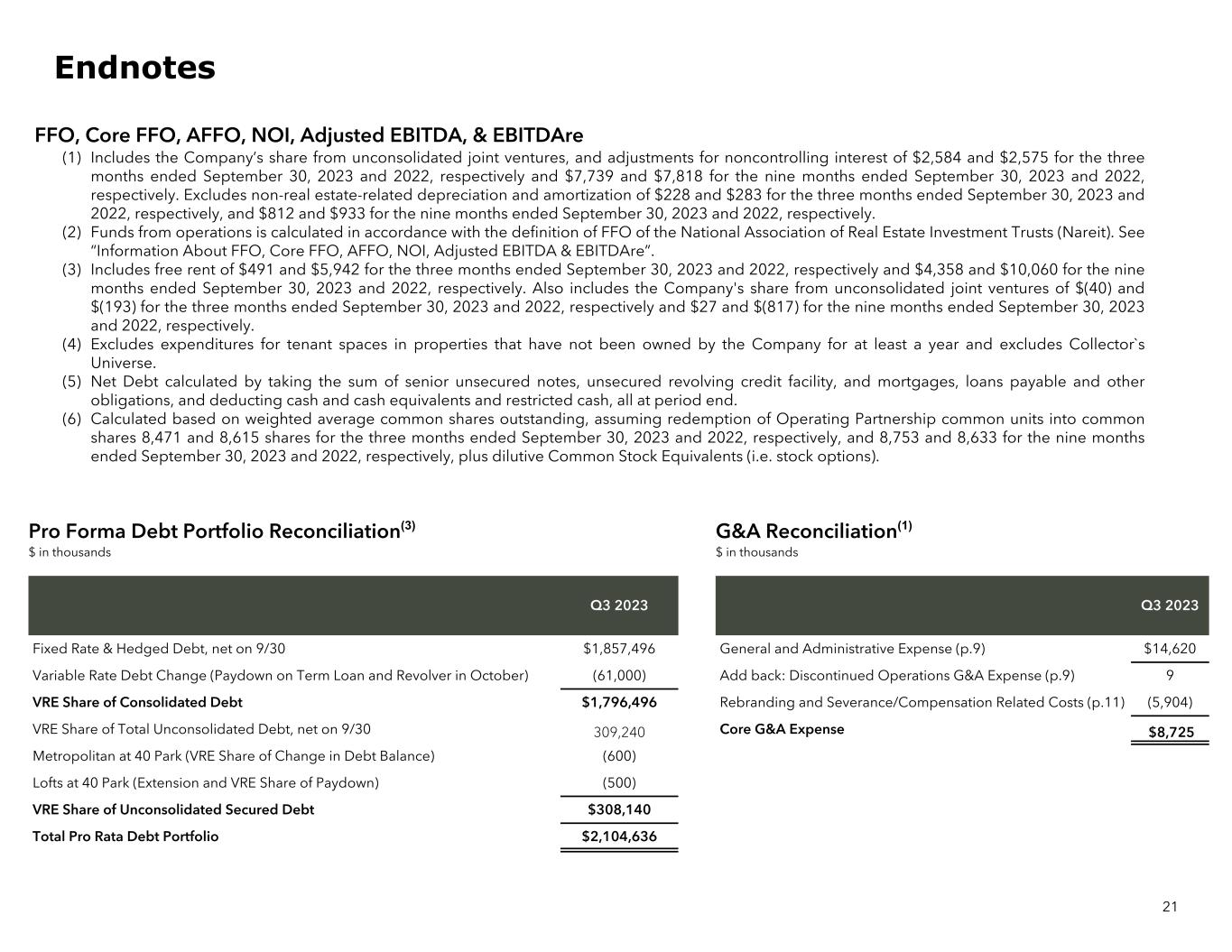

FFO, Core FFO, AFFO, NOI, Adjusted EBITDA, & EBITDAre (1) Includes the Company’s share from unconsolidated joint ventures, and adjustments for noncontrolling interest of $2,584 and $2,575 for the three months ended September 30, 2023 and 2022, respectively and $7,739 and $7,818 for the nine months ended September 30, 2023 and 2022, respectively. Excludes non-real estate-related depreciation and amortization of $228 and $283 for the three months ended September 30, 2023 and 2022, respectively, and $812 and $933 for the nine months ended September 30, 2023 and 2022, respectively. (2) Funds from operations is calculated in accordance with the definition of FFO of the National Association of Real Estate Investment Trusts (Nareit). See “Information About FFO, Core FFO, AFFO, NOI, Adjusted EBITDA & EBITDAre”. (3) Includes free rent of $491 and $5,942 for the three months ended September 30, 2023 and 2022, respectively and $4,358 and $10,060 for the nine months ended September 30, 2023 and 2022, respectively. Also includes the Company's share from unconsolidated joint ventures of $(40) and $(193) for the three months ended September 30, 2023 and 2022, respectively and $27 and $(817) for the nine months ended September 30, 2023 and 2022, respectively. (4) Excludes expenditures for tenant spaces in properties that have not been owned by the Company for at least a year and excludes Collector`s Universe. (5) Net Debt calculated by taking the sum of senior unsecured notes, unsecured revolving credit facility, and mortgages, loans payable and other obligations, and deducting cash and cash equivalents and restricted cash, all at period end. (6) Calculated based on weighted average common shares outstanding, assuming redemption of Operating Partnership common units into common shares 8,471 and 8,615 shares for the three months ended September 30, 2023 and 2022, respectively, and 8,753 and 8,633 for the nine months ended September 30, 2023 and 2022, respectively, plus dilutive Common Stock Equivalents (i.e. stock options). 21 Endnotes Q3 2023 Fixed Rate & Hedged Debt, net on 9/30 $1,857,496 Variable Rate Debt Change (Paydown on Term Loan and Revolver in October) (61,000) VRE Share of Consolidated Debt $1,796,496 VRE Share of Total Unconsolidated Debt, net on 9/30 309,240 Metropolitan at 40 Park (VRE Share of Change in Debt Balance) (600) Lofts at 40 Park (Extension and VRE Share of Paydown) (500) VRE Share of Unconsolidated Secured Debt $308,140 Total Pro Rata Debt Portfolio $2,104,636 Pro Forma Debt Portfolio Reconciliation(3) $ in thousands G&A Reconciliation(1) $ in thousands Q3 2023 General and Administrative Expense (p.9) $14,620 Add back: Discontinued Operations G&A Expense (p.9) 9 Rebranding and Severance/Compensation Related Costs (p.11) (5,904) Core G&A Expense $8,725

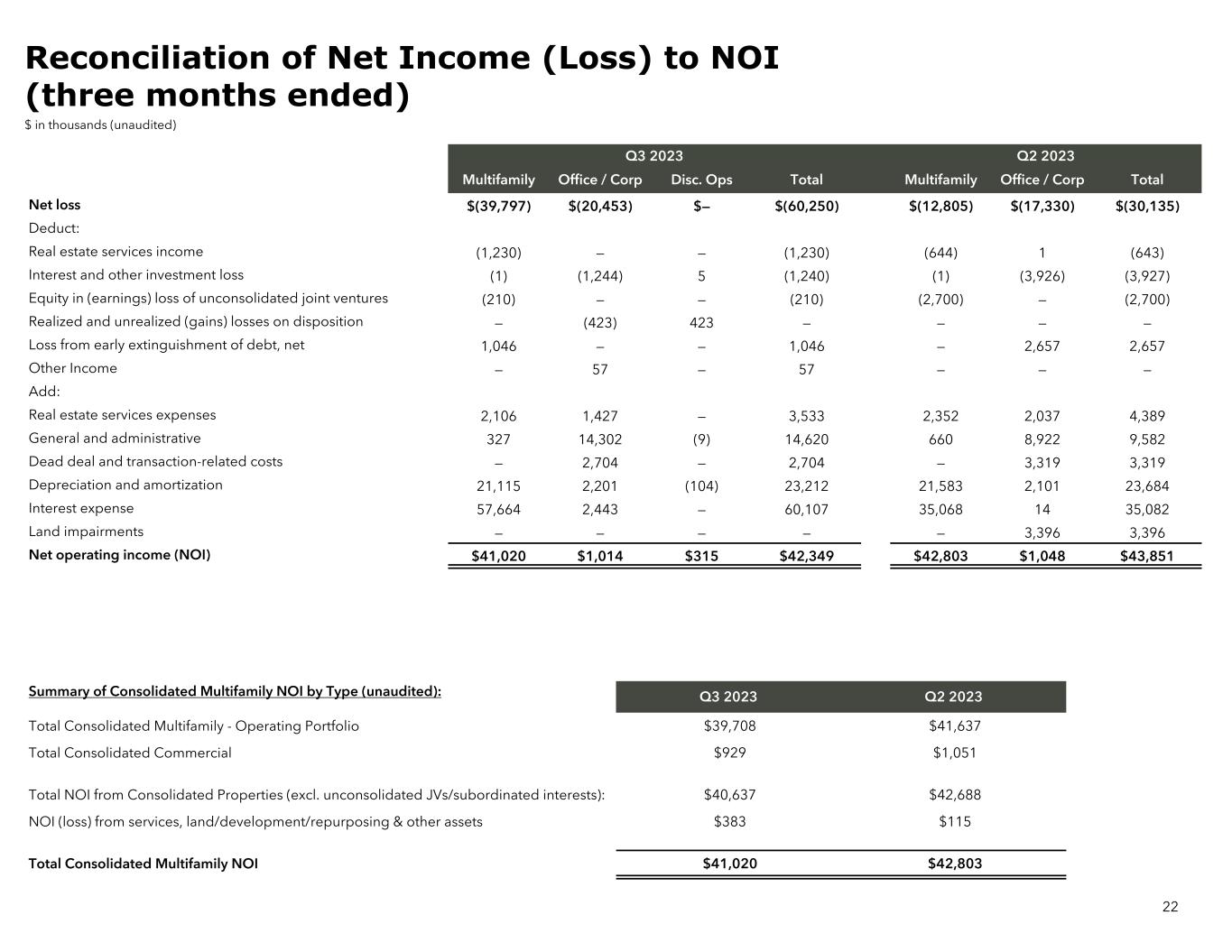

22 Q3 2023 Q2 2023 Multifamily Office / Corp Disc. Ops Total Multifamily Office / Corp Total Net loss $(39,797) $(20,453) $— $(60,250) $(12,805) $(17,330) $(30,135) Deduct: Real estate services income (1,230) — — (1,230) (644) 1 (643) Interest and other investment loss (1) (1,244) 5 (1,240) (1) (3,926) (3,927) Equity in (earnings) loss of unconsolidated joint ventures (210) — — (210) (2,700) — (2,700) Realized and unrealized (gains) losses on disposition — (423) 423 — — — — Loss from early extinguishment of debt, net 1,046 — — 1,046 — 2,657 2,657 Other Income — 57 — 57 — — — Add: Real estate services expenses 2,106 1,427 — 3,533 2,352 2,037 4,389 General and administrative 327 14,302 (9) 14,620 660 8,922 9,582 Dead deal and transaction-related costs — 2,704 — 2,704 — 3,319 3,319 Depreciation and amortization 21,115 2,201 (104) 23,212 21,583 2,101 23,684 Interest expense 57,664 2,443 — 60,107 35,068 14 35,082 Land impairments — — — — — 3,396 3,396 Net operating income (NOI) $41,020 $1,014 $315 $42,349 $42,803 $1,048 $43,851 Summary of Consolidated Multifamily NOI by Type (unaudited): Q3 2023 Q2 2023 Total Consolidated Multifamily - Operating Portfolio $39,708 $41,637 Total Consolidated Commercial $929 $1,051 Total NOI from Consolidated Properties (excl. unconsolidated JVs/subordinated interests): $40,637 $42,688 NOI (loss) from services, land/development/repurposing & other assets $383 $115 Total Consolidated Multifamily NOI $41,020 $42,803 Reconciliation of Net Income (Loss) to NOI (three months ended) $ in thousands (unaudited)

23 Company Information Corporate Headquarters Stock Exchange Listing Contact Information Veris Residential, Inc. New York Stock Exchange Veris Residential, Inc. Harborside 3, 210 Hudson St., Ste. Investor Relations Department Jersey City, New Jersey 07311 Trading Symbol Harborside 3, 210 Hudson St., Ste. 400 (732) 590-1010 Common Shares: VRE Jersey City, New Jersey 07311 Anna Malhari Chief Operating Officer E-Mail: amalhari@verisresidential.com Web: www.verisresidential.com Executive Officers Mahbod Nia Amanda Lombard Taryn Fielder Jeff Turkanis Chief Executive Officer Chief Financial Officer General Counsel and Secretary EVP and Chief Investment Officer Anna Malhari Chief Operating Officer Equity Research Coverage Bank of America Merrill Lynch BTIG, LLC Citigroup Evercore ISI Josh Dennerlein Thomas Catherwood Nicholas Joseph Steve Sakwa Green Street Advisors JP Morgan Truist John Pawlowski Anthony Paolone Michael R. Lewis Any opinions, estimates, forecasts or predictions regarding Veris Residential, Inc's performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Veris Residential, Inc. or its management. Veris Residential, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such opinions, estimates, forecasts or predictions. Company Information, Executive Officers & Analysts